In this day and age in which screens are the norm The appeal of tangible, printed materials hasn't diminished. For educational purposes in creative or artistic projects, or simply adding an individual touch to the home, printables for free are now a useful resource. For this piece, we'll take a dive into the world "Electric Vehicle Tax Credit," exploring what they are, how to find them and how they can improve various aspects of your lives.

Get Latest Electric Vehicle Tax Credit Below

Electric Vehicle Tax Credit

Electric Vehicle Tax Credit -

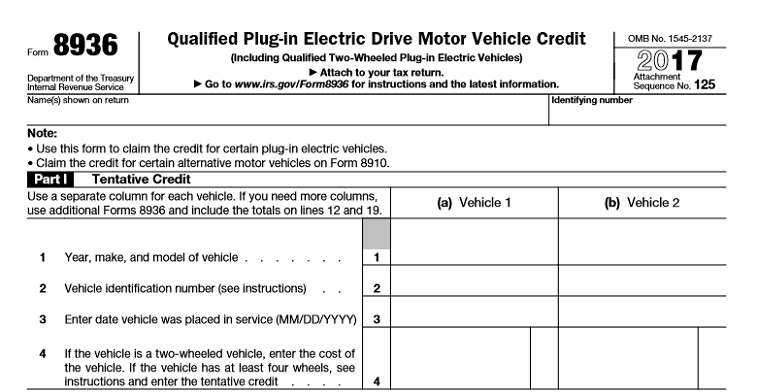

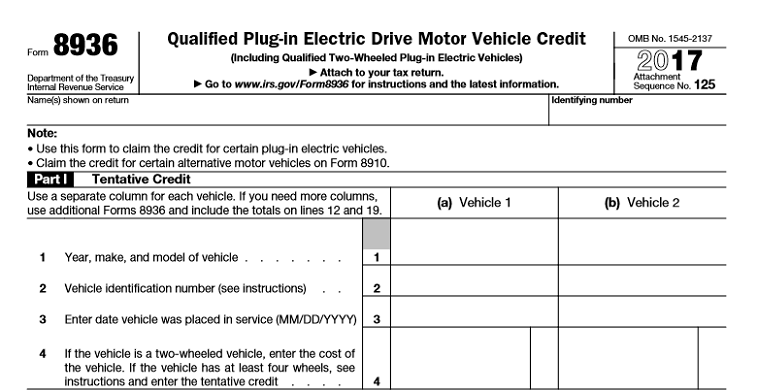

What Is the Electric Vehicle EV Tax Credit The EV tax credit is a federal incentive to encourage consumers to purchase EVs Taxpayers who meet the income requirements and buy a

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

Electric Vehicle Tax Credit provide a diverse selection of printable and downloadable items that are available online at no cost. These resources come in various formats, such as worksheets, coloring pages, templates and much more. The attraction of printables that are free is their versatility and accessibility.

More of Electric Vehicle Tax Credit

Government Electric Vehicle Tax Credit Electric Tax Credits Car

Government Electric Vehicle Tax Credit Electric Tax Credits Car

Treasury Releases Initial Information on Electric Vehicle Tax Credit Under Newly Enacted Inflation Reduction Act August 16 2022 Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles more affordable

Aug 8 2022 Read Article Page 1 of 2Next The federal electric vehicle tax credit is complicated with rules related to assembly batteries income and more As new EVs are added or removed

Electric Vehicle Tax Credit have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization We can customize designs to suit your personal needs such as designing invitations, organizing your schedule, or decorating your home.

-

Educational Worth: Downloads of educational content for free cater to learners from all ages, making them a valuable device for teachers and parents.

-

Easy to use: instant access numerous designs and templates can save you time and energy.

Where to Find more Electric Vehicle Tax Credit

Electric Vehicle Tax Credit Survives In Latest Tax Bill But Phase Out

Electric Vehicle Tax Credit Survives In Latest Tax Bill But Phase Out

90 of qualifying electric vehicle buyers opt for 7 500 new clean vehicle tax credit as upfront payment Treasury says The Inflation Reduction Act turned a 7 500 tax credit for new

Electric vehicle buyers can get up to 7 500 in tax savings right at the dealership under changes to the law that went into effect Jan 1 By contrast those who drove an EV off the lot last year

We hope we've stimulated your curiosity about Electric Vehicle Tax Credit Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection and Electric Vehicle Tax Credit for a variety goals.

- Explore categories like decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free with flashcards and other teaching materials.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a broad range of topics, that includes DIY projects to party planning.

Maximizing Electric Vehicle Tax Credit

Here are some new ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Electric Vehicle Tax Credit are an abundance of practical and imaginative resources catering to different needs and preferences. Their availability and versatility make them a great addition to the professional and personal lives of both. Explore the vast world of Electric Vehicle Tax Credit now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can download and print the resources for free.

-

Does it allow me to use free printables for commercial uses?

- It's determined by the specific conditions of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may come with restrictions on their use. You should read the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- Print them at home using an printer, or go to a local print shop to purchase better quality prints.

-

What software will I need to access printables for free?

- The majority of PDF documents are provided in PDF format. These can be opened using free software like Adobe Reader.

The 7 500 Electric Vehicle Tax Credit Would Be Killed Under This

EU Says US Electric Vehicle Tax Credit Could Break WTO Rules AP News

Check more sample of Electric Vehicle Tax Credit below

Electric Vehicle Tax Credit Explained Rhythm

Electric Vehicle Tax Credit These EVs No Longer Qualify For The 7 500

Why The Electric Vehicle Tax Credit Was Removed OsVehicle

Much Needed Electric Vehicle Tax Credit Reforms Finally Announced

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

How Electric Vehicle Tax Credit Works Web2Carz

https://www. irs.gov /credits-deductions/credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

https://www. irs.gov /clean-vehicle-tax-credits

We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought Planning to buy or already bought a used clean vehicle

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought Planning to buy or already bought a used clean vehicle

Much Needed Electric Vehicle Tax Credit Reforms Finally Announced

Electric Vehicle Tax Credit These EVs No Longer Qualify For The 7 500

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What

How Electric Vehicle Tax Credit Works Web2Carz

Qualifying Cars For The 2022 Electric Vehicle Tax Credit Verified

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F23938435%2Fmerlin_2916542.jpg)

EU Calls Electric Vehicle Tax Credit In The Inflation Reduction Act