In this age of technology, where screens dominate our lives however, the attraction of tangible printed objects hasn't waned. Whether it's for educational purposes in creative or artistic projects, or simply adding an individual touch to your home, printables for free are a great resource. The following article is a dive deep into the realm of "Exemption Of Ppf Interest Section," exploring the different types of printables, where you can find them, and how they can enhance various aspects of your daily life.

Get Latest Exemption Of Ppf Interest Section Below

Exemption Of Ppf Interest Section

Exemption Of Ppf Interest Section -

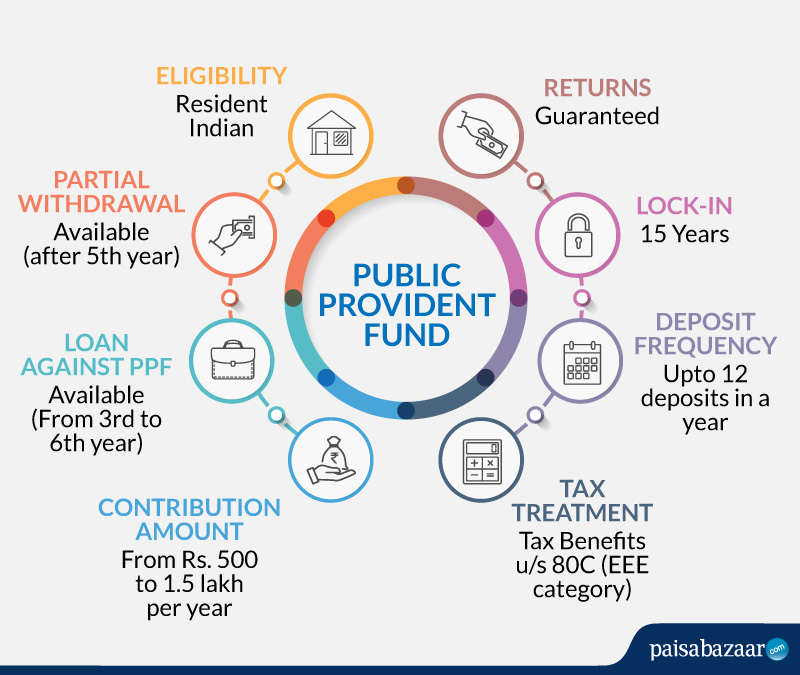

This scheme is falls under the EEE category i e Exempt Exempt and Exempt which means if you invest in it you will get a deduction u s 80C on your income Further the interest you earn on it alongwith its maturity proceeds will be tax free in the hand of investor This article is covering various points related to PPF scheme Page

Tax benefit The PPF interest and maturity amount are tax free under section 80C of the Income Tax Act 1961 Partial withdrawal PPF amount can be withdrawn partially from the 5th financial year onwards What is the interest rate on PPF The current PPF interest rate is 7 1 p a that is compounded annually

Exemption Of Ppf Interest Section cover a large assortment of printable, downloadable material that is available online at no cost. These resources come in many designs, including worksheets templates, coloring pages and much more. The appeal of printables for free is in their variety and accessibility.

More of Exemption Of Ppf Interest Section

PPF Tax Benefits 2022 PPF Tax Exemption Know Here Hindiholic

PPF Tax Benefits 2022 PPF Tax Exemption Know Here Hindiholic

You should also know that PPF investments fall under the Exempt Exempt Exempt EEE category This means The amount you invest in PPF is exempt from tax The interest you earn on PPF is exempt from tax The final corpus at the time of withdrawal is also exempt from tax

Tax saving investments PPF offers tax exemptions at the time of investment accrual and withdrawal It has a current interest rate of 7 1 per annum and a maximum deposit limit of Rs 1 5 lakh per financial year PPF accounts can be extended indefinitely in blocks of 5 years

Exemption Of Ppf Interest Section have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

customization: There is the possibility of tailoring designs to suit your personal needs whether it's making invitations and schedules, or even decorating your home.

-

Educational Benefits: The free educational worksheets can be used by students of all ages, which makes them an essential source for educators and parents.

-

The convenience of instant access many designs and templates reduces time and effort.

Where to Find more Exemption Of Ppf Interest Section

PPF Tax Exemption In Hindi

PPF Tax Exemption In Hindi

As per Section 80C of the Income Tax Act a PPF deposit up to 1 50 lakh in one financial year can be claimed for income tax benefit This tax benefit under Section 80C has to be claimed

So if you are wondering if PPF interest is taxable or not the answer is no it is tax exempt The third tax exemption of PPF is on the maturity amount When the PPF account matures after 15 years the maturity proceeds you receive at withdrawal will also be

Since we've got your interest in Exemption Of Ppf Interest Section and other printables, let's discover where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and Exemption Of Ppf Interest Section for a variety objectives.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a broad array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Exemption Of Ppf Interest Section

Here are some unique ways create the maximum value of Exemption Of Ppf Interest Section:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Exemption Of Ppf Interest Section are an abundance of practical and innovative resources for a variety of needs and needs and. Their accessibility and versatility make them a valuable addition to both professional and personal life. Explore the world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Exemption Of Ppf Interest Section really are they free?

- Yes they are! You can print and download the resources for free.

-

Can I make use of free printables for commercial use?

- It's all dependent on the terms of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables might have limitations regarding their use. Be sure to read the conditions and terms of use provided by the author.

-

How do I print Exemption Of Ppf Interest Section?

- You can print them at home with printing equipment or visit any local print store for high-quality prints.

-

What software do I require to open printables that are free?

- A majority of printed materials are in PDF format. These can be opened using free software, such as Adobe Reader.

PPF Interest Rates 2023 24 Current And Historical Rates

PPF Tax Exemption What Does It Mean Investment Simplified

Check more sample of Exemption Of Ppf Interest Section below

How To Start A Ppf Account Soupcrazy1

Public Provident Fund PPF PPF Account Types Benefits

Capital Gain Exemption Section 54EC Bond Discontinued By NHAI

PPF PF Public Provident Fund Apart From Good Interest And Tax

PPF Interest Rate Good News For PPF Holders Central Government May

1000 PPF Interest Calculation For 15 Years FinCalC Blog

https://cleartax.in/s/ppf

Tax benefit The PPF interest and maturity amount are tax free under section 80C of the Income Tax Act 1961 Partial withdrawal PPF amount can be withdrawn partially from the 5th financial year onwards What is the interest rate on PPF The current PPF interest rate is 7 1 p a that is compounded annually

https://taxguru.in/income-tax/public-provident...

Which section in Income tax Act gives exemption on PPF PF interest earned up to what of interest is exempt please clarify me with all the relevant sections

Tax benefit The PPF interest and maturity amount are tax free under section 80C of the Income Tax Act 1961 Partial withdrawal PPF amount can be withdrawn partially from the 5th financial year onwards What is the interest rate on PPF The current PPF interest rate is 7 1 p a that is compounded annually

Which section in Income tax Act gives exemption on PPF PF interest earned up to what of interest is exempt please clarify me with all the relevant sections

PPF PF Public Provident Fund Apart From Good Interest And Tax

Public Provident Fund PPF PPF Account Types Benefits

PPF Interest Rate Good News For PPF Holders Central Government May

1000 PPF Interest Calculation For 15 Years FinCalC Blog

PPF Stays On Exemption List Only EPF Interest To Attract Tax

Exemption Of Deposits Under Section 51A Of Customs Act 1962

Exemption Of Deposits Under Section 51A Of Customs Act 1962

PPF Calculator Interest Rates In 2023 Calculate The Estimated