In a world with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Be it for educational use for creative projects, simply to add an individual touch to the area, Electric Vehicle Charging Station Tax Credit 2022 Irs are a great resource. With this guide, you'll dive into the world of "Electric Vehicle Charging Station Tax Credit 2022 Irs," exploring what they are, where to locate them, and how they can be used to enhance different aspects of your lives.

Get Latest Electric Vehicle Charging Station Tax Credit 2022 Irs Below

Electric Vehicle Charging Station Tax Credit 2022 Irs

Electric Vehicle Charging Station Tax Credit 2022 Irs -

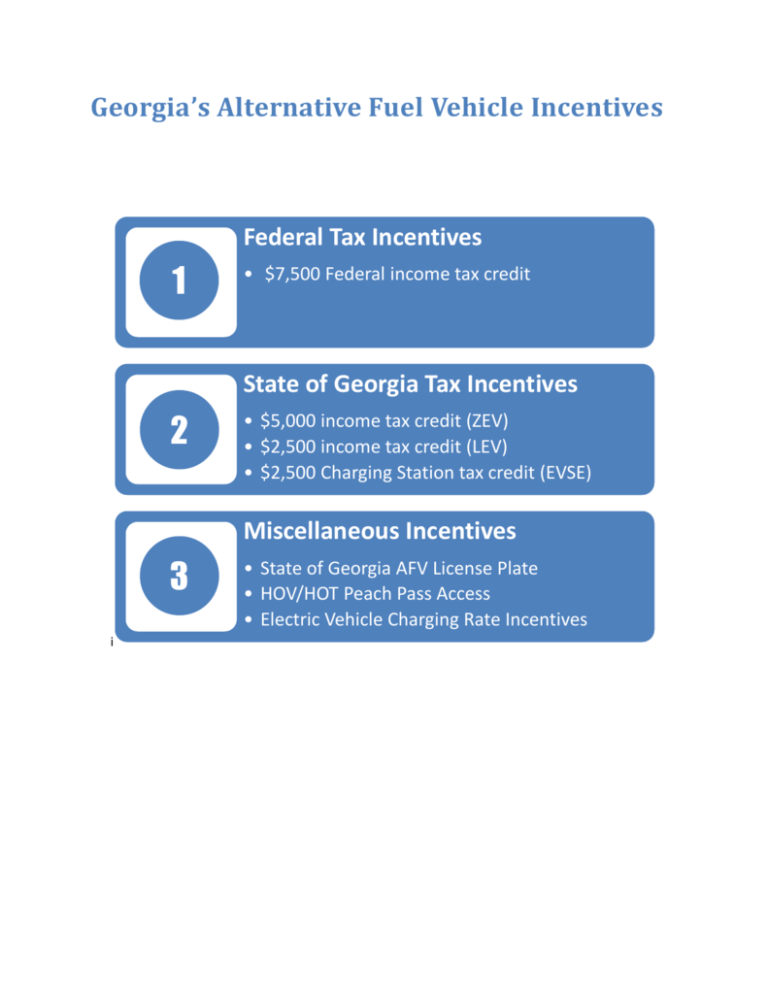

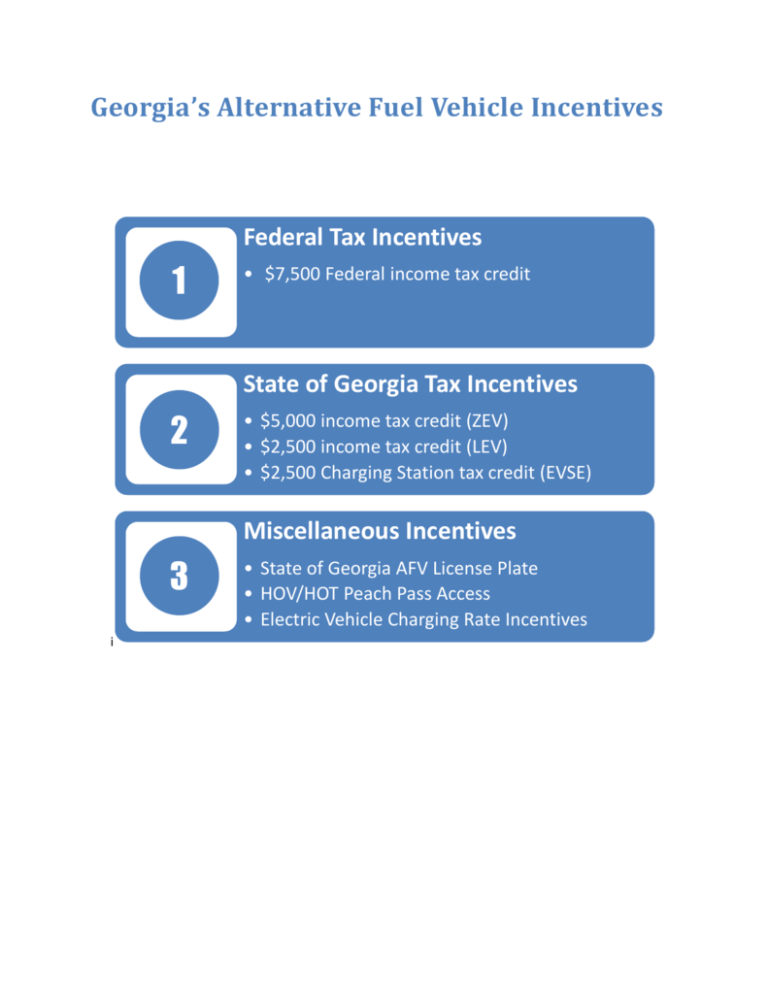

The credit may be claimed by individuals for home electric vehicle charging and other refueling equipment and by businesses The credit with respect to

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Electric Vehicle Charging Station Tax Credit 2022 Irs provide a diverse range of downloadable, printable materials online, at no cost. These printables come in different styles, from worksheets to coloring pages, templates and much more. The great thing about Electric Vehicle Charging Station Tax Credit 2022 Irs is their flexibility and accessibility.

More of Electric Vehicle Charging Station Tax Credit 2022 Irs

Electric Car Charging Home Installation ElectricCarTalk

Electric Car Charging Home Installation ElectricCarTalk

Essentially if you install a home EV charging station the tax credit is 30 of the cost of hardware and installation up to 1 000 Also beginning last year the EV charger

Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly

The Electric Vehicle Charging Station Tax Credit 2022 Irs have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: This allows you to modify designs to suit your personal needs whether you're designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Worth: Printing educational materials for no cost can be used by students of all ages, which makes them an invaluable aid for parents as well as educators.

-

An easy way to access HTML0: Access to various designs and templates is time-saving and saves effort.

Where to Find more Electric Vehicle Charging Station Tax Credit 2022 Irs

Revving Up EV Adoption Expanding The 2022 EV Charging Station Tax Credit

Revving Up EV Adoption Expanding The 2022 EV Charging Station Tax Credit

After having expired at the end of 2021 the Internal Revenue Code Section 30C tax credit for electric vehicle charging stations is back

For a broader view of what vehicles may now be eligible for this credit the Department of Energy published a list of Model Year 2022 and early Model Year 2023

If we've already piqued your curiosity about Electric Vehicle Charging Station Tax Credit 2022 Irs Let's take a look at where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Electric Vehicle Charging Station Tax Credit 2022 Irs to suit a variety of goals.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a broad variety of topics, ranging from DIY projects to party planning.

Maximizing Electric Vehicle Charging Station Tax Credit 2022 Irs

Here are some new ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free for reinforcement of learning at home for the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Electric Vehicle Charging Station Tax Credit 2022 Irs are an abundance of practical and imaginative resources that can meet the needs of a variety of people and interests. Their accessibility and flexibility make them an invaluable addition to both professional and personal lives. Explore the world of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes you can! You can print and download these files for free.

-

Are there any free templates for commercial use?

- It is contingent on the specific usage guidelines. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright rights issues with Electric Vehicle Charging Station Tax Credit 2022 Irs?

- Some printables may come with restrictions on their use. Make sure to read the terms of service and conditions provided by the designer.

-

How do I print Electric Vehicle Charging Station Tax Credit 2022 Irs?

- You can print them at home with a printer or visit an in-store print shop to get higher quality prints.

-

What program do I require to open Electric Vehicle Charging Station Tax Credit 2022 Irs?

- Many printables are offered in the format of PDF, which can be opened using free programs like Adobe Reader.

Inflation Reduction Act Commercial EV Charging Station Tax Credits

EV Charging Station Tax Credit How Businesses Can Benefit Powered By

Check more sample of Electric Vehicle Charging Station Tax Credit 2022 Irs below

The Long Term Benefits And Impacts Of The 2022 EV Charging Station Tax

Electric Cars Versus Gas Cars ElectricCarTalk

Extension Of Section 30C Tax Credit For EV Charging Stations Foley

Zooming In On The 2022 EV Charging Station Tax Credit And Its Impact On

Enhanced Child Tax Credit 2022

An Analysis Of How The 2022 EV Charging Station Tax Credit Affects EV

https://www.irs.gov/credits-deductions/credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

https://www.forbes.com/.../ev-charger-ta…

During the 2023 tax season taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed at their homes in 2022 It s a one time nonrefundable

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

During the 2023 tax season taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed at their homes in 2022 It s a one time nonrefundable

Zooming In On The 2022 EV Charging Station Tax Credit And Its Impact On

Electric Cars Versus Gas Cars ElectricCarTalk

Enhanced Child Tax Credit 2022

An Analysis Of How The 2022 EV Charging Station Tax Credit Affects EV

Ev Charger Tax Credit California Expose Log Book Picture Show

Electric Vehicle Incentive Programs Plug

Electric Vehicle Incentive Programs Plug

Understanding The Differences Between The Federal And State EV Charging