In this digital age, in which screens are the norm, the charm of tangible printed objects isn't diminished. Whatever the reason, whether for education for creative projects, just adding an extra personal touch to your home, printables for free are now a useful source. The following article is a dive into the world "Farm Land Tax Deduction," exploring what they are, how to get them, as well as how they can add value to various aspects of your lives.

Get Latest Farm Land Tax Deduction Below

Farm Land Tax Deduction

Farm Land Tax Deduction -

Like any business farmers are permitted to deduct their business expenses from their taxable income Deductions are split into two categories Current costs which you deduct in the year they incurred Capitalized costs which

Keep in mind that taking your land out of agricultural use can result in a bill for back taxes So if you decide you no longer want to rent your land to a farmer or grow veggies on your acreage the state may require that you pay back the taxes that were exempted in previous years

Farm Land Tax Deduction cover a large array of printable material that is available online at no cost. These resources come in many forms, like worksheets templates, coloring pages and much more. The attraction of printables that are free is their flexibility and accessibility.

More of Farm Land Tax Deduction

Vacant Land Tax Deduction Changes

Vacant Land Tax Deduction Changes

All property taxes from farmland are tax deductible however this does not include property taxes from a house or land with a home on it To determine the amount of property taxes that are tax deductible for an operation one must compare the value of the home with the value of farmland

Farmer tax deductions are critical in reducing taxable income directly impacting the financial health of a farming enterprise These deductions range from everyday operational expenses like seeds feed and fertilizers to more significant costs such as farm equipment maintenance and repairs

The Farm Land Tax Deduction have gained huge popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Flexible: There is the possibility of tailoring printables to fit your particular needs in designing invitations planning your schedule or decorating your home.

-

Educational Benefits: These Farm Land Tax Deduction cater to learners from all ages, making them a useful aid for parents as well as educators.

-

Simple: You have instant access an array of designs and templates helps save time and effort.

Where to Find more Farm Land Tax Deduction

Farm Land Tax

Farm Land Tax

Illinois FBFM University of Illinois Champaign Urbana Wednesday February 22 2023 What Should My AGI Be Amounts needed for 80 000 20 000 30 000 130 000 Family living Income tax liability Principal payments above Depreciation Adjusted Gross Income To the extent actual AGI is less than 130 000 tax deferral is generated

If you utilize land for a small farm to raise crops or livestock you may be eligible for any farm tax credit under local state or federal tax laws Here are a few tips to making the most of a small farm on your land and to keep in mind as

If we've already piqued your curiosity about Farm Land Tax Deduction Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Farm Land Tax Deduction for various applications.

- Explore categories such as decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free with flashcards and other teaching tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide array of topics, ranging that range from DIY projects to planning a party.

Maximizing Farm Land Tax Deduction

Here are some inventive ways create the maximum value use of Farm Land Tax Deduction:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Farm Land Tax Deduction are a treasure trove with useful and creative ideas catering to different needs and interests. Their access and versatility makes them a fantastic addition to any professional or personal life. Explore the many options of Farm Land Tax Deduction and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes, they are! You can print and download these files for free.

-

Can I make use of free templates for commercial use?

- It depends on the specific rules of usage. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in Farm Land Tax Deduction?

- Certain printables may be subject to restrictions regarding their use. Make sure to read the terms and conditions provided by the author.

-

How do I print Farm Land Tax Deduction?

- Print them at home with a printer or visit a print shop in your area for the highest quality prints.

-

What software do I require to open printables for free?

- The majority of printed documents are in the PDF format, and is open with no cost software, such as Adobe Reader.

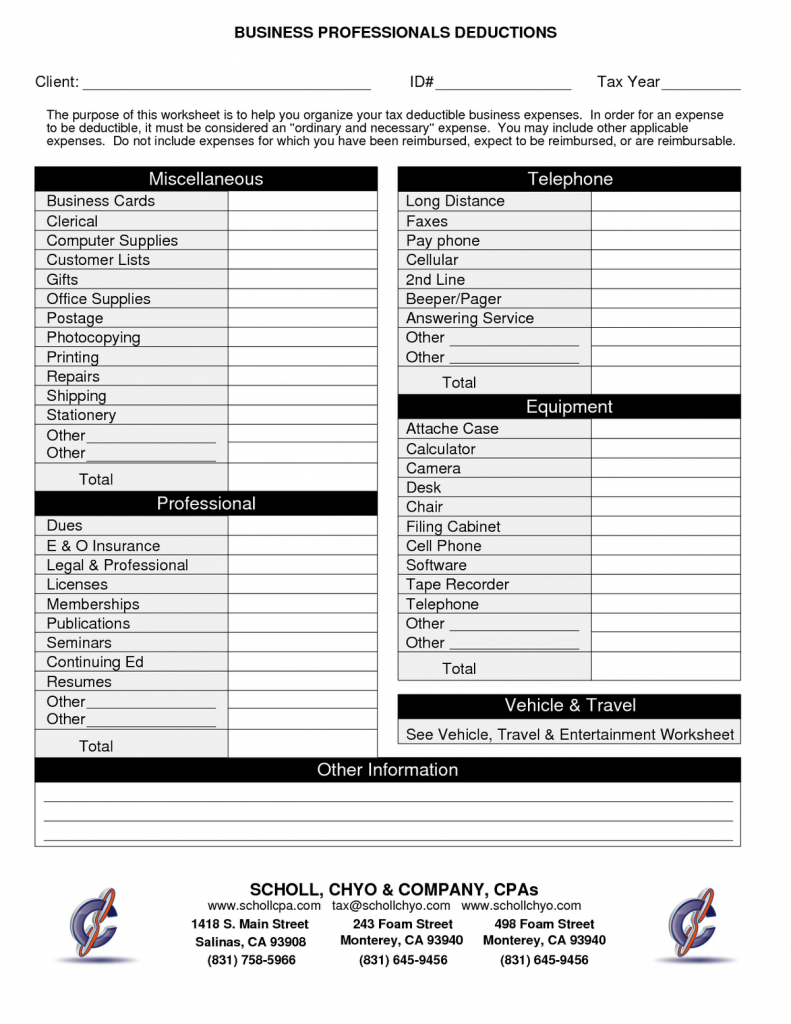

10 Business Tax Deductions Worksheet Worksheeto

Dentons Congress Giveth And The Tax Court Taketh Away Partnership s

Check more sample of Farm Land Tax Deduction below

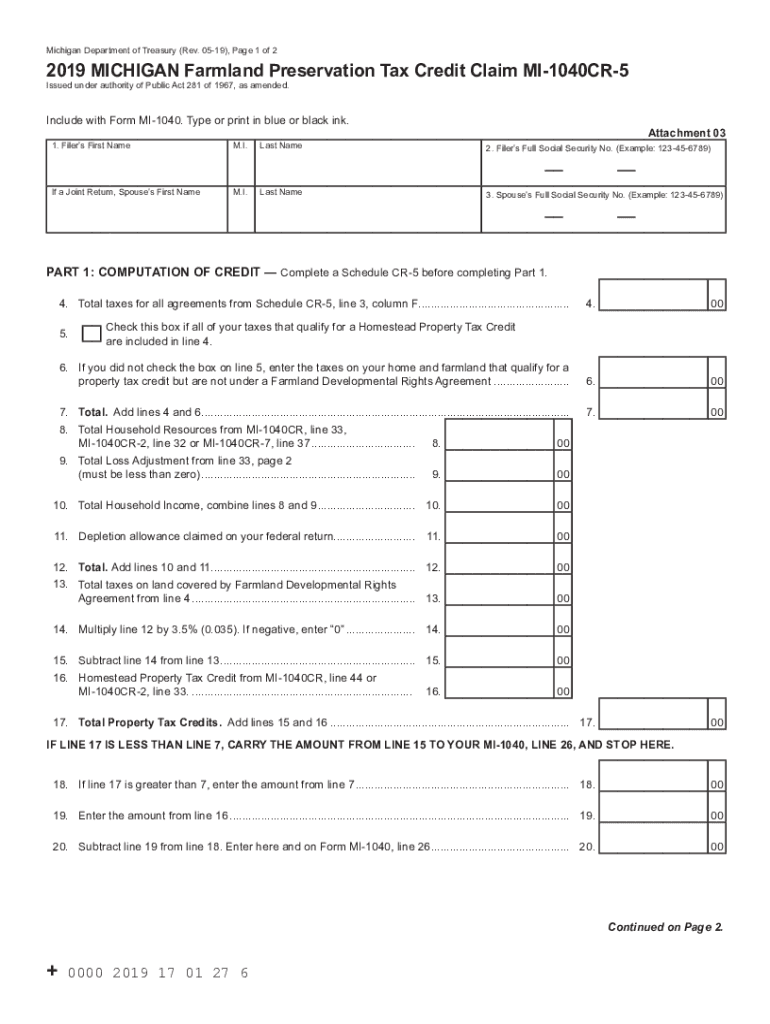

Farm Land Preservationtax Form For Michigan Fill Out And Sign

Citizens Have The Right To Land Tax Deduction The Interdistrict

Tax Deduction Spreadsheet Template Excel Regarding Spreadsheet For

Minnesota Farm Land Deduction Offers Estate Planning Opportunities For

Dentons Congress Giveth And The Tax Court Taketh Away Partnership s

Tax Deduction Via Donation Of Land Wetland Economic Benefits For

https://smartasset.com/taxes/understanding-agricultural-tax-exemptions

Keep in mind that taking your land out of agricultural use can result in a bill for back taxes So if you decide you no longer want to rent your land to a farmer or grow veggies on your acreage the state may require that you pay back the taxes that were exempted in previous years

https://www.farmlandriches.com/farmland-investing-taxes

Thus certain portions of farmland investments can qualify as a charitable tax deduction on federal income tax returns Could you check with your tax professional to determine what percentage of the value of the farmland qualifies as itemized deductions

Keep in mind that taking your land out of agricultural use can result in a bill for back taxes So if you decide you no longer want to rent your land to a farmer or grow veggies on your acreage the state may require that you pay back the taxes that were exempted in previous years

Thus certain portions of farmland investments can qualify as a charitable tax deduction on federal income tax returns Could you check with your tax professional to determine what percentage of the value of the farmland qualifies as itemized deductions

Minnesota Farm Land Deduction Offers Estate Planning Opportunities For

Citizens Have The Right To Land Tax Deduction The Interdistrict

Dentons Congress Giveth And The Tax Court Taketh Away Partnership s

Tax Deduction Via Donation Of Land Wetland Economic Benefits For

Printable Itemized Deductions Worksheet

2024 ReLakhs

2024 ReLakhs

Printable Itemized Deductions Worksheet