In this digital age, when screens dominate our lives yet the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes as well as creative projects or simply adding personal touches to your area, Energy Star Roof Tax Credit 2022 are now a useful resource. In this article, we'll take a dive deep into the realm of "Energy Star Roof Tax Credit 2022," exploring what they are, where they are, and how they can be used to enhance different aspects of your lives.

Get Latest Energy Star Roof Tax Credit 2022 Below

Energy Star Roof Tax Credit 2022

Energy Star Roof Tax Credit 2022 -

In the case of property placed in service after December 31 2022 and before January 1 2024 22 Q Is a roof eligible for the residential energy efficient property tax

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs

Printables for free include a vast collection of printable material that is available online at no cost. They are available in numerous forms, including worksheets, templates, coloring pages and much more. The beauty of Energy Star Roof Tax Credit 2022 is in their variety and accessibility.

More of Energy Star Roof Tax Credit 2022

The Solar Tax Credit Explained 2022 YouTube

The Solar Tax Credit Explained 2022 YouTube

The Inflation Reduction Act of 2022 provided new Energy Efficient Home Improvement Credits which are available on certain products installed from January 1 2023

The Energy Star Roof Tax Credit for 2024 and 2025 is a government backed initiative designed to incentivize homeowners to upgrade their roofs with Energy Star certified

Energy Star Roof Tax Credit 2022 have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: This allows you to modify printing templates to your own specific requirements when it comes to designing invitations or arranging your schedule or even decorating your house.

-

Educational Benefits: Education-related printables at no charge can be used by students of all ages, making them an invaluable device for teachers and parents.

-

Convenience: Instant access to a variety of designs and templates cuts down on time and efforts.

Where to Find more Energy Star Roof Tax Credit 2022

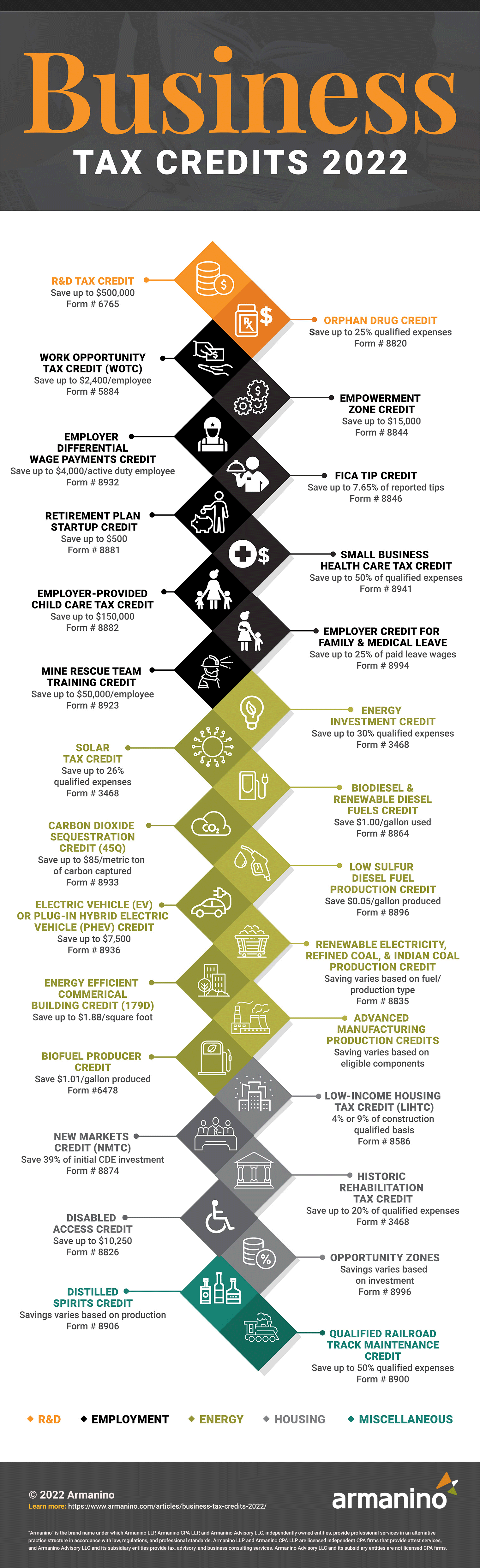

2022 Business Tax Credits Armanino

2022 Business Tax Credits Armanino

Oil furnaces or hot water boilers if they meet or exceed 2021 Energy Star efficiency criteria and are rated by the manufacturer for use with fuel blends at least 20 of

The Inflation Reduction Act of 2022 features tax credits for consumers and businesses that save money on energy bills create jobs make homes and buildings more

We hope we've stimulated your interest in Energy Star Roof Tax Credit 2022 Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Energy Star Roof Tax Credit 2022 suitable for many goals.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free or flashcards as well as learning tools.

- Great for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a broad range of interests, ranging from DIY projects to planning a party.

Maximizing Energy Star Roof Tax Credit 2022

Here are some inventive ways of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Energy Star Roof Tax Credit 2022 are a treasure trove of innovative and useful resources that cater to various needs and passions. Their access and versatility makes them a valuable addition to any professional or personal life. Explore the vast world of Energy Star Roof Tax Credit 2022 today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes you can! You can print and download these free resources for no cost.

-

Are there any free printables for commercial uses?

- It's determined by the specific conditions of use. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns when using Energy Star Roof Tax Credit 2022?

- Some printables could have limitations regarding their use. Make sure to read the terms and conditions offered by the designer.

-

How can I print printables for free?

- Print them at home with your printer or visit the local print shop for high-quality prints.

-

What program do I require to open Energy Star Roof Tax Credit 2022?

- The majority of PDF documents are provided in the format of PDF, which can be opened using free software such as Adobe Reader.

EV Tax Credit 2022 2023 Which Cars Qualify How It Works

How Much Does It Cost To Install Solar Panels Updated 2024

Check more sample of Energy Star Roof Tax Credit 2022 below

ERC Tax Credit 2022 Is The ERC Tax Credit Still Available Marca

Metal Roof Tax Credit YouTube

EITC TAX CREDIT 2022 EARNED INCOME TAX CREDIT CALCULATOR 2022 YouTube

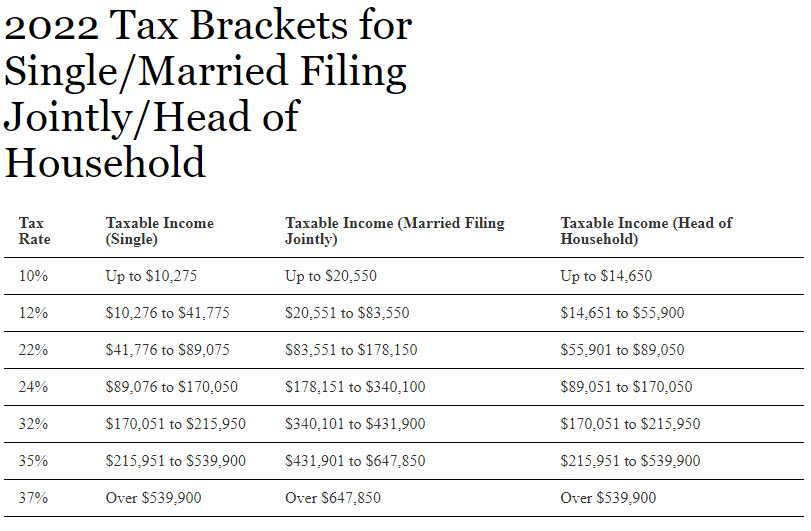

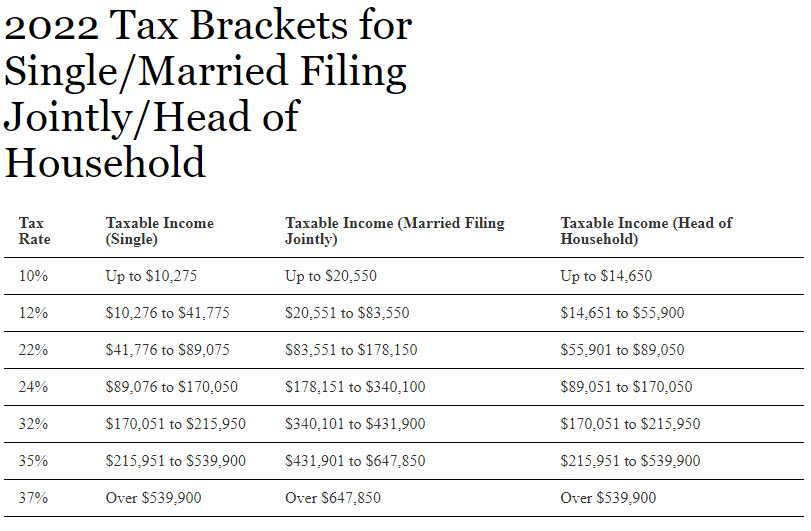

2022 Tax Changes Method CPA

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Tax Credits For New Roofs Residential And Commercial Buildings

https://www.energystar.gov/about/fede…

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs

https://www.energystar.gov/products/a…

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may

2022 Tax Changes Method CPA

Metal Roof Tax Credit YouTube

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Tax Credits For New Roofs Residential And Commercial Buildings

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Metal Roof Tax Credit For 2023 And 2024 Extended Offering Incentives

Metal Roof Tax Credit For 2023 And 2024 Extended Offering Incentives

Does A New Roof Qualify For The Solar Investment Tax Credit Florida