In this age of electronic devices, where screens have become the dominant feature of our lives and the appeal of physical printed materials hasn't faded away. No matter whether it's for educational uses and creative work, or just adding a personal touch to your area, Federal 25c Tax Credit Program have proven to be a valuable resource. This article will dive in the world of "Federal 25c Tax Credit Program," exploring what they are, how they are, and how they can improve various aspects of your daily life.

Get Latest Federal 25c Tax Credit Program Below

Federal 25c Tax Credit Program

Federal 25c Tax Credit Program -

On August 4 2023 the Internal Revenue Service IRS released IRS Notice 2023 59 which outlines the requirements for taxpayers to claim the Energy Efficient Home Improvement

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Federal 25c Tax Credit Program include a broad variety of printable, downloadable materials available online at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and many more. The appealingness of Federal 25c Tax Credit Program is their flexibility and accessibility.

More of Federal 25c Tax Credit Program

25C Tax Credit Fact Sheet Building Performance Association

25C Tax Credit Fact Sheet Building Performance Association

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax

Notes The Section 25C credit is claimed on Form 5695 The instructions give taxpayers additional information regarding eligibility for the credit Residential

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization There is the possibility of tailoring the templates to meet your individual needs in designing invitations, organizing your schedule, or even decorating your house.

-

Educational value: Education-related printables at no charge can be used by students of all ages. This makes these printables a powerful device for teachers and parents.

-

It's easy: Fast access various designs and templates reduces time and effort.

Where to Find more Federal 25c Tax Credit Program

Tax Credit 25C HVAC Tax Credits

Tax Credit 25C HVAC Tax Credits

IRS Releases Section 25C Tax Credit Qualification Requirements for Home Energy Audits On August 4 2023 the U S Internal Review Service IRS released IRS Notice 2023 59

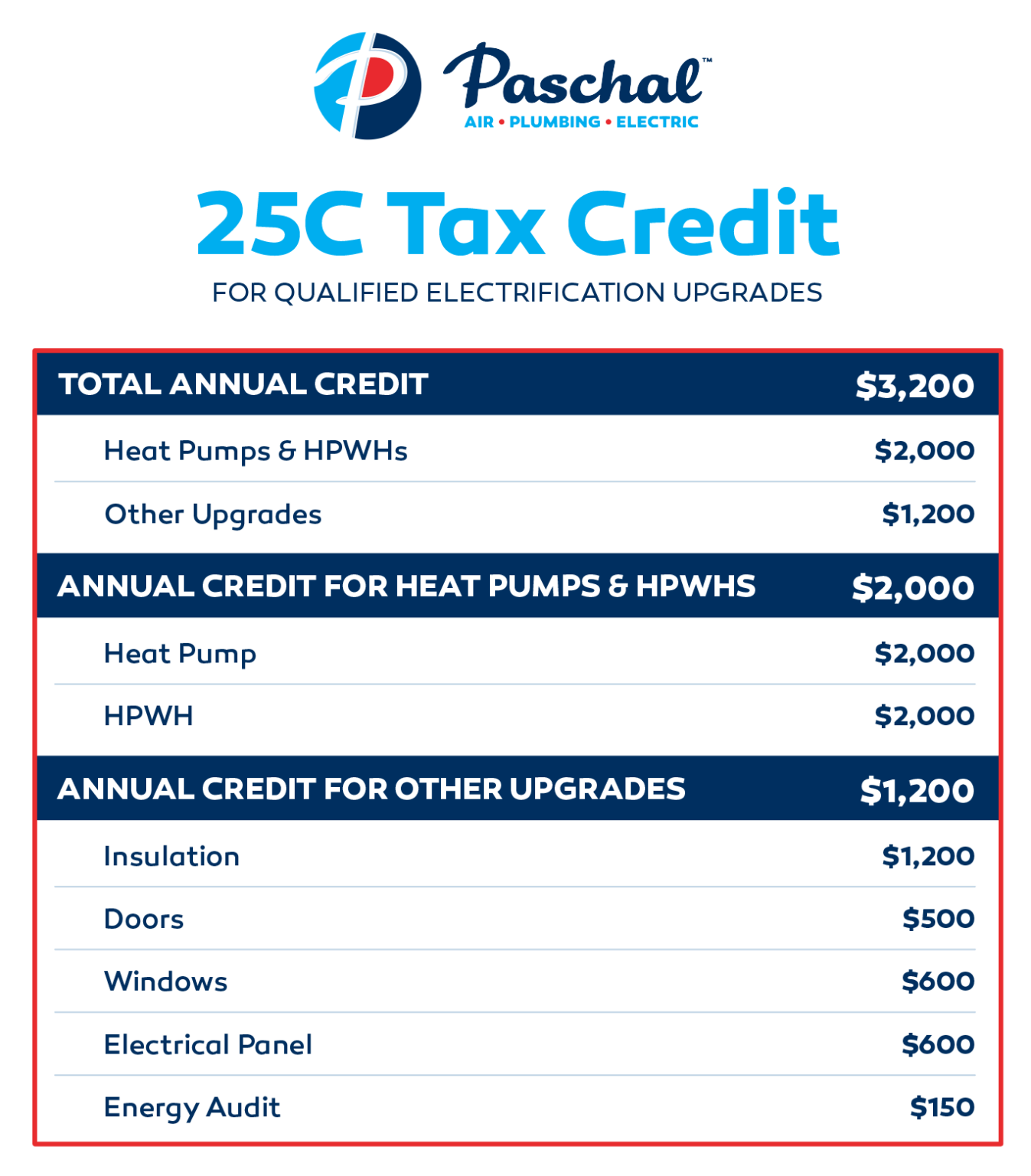

25C Tax Credit For Qualified Electrification Upgrades Heat pumps and HPWHs 3 200 Other upgrades Heat Pump 2 000 HPWH Insulation Doors Windows Electrical

After we've peaked your curiosity about Federal 25c Tax Credit Program, let's explore where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Federal 25c Tax Credit Program for a variety applications.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a wide selection of subjects, that includes DIY projects to planning a party.

Maximizing Federal 25c Tax Credit Program

Here are some innovative ways to make the most of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets from the internet for teaching at-home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Federal 25c Tax Credit Program are an abundance of fun and practical tools for a variety of needs and interests. Their accessibility and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the plethora that is Federal 25c Tax Credit Program today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes they are! You can print and download the resources for free.

-

Can I use free templates for commercial use?

- It's contingent upon the specific terms of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns with Federal 25c Tax Credit Program?

- Certain printables could be restricted in use. Make sure you read the conditions and terms of use provided by the creator.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit any local print store for more high-quality prints.

-

What program must I use to open printables that are free?

- A majority of printed materials are in PDF format. They can be opened with free programs like Adobe Reader.

Expanding The 25C Tax Credit Is A No Brainer For Climate Action

Spray Foam Tax Credit Information And More

Check more sample of Federal 25c Tax Credit Program below

25C Tax Credit Sila Heating Cooling Plumbing DC MD VA

25C Tax Credit Energy Incentives For Homeowners Sansone

25C Residential Energy Efficiency Tax Credit Paschal Air Plumbing

Dependable Partner Program Maytag HVAC

IRA Webinar 2 Understanding The 25C Tax Credit For Contractors

Companies Organizations Call For Modernizing Homeowner Energy

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

https://www.irs.gov/credits-deductions/frequently...

Background Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Background Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient

Dependable Partner Program Maytag HVAC

25C Tax Credit Energy Incentives For Homeowners Sansone

IRA Webinar 2 Understanding The 25C Tax Credit For Contractors

Companies Organizations Call For Modernizing Homeowner Energy

25C Federal Tax Credit Al Terry Plumbing Heating HVAC More

The Inflation Reduction Act s Energy Efficient Home Improvement Tax

The Inflation Reduction Act s Energy Efficient Home Improvement Tax

25C Federal Tax Credit Al Terry Plumbing Heating HVAC More