In this day and age where screens dominate our lives however, the attraction of tangible printed material hasn't diminished. For educational purposes for creative projects, simply adding a personal touch to your space, Exemption Of Interest Income For Senior Citizens have become an invaluable source. For this piece, we'll take a dive deep into the realm of "Exemption Of Interest Income For Senior Citizens," exploring what they are, how to find them, and how they can add value to various aspects of your daily life.

Get Latest Exemption Of Interest Income For Senior Citizens Below

Exemption Of Interest Income For Senior Citizens

Exemption Of Interest Income For Senior Citizens -

Discover the benefits of Section 80TTB a special income tax deduction for senior citizens Learn about eligibility criteria deduction limits and how to claim this tax benefit on interest income from savings accounts fixed deposits and other specified

Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above Conditions for exemption are Senior Citizen should be of age 75 years or above Senior Citizen should be

Exemption Of Interest Income For Senior Citizens cover a large range of printable, free material that is available online at no cost. These resources come in many styles, from worksheets to templates, coloring pages and much more. The benefit of Exemption Of Interest Income For Senior Citizens lies in their versatility and accessibility.

More of Exemption Of Interest Income For Senior Citizens

How To Fill Form 15H In Hindi Form 15H To Save TDS On Interest Income

How To Fill Form 15H In Hindi Form 15H To Save TDS On Interest Income

Does the interest earned from SCSS qualify as part of the Rs 50 000 deduction in interest income that s meant for senior citizens Archit Gupta CEO ClearTax replies Interest of up to Rs 50 000 received from this scheme will be eligible for a deduction under Section 80TTB of the Income Tax Act

In most cases property you receive as a gift bequest or inheritance isn t included in your income However if property you receive this way later produces income such as interest dividends or rents that income is taxable to you

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Customization: The Customization feature lets you tailor printables to fit your particular needs such as designing invitations, organizing your schedule, or even decorating your house.

-

Educational Use: Printing educational materials for no cost are designed to appeal to students of all ages, which makes them a useful source for educators and parents.

-

Simple: immediate access the vast array of design and templates will save you time and effort.

Where to Find more Exemption Of Interest Income For Senior Citizens

Smart Money Guide Update On Progress Bars And Interest Income

Smart Money Guide Update On Progress Bars And Interest Income

Section 80TTB of the Income tax Act 1961 allows a resident senior citizen to claim a deduction against interest income on the deposit All you need to know about section 80TTB and how to use it

Are my wages exempt from federal income tax withholding Determine if your retirement income is taxable Use the Interactive Tax Assistant to get retirement income information including pensions IRAs and Social Security Social Security and railroad retirement benefits Determine if these benefits are taxable Review the tax rules

After we've peaked your interest in Exemption Of Interest Income For Senior Citizens and other printables, let's discover where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Exemption Of Interest Income For Senior Citizens suitable for many reasons.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free or flashcards as well as learning tools.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- These blogs cover a wide spectrum of interests, that includes DIY projects to planning a party.

Maximizing Exemption Of Interest Income For Senior Citizens

Here are some ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Exemption Of Interest Income For Senior Citizens are an abundance of innovative and useful resources that cater to various needs and needs and. Their availability and versatility make them an invaluable addition to both professional and personal life. Explore the plethora of Exemption Of Interest Income For Senior Citizens and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can print and download these files for free.

-

Are there any free printables to make commercial products?

- It's all dependent on the rules of usage. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues with Exemption Of Interest Income For Senior Citizens?

- Certain printables might have limitations in use. You should read these terms and conditions as set out by the creator.

-

How can I print Exemption Of Interest Income For Senior Citizens?

- Print them at home with any printer or head to a print shop in your area for top quality prints.

-

What software will I need to access printables at no cost?

- The majority of printables are in the format of PDF, which can be opened using free software like Adobe Reader.

Income Investments For Senior Citizens

Form 15H Amended Senior Citizens To Get Higher TDS Exemption On

Check more sample of Exemption Of Interest Income For Senior Citizens below

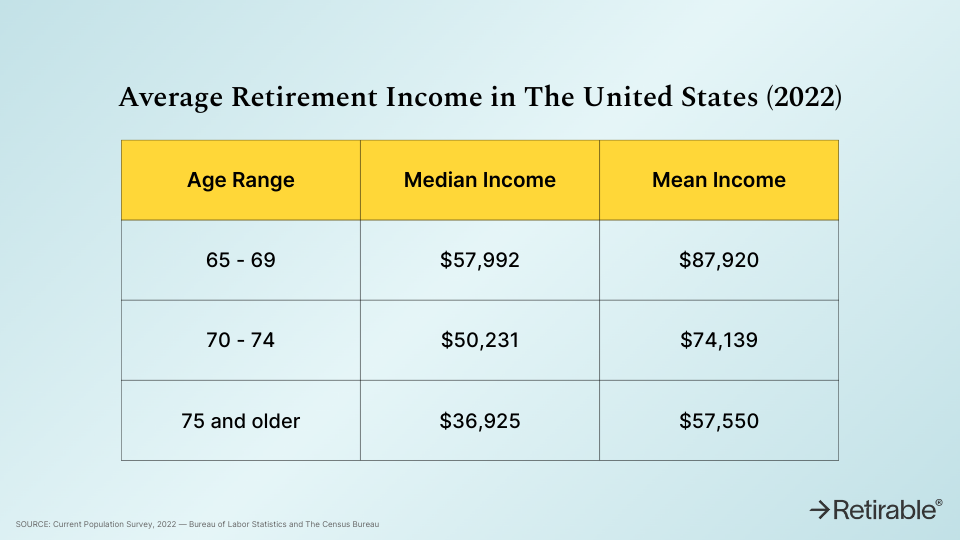

Average Retirement Income 2023 How Do You Compare

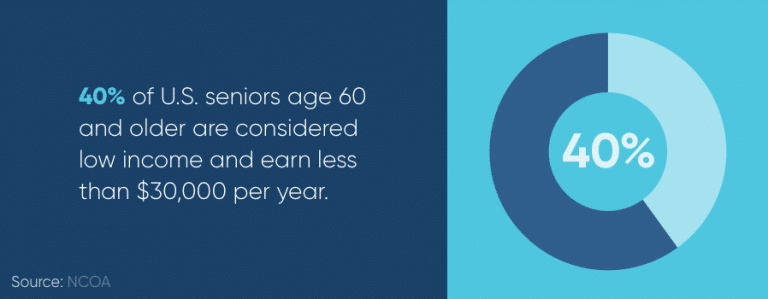

What Is Considered Low Income For Senior Citizens GoodLife 2022

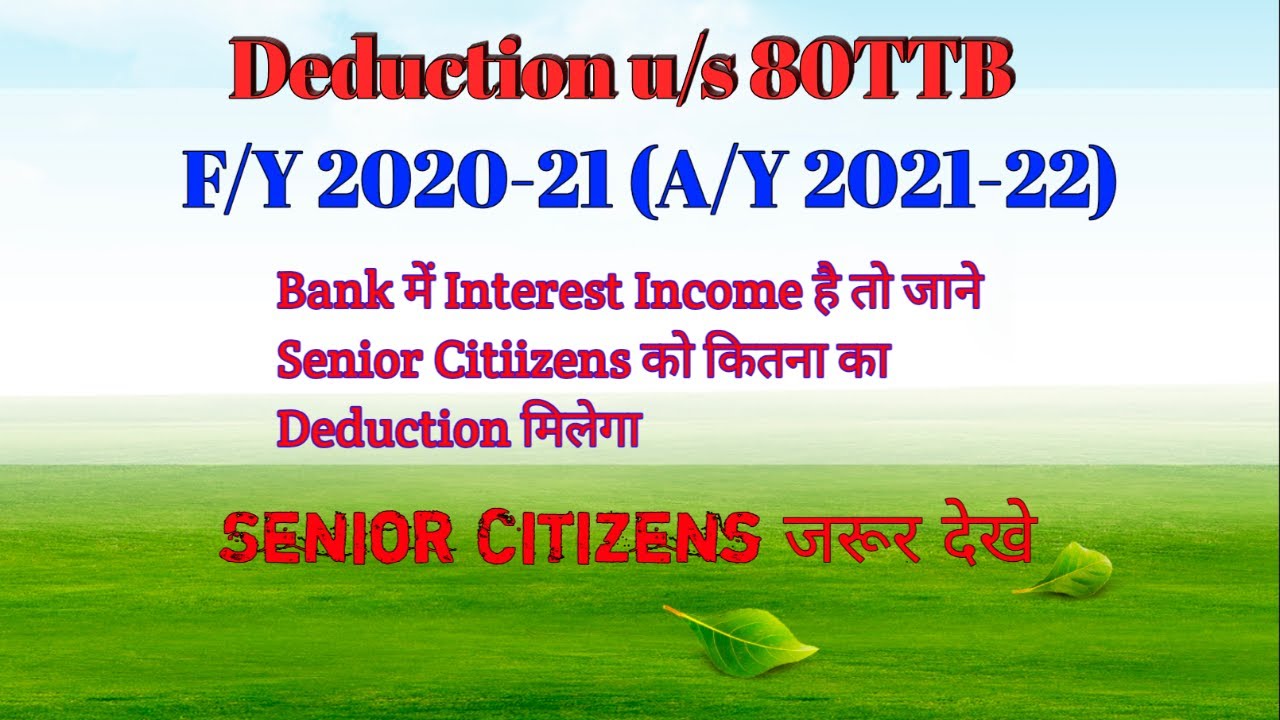

Section 80TTB AY 2021 22 Deduction On Interest Income For Senior

Budget 2018 Exemption On Interest Income For Senior Citizens Hiked To

Tax Exemption U S 80TTB Interest Income For Senior Citizens Video

SCSS Or Senior Citizen Savings Scheme Details Benefits Interest Rates

https://www.incometax.gov.in/iec/foportal/help/...

Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above Conditions for exemption are Senior Citizen should be of age 75 years or above Senior Citizen should be

https://www.livemint.com/money/personal-finance/...

As the interest under Section 80TTB is exempt up to Rs 50 000 resident senior citizens benefit Mint Section 80TTB of the Income Tax Act outlines the tax benefits that senior citizens can

Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above Conditions for exemption are Senior Citizen should be of age 75 years or above Senior Citizen should be

As the interest under Section 80TTB is exempt up to Rs 50 000 resident senior citizens benefit Mint Section 80TTB of the Income Tax Act outlines the tax benefits that senior citizens can

Budget 2018 Exemption On Interest Income For Senior Citizens Hiked To

What Is Considered Low Income For Senior Citizens GoodLife 2022

Tax Exemption U S 80TTB Interest Income For Senior Citizens Video

SCSS Or Senior Citizen Savings Scheme Details Benefits Interest Rates

Income Tax Rules Big News Senior Citizens Can Avoid Paying 10 TDS On

What Is Considered Low Income For Senior Citizens GoodLife

What Is Considered Low Income For Senior Citizens GoodLife

What Is Considered Low Income For Senior Citizens GoodLife 2022