Today, when screens dominate our lives, the charm of tangible, printed materials hasn't diminished. Whatever the reason, whether for education, creative projects, or just adding personal touches to your home, printables for free are a great source. This article will take a dive in the world of "Entertainment Tax Deduction 2021," exploring the benefits of them, where you can find them, and how they can improve various aspects of your lives.

Get Latest Entertainment Tax Deduction 2021 Below

Entertainment Tax Deduction 2021

Entertainment Tax Deduction 2021 -

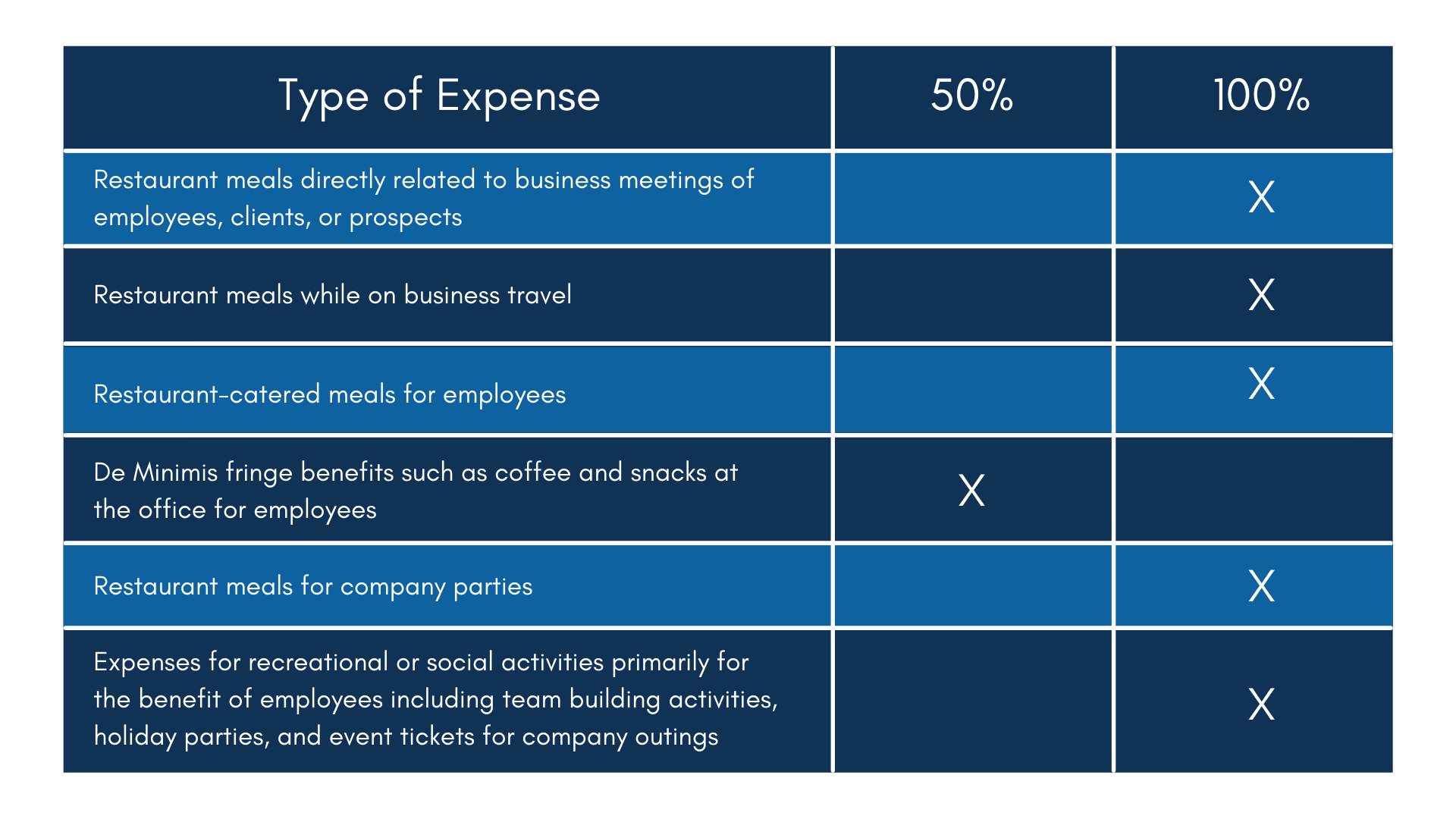

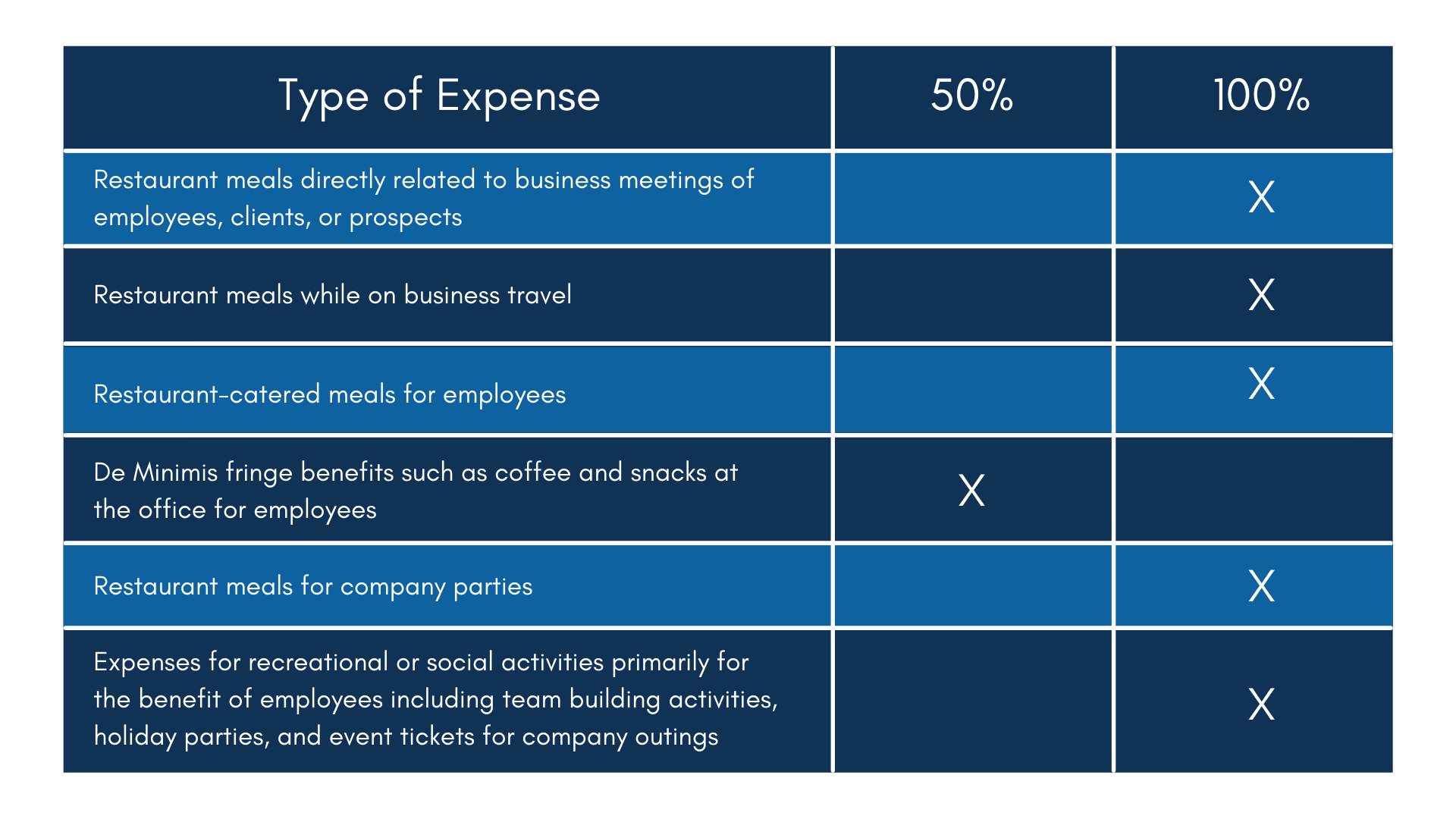

The TCJA eliminated the Sec 274 a deduction for expenses related to business entertainment amusement or recreational activities These final regulations bring clarity for the business community on what food and beverage expenses are deductible that can be separated from entertainment amusement or recreational activities

Last updated 06 Jan 2021 An overview of which entertainment expenses you ll need to pay fringe benefit tax on and which are 100 or only 50 deductible

Printables for free include a vast variety of printable, downloadable materials online, at no cost. These printables come in different forms, like worksheets templates, coloring pages, and many more. One of the advantages of Entertainment Tax Deduction 2021 is in their variety and accessibility.

More of Entertainment Tax Deduction 2021

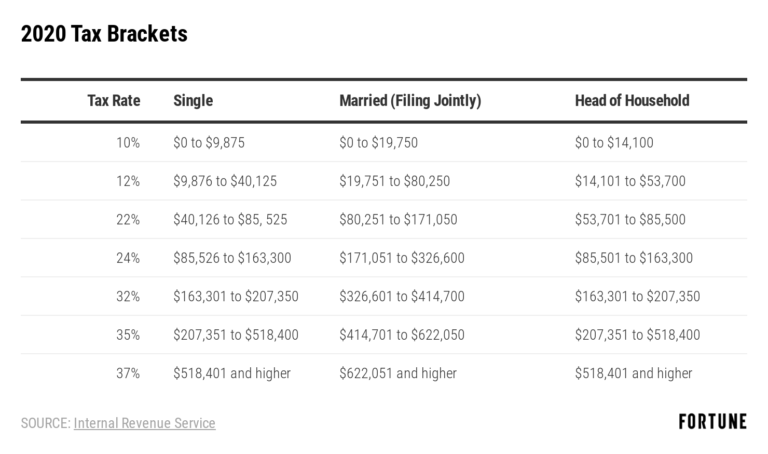

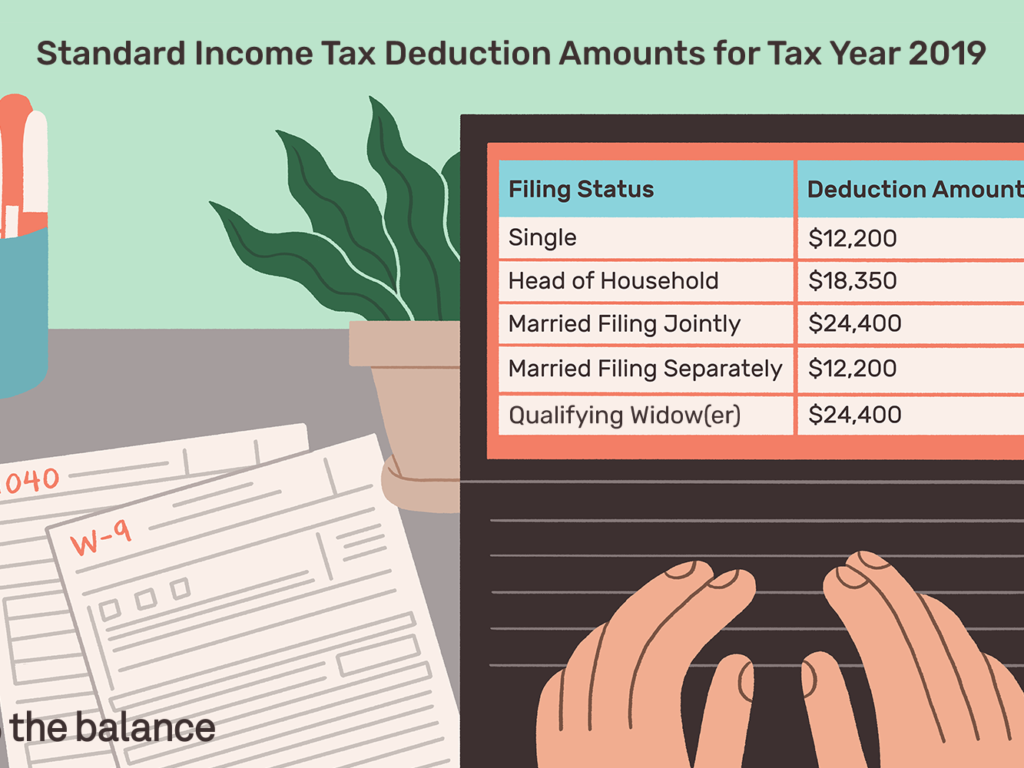

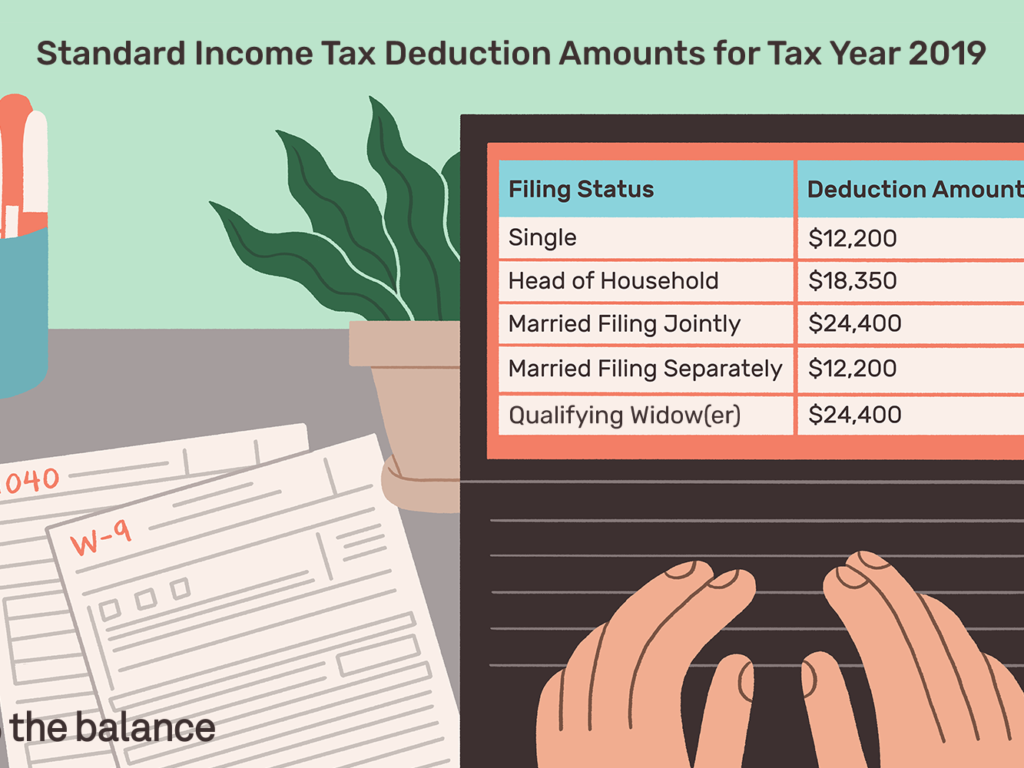

2020 Tax Deductions Standard Deduction 2021

2020 Tax Deductions Standard Deduction 2021

The Act allows companies to deduct 100 of the cost of business related restaurant meals consumed from January 1 2021 through December 31 2022 Previously you could only deduct 50 of the bill To qualify for the increased deduction either the company s owner or an employee must be present when dining

In just the past few years uncertainty has reigned regarding the availability and requirements for the business meal deduction because of its abrupt separation from its historic tax deduction counterpart the business entertainment expense deduction

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Individualization The Customization feature lets you tailor designs to suit your personal needs in designing invitations and schedules, or even decorating your house.

-

Educational Value: Educational printables that can be downloaded for free can be used by students of all ages. This makes them a great tool for parents and teachers.

-

An easy way to access HTML0: Fast access a variety of designs and templates will save you time and effort.

Where to Find more Entertainment Tax Deduction 2021

Federal Income Tax Standard Deduction 2021 Standard Deduction 2021

Federal Income Tax Standard Deduction 2021 Standard Deduction 2021

Entertainment expenses which are expenses incurred for entertainment recreation or amusement are still not considered tax deductible However if you choose to provide food and beverages during the recreational event those expenses are now 100 deductible if they meet a few requirements

Entertainment expenses that otherwise would be allowable under chapter 1 of the Code chapter 1 Section 274 a 1 generally disallows deductions for expenses for entertainment amusement or recreation Section 1 274 11 of the Income Tax Regulations provides that the disallowance under section 274 a 1 does not apply to

Now that we've ignited your interest in printables for free, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of objectives.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing Entertainment Tax Deduction 2021

Here are some unique ways of making the most use of Entertainment Tax Deduction 2021:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Entertainment Tax Deduction 2021 are an abundance of useful and creative resources which cater to a wide range of needs and passions. Their access and versatility makes them a fantastic addition to the professional and personal lives of both. Explore the world that is Entertainment Tax Deduction 2021 today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes, they are! You can print and download the resources for free.

-

Do I have the right to use free printables to make commercial products?

- It depends on the specific conditions of use. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Do you have any copyright issues when you download Entertainment Tax Deduction 2021?

- Certain printables may be subject to restrictions regarding usage. Be sure to read the terms of service and conditions provided by the creator.

-

How do I print Entertainment Tax Deduction 2021?

- Print them at home using either a printer or go to a local print shop to purchase high-quality prints.

-

What program is required to open printables at no cost?

- The majority of printed documents are in the format PDF. This can be opened with free programs like Adobe Reader.

Deducting Meals And Entertainment In 2021 2022 Lifetime Paradigm

2020 Standard Deduction Over 65 Standard Deduction 2021

Check more sample of Entertainment Tax Deduction 2021 below

New York State Standard Deduction 2020 Standard Deduction 2021

Standard Deduction For 2021 Taxes Standard Deduction 2021

GOP Tax Overhaul Eliminates Business Entertainment Tax Deduction

Self Employed Meal Deduction 2021 EmploymentProTalk

Meals Entertainment Deductions What s New For 2021 2022 Beaird

Standard Income Tax Deduction For 2020 Standard Deduction 2021

https://www.ird.govt.nz/income-tax/income-tax-for...

Last updated 06 Jan 2021 An overview of which entertainment expenses you ll need to pay fringe benefit tax on and which are 100 or only 50 deductible

https://www.irs.gov/newsroom/heres-what-businesses...

Entertainment events Business owners may be able to deduct the costs of meals and beverages provided during an entertainment event if either of these apply the purchase of the food and beverages occurs separately from the entertainment

Last updated 06 Jan 2021 An overview of which entertainment expenses you ll need to pay fringe benefit tax on and which are 100 or only 50 deductible

Entertainment events Business owners may be able to deduct the costs of meals and beverages provided during an entertainment event if either of these apply the purchase of the food and beverages occurs separately from the entertainment

Self Employed Meal Deduction 2021 EmploymentProTalk

Standard Deduction For 2021 Taxes Standard Deduction 2021

Meals Entertainment Deductions What s New For 2021 2022 Beaird

Standard Income Tax Deduction For 2020 Standard Deduction 2021

Standard Deduction 2020 Self Employed Standard Deduction 2021

Blog Meals And Entertainment Deduction Changes Gold Standard Tax

Blog Meals And Entertainment Deduction Changes Gold Standard Tax

Do You Know What