In this day and age where screens rule our lives but the value of tangible printed products hasn't decreased. For educational purposes and creative work, or simply to add an individual touch to your area, Energy Efficiency Tax Credit Commercial Buildings are now a vital source. For this piece, we'll take a dive deep into the realm of "Energy Efficiency Tax Credit Commercial Buildings," exploring their purpose, where you can find them, and what they can do to improve different aspects of your life.

Get Latest Energy Efficiency Tax Credit Commercial Buildings Below

Energy Efficiency Tax Credit Commercial Buildings

Energy Efficiency Tax Credit Commercial Buildings -

Commercial Multifamily Sponsored by the U S Department of Energy s Building Technologies Office this prize offers up to 2 million to encourage the production of high performance cost effective secondary glazing

The 179D commercial buildings energy efficiency tax deduction primarily enables building owners to claim a tax deduction for installing qualifying systems in buildings

Energy Efficiency Tax Credit Commercial Buildings include a broad selection of printable and downloadable materials online, at no cost. These printables come in different styles, from worksheets to templates, coloring pages, and more. The great thing about Energy Efficiency Tax Credit Commercial Buildings lies in their versatility and accessibility.

More of Energy Efficiency Tax Credit Commercial Buildings

Residential Energy Efficiency Tax Credits Extended To 2032 Verde Energy

Residential Energy Efficiency Tax Credits Extended To 2032 Verde Energy

These newly enacted changes to Sec 179D provide additional opportunities for taxpayers including as much as 5 36 per square foot sq ft in immediate deductions to encourage the

The Consolidated Appropriations Act 2021 H R 133 made the 179D energy efficient commercial buildings federal tax deduction permanent updated

Energy Efficiency Tax Credit Commercial Buildings have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Customization: The Customization feature lets you tailor printables to your specific needs for invitations, whether that's creating them planning your schedule or decorating your home.

-

Education Value Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages. This makes the perfect tool for parents and educators.

-

The convenience of Access to an array of designs and templates will save you time and effort.

Where to Find more Energy Efficiency Tax Credit Commercial Buildings

Commercial Building Inspection PCA Due Diligence

Commercial Building Inspection PCA Due Diligence

Section 179D energy efficient commercial buildings deduction Section 45L energy efficient residential housing credit Solar investment tax credit ITC Renewable

Qualification for the 179D tax deduction is based on the energy and power cost savings in a tax payer s building relative to a reference building that meets the minimum

Now that we've piqued your curiosity about Energy Efficiency Tax Credit Commercial Buildings Let's see where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of reasons.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free, flashcards, and learning tools.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a wide range of topics, everything from DIY projects to planning a party.

Maximizing Energy Efficiency Tax Credit Commercial Buildings

Here are some ideas for you to get the best of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Energy Efficiency Tax Credit Commercial Buildings are a treasure trove with useful and creative ideas that can meet the needs of a variety of people and pursuits. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast array of Energy Efficiency Tax Credit Commercial Buildings now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Energy Efficiency Tax Credit Commercial Buildings really are they free?

- Yes you can! You can download and print these materials for free.

-

Can I use the free printables to make commercial products?

- It's contingent upon the specific conditions of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may come with restrictions on usage. Be sure to check the conditions and terms of use provided by the designer.

-

How do I print Energy Efficiency Tax Credit Commercial Buildings?

- You can print them at home with the printer, or go to the local print shops for superior prints.

-

What program do I require to view Energy Efficiency Tax Credit Commercial Buildings?

- The majority of printables are in PDF format. These can be opened with free software like Adobe Reader.

What Qualifies For Energy Efficient Tax Credit

How To Get The Energy Efficiency Tax Credit For Commercial Buildings

Check more sample of Energy Efficiency Tax Credit Commercial Buildings below

Companies Organizations Call For Modernizing Homeowner Energy

Roofing Options To Consider When It s Time To Replace

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L

Claim Energy Efficiency Tax Credit For Homeowners Before It s Gone Inman

An Energy Efficiency Tax Credit And Motivated Buyers Await Builders Who

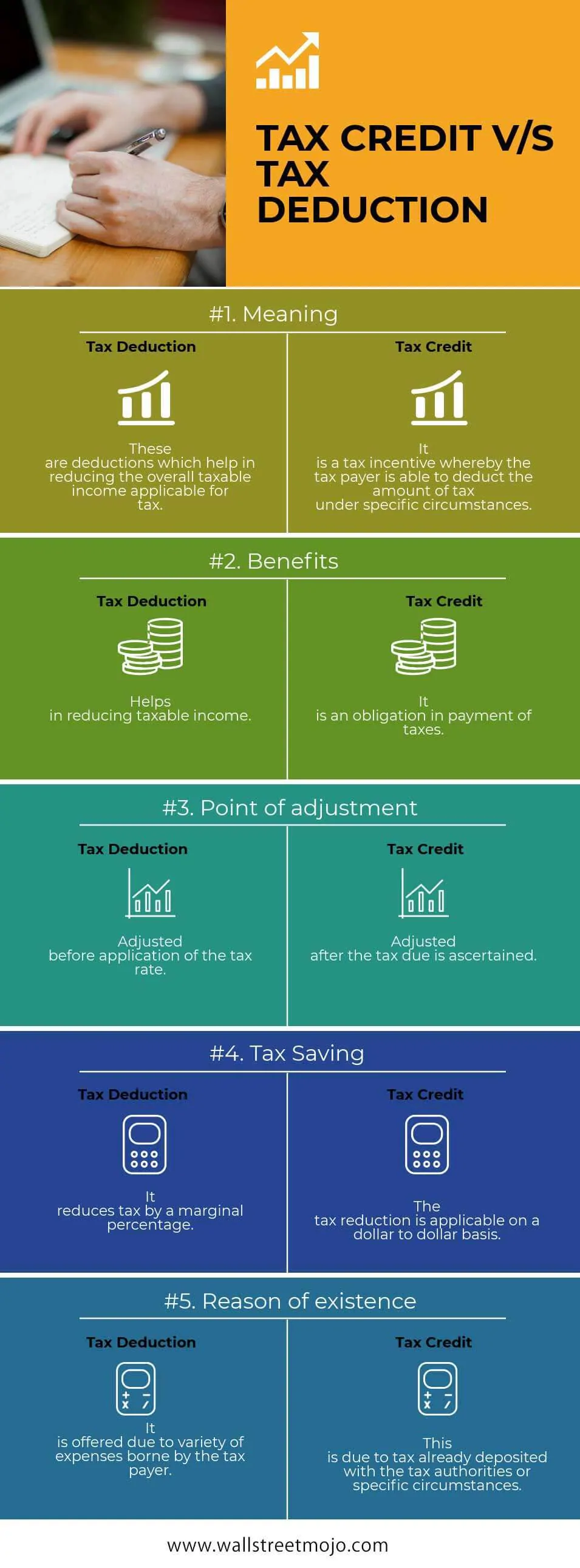

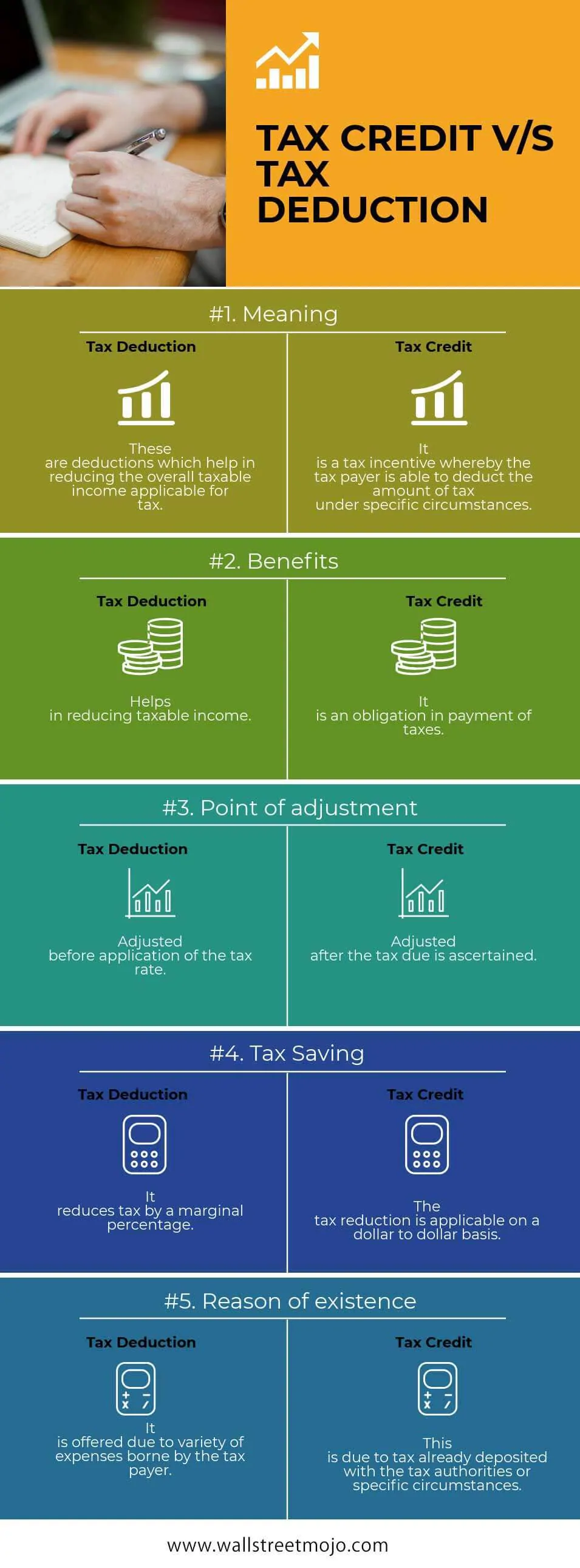

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

https://www.energy.gov/eere/buildings/179d...

The 179D commercial buildings energy efficiency tax deduction primarily enables building owners to claim a tax deduction for installing qualifying systems in buildings

https://betterbuildingssolutioncenter.energy.gov/...

The 179D commercial buildings energy efficiency tax deduction provides a permanent tax deduction for energy efficiency improvements to commercial

The 179D commercial buildings energy efficiency tax deduction primarily enables building owners to claim a tax deduction for installing qualifying systems in buildings

The 179D commercial buildings energy efficiency tax deduction provides a permanent tax deduction for energy efficiency improvements to commercial

Claim Energy Efficiency Tax Credit For Homeowners Before It s Gone Inman

Roofing Options To Consider When It s Time To Replace

An Energy Efficiency Tax Credit And Motivated Buyers Await Builders Who

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

WB2B863 Viessmann WB2B863 WB2B 105 304 000 BTU Output Vitodens 200

WB2B860 Viessmann WB2B860 WB2B 45 127 000 BTU Output Vitodens 200

WB2B860 Viessmann WB2B860 WB2B 45 127 000 BTU Output Vitodens 200

C mo Obtener El Cr dito Fiscal Por Eficiencia Energ tica Para Edificios