In this digital age, where screens dominate our lives, the charm of tangible printed products hasn't decreased. If it's to aid in education or creative projects, or just adding an individual touch to the space, Electric Vehicle Credit Tax Return have become a valuable resource. This article will dive into the world "Electric Vehicle Credit Tax Return," exploring what they are, how they are, and how they can be used to enhance different aspects of your daily life.

Get Latest Electric Vehicle Credit Tax Return Below

Electric Vehicle Credit Tax Return

Electric Vehicle Credit Tax Return -

What Is the Electric Vehicle EV Tax Credit The EV tax credit is a federal incentive to encourage consumers to purchase EVs Taxpayers who meet the income requirements and buy a

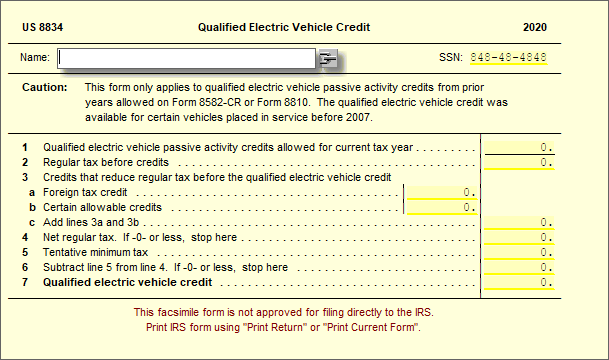

Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return

Printables for free cover a broad assortment of printable content that can be downloaded from the internet at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages, and much more. The appealingness of Electric Vehicle Credit Tax Return is in their variety and accessibility.

More of Electric Vehicle Credit Tax Return

New Clean Vehicle Tax Credit Plan Means Most EVs No Longer Qualify 2022

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most EVs No Longer Qualify 2022

Key Takeaways The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The Inflation Reduction Act of 2022 changed this tax credit by extending its life through 2032 and expanding it to cover more vehicles

EV Tax Credit Overview EV Income Limits Qualifying Vehicles EV News 2024 EV Credit Point of Sale Claiming the EV Tax Credit EV Leases Home EV Chargers Other IRA Tax

The Electric Vehicle Credit Tax Return have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization: There is the possibility of tailoring printed materials to meet your requirements be it designing invitations planning your schedule or even decorating your house.

-

Educational Value: Education-related printables at no charge offer a wide range of educational content for learners of all ages, which makes them a valuable instrument for parents and teachers.

-

Accessibility: Fast access the vast array of design and templates will save you time and effort.

Where to Find more Electric Vehicle Credit Tax Return

Electric Vehicle Credit Tax Answers In 90 Seconds Mickle

Electric Vehicle Credit Tax Answers In 90 Seconds Mickle

Which Cars Qualify For The EV Federal Tax Credit The basic rules are pretty clear As of January 1 2023 if the final assembly of a new electric car does not take place in North America

No If you entered into a written binding contract to purchase a qualifying electric vehicle before the date of enactment of the Inflation Reduction Act August 16 2022 the changes in the Inflation Reduction Act will not impact your tax credit You may claim the credit based on the rules that were in effect before August 16 2022

After we've peaked your curiosity about Electric Vehicle Credit Tax Return Let's look into where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Electric Vehicle Credit Tax Return for various reasons.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets with flashcards and other teaching tools.

- Perfect for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a broad spectrum of interests, that range from DIY projects to planning a party.

Maximizing Electric Vehicle Credit Tax Return

Here are some fresh ways in order to maximize the use use of Electric Vehicle Credit Tax Return:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets for free for teaching at-home (or in the learning environment).

3. Event Planning

- Invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Electric Vehicle Credit Tax Return are an abundance filled with creative and practical information that meet a variety of needs and pursuits. Their availability and versatility make these printables a useful addition to any professional or personal life. Explore the vast array of Electric Vehicle Credit Tax Return right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes they are! You can download and print these resources at no cost.

-

Does it allow me to use free printables for commercial uses?

- It's based on specific rules of usage. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright concerns with Electric Vehicle Credit Tax Return?

- Certain printables could be restricted regarding usage. Be sure to read the conditions and terms of use provided by the author.

-

How do I print Electric Vehicle Credit Tax Return?

- You can print them at home with your printer or visit the local print shops for more high-quality prints.

-

What program do I require to open Electric Vehicle Credit Tax Return?

- Many printables are offered in PDF format. They is open with no cost programs like Adobe Reader.

Electric Vehicle Credit Undergoes Major Overhaul

How Long Should You Keep Tax Returns Longer Than You Think Longer Than

Check more sample of Electric Vehicle Credit Tax Return below

Are Electric Vehicle Credits Part Of Your Sales Strategy

claim Tax Credit 7500

Agatha Bagwell

US Federal 7 500 Electric Vehicle Credit Expiry Date By Automaker

How Does The 7500 Electric Vehicle Tax Credit Work Electric Vehicle List

Is The Electric Vehicle Tax Credit Refundable

https://www.irs.gov/newsroom/qualifying-clean...

Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png?w=186)

https://www.irs.gov/newsroom/heres-what-taxpayers...

The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may

Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return

The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may

US Federal 7 500 Electric Vehicle Credit Expiry Date By Automaker

claim Tax Credit 7500

How Does The 7500 Electric Vehicle Tax Credit Work Electric Vehicle List

Is The Electric Vehicle Tax Credit Refundable

8834 Qualified Electric Vehicle Credit UltimateTax Solution Center

US Federal 7 500 Electric Vehicle Credit Expiry Date By Automaker

US Federal 7 500 Electric Vehicle Credit Expiry Date By Automaker

Changes In The Section 30D Electric Vehicle Credit Allied Financial