Today, where screens dominate our lives but the value of tangible printed products hasn't decreased. In the case of educational materials, creative projects, or simply to add the personal touch to your home, printables for free have become an invaluable source. In this article, we'll take a dive deep into the realm of "Eligibility Of Tax Rebate U S 87a," exploring the benefits of them, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest Eligibility Of Tax Rebate U S 87a Below

Eligibility Of Tax Rebate U S 87a

Eligibility Of Tax Rebate U S 87a -

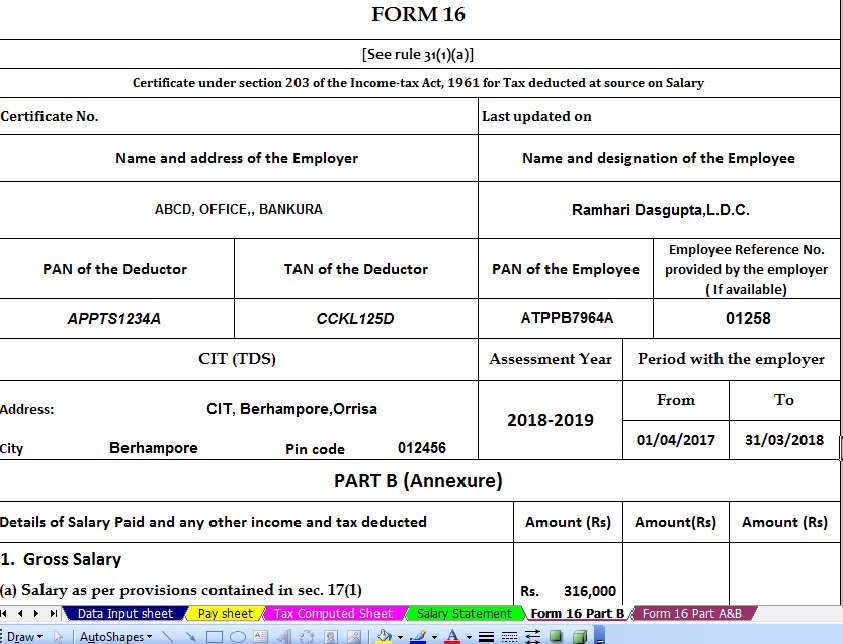

Individuals who are granted a tax rebate under Section 87A should fall under either of the below mentioned criteria Individual Taxpayers Below Age 60 If their total

Senior citizens above 60 years and up to 80 years of age are eligible to claim rebates under Section 87A Super senior citizens above 80 years are not eligible to claim the

Eligibility Of Tax Rebate U S 87a cover a large range of printable, free documents that can be downloaded online at no cost. These printables come in different designs, including worksheets templates, coloring pages, and more. One of the advantages of Eligibility Of Tax Rebate U S 87a is their flexibility and accessibility.

More of Eligibility Of Tax Rebate U S 87a

Income Tax Sec 87A Amendment Rebate YouTube

Income Tax Sec 87A Amendment Rebate YouTube

Under the new regime taxpayers with income less than Rs 7 lakh are eligible for a rebate of up to Rs 25 000 under Section 87A In case the income exceeds Rs 7 lakh Rebate

To claim a rebate under Section 87A for FY 2021 22 and FY 2020 21 the following conditions will have to be satisfied If you are a resident individual and your total income after reducing deductions under Chapter VI A Section 80C

The Eligibility Of Tax Rebate U S 87a have gained huge popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Personalization There is the possibility of tailoring printables to fit your particular needs such as designing invitations to organize your schedule or decorating your home.

-

Educational Benefits: Printables for education that are free provide for students of all ages, which makes the perfect aid for parents as well as educators.

-

An easy way to access HTML0: Access to various designs and templates saves time and effort.

Where to Find more Eligibility Of Tax Rebate U S 87a

Income Tax Rebate U s 87A For The Financial Year 2022 23

Income Tax Rebate U s 87A For The Financial Year 2022 23

For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate amount is either Rs 12 500 or the amount of tax payable

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under

Since we've got your interest in printables for free Let's take a look at where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection with Eligibility Of Tax Rebate U S 87a for all motives.

- Explore categories such as decoration for your home, education, craft, and organization.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets including flashcards, learning materials.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs are a vast spectrum of interests, all the way from DIY projects to planning a party.

Maximizing Eligibility Of Tax Rebate U S 87a

Here are some ways ensure you get the very most of Eligibility Of Tax Rebate U S 87a:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to aid in learning at your home or in the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars with to-do lists, planners, and meal planners.

Conclusion

Eligibility Of Tax Rebate U S 87a are an abundance of fun and practical tools for a variety of needs and hobbies. Their accessibility and flexibility make them an invaluable addition to both professional and personal life. Explore the vast array of Eligibility Of Tax Rebate U S 87a and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes you can! You can download and print these tools for free.

-

Can I use free printables in commercial projects?

- It's dependent on the particular rules of usage. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables may be subject to restrictions on use. Always read the terms and conditions provided by the creator.

-

How can I print printables for free?

- Print them at home with printing equipment or visit a local print shop to purchase superior prints.

-

What software must I use to open printables that are free?

- The majority of printables are with PDF formats, which can be opened with free programs like Adobe Reader.

Income Tax Rebate Rs 2500 U s 87A Tdstaxindia

What Is Income Tax Rebate Under Section 87A HDFC Life

Check more sample of Eligibility Of Tax Rebate U S 87a below

Rebate U s 87A

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

Income Tax Rebate Under Section 87A

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://tax2win.in/guide/section-87a

Senior citizens above 60 years and up to 80 years of age are eligible to claim rebates under Section 87A Super senior citizens above 80 years are not eligible to claim the

https://economictimes.indiatimes.com/wealth/tax/...

Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if their taxable income does not exceed Rs 7 lakh

Senior citizens above 60 years and up to 80 years of age are eligible to claim rebates under Section 87A Super senior citizens above 80 years are not eligible to claim the

Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if their taxable income does not exceed Rs 7 lakh

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5