In this age of technology, where screens rule our lives yet the appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons, creative projects, or just adding an extra personal touch to your space, Farm Tax Benefits Canada have proven to be a valuable resource. We'll dive through the vast world of "Farm Tax Benefits Canada," exploring the different types of printables, where to find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Farm Tax Benefits Canada Below

Farm Tax Benefits Canada

Farm Tax Benefits Canada -

AgriStability Alberta Saskatchewan and Prince Edward Island and AgriInvest Northwest Territories Yukon and all provinces except Quebec participants You must file your 2023 tax

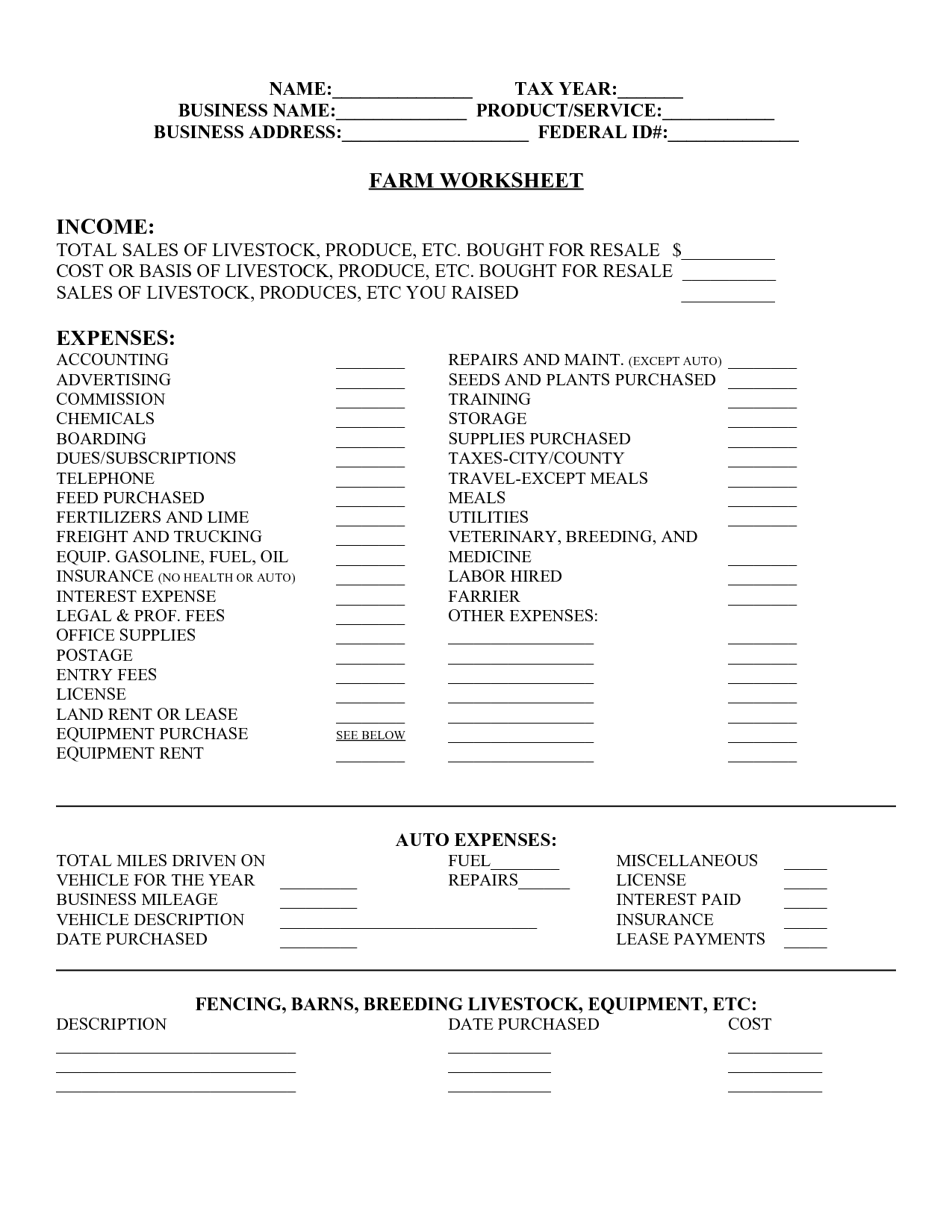

Canadian farmers can deduct typical business expenses such as utilities and maintenance costs They are also entitled to claim tax deductions that other businesses cannot This includes things such as veterinary costs

Printables for free cover a broad assortment of printable resources available online for download at no cost. These printables come in different types, such as worksheets coloring pages, templates and more. The value of Farm Tax Benefits Canada is their flexibility and accessibility.

More of Farm Tax Benefits Canada

ADHD And Tax Disability Benefits Tax Benefits Canada

ADHD And Tax Disability Benefits Tax Benefits Canada

In cases where taxable income is significant the transfer of the farming business to a corporation may provide some tax benefits The main tax advantage to incorporating a farm business is the deferral of tax due to the

If you have questions about reporting your farm income for tax purposes contact the CRA at 1 800 959 5525 This guide explains the most common tax situations

The Farm Tax Benefits Canada have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Customization: The Customization feature lets you tailor printed materials to meet your requirements such as designing invitations or arranging your schedule or decorating your home.

-

Educational Use: The free educational worksheets are designed to appeal to students of all ages, making them a useful instrument for parents and teachers.

-

The convenience of immediate access numerous designs and templates, which saves time as well as effort.

Where to Find more Farm Tax Benefits Canada

Child Tax Disability Benefits Tax Benefits Canada

Child Tax Disability Benefits Tax Benefits Canada

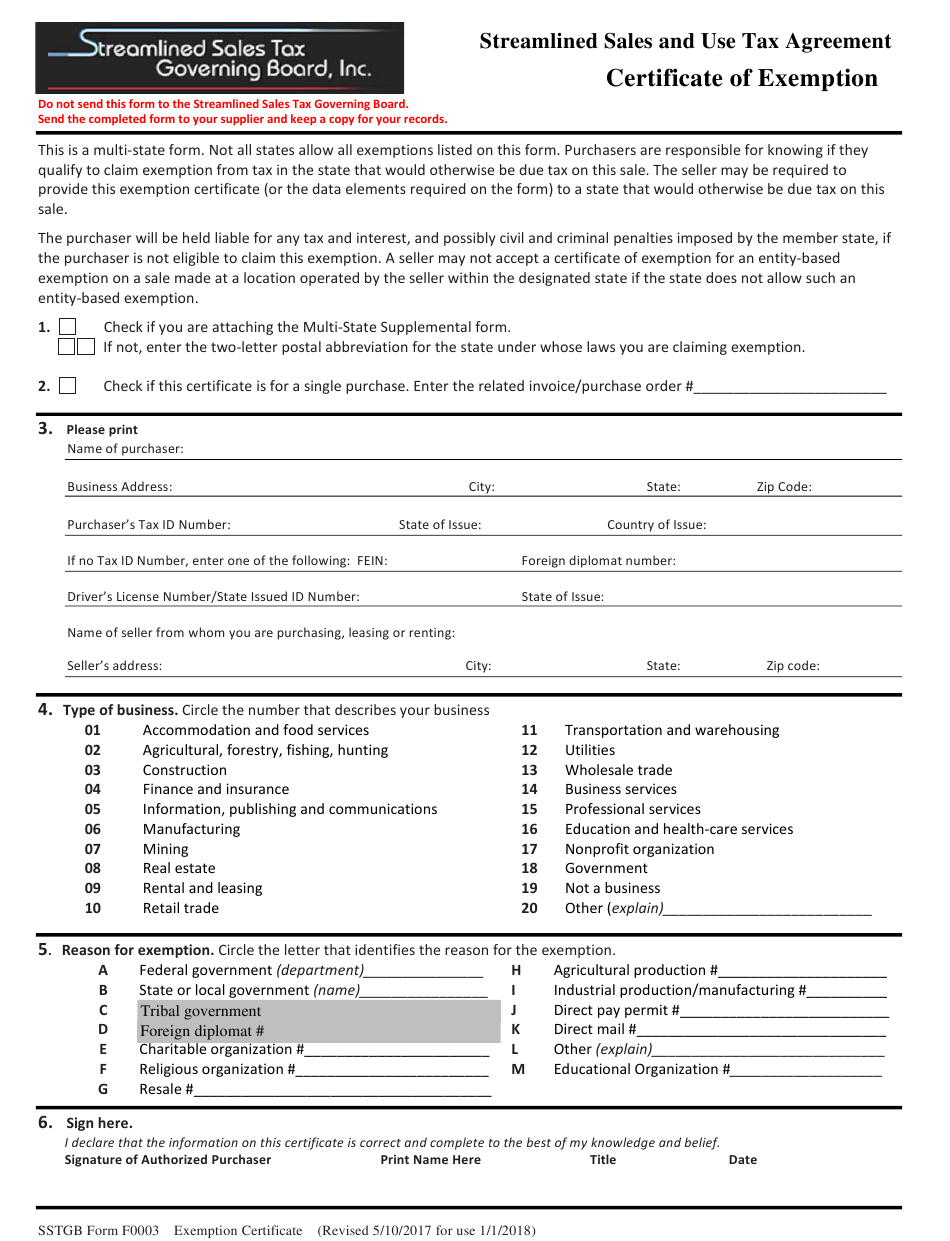

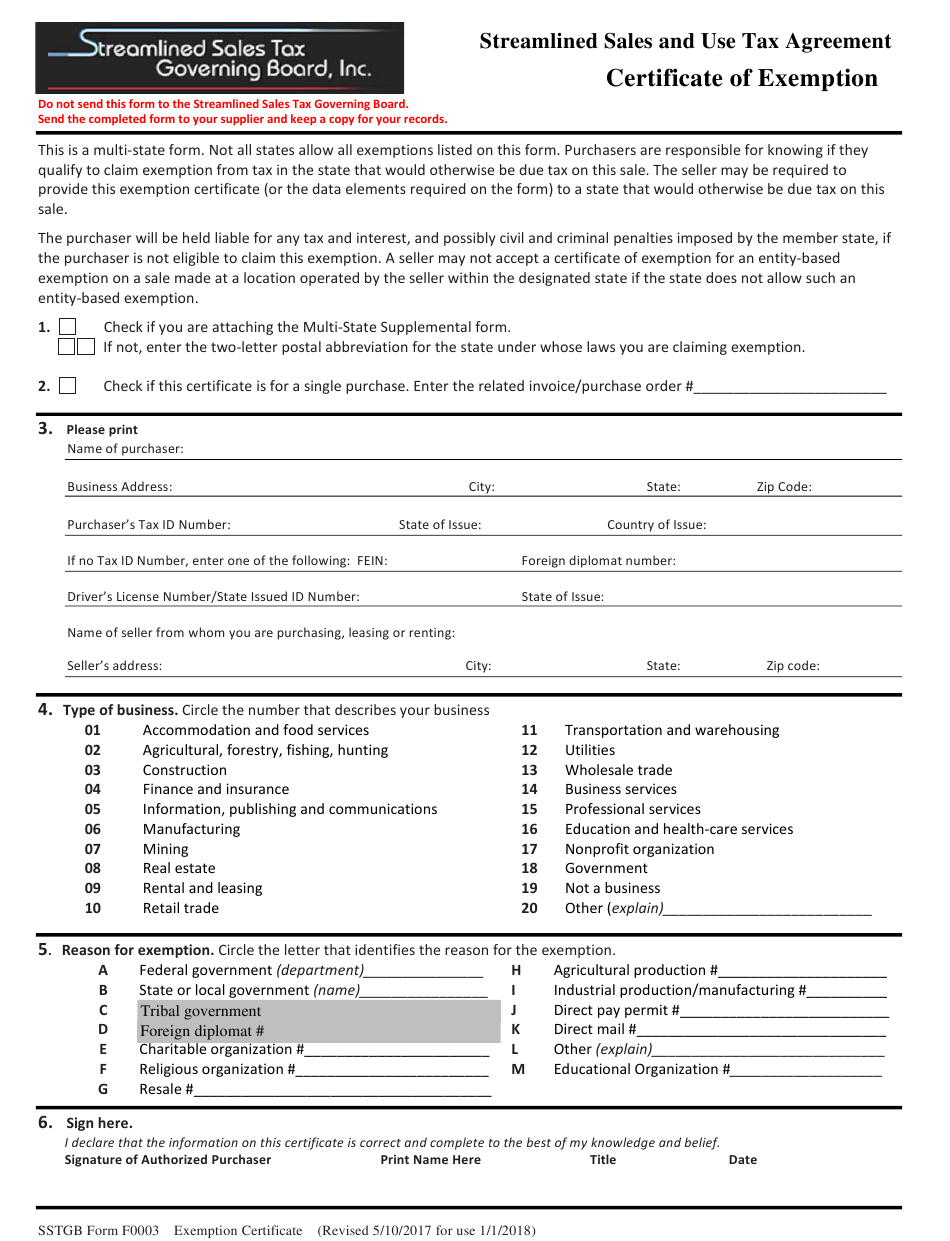

If you own a farm and you believe it could qualify for the Farm Property Class Tax Rate Program also known as the Farm Tax Program you must submit an application to Agricorp For

This form is used by self employed farmer or member of farming partnerships to help to calculate the farming income and expenses for income tax purposes

We hope we've stimulated your interest in printables for free, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Farm Tax Benefits Canada to suit a variety of motives.

- Explore categories like decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets along with flashcards, as well as other learning materials.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs are a vast spectrum of interests, that range from DIY projects to planning a party.

Maximizing Farm Tax Benefits Canada

Here are some ways that you can make use use of Farm Tax Benefits Canada:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home and in class.

3. Event Planning

- Make invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Farm Tax Benefits Canada are an abundance of innovative and useful resources which cater to a wide range of needs and interest. Their availability and versatility make them a wonderful addition to both professional and personal lives. Explore the world of Farm Tax Benefits Canada to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes, they are! You can print and download these tools for free.

-

Can I use the free printouts for commercial usage?

- It depends on the specific terms of use. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables could be restricted on usage. Be sure to read the terms of service and conditions provided by the creator.

-

How can I print Farm Tax Benefits Canada?

- You can print them at home using your printer or visit the local print shops for superior prints.

-

What software do I require to open printables for free?

- The majority of printables are in the format PDF. This can be opened using free software, such as Adobe Reader.

Best Employee Benefits In Canada In 2023 BeMo

Farm Tax Exemption Keep Your Money

Check more sample of Farm Tax Benefits Canada below

Income Tax Estimator 2020 LlinosJenny

Glencore USW Agreement Includes Benefits Gains Increased Disability

14 Monthly Income Expense Worksheet Template Worksheeto

Depression And Disability Tax Benefits Tax Benefits Canada

A Brief Guide To The Child Tax Benefit In Canada

-1.png)

Small Farm Tax Deductions Finance Zacks

https://fbc.ca/blog/facts-about-full-tim…

Canadian farmers can deduct typical business expenses such as utilities and maintenance costs They are also entitled to claim tax deductions that other businesses cannot This includes things such as veterinary costs

https://turbotax.intuit.ca/tips/tax-breaks-f…

The government of Canada supports farmers by providing programs to help keep farms viable such as AgriStability and AgriInvest risk management programs that help protect farms from drops in income There

Canadian farmers can deduct typical business expenses such as utilities and maintenance costs They are also entitled to claim tax deductions that other businesses cannot This includes things such as veterinary costs

The government of Canada supports farmers by providing programs to help keep farms viable such as AgriStability and AgriInvest risk management programs that help protect farms from drops in income There

Depression And Disability Tax Benefits Tax Benefits Canada

Glencore USW Agreement Includes Benefits Gains Increased Disability

-1.png)

A Brief Guide To The Child Tax Benefit In Canada

Small Farm Tax Deductions Finance Zacks

Tips For Farmers And Farm Tax Returns AZ Money Guy

Wv Farm Tax Exemption Form ExemptForm

Wv Farm Tax Exemption Form ExemptForm

Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow