Today, with screens dominating our lives it's no wonder that the appeal of tangible printed material hasn't diminished. Whether it's for educational purposes or creative projects, or simply to add the personal touch to your space, Employment Tax Deduction are now a useful source. We'll take a dive deeper into "Employment Tax Deduction," exploring the different types of printables, where to locate them, and how they can add value to various aspects of your life.

Get Latest Employment Tax Deduction Below

Employment Tax Deduction

Employment Tax Deduction -

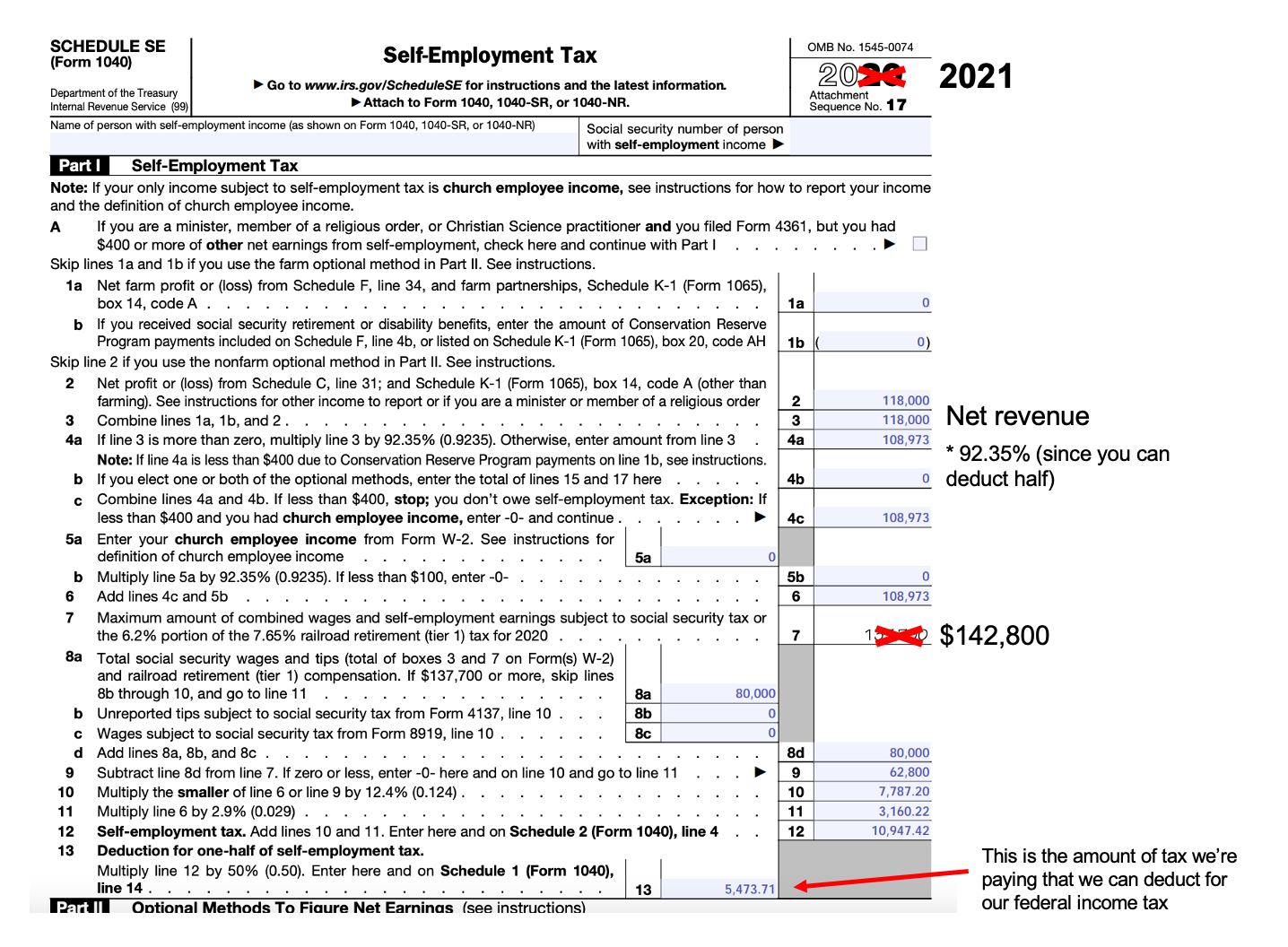

1 Self Employment Tax Deduction What It Is The self employment tax refers to the Social Security and Medicare taxes that self employed people like freelancers independent contractors

Employers generally must withhold federal income tax from employees wages To figure out how much tax to withhold use the employee s Form W 4 Employee s Withholding Certificate the appropriate method and the appropriate withholding table described in Publication 15 T Federal Income Tax Withholding Methods

Employment Tax Deduction offer a wide collection of printable content that can be downloaded from the internet at no cost. They are available in numerous styles, from worksheets to coloring pages, templates and much more. The great thing about Employment Tax Deduction is their flexibility and accessibility.

More of Employment Tax Deduction

Goodwill Donation Spreadsheet Template Throughout Clothing Donation

Goodwill Donation Spreadsheet Template Throughout Clothing Donation

The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide

You can deduct 50 of your self employment tax on your income taxes You may need to pay self employment tax if you re a freelancer an independent contractor or a small business owner

Employment Tax Deduction have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization There is the possibility of tailoring the templates to meet your individual needs such as designing invitations and schedules, or decorating your home.

-

Educational Benefits: Downloads of educational content for free cater to learners of all ages, which makes the perfect resource for educators and parents.

-

Simple: immediate access various designs and templates will save you time and effort.

Where to Find more Employment Tax Deduction

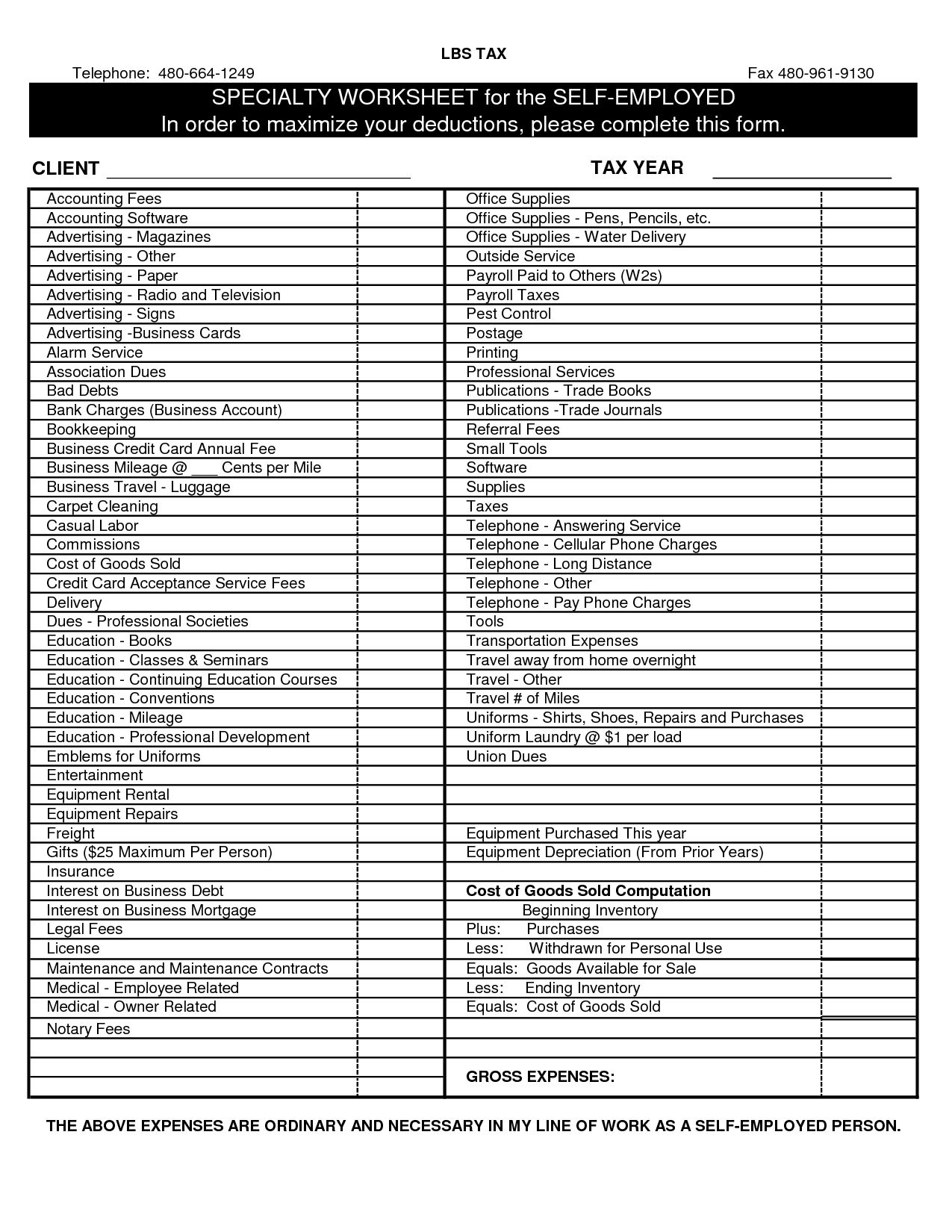

12 Self Employed Tax Worksheet Worksheeto

12 Self Employed Tax Worksheet Worksheeto

Under section 16 a taxpayer may deduct the amount paid on account of an employment tax or professional tax Here Article 276 2 of the Constitution specifies the employment tax

Tax deductions can lower the amount of income that is subject to tax Here s more on how tax deductions work plus 22 tax breaks that might come in handy

Since we've got your curiosity about Employment Tax Deduction Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection and Employment Tax Deduction for a variety needs.

- Explore categories like interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free with flashcards and other teaching tools.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- These blogs cover a broad selection of subjects, that includes DIY projects to planning a party.

Maximizing Employment Tax Deduction

Here are some ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Employment Tax Deduction are a treasure trove of creative and practical resources designed to meet a range of needs and preferences. Their accessibility and versatility make them an invaluable addition to each day life. Explore the world of Employment Tax Deduction today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Employment Tax Deduction really free?

- Yes they are! You can download and print these files for free.

-

Can I use the free templates for commercial use?

- It's based on specific conditions of use. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Are there any copyright violations with Employment Tax Deduction?

- Some printables could have limitations on usage. Be sure to read the terms and condition of use as provided by the author.

-

How can I print printables for free?

- You can print them at home using a printer or visit a print shop in your area for high-quality prints.

-

What software do I need to run printables that are free?

- A majority of printed materials are as PDF files, which can be opened with free software, such as Adobe Reader.

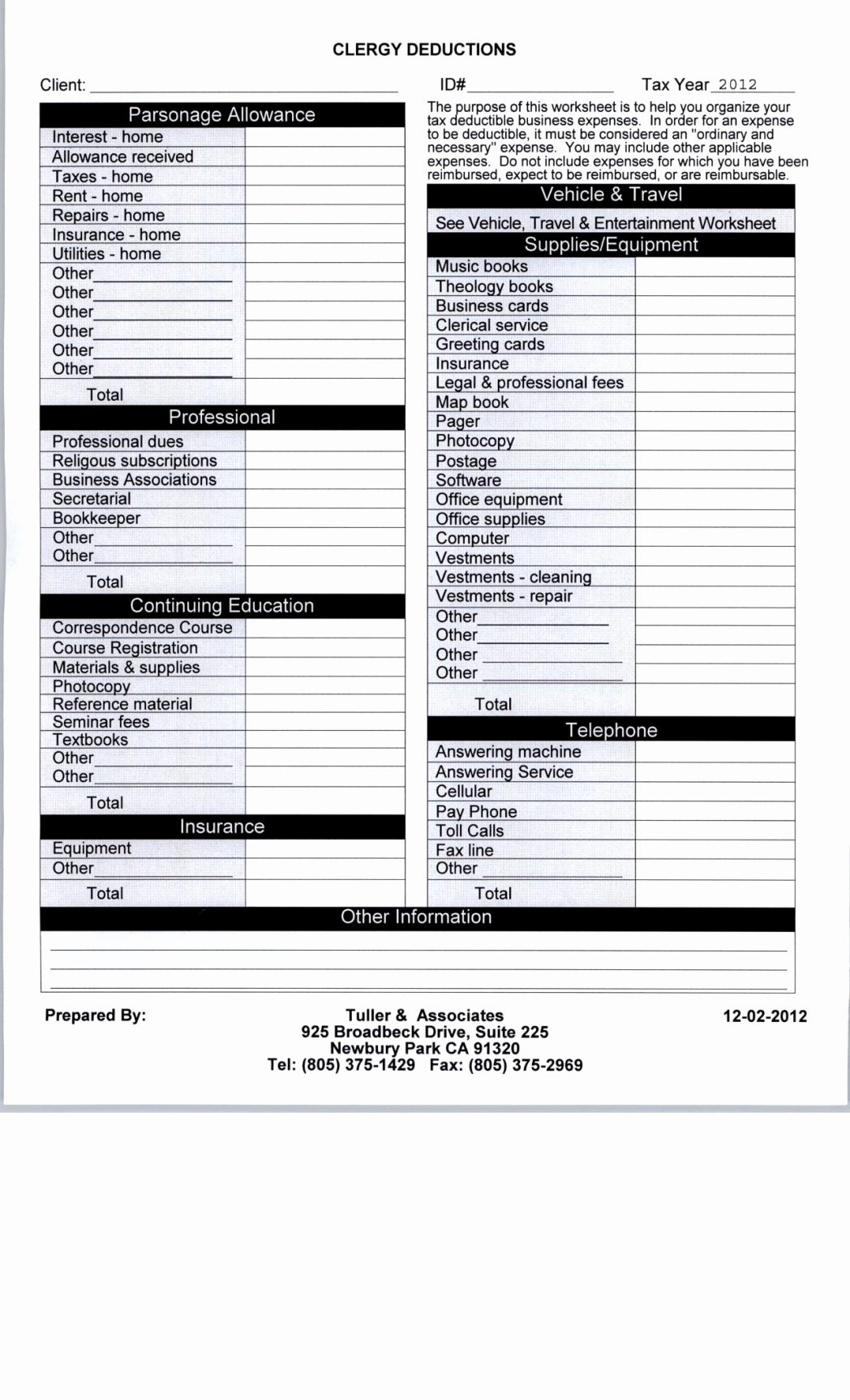

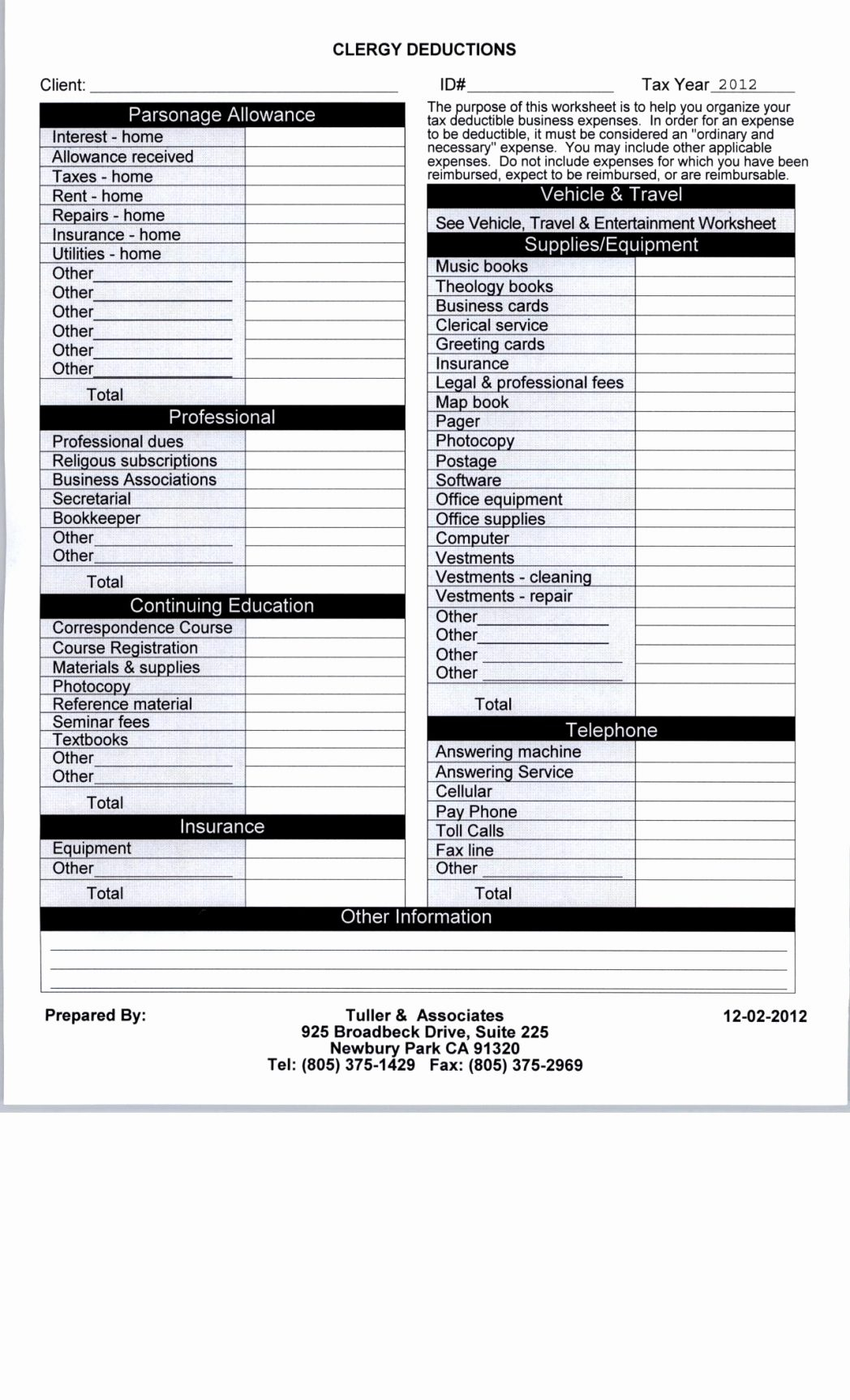

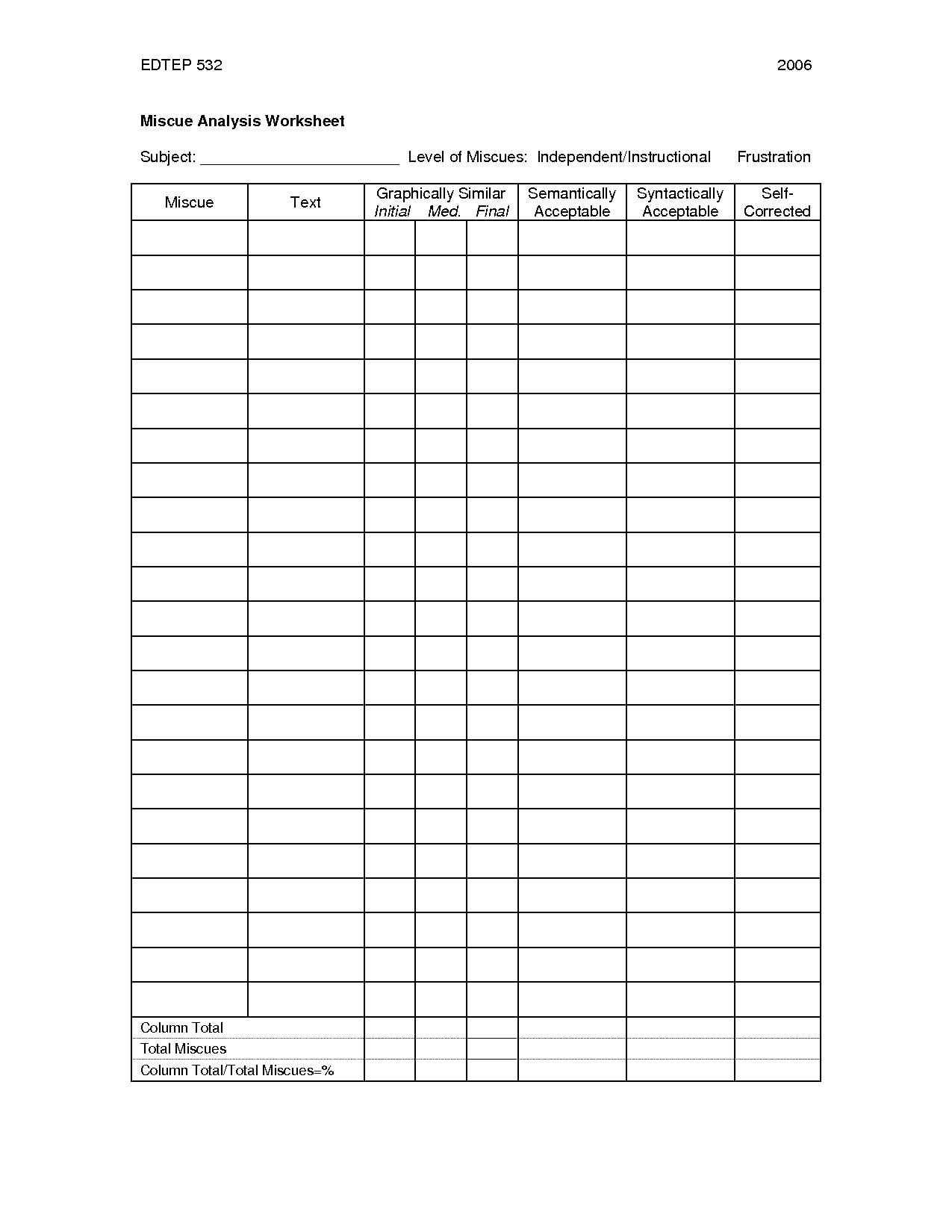

Self Employment Deduction Worksheet Worksheets For Kindergarten

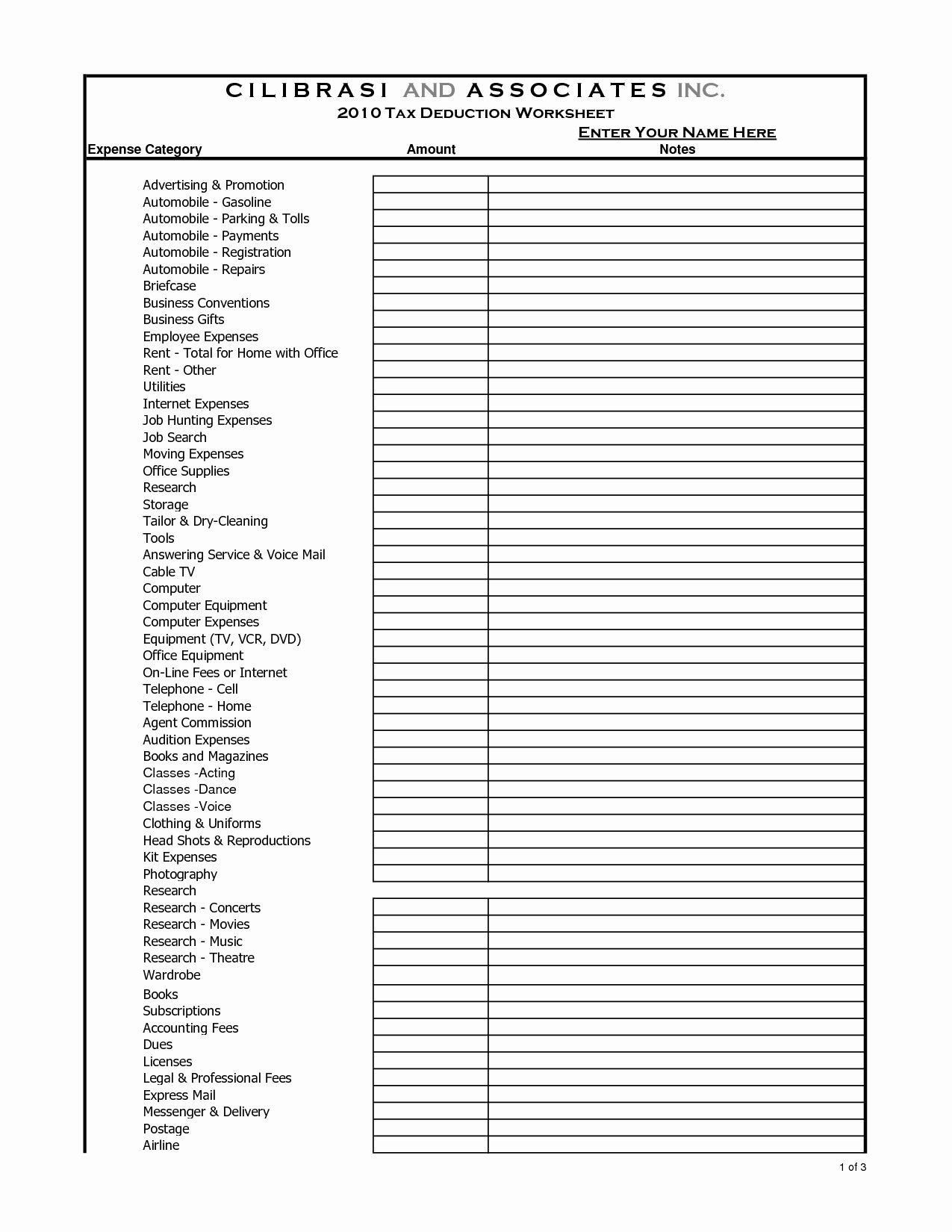

Printable Tax Organizer Template

Check more sample of Employment Tax Deduction below

2016 Self Employment Tax And Deduction Worksheet Db excel

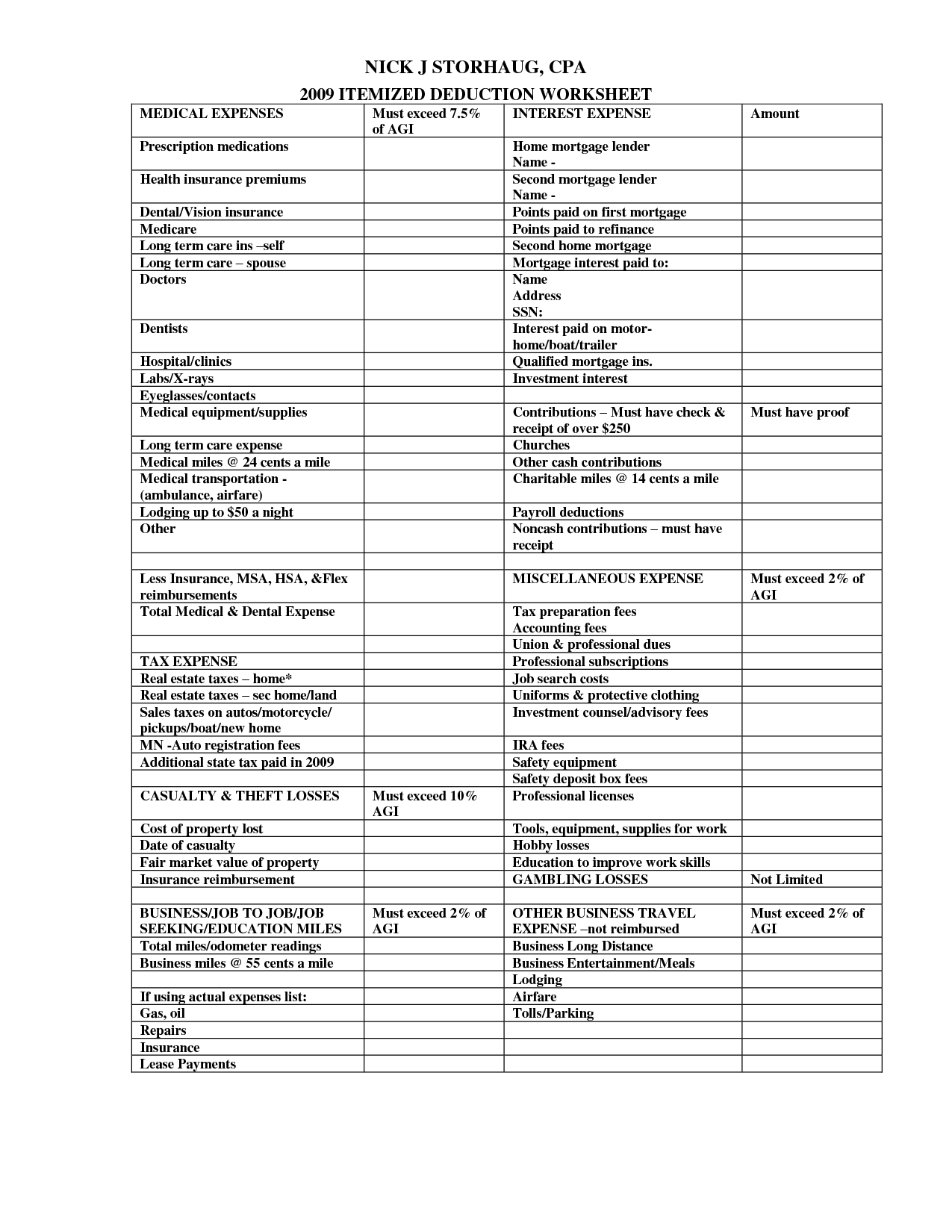

Printable Itemized Deductions Worksheet

2022 Self Employment Deduction Form Employment Form

May Sheets Home Office Deduction Simplified Method Worksheet 2018

8 Tax Preparation Organizer Worksheet Worksheeto

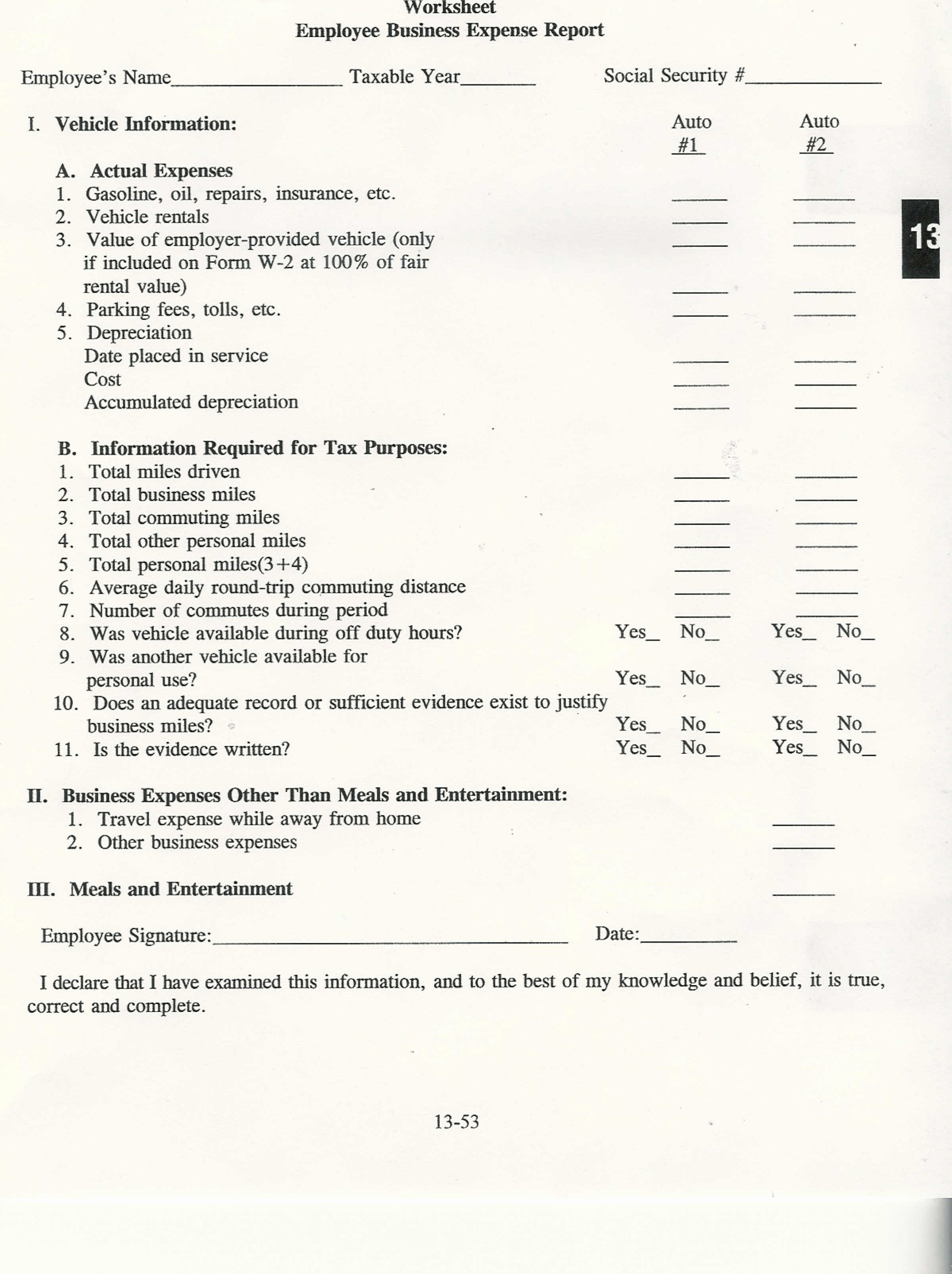

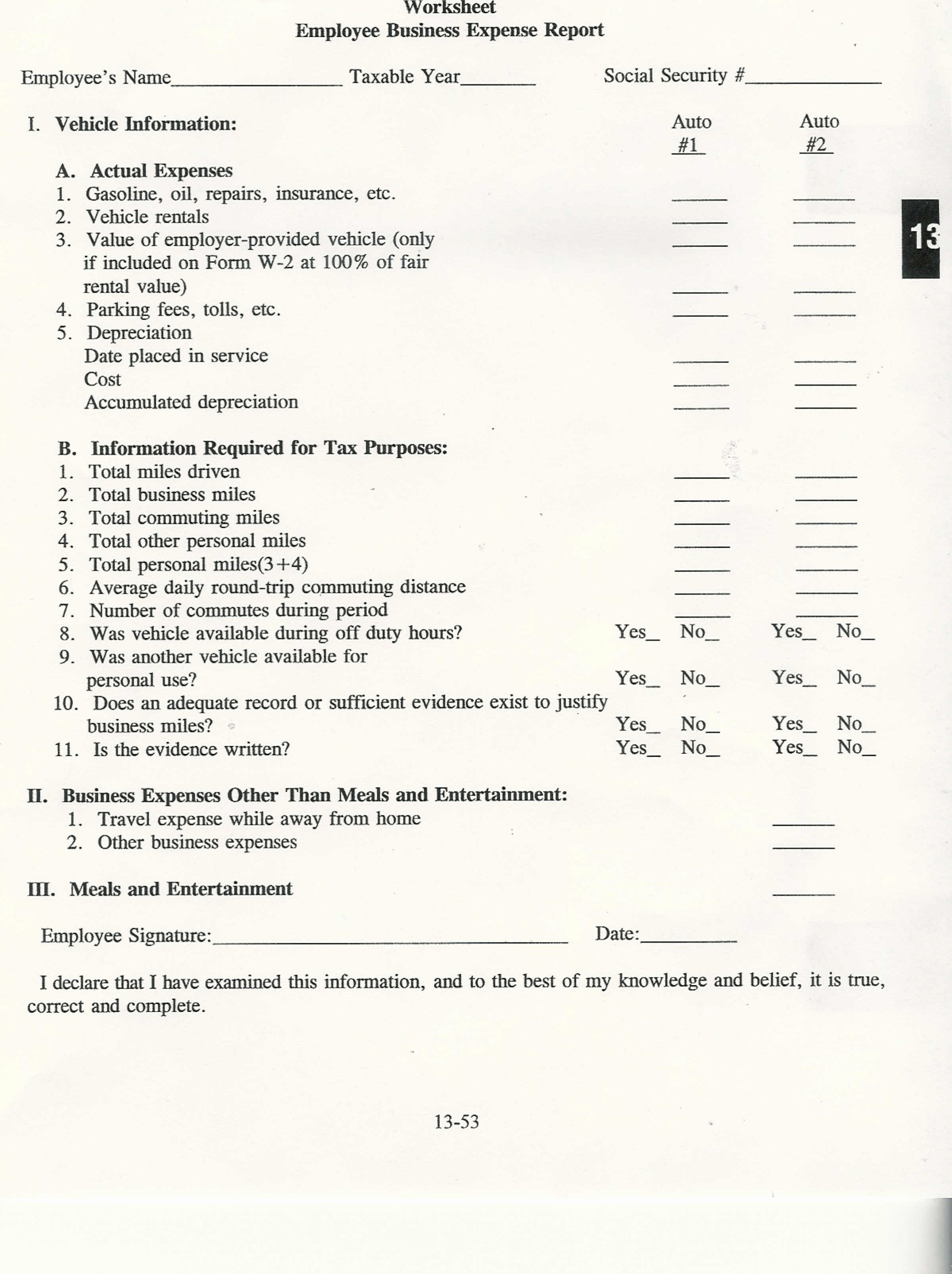

Business Expenses Worksheet

https://www.irs.gov › ... › understanding-employment-taxes

Employers generally must withhold federal income tax from employees wages To figure out how much tax to withhold use the employee s Form W 4 Employee s Withholding Certificate the appropriate method and the appropriate withholding table described in Publication 15 T Federal Income Tax Withholding Methods

https://www.nerdwallet.com › article › taxes › self...

Here are 15 big self employment tax deductions and tax benefits that could slash tax bills for freelancers contractors other people who work for themselves

Employers generally must withhold federal income tax from employees wages To figure out how much tax to withhold use the employee s Form W 4 Employee s Withholding Certificate the appropriate method and the appropriate withholding table described in Publication 15 T Federal Income Tax Withholding Methods

Here are 15 big self employment tax deductions and tax benefits that could slash tax bills for freelancers contractors other people who work for themselves

May Sheets Home Office Deduction Simplified Method Worksheet 2018

Printable Itemized Deductions Worksheet

8 Tax Preparation Organizer Worksheet Worksheeto

Business Expenses Worksheet

Tax Deduction Worksheet Worksheet Itemized Deductions Deduction Tax

Self Employment Tax And Deduction Worksheet The Best Justgoing 2020

Self Employment Tax And Deduction Worksheet The Best Justgoing 2020

Calculate Self Employment Tax Deduction ShannonTroy