In this digital age, in which screens are the norm and the appeal of physical printed materials isn't diminishing. Be it for educational use, creative projects, or simply adding personal touches to your home, printables for free have become a valuable source. Through this post, we'll dive into the sphere of "Explanation Of Exemptions And Rebates In Service Tax Law," exploring the benefits of them, where you can find them, and ways they can help you improve many aspects of your lives.

Get Latest Explanation Of Exemptions And Rebates In Service Tax Law Below

Explanation Of Exemptions And Rebates In Service Tax Law

Explanation Of Exemptions And Rebates In Service Tax Law -

Web was designed in part to tax energy products so as to reflect both energy content and CO 2 emissions as under the current ETD most of the minimum tax rates arebased on the

Web 3 juil 2019 nbsp 0183 32 Income tax exemption v s tax deduction Income tax exemptions are provided on particular sources of income and not on the total income It can also mean that you do

Printables for free cover a broad selection of printable and downloadable materials available online at no cost. The resources are offered in a variety designs, including worksheets coloring pages, templates and much more. The beauty of Explanation Of Exemptions And Rebates In Service Tax Law is their versatility and accessibility.

More of Explanation Of Exemptions And Rebates In Service Tax Law

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

Web Understanding the difference between Tax Deduction Tax Exemption and Tax Rebate Tax Among the many words that get associated with income tax two stands out the most

Web 5 f 233 vr 2021 nbsp 0183 32 Here s a quick look at those portions of Income Tax Act that describe benefits by way of exemptions deductions and rebates Before we assess these benefits to

Explanation Of Exemptions And Rebates In Service Tax Law have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization They can make printing templates to your own specific requirements, whether it's designing invitations or arranging your schedule or even decorating your house.

-

Educational value: Printables for education that are free provide for students from all ages, making them a vital instrument for parents and teachers.

-

Convenience: Fast access a myriad of designs as well as templates will save you time and effort.

Where to Find more Explanation Of Exemptions And Rebates In Service Tax Law

Difference Between Income Tax Deductions Exemptions And Rebate Plan

Difference Between Income Tax Deductions Exemptions And Rebate Plan

Web 22 mai 2022 nbsp 0183 32 This article provides an exhaustive overview of the exemptions available under Section 10 of the Income Tax Act 1961 with relevant case laws and illustrations

Web De tr 232 s nombreux exemples de phrases traduites contenant quot exemptions and rebates quot Dictionnaire fran 231 ais anglais et moteur de recherche de traductions fran 231 aises

Now that we've ignited your curiosity about Explanation Of Exemptions And Rebates In Service Tax Law Let's look into where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection in Explanation Of Exemptions And Rebates In Service Tax Law for different objectives.

- Explore categories such as decoration for your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing Explanation Of Exemptions And Rebates In Service Tax Law

Here are some new ways create the maximum value of Explanation Of Exemptions And Rebates In Service Tax Law:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Explanation Of Exemptions And Rebates In Service Tax Law are an abundance of practical and innovative resources catering to different needs and needs and. Their accessibility and flexibility make them a great addition to each day life. Explore the many options of Explanation Of Exemptions And Rebates In Service Tax Law right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Explanation Of Exemptions And Rebates In Service Tax Law really cost-free?

- Yes, they are! You can print and download these files for free.

-

Can I download free printables to make commercial products?

- It's based on the rules of usage. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may contain restrictions on use. Be sure to check the terms and condition of use as provided by the designer.

-

How do I print Explanation Of Exemptions And Rebates In Service Tax Law?

- You can print them at home with an printer, or go to a local print shop to purchase superior prints.

-

What software do I need to run printables at no cost?

- The majority of printed documents are with PDF formats, which can be opened using free software like Adobe Reader.

Gift Tax Limit 2023 Explanation Exemptions Calculation How To Avoid It

Exemptions In ACCA In 2022 ACCA Exemption Detailed

Check more sample of Explanation Of Exemptions And Rebates In Service Tax Law below

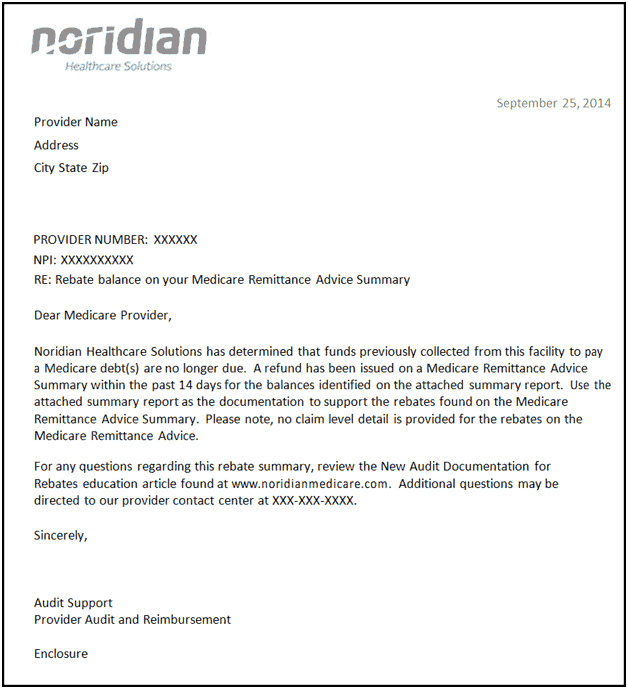

Sample Cover Letter For Medicard Reimbursement Reimbursement

7 Useful Income Tax Exemptions For The Salaried

Online Tax Planning In Pan India Not Compulsory Rs 999 hour ID

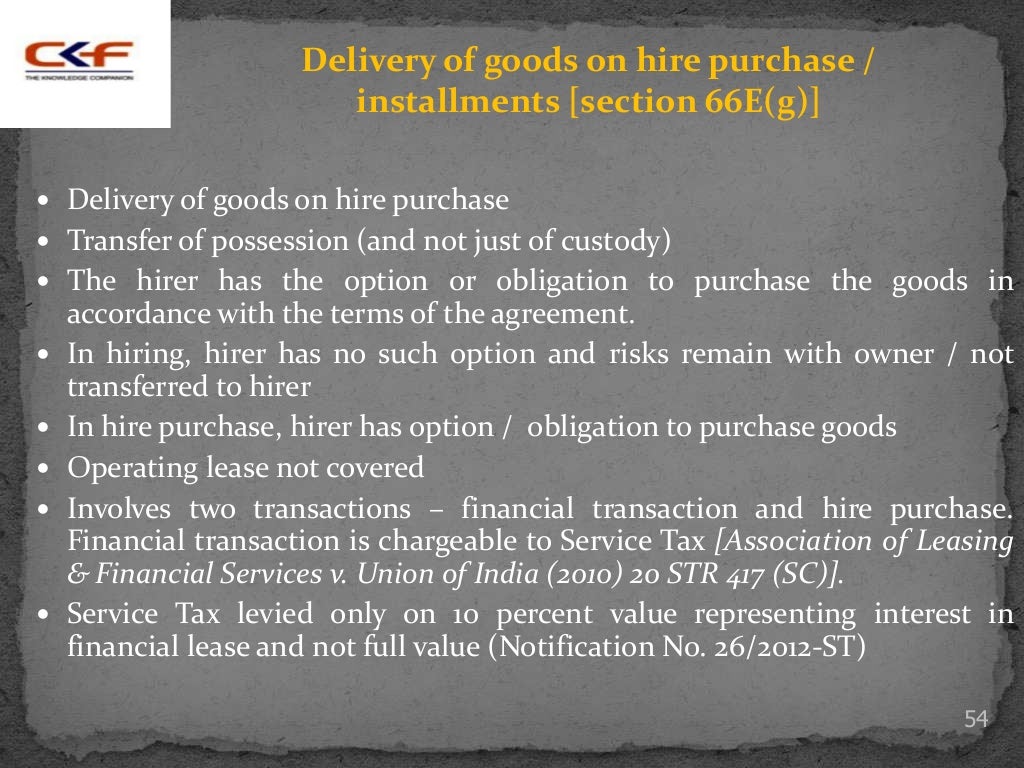

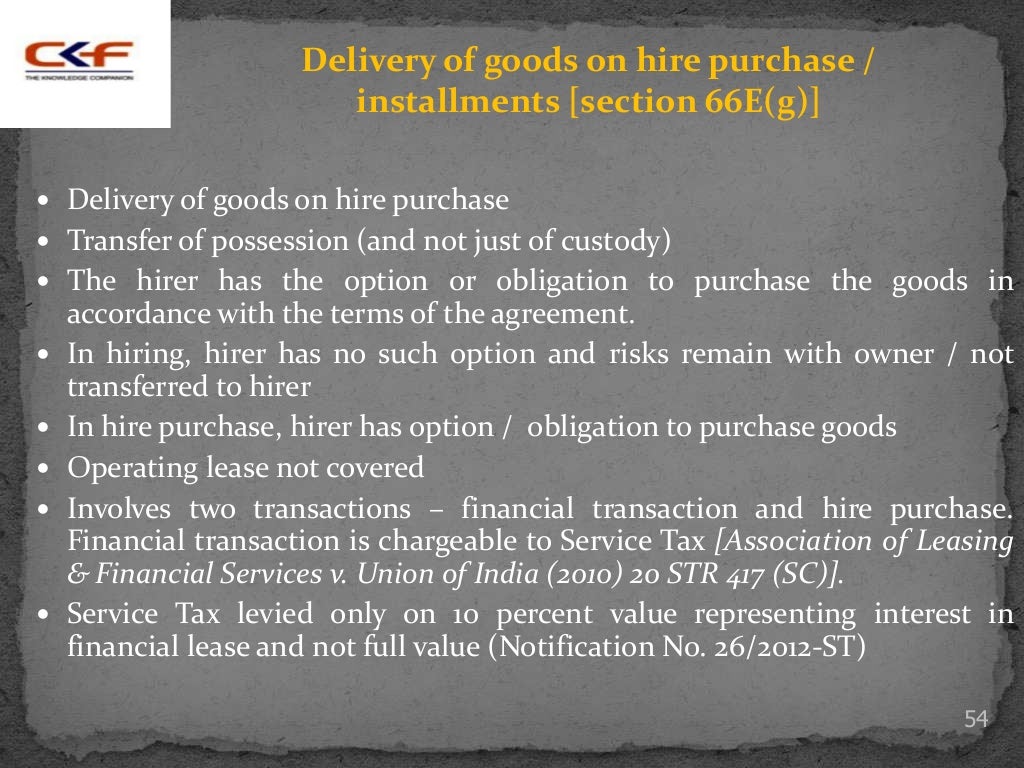

Service Tax Law Simplified Session Ii

What Is The Income Tax Slab For Women In India

Difference Between Exemption And Deduction Difference Between

https://cleartax.in/s/difference-between-tax-exemption-vs-tax...

Web 3 juil 2019 nbsp 0183 32 Income tax exemption v s tax deduction Income tax exemptions are provided on particular sources of income and not on the total income It can also mean that you do

https://escalon.services/blog/confused-between-the-terms-tax-exemptio…

Web 19 ao 251 t 2021 nbsp 0183 32 Federal tax law allows taxpayers to deduct a number of different personal expenses from their taxable income each year However according to the U S Internal

Web 3 juil 2019 nbsp 0183 32 Income tax exemption v s tax deduction Income tax exemptions are provided on particular sources of income and not on the total income It can also mean that you do

Web 19 ao 251 t 2021 nbsp 0183 32 Federal tax law allows taxpayers to deduct a number of different personal expenses from their taxable income each year However according to the U S Internal

Service Tax Law Simplified Session Ii

7 Useful Income Tax Exemptions For The Salaried

What Is The Income Tax Slab For Women In India

Difference Between Exemption And Deduction Difference Between

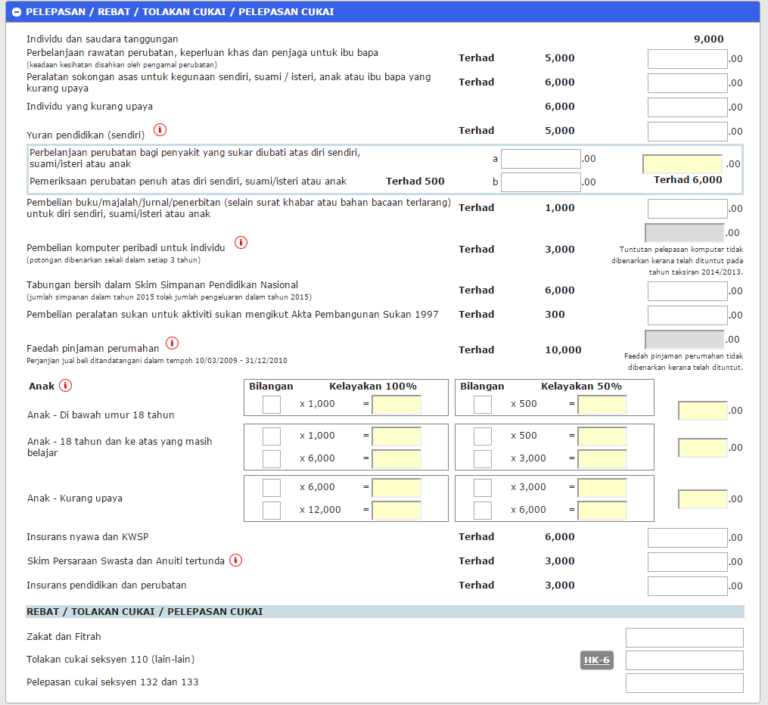

How To Submit Income Tax 2019 Through E Filing LHDN Malaysia

REAL ESTATE TAX EXEMPTIONS OR REBATES FOR NON RESIDENTS YLG Yazdani

REAL ESTATE TAX EXEMPTIONS OR REBATES FOR NON RESIDENTS YLG Yazdani

Service Tax Law Simplified Session Ii