In the digital age, where screens rule our lives, the charm of tangible printed objects hasn't waned. Whatever the reason, whether for education project ideas, artistic or simply adding an extra personal touch to your home, printables for free have proven to be a valuable source. This article will dive into the world "Ev Credit Rules 2022," exploring the different types of printables, where to locate them, and the ways that they can benefit different aspects of your lives.

Get Latest Ev Credit Rules 2022 Below

Ev Credit Rules 2022

Ev Credit Rules 2022 -

The rules for cars purchased in 2022 or before The rules for cars purchased after January 1st 2023 The list of eligible vehicles The rules for used cars The rules for commercial

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before Internal Revenue Service

Ev Credit Rules 2022 provide a diverse selection of printable and downloadable content that can be downloaded from the internet at no cost. These resources come in many types, such as worksheets templates, coloring pages and more. The great thing about Ev Credit Rules 2022 lies in their versatility as well as accessibility.

More of Ev Credit Rules 2022

The Tesla EV Tax Credit 2023

.jpg)

The Tesla EV Tax Credit 2023

For a broader view of what vehicles may now be eligible for this credit the Department of Energy published a list of Model Year 2022 and early Model Year 2023 electric vehicles that likely meet the final assembly requirement The eligibility for a specific vehicle should be confirmed using its VIN number

Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further changes to the eligibility rules will begin in 2023

Ev Credit Rules 2022 have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization: This allows you to modify designs to suit your personal needs be it designing invitations planning your schedule or even decorating your house.

-

Educational Use: The free educational worksheets offer a wide range of educational content for learners from all ages, making them a great tool for parents and educators.

-

An easy way to access HTML0: instant access the vast array of design and templates can save you time and energy.

Where to Find more Ev Credit Rules 2022

New EV Tax Credits For 2023 Every Electric Vehicle Incentive

New EV Tax Credits For 2023 Every Electric Vehicle Incentive

WASHINGTON Aug 16 Reuters The Biden administration said on Tuesday about 20 models will still qualify for electric vehicle tax credits of up to 7 500 through the end of 2022 under

The IRS released guidance to assist taxpayers with navigating the transition from electric vehicle EV credits under prior law to the rules under the Inflation Reduction Act of 2022 the Act

In the event that we've stirred your interest in Ev Credit Rules 2022, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Ev Credit Rules 2022 to suit a variety of applications.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- These blogs cover a broad variety of topics, that includes DIY projects to party planning.

Maximizing Ev Credit Rules 2022

Here are some inventive ways that you can make use use of Ev Credit Rules 2022:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Ev Credit Rules 2022 are an abundance of fun and practical tools that meet a variety of needs and preferences. Their access and versatility makes them an invaluable addition to every aspect of your life, both professional and personal. Explore the world of Ev Credit Rules 2022 to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can download and print these files for free.

-

Can I download free printables in commercial projects?

- It's dependent on the particular terms of use. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with Ev Credit Rules 2022?

- Some printables may have restrictions regarding their use. Make sure to read the terms and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home with a printer or visit any local print store for top quality prints.

-

What software must I use to open printables at no cost?

- Most PDF-based printables are available in the format of PDF, which can be opened using free software like Adobe Reader.

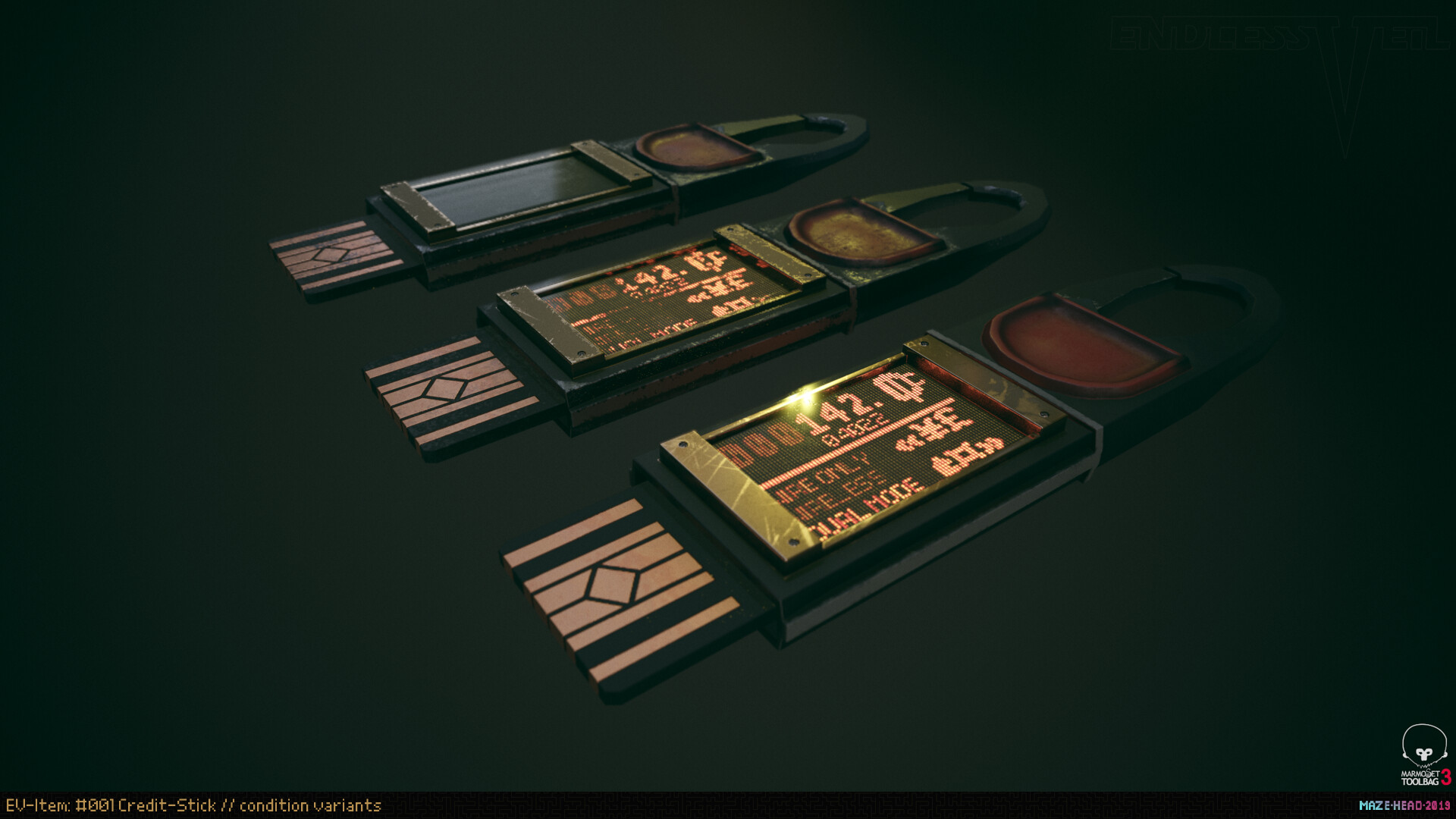

ArtStation EV Credit Sticks

The EV Tax Credit Rules Are Being Delayed Until March 2023 Here s

Check more sample of Ev Credit Rules 2022 below

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

IRS Officially Updates Its EV Tax Credit Rules Cutting Out Even More

Buy An EV Now Or Later The Tax Credit Rules Are About To Change West

Nissan Plans More U S EV Production To Meet Tax Credit Rules

It s Electric The New EV Credit Rules Bertolo Warshaw Accounting

New U S EV Tax Credit Rules To Take Effect From April 18 QUATRO

https://www.irs.gov/credits-deductions/...

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before Internal Revenue Service

.jpg?w=186)

https://techcrunch.com/2022/09/02/a-complete-guide...

10 00 AM PDT September 2 2022 Comment Image Credits Bryce Durbin Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before Internal Revenue Service

10 00 AM PDT September 2 2022 Comment Image Credits Bryce Durbin Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements

Nissan Plans More U S EV Production To Meet Tax Credit Rules

IRS Officially Updates Its EV Tax Credit Rules Cutting Out Even More

It s Electric The New EV Credit Rules Bertolo Warshaw Accounting

New U S EV Tax Credit Rules To Take Effect From April 18 QUATRO

The EV Tax Credit Rules Are Becoming More Complex Wzifah

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

US Unveils Stricter EV Tax Credit Rules To Take Effect April 18