In this age of technology, where screens dominate our lives but the value of tangible printed material hasn't diminished. For educational purposes and creative work, or just adding an individual touch to your area, Electric Vehicle Income Tax Benefits are a great source. This article will dive into the sphere of "Electric Vehicle Income Tax Benefits," exploring the benefits of them, where you can find them, and what they can do to improve different aspects of your lives.

Get Latest Electric Vehicle Income Tax Benefits Below

Electric Vehicle Income Tax Benefits

Electric Vehicle Income Tax Benefits -

The 2022 update of ACEA s comprehensive overview shows the fiscal measures for buying electric vehicles that are currently available in the 27 EU member

What is Section 80EEB Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to

Electric Vehicle Income Tax Benefits encompass a wide selection of printable and downloadable content that can be downloaded from the internet at no cost. The resources are offered in a variety kinds, including worksheets coloring pages, templates and many more. The appealingness of Electric Vehicle Income Tax Benefits lies in their versatility as well as accessibility.

More of Electric Vehicle Income Tax Benefits

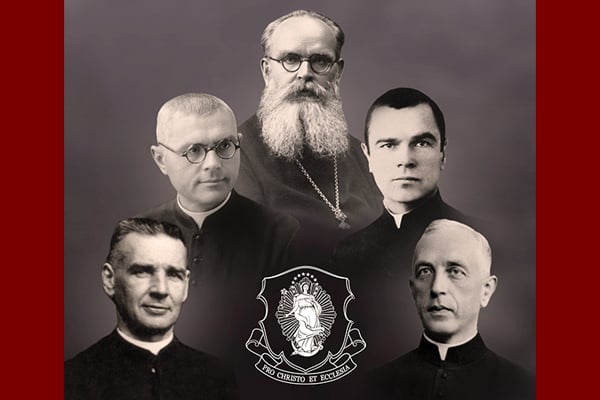

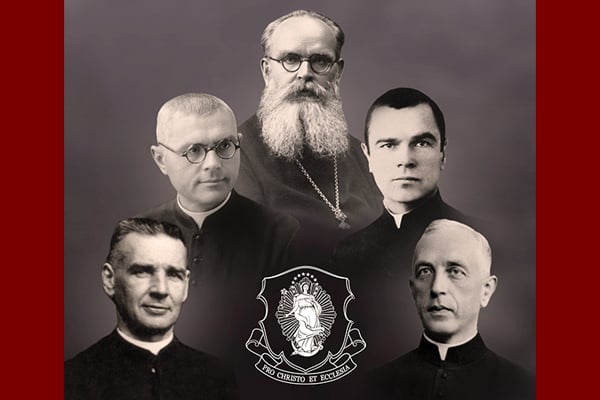

One Of The Greatest Marian Helpers St Juan Diego Marians Of The

One Of The Greatest Marian Helpers St Juan Diego Marians Of The

For the 2021 22 tax year where the car is 100 electric the BiK charge is just 1 of the list price of the car This rises to 2 for each of the next three tax years This charge

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Electric Vehicle Income Tax Benefits have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

The ability to customize: Your HTML0 customization options allow you to customize print-ready templates to your specific requirements in designing invitations or arranging your schedule or decorating your home.

-

Educational Value: The free educational worksheets can be used by students of all ages, which makes them a great tool for parents and educators.

-

It's easy: Quick access to an array of designs and templates can save you time and energy.

Where to Find more Electric Vehicle Income Tax Benefits

Call Them Brothers Marians Of The Immaculate Conception

Call Them Brothers Marians Of The Immaculate Conception

Any business can benefit from the new super deduction which offers a first year allowance of up to 130 percent on qualifying electric charge points for cars To claim the relief

Since the electric vehicle EV tax credit is a non refundable credit it may take some planning to maximize the benefits The answer depends on your total taxable income deductions and credits

Since we've got your interest in printables for free, let's explore where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Electric Vehicle Income Tax Benefits designed for a variety purposes.

- Explore categories like decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing including flashcards, learning materials.

- The perfect resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- The blogs covered cover a wide selection of subjects, everything from DIY projects to party planning.

Maximizing Electric Vehicle Income Tax Benefits

Here are some innovative ways for you to get the best use of Electric Vehicle Income Tax Benefits:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Print free worksheets to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Electric Vehicle Income Tax Benefits are a treasure trove of useful and creative resources that can meet the needs of a variety of people and hobbies. Their accessibility and versatility make these printables a useful addition to your professional and personal life. Explore the vast collection that is Electric Vehicle Income Tax Benefits today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Electric Vehicle Income Tax Benefits really cost-free?

- Yes they are! You can download and print these resources at no cost.

-

Can I use free printables for commercial use?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables could be restricted on use. Make sure to read the terms and conditions set forth by the creator.

-

How can I print printables for free?

- Print them at home using printing equipment or visit an area print shop for the highest quality prints.

-

What program do I need in order to open printables that are free?

- The majority of printed documents are in the PDF format, and can be opened using free software such as Adobe Reader.

Honda Confirms New Pilot And CR V Debut In 2022 Accord Hybrid In 2023

Sanchez Promises To Deduct 15 Of Personal Income Tax For Buying An

Check more sample of Electric Vehicle Income Tax Benefits below

EV Tax Benefits In India Everything You Need To Know Before Buying An

2023 Electric Vehicle Tax Benefits Virginia CPA Firm

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

Five Marian Martyrs On The Road To Canonization Marians Of The

Federal Income Tax Credit Electric Vehicle Todrivein

Reports Highlight Income Gap In Accessing Electric Vehicles Market

https://cleartax.in/s/section-80eeb-deduction-purchase-electric-vehicle

What is Section 80EEB Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to

https://www.npr.org/2023/01/07/1147209505

For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles

What is Section 80EEB Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to

For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles

Five Marian Martyrs On The Road To Canonization Marians Of The

2023 Electric Vehicle Tax Benefits Virginia CPA Firm

Federal Income Tax Credit Electric Vehicle Todrivein

Reports Highlight Income Gap In Accessing Electric Vehicles Market

South America s lithium Fields Reveal The Dark Side Of Our Electric

End Of Tax Holiday Time To Focus On More Benefits For EV Owners New

End Of Tax Holiday Time To Focus On More Benefits For EV Owners New

Budget 2019 Government Proposes Income Tax Benefits To Drive Electric