In a world where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes, creative projects, or simply to add an element of personalization to your space, Energy Tax Credit For Business are a great source. In this article, we'll take a dive into the sphere of "Energy Tax Credit For Business," exploring their purpose, where you can find them, and ways they can help you improve many aspects of your daily life.

Get Latest Energy Tax Credit For Business Below

Energy Tax Credit For Business

Energy Tax Credit For Business -

A list of forms for claiming business tax credits and a complete explanation about when carryovers credits and deductions cease

An energy tax credit is a government sponsored incentive that reduces the cost for people and businesses to use alternative energy resources Eligible individuals or entities meeting the criteria are reimbursed for their efforts to make the planet greener when paying income taxes with the credit amount See more

Energy Tax Credit For Business encompass a wide array of printable content that can be downloaded from the internet at no cost. They are available in numerous styles, from worksheets to coloring pages, templates and more. The value of Energy Tax Credit For Business is in their variety and accessibility.

More of Energy Tax Credit For Business

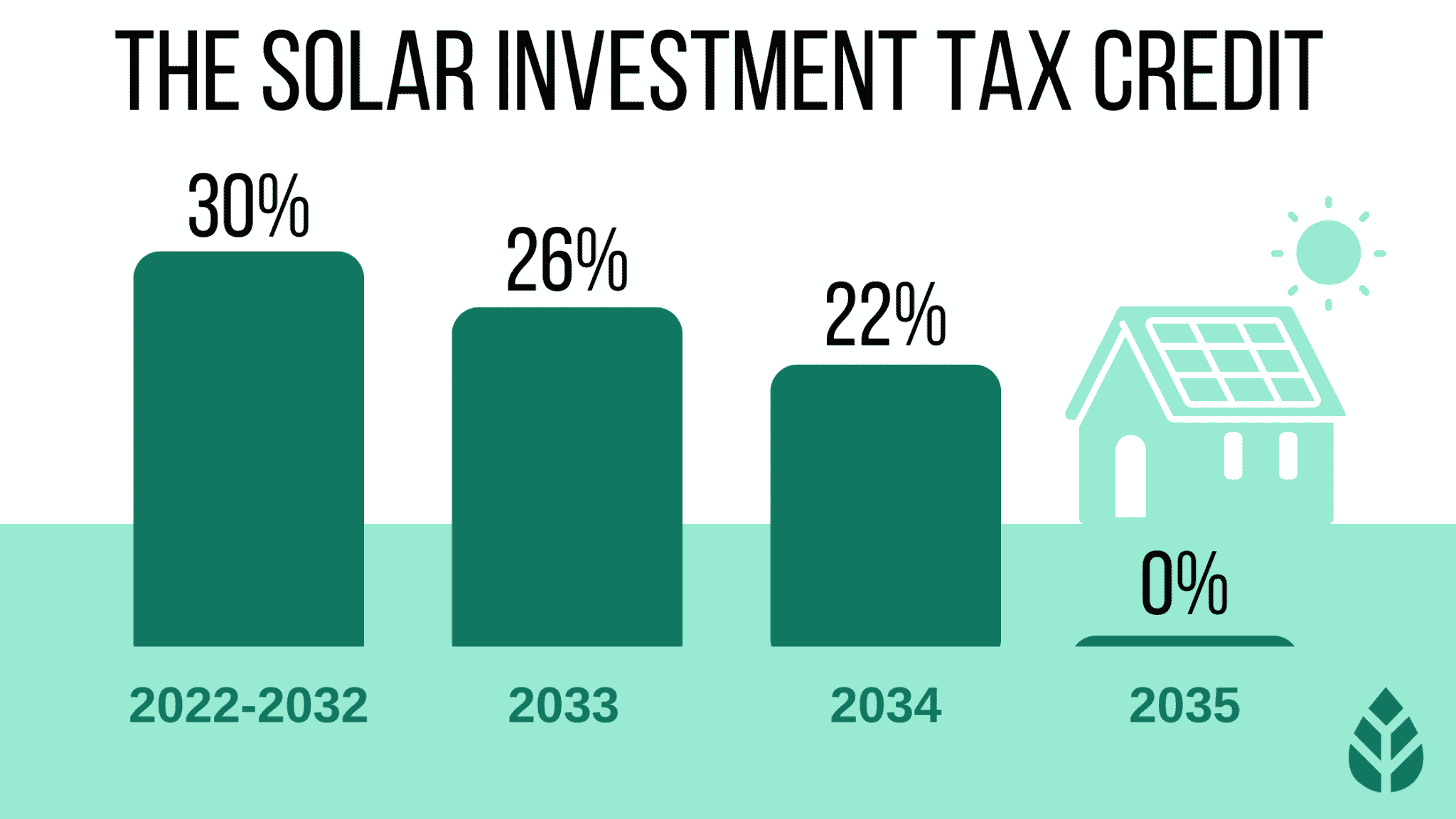

Federal Solar Tax Credit What It Is How To Claim It For 2023

Federal Solar Tax Credit What It Is How To Claim It For 2023

Business energy tax credits The Business Energy Investment Tax Credit ITC and Renewable Energy Production Tax Credit PTC allow businesses to deduct a percentage of the cost of renewable energy systems

This webpage provides an overview of the federal investment and production tax credits for businesses that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP energy generation technologies

Energy Tax Credit For Business have risen to immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Modifications: The Customization feature lets you tailor printing templates to your own specific requirements in designing invitations, organizing your schedule, or decorating your home.

-

Educational Benefits: These Energy Tax Credit For Business offer a wide range of educational content for learners from all ages, making them a useful resource for educators and parents.

-

Accessibility: The instant accessibility to many designs and templates saves time and effort.

Where to Find more Energy Tax Credit For Business

Energy Tax Credit 2011 Not What It Used To Be Darwin s Money

Energy Tax Credit 2011 Not What It Used To Be Darwin s Money

The Energy Policy Act of 2005 EPACT offered businesses tax deductions for the costs of improving the energy efficiency of commercial buildings The Emergency Economic

The Clean Electricity Production Credit is a credit available under the production tax credit for businesses and other entities that produce in a qualified clean or renewable energy

We've now piqued your interest in printables for free Let's take a look at where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Energy Tax Credit For Business for different objectives.

- Explore categories like furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide selection of subjects, ranging from DIY projects to party planning.

Maximizing Energy Tax Credit For Business

Here are some innovative ways how you could make the most use of Energy Tax Credit For Business:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Energy Tax Credit For Business are an abundance of innovative and useful resources that cater to various needs and preferences. Their accessibility and versatility make them a wonderful addition to both professional and personal lives. Explore the endless world of Energy Tax Credit For Business and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Energy Tax Credit For Business really free?

- Yes you can! You can download and print these files for free.

-

Can I utilize free printables for commercial use?

- It's determined by the specific rules of usage. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions in their usage. Make sure to read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home with any printer or head to a print shop in your area for top quality prints.

-

What program do I require to view printables at no cost?

- Most printables come in the format PDF. This can be opened using free programs like Adobe Reader.

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Business Energy Tax Credit Benefits O Brien Riley Ryan P C

Check more sample of Energy Tax Credit For Business below

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Energy Tax Credit For 2023 What Is An Energy Tax Credit

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

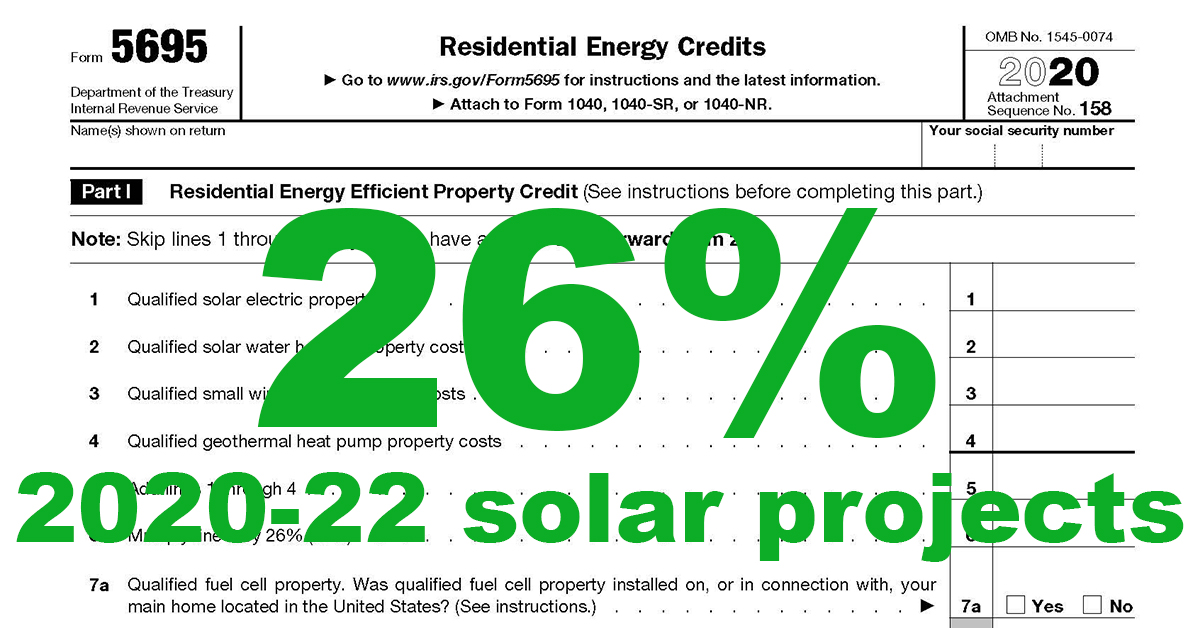

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

2015 Tax Guide Making Use Of Your Energy Tax Credit

The Federal Electric Car Rebate A Great Way To Save Money And Combat

https://www.investopedia.com › terms › energy-tax-credit.asp

An energy tax credit is a government sponsored incentive that reduces the cost for people and businesses to use alternative energy resources Eligible individuals or entities meeting the criteria are reimbursed for their efforts to make the planet greener when paying income taxes with the credit amount See more

https://pro.bloombergtax.com › insights › federal-tax › ...

The energy credit provides a tax credit for investment in renewable energy fuel cell solar geothermal small wind energy storage biogas microgrid controllers combined

An energy tax credit is a government sponsored incentive that reduces the cost for people and businesses to use alternative energy resources Eligible individuals or entities meeting the criteria are reimbursed for their efforts to make the planet greener when paying income taxes with the credit amount See more

The energy credit provides a tax credit for investment in renewable energy fuel cell solar geothermal small wind energy storage biogas microgrid controllers combined

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Energy Tax Credit For 2023 What Is An Energy Tax Credit

2015 Tax Guide Making Use Of Your Energy Tax Credit

The Federal Electric Car Rebate A Great Way To Save Money And Combat

Energy Tax Credit Don t Leave Money On The Table Armchair Builder

Getting An Energy Tax Credit For Solar Panel Projects

Getting An Energy Tax Credit For Solar Panel Projects

Puget Sound Solar LLC