In the age of digital, with screens dominating our lives The appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education in creative or artistic projects, or simply to add the personal touch to your space, Exemption To Senior Citizens In Income Tax are now an essential resource. Here, we'll dive into the world of "Exemption To Senior Citizens In Income Tax," exploring the benefits of them, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Exemption To Senior Citizens In Income Tax Below

Exemption To Senior Citizens In Income Tax

Exemption To Senior Citizens In Income Tax -

By tax filing 1 Higher Tax Exemption Limit Senior citizens aged 60 80 enjoy a higher exemption limit of Rs 3 lakh compared to Rs 2 5 lakh for those below 60 The exemption limit for senior

A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident senior citizen is Rs 3 00 000 The exemption limit for non senior citizen is Rs 2 50 000

Exemption To Senior Citizens In Income Tax provide a diverse range of downloadable, printable documents that can be downloaded online at no cost. These resources come in many designs, including worksheets coloring pages, templates and much more. The great thing about Exemption To Senior Citizens In Income Tax lies in their versatility and accessibility.

More of Exemption To Senior Citizens In Income Tax

Senior Citizens Tax Exemption Are Senior Citizens Going To Get Income

Senior Citizens Tax Exemption Are Senior Citizens Going To Get Income

The U S tax code offers quite a few tax breaks exclusively to older adults including a special tax credit just for those 65 or older If you re age 65 or older you get a larger standard deduction which might make it hard to choose between an itemized deduction and a standard deduction

If you re married filing jointly or separately the extra standard deduction amount is 1 500 per qualifying individual If you are 65 or older and blind the extra standard deduction is 3 700

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization There is the possibility of tailoring printables to your specific needs be it designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free can be used by students of all ages, making them a valuable aid for parents as well as educators.

-

Easy to use: Quick access to many designs and templates cuts down on time and efforts.

Where to Find more Exemption To Senior Citizens In Income Tax

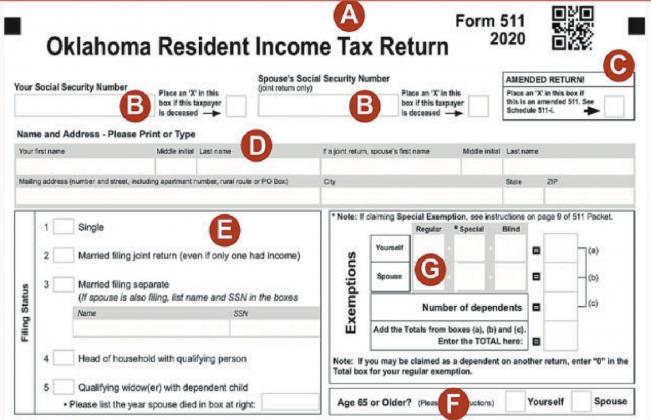

State Says Income Tax Exemption For Tribal Citizens On Reservations

State Says Income Tax Exemption For Tribal Citizens On Reservations

For tax year 2023 seniors filing as single or married filing separately will usually need to file a return if You are at least 65 years of age and Your gross income for tax is 15 700 or more However if your only income is from Social Security benefits and the amount that you receive is less than 50 000 per year you don t typically

The AMT exemption amount has increased to 81 300 126 500 if married filing jointly or qualifying surviving spouse 63 250 if married filing separately Earned income credit The maximum amount of income you can earn and still get the credit has changed You may be able to take the credit if you earn less than

Since we've got your interest in Exemption To Senior Citizens In Income Tax Let's look into where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection in Exemption To Senior Citizens In Income Tax for different applications.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- These blogs cover a broad selection of subjects, from DIY projects to party planning.

Maximizing Exemption To Senior Citizens In Income Tax

Here are some fresh ways in order to maximize the use use of Exemption To Senior Citizens In Income Tax:

1. Home Decor

- Print and frame gorgeous images, quotes, or festive decorations to decorate your living areas.

2. Education

- Print free worksheets to enhance learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Exemption To Senior Citizens In Income Tax are a treasure trove of useful and creative resources catering to different needs and needs and. Their availability and versatility make them a great addition to each day life. Explore the many options that is Exemption To Senior Citizens In Income Tax today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes they are! You can print and download these files for free.

-

Can I utilize free printing templates for commercial purposes?

- It's dependent on the particular rules of usage. Always read the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright rights issues with Exemption To Senior Citizens In Income Tax?

- Some printables may come with restrictions on usage. Be sure to review the conditions and terms of use provided by the author.

-

How do I print printables for free?

- You can print them at home using your printer or visit the local print shop for top quality prints.

-

What software must I use to open Exemption To Senior Citizens In Income Tax?

- A majority of printed materials are in PDF format, which can be opened with free software such as Adobe Reader.

House Of Representatives Files Bill Of Tax Exemption For Senior

What Are The Income Tax Slabs For Senior Citizens In India

Check more sample of Exemption To Senior Citizens In Income Tax below

Senior Citizens Get Special Exemption In Income Tax Know 5 Big

Tax Saving For Senior Citizens In India StepUpMoney

Tax Exemption Limit Increases For Senior Citizens Financial Freedom

Income Tax Exemption Granted To Senior Citizens AY2023 24

Income Tax Rules For Senior Citizens Income Tax Exemption For Senior

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

https://taxguru.in/income-tax/what-are-the-tax...

A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident senior citizen is Rs 3 00 000 The exemption limit for non senior citizen is Rs 2 50 000

https://cleartax.in/s/income-tax-slab-for-senior-citizen

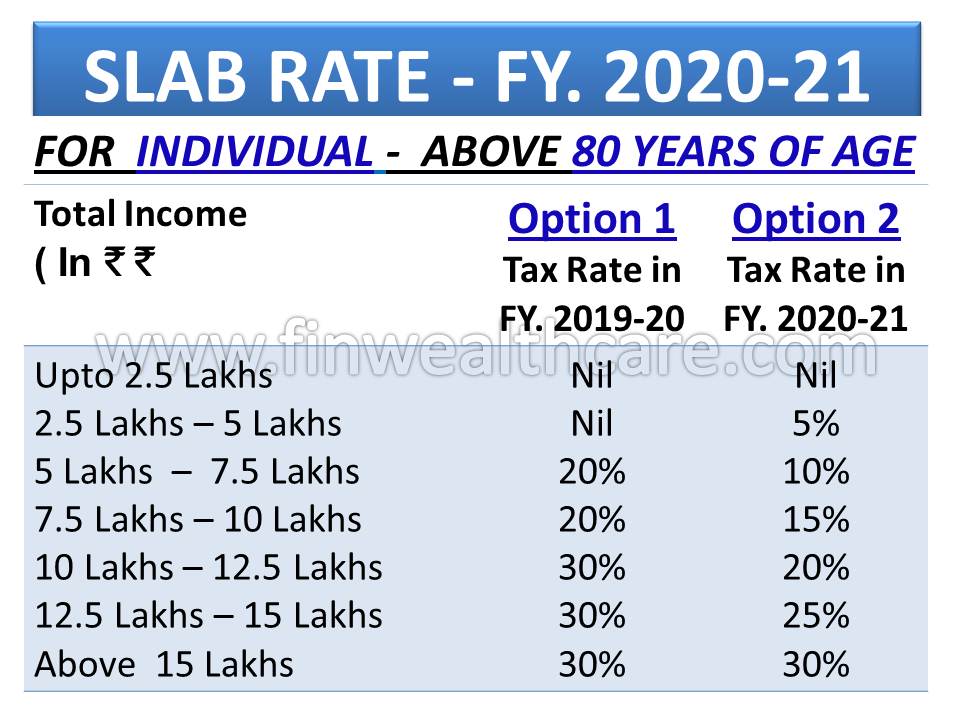

Senior and super senior citizens are eligible to avail numerous tax benefits as offered by Income Tax Act 1961 as are described below Higher income exemption limit Senior citizens are required to pay tax over the income of Rs 3 00 000 while this limit is Rs 5 00 000 for super senior citizens

A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident senior citizen is Rs 3 00 000 The exemption limit for non senior citizen is Rs 2 50 000

Senior and super senior citizens are eligible to avail numerous tax benefits as offered by Income Tax Act 1961 as are described below Higher income exemption limit Senior citizens are required to pay tax over the income of Rs 3 00 000 while this limit is Rs 5 00 000 for super senior citizens

Income Tax Exemption Granted To Senior Citizens AY2023 24

Tax Saving For Senior Citizens In India StepUpMoney

Income Tax Rules For Senior Citizens Income Tax Exemption For Senior

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

New Income Tax Slab FY 2020 21 India Vs Old

Senior Citizens Granted 20 Discount VAT Exemption For Vitamins

Senior Citizens Granted 20 Discount VAT Exemption For Vitamins

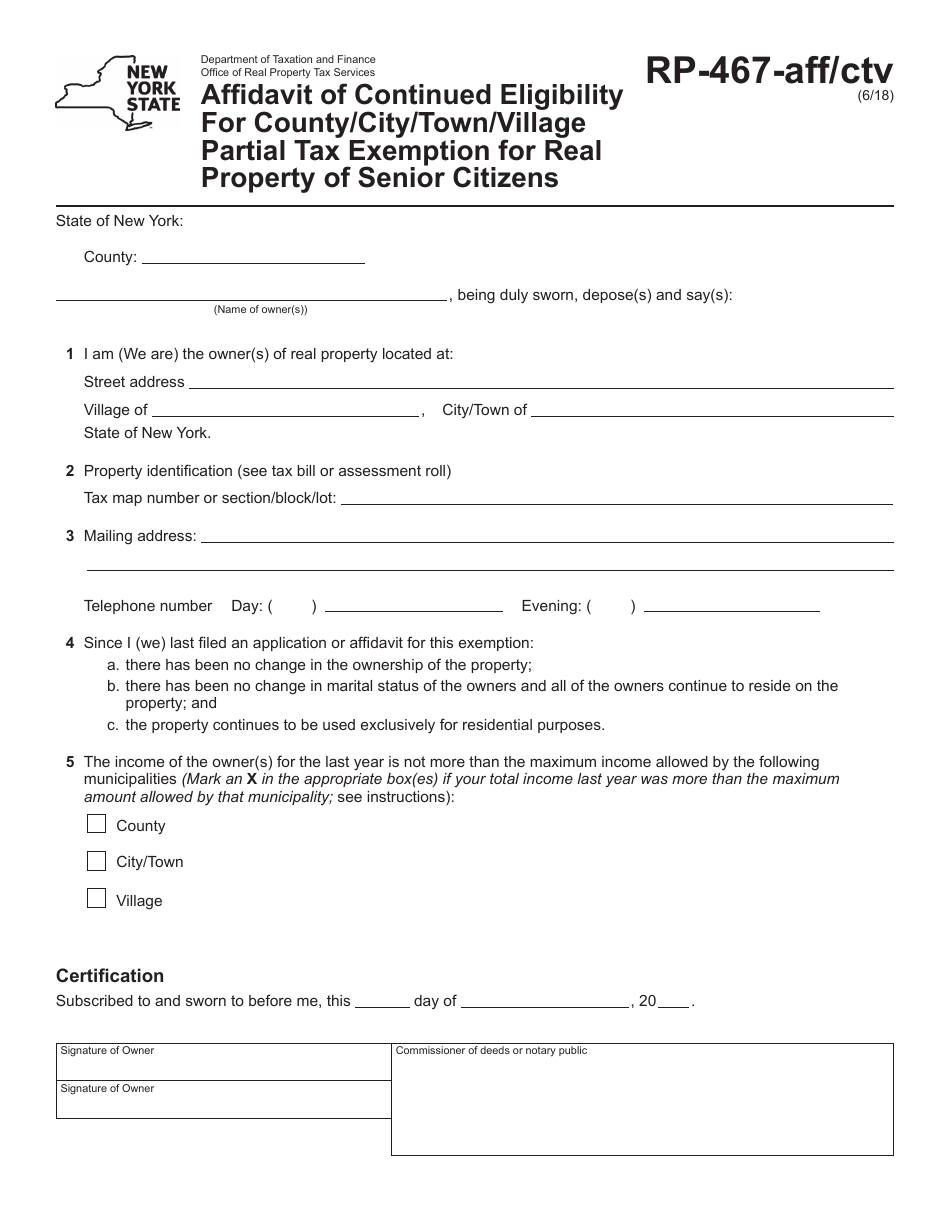

Form RP 467 AFF CTV Fill Out Sign Online And Download Fillable PDF