In this day and age where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed objects hasn't waned. No matter whether it's for educational uses in creative or artistic projects, or just adding personal touches to your space, Family Trust Tax Benefits have become an invaluable source. The following article is a dive through the vast world of "Family Trust Tax Benefits," exploring the benefits of them, where to get them, as well as what they can do to improve different aspects of your lives.

Get Latest Family Trust Tax Benefits Below

Family Trust Tax Benefits

Family Trust Tax Benefits -

The benefit of grantor trust treatment is that the trust doesn t have to file a separate tax return at the entity level Instead the person creating the trust has to

In general wealthier individuals stand to gain the largest tax benefits by creating a family trust By moving assets into a qualifying trust you may be able to avoid paying some or all of the estate tax due on your estate

Family Trust Tax Benefits offer a wide range of downloadable, printable items that are available online at no cost. They are available in numerous types, like worksheets, templates, coloring pages and much more. The great thing about Family Trust Tax Benefits lies in their versatility as well as accessibility.

More of Family Trust Tax Benefits

Family Trust Tax Changes Are Coming Beyond Advisors CFO Service

Family Trust Tax Changes Are Coming Beyond Advisors CFO Service

Explore the vital role of family trusts in protecting assets and securing legacies in today s financial world Learn how these trusts accessible to all provide controlled asset

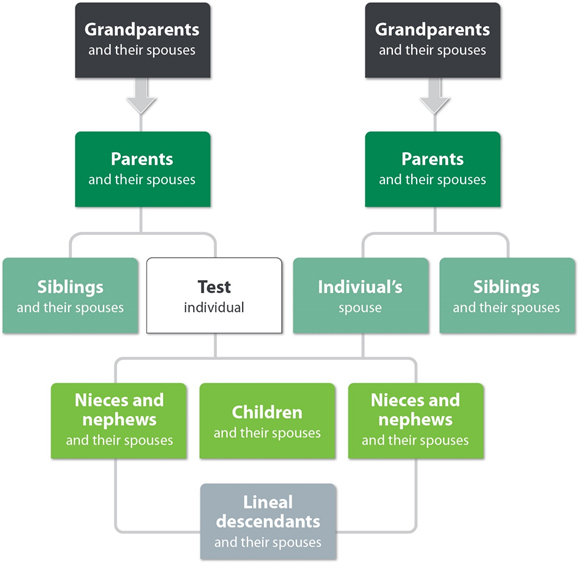

What trusts are for Trusts are set up for a number of reasons including to control and protect family assets when someone s too young to handle their affairs

Family Trust Tax Benefits have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

customization Your HTML0 customization options allow you to customize the design to meet your needs in designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value: These Family Trust Tax Benefits offer a wide range of educational content for learners from all ages, making these printables a powerful aid for parents as well as educators.

-

Affordability: Instant access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Family Trust Tax Benefits

Family Trust Tax Changes Are Coming Beyond Advisors CFO Service

Family Trust Tax Changes Are Coming Beyond Advisors CFO Service

Earned income includes pay from employment as well as pensions and benefits Your exact tax rate depends on your annual income home municipality religious affiliation

1 Tax Purposes Trusts may be advantageous if the beneficiaries fall within a lower tax bracket than the trustee Effective income distribution to beneficiaries at lower

If we've already piqued your interest in printables for free Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Family Trust Tax Benefits designed for a variety motives.

- Explore categories such as decorating your home, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a wide range of topics, from DIY projects to planning a party.

Maximizing Family Trust Tax Benefits

Here are some ideas in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Family Trust Tax Benefits are an abundance filled with creative and practical information for a variety of needs and interests. Their accessibility and flexibility make them a wonderful addition to each day life. Explore the endless world of Family Trust Tax Benefits today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can print and download these free resources for no cost.

-

Do I have the right to use free printables for commercial uses?

- It's dependent on the particular rules of usage. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables may be subject to restrictions on use. Be sure to read the terms and regulations provided by the author.

-

How do I print printables for free?

- Print them at home using printing equipment or visit the local print shop for superior prints.

-

What program do I need to open Family Trust Tax Benefits?

- Many printables are offered in PDF format. They can be opened with free software such as Adobe Reader.

New Family Trust Tax Rules Will The Changes Impact You Fiskl Advisory

Wealth Management

Check more sample of Family Trust Tax Benefits below

Family Trust Tax Changes Are Coming Beyond Advisors CFO Service

Wealth Management

Family Trusts 2020 Trust Tax Returns Wealth Accountants Gold Coast

How To Set Up A Family Trust 2022 Update

Nest 529 Investment Options Photos

The Family Trust Tax Rate Explained Set Ups Benefits 2022

https://turbotax.intuit.com/tax-tips/fami…

In general wealthier individuals stand to gain the largest tax benefits by creating a family trust By moving assets into a qualifying trust you may be able to avoid paying some or all of the estate tax due on your estate

https://www.forbes.com/.../family-trust

A family trust is any trust you set up that benefits members of your family It s often used as a legally binding agreement to establish who will receive portions of your wealth after you

In general wealthier individuals stand to gain the largest tax benefits by creating a family trust By moving assets into a qualifying trust you may be able to avoid paying some or all of the estate tax due on your estate

A family trust is any trust you set up that benefits members of your family It s often used as a legally binding agreement to establish who will receive portions of your wealth after you

How To Set Up A Family Trust 2022 Update

Wealth Management

Nest 529 Investment Options Photos

The Family Trust Tax Rate Explained Set Ups Benefits 2022

Family Trust Tax Changes You NEED To Know About SHERIDAN LEGAL

9 Reasons Why A Family Trust Might Not Be A Good Idea Westcourt

9 Reasons Why A Family Trust Might Not Be A Good Idea Westcourt

Advantages And Disadvantages Of Family Trusts IOOF