In this age of electronic devices, where screens dominate our lives yet the appeal of tangible printed items hasn't gone away. If it's to aid in education or creative projects, or just adding an element of personalization to your area, Examples Of Tax Credits have become a valuable resource. We'll dive into the sphere of "Examples Of Tax Credits," exploring what they are, where they can be found, and how they can add value to various aspects of your life.

Get Latest Examples Of Tax Credits Below

Examples Of Tax Credits

Examples Of Tax Credits -

A tax credit is a dollar for dollar reduction of a tax bill This allows taxpayers to reduce what they owe or potentially increase their refund

A tax credit is an amount taxpayers claim on their tax return generally to reduce their income tax Eligible taxpayers can use them to potentially reduce their tax bill and increase their refund

Examples Of Tax Credits provide a diverse variety of printable, downloadable documents that can be downloaded online at no cost. These printables come in different forms, including worksheets, coloring pages, templates and much more. The benefit of Examples Of Tax Credits is their flexibility and accessibility.

More of Examples Of Tax Credits

What Tax Credits Are Available In Ireland Ireland Accountant

What Tax Credits Are Available In Ireland Ireland Accountant

Tax deductions lower your taxable income how much of your income you actually pay tax on while tax credits are a dollar for dollar reduction to your tax bill

Overall the most common credits fall into the following categories tax credits for college tax credits for families tax credits for income eligible households and tax credits

The Examples Of Tax Credits have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

customization They can make the design to meet your needs in designing invitations to organize your schedule or even decorating your house.

-

Education Value Printables for education that are free cater to learners of all ages, which makes them an essential tool for parents and teachers.

-

Convenience: Instant access to an array of designs and templates is time-saving and saves effort.

Where to Find more Examples Of Tax Credits

Most Important Factors That Affect Your Tax Credits

Most Important Factors That Affect Your Tax Credits

Tax credits are subtracted directly from a person s tax liability they therefore reduce taxes dollar for dollar Credits have the same value for everyone who can claim their full value

A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in your tax filing software

After we've peaked your interest in printables for free Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in Examples Of Tax Credits for different needs.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs covered cover a wide range of interests, including DIY projects to party planning.

Maximizing Examples Of Tax Credits

Here are some ways that you can make use use of Examples Of Tax Credits:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Examples Of Tax Credits are a treasure trove of innovative and useful resources for a variety of needs and interests. Their availability and versatility make they a beneficial addition to both professional and personal lives. Explore the vast collection of Examples Of Tax Credits today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Examples Of Tax Credits really for free?

- Yes you can! You can print and download these files for free.

-

Are there any free printables for commercial uses?

- It's based on the usage guidelines. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables might have limitations regarding their use. Make sure you read the terms and conditions set forth by the author.

-

How do I print printables for free?

- Print them at home with any printer or head to an area print shop for top quality prints.

-

What program will I need to access printables for free?

- Most printables come in the format PDF. This can be opened with free software such as Adobe Reader.

Taking Advantage Of Tax Credits For Your Business Butterfield

The Complete List Of Tax Credits For Individuals

Check more sample of Examples Of Tax Credits below

What Is The Difference Between A Tax Credit And Tax Deduction

Types Of Renewable Efficiency Tax Credits With Links Attainable Home

The Complete List Of Tax Credits

Is There A Difference Between Child Tax Credit And Additional Child Tax

Two Types Of Tax Credit Types Of Taxes Tax Credits Accounting Services

How To Calculate R D Tax Credits with Examples Kene Partners

https://www.irs.gov/newsroom/tax-credits-for-individuals-what-they...

A tax credit is an amount taxpayers claim on their tax return generally to reduce their income tax Eligible taxpayers can use them to potentially reduce their tax bill and increase their refund

https://www.nerdwallet.com/article/taxes/tax-deductions-tax-breaks

22 Popular Tax Deductions and Tax Breaks for 2023 2024 A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly Learn more about

A tax credit is an amount taxpayers claim on their tax return generally to reduce their income tax Eligible taxpayers can use them to potentially reduce their tax bill and increase their refund

22 Popular Tax Deductions and Tax Breaks for 2023 2024 A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly Learn more about

Is There A Difference Between Child Tax Credit And Additional Child Tax

Types Of Renewable Efficiency Tax Credits With Links Attainable Home

Two Types Of Tax Credit Types Of Taxes Tax Credits Accounting Services

How To Calculate R D Tax Credits with Examples Kene Partners

Tax Credit Vs Tax Deduction Difference And Comparison Diffen

10 Types Of Tax Credits You Need To Know CentSai

10 Types Of Tax Credits You Need To Know CentSai

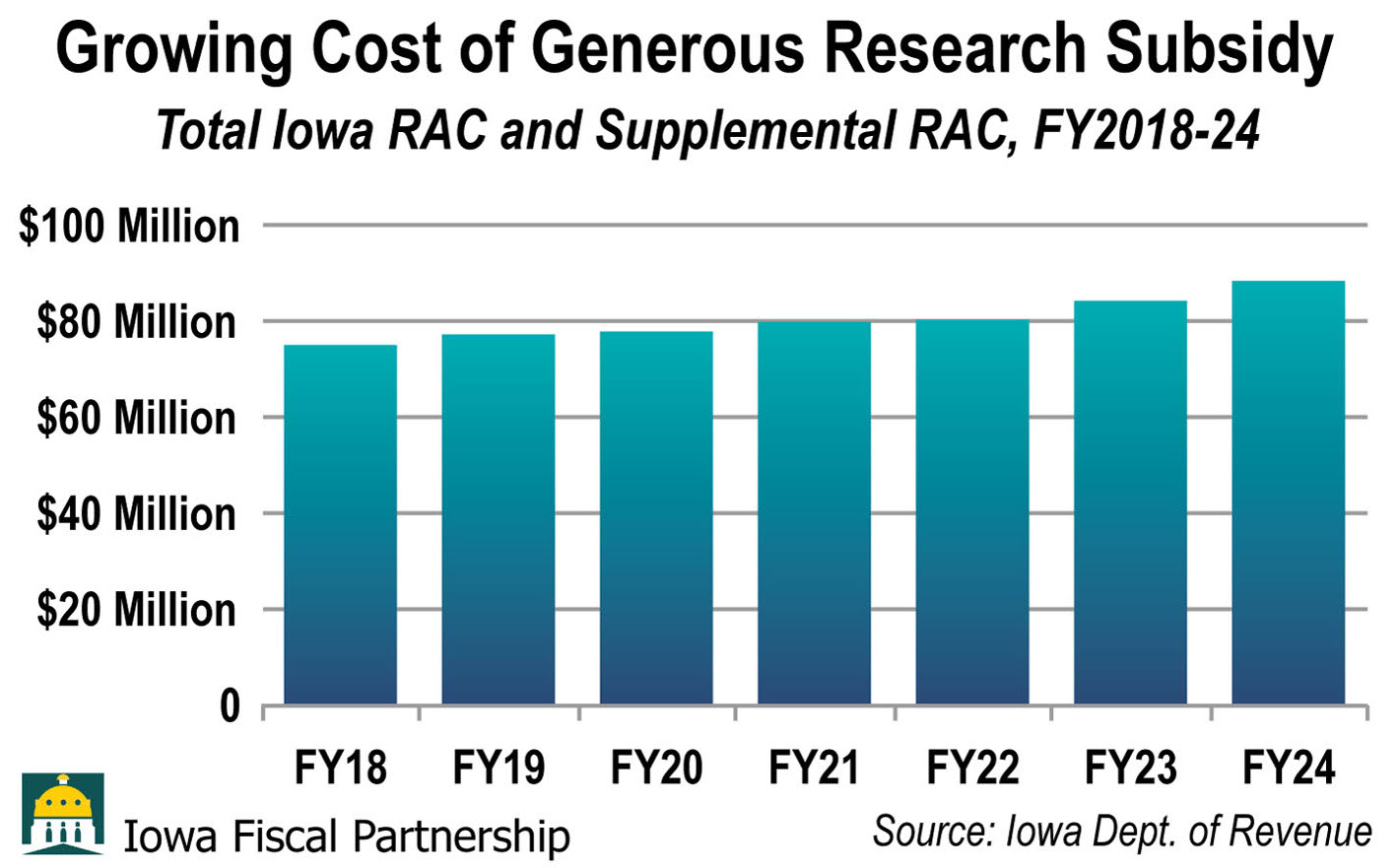

Tax Credits Just Review Them Iowa Policy Points