In this age of electronic devices, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Be it for educational use and creative work, or just adding the personal touch to your space, Electric Car Tax Deduction Uk are now a useful resource. In this article, we'll take a dive deep into the realm of "Electric Car Tax Deduction Uk," exploring the different types of printables, where to find them, and the ways that they can benefit different aspects of your life.

Get Latest Electric Car Tax Deduction Uk Below

Electric Car Tax Deduction Uk

Electric Car Tax Deduction Uk -

The Finance No 2 Act 2017 introduced measures to incentivise the adoption of ultra low emission vehicles including electric cars through favourable capital allowances Capital allowances sole traders partnerships and companies From April 2021 electric vehicles are eligible for 100 first year capital allowances

Zero emission cars first registered on or after 1 April 2017 will be liable to pay the lowest first year rate of VED which currently applies to vehicles with CO2 emissions 1 to 50g km From the

Electric Car Tax Deduction Uk provide a diverse assortment of printable items that are available online at no cost. These resources come in many designs, including worksheets templates, coloring pages, and much more. One of the advantages of Electric Car Tax Deduction Uk is in their versatility and accessibility.

More of Electric Car Tax Deduction Uk

Car Donation For Tax Deduction Part 1 2022 Car Donation For Tax

Car Donation For Tax Deduction Part 1 2022 Car Donation For Tax

Electric vehicles EVs currently enjoy free road tax also called Vehicle Excise Duty However from 1 April 2025 drivers of electric cars in the UK will need to pay for road tax for the first time

Unlike with a combustion engined car businesses can deduct the full cost of buying or leasing an electric vehicle from their pre tax profits resulting in lower tax bills

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization They can make printables to fit your particular needs, whether it's designing invitations or arranging your schedule or decorating your home.

-

Educational Benefits: Free educational printables are designed to appeal to students of all ages, making the perfect source for educators and parents.

-

Easy to use: immediate access the vast array of design and templates can save you time and energy.

Where to Find more Electric Car Tax Deduction Uk

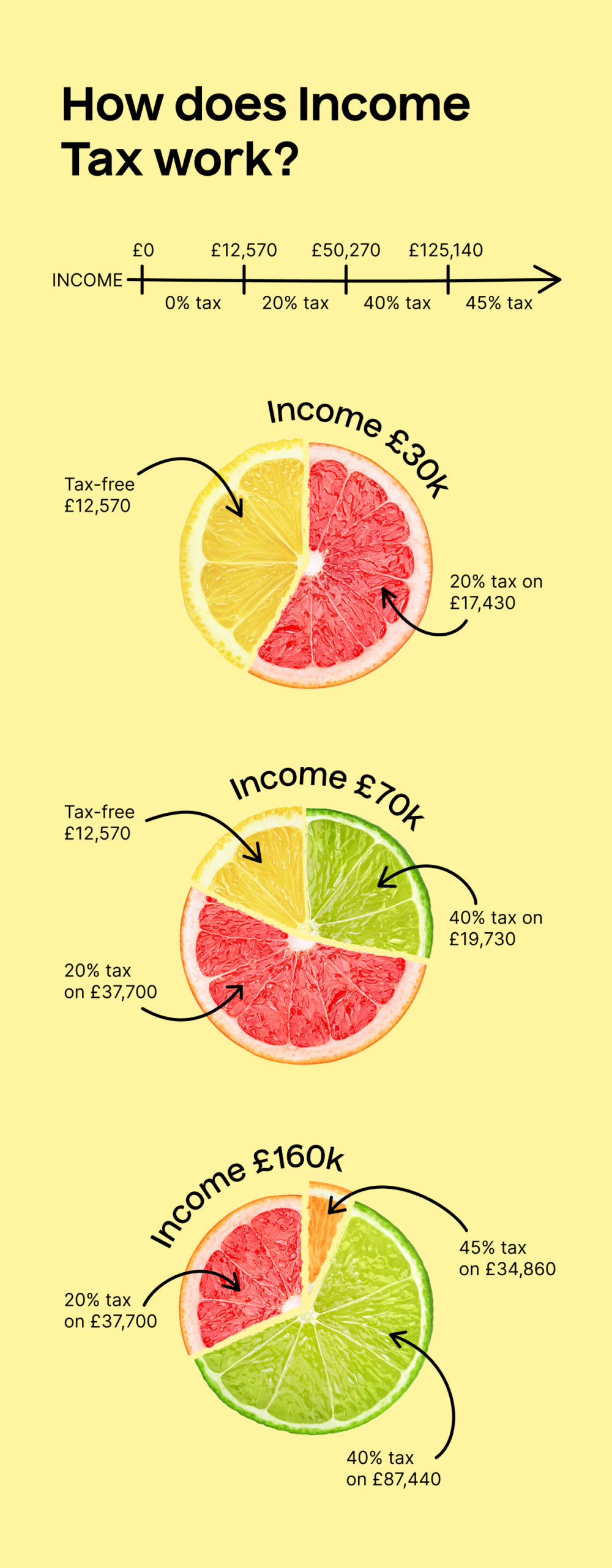

Income Tax Rates In The UK TaxScouts

Income Tax Rates In The UK TaxScouts

From 1 April 2025 all electric car owners must pay Band B VED with the Band A rate of zero effectively removed Under 2024 2025 car tax rates that means an annual cost of 10 in the first year and 190 in subsequent years although this is subject to change prior to 2025

For the first year allowance for electric vehicle charge points this measure will have effect for expenditure incurred on or after 1 April 2025 for Corporation Tax purposes and on or after 6

If we've already piqued your interest in printables for free Let's take a look at where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of goals.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free including flashcards, learning tools.

- The perfect resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide range of topics, from DIY projects to planning a party.

Maximizing Electric Car Tax Deduction Uk

Here are some creative ways of making the most use of Electric Car Tax Deduction Uk:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Electric Car Tax Deduction Uk are an abundance of practical and innovative resources that satisfy a wide range of requirements and hobbies. Their availability and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the world that is Electric Car Tax Deduction Uk today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes, they are! You can download and print these documents for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's based on specific conditions of use. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables may be subject to restrictions regarding their use. Be sure to review the terms and condition of use as provided by the author.

-

How can I print Electric Car Tax Deduction Uk?

- Print them at home using your printer or visit a local print shop for high-quality prints.

-

What software do I need to open printables that are free?

- The majority of printed documents are in the format PDF. This can be opened with free software like Adobe Reader.

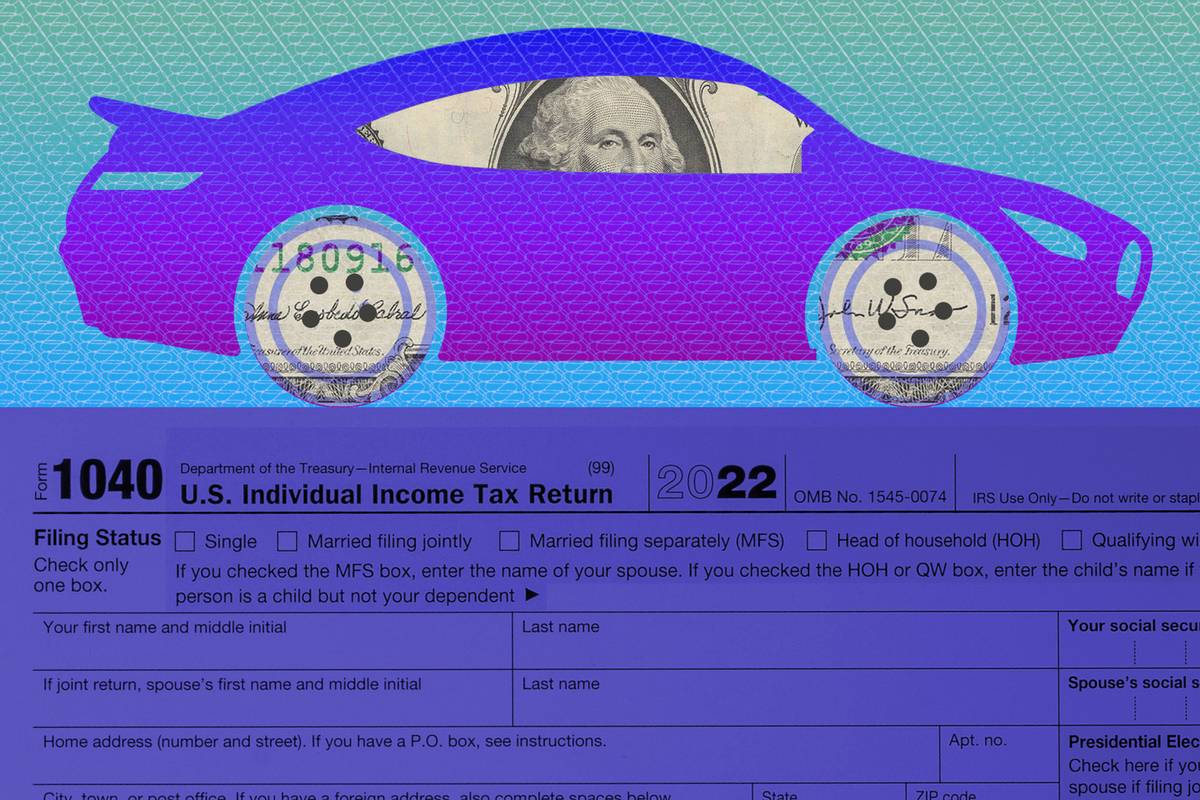

Donate Junk Car Tax Deduction Walls Open

Donate Car Tax Deduction Calculator YouTube

Check more sample of Electric Car Tax Deduction Uk below

Car Donation Tax Deduction HumaneCARS

How Much Tax Can You Claim Without Receipts

Car Donation Tax Deduction Donate Junk Car Tax Deduction 2023

Claim Your Car As A Tax Deduction YouTube

Is Buying A Car Tax Deductible Cars

UK Super deduction Learn How You Can Save With Capital Allowance

https://www.gov.uk › government › publications › ...

Zero emission cars first registered on or after 1 April 2017 will be liable to pay the lowest first year rate of VED which currently applies to vehicles with CO2 emissions 1 to 50g km From the

https://www.bbc.co.uk › news

Under the plans laid out today electric cars registered from April 2025 will pay the lowest rate of 10 in the first year then move to the standard rate which is currently 165 The standard

Zero emission cars first registered on or after 1 April 2017 will be liable to pay the lowest first year rate of VED which currently applies to vehicles with CO2 emissions 1 to 50g km From the

Under the plans laid out today electric cars registered from April 2025 will pay the lowest rate of 10 in the first year then move to the standard rate which is currently 165 The standard

Claim Your Car As A Tax Deduction YouTube

How Much Tax Can You Claim Without Receipts

Is Buying A Car Tax Deductible Cars

UK Super deduction Learn How You Can Save With Capital Allowance

Learn The Steps To Claim Your Electric Vehicle Tax Credit

2018 Car Donation Tax Questions Answered Car Donation Wizard

2018 Car Donation Tax Questions Answered Car Donation Wizard

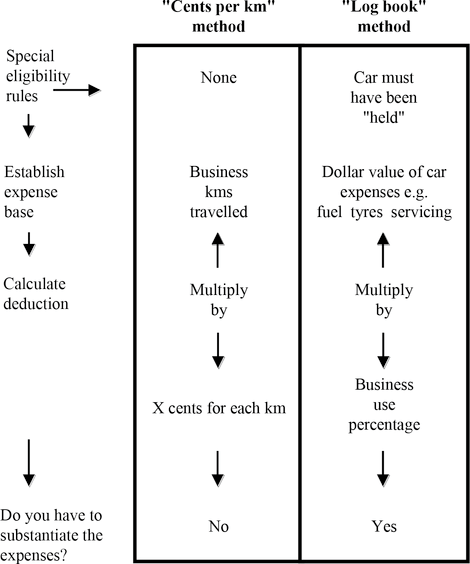

Work Related Expenses Car Tax Deductions