In this age of electronic devices, in which screens are the norm, the charm of tangible printed objects isn't diminished. Be it for educational use, creative projects, or simply to add some personal flair to your space, Energy Efficiency Tax Credit are now a useful resource. For this piece, we'll dive into the sphere of "Energy Efficiency Tax Credit," exploring what they are, where they can be found, and what they can do to improve different aspects of your daily life.

Get Latest Energy Efficiency Tax Credit Below

Energy Efficiency Tax Credit

Energy Efficiency Tax Credit -

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total sum owed to the

Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023

Energy Efficiency Tax Credit include a broad assortment of printable materials available online at no cost. They are available in numerous forms, including worksheets, templates, coloring pages and more. The value of Energy Efficiency Tax Credit lies in their versatility as well as accessibility.

More of Energy Efficiency Tax Credit

An Energy Efficiency Tax Credit And Motivated Buyers Await Builders Who

An Energy Efficiency Tax Credit And Motivated Buyers Await Builders Who

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500

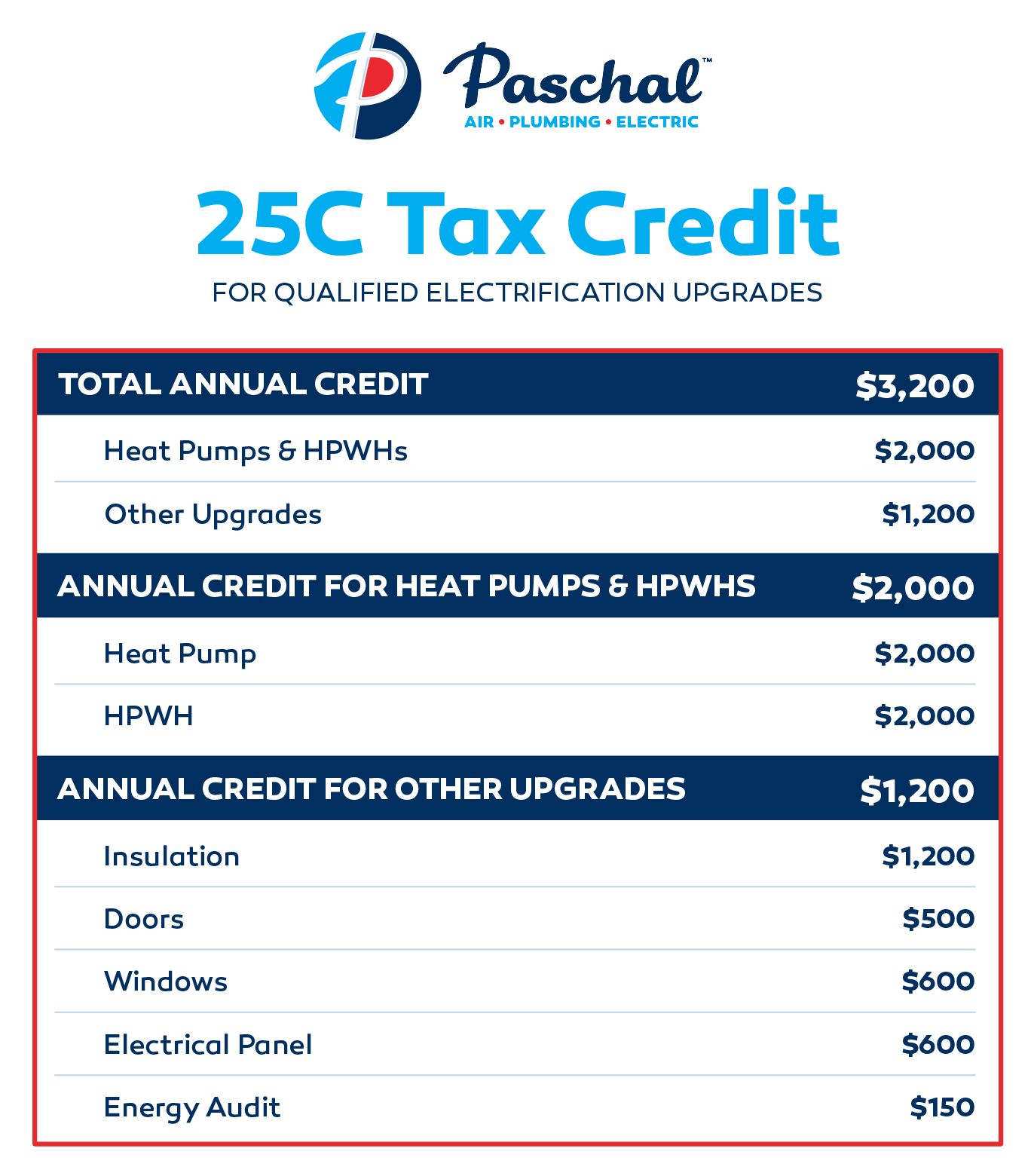

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit These enhancements not only contribute to a greener planet but also result in long term cost savings for homeowners through reduced energy

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Personalization You can tailor designs to suit your personal needs, whether it's designing invitations planning your schedule or even decorating your home.

-

Educational Benefits: Downloads of educational content for free offer a wide range of educational content for learners of all ages, making them an essential aid for parents as well as educators.

-

Accessibility: Fast access the vast array of design and templates will save you time and effort.

Where to Find more Energy Efficiency Tax Credit

Energy Efficiency Tax Credit Extended Boothbay Register

Energy Efficiency Tax Credit Extended Boothbay Register

Electric Vehicle Tax Credit The IRA includes a 7 500 consumer tax credit for electric vehicle purchases you are eligible if your adjusted gross income is up to 150 000 for individuals or

Solar investment tax credit ITC Renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps Investing in solar energy equipment can yield tax

We hope we've stimulated your curiosity about Energy Efficiency Tax Credit We'll take a look around to see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Energy Efficiency Tax Credit for different reasons.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a broad array of topics, ranging everything from DIY projects to party planning.

Maximizing Energy Efficiency Tax Credit

Here are some ways of making the most of Energy Efficiency Tax Credit:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print free worksheets for teaching at-home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Energy Efficiency Tax Credit are an abundance filled with creative and practical information that cater to various needs and desires. Their access and versatility makes them a valuable addition to each day life. Explore the vast world of Energy Efficiency Tax Credit today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Energy Efficiency Tax Credit really are they free?

- Yes you can! You can print and download these documents for free.

-

Can I utilize free printables to make commercial products?

- It's all dependent on the conditions of use. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright concerns with Energy Efficiency Tax Credit?

- Certain printables may be subject to restrictions in their usage. Always read the conditions and terms of use provided by the designer.

-

How do I print Energy Efficiency Tax Credit?

- Print them at home with the printer, or go to an in-store print shop to get higher quality prints.

-

What program is required to open printables for free?

- A majority of printed materials are in PDF format. They is open with no cost software, such as Adobe Reader.

Companies Organizations Call For Modernizing Homeowner Energy

What Qualifies For Energy Efficient Tax Credit

Check more sample of Energy Efficiency Tax Credit below

Energy Efficiency Tax Credit 6729 Diy Solar Concentrator Generator

HVAC Energy Efficiency Tax Credit Expires December 31 2010 Homesense

25C Residential Energy Efficiency Tax Credit Paschal Air Plumbing

C mo Obtener El Cr dito Fiscal Por Eficiencia Energ tica Para Edificios

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Susan Haas Joyner Commercial

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023

https://www.energystar.gov/about/federal_tax_credits

Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023

Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

C mo Obtener El Cr dito Fiscal Por Eficiencia Energ tica Para Edificios

HVAC Energy Efficiency Tax Credit Expires December 31 2010 Homesense

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Susan Haas Joyner Commercial

Residential Energy Efficiency Tax Credits Extended To 2032 Verde Energy

IRA Fact Sheets Rewiring America

IRA Fact Sheets Rewiring America

Some Ideas On The Employee Retention Credit KPMG Tax You Need To Know