In this age of electronic devices, where screens have become the dominant feature of our lives, the charm of tangible printed items hasn't gone away. Be it for educational use project ideas, artistic or simply to add an extra personal touch to your space, Federal Earned Income Tax Credit Calculator are now a useful resource. With this guide, you'll dive deep into the realm of "Federal Earned Income Tax Credit Calculator," exploring the benefits of them, where to find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Federal Earned Income Tax Credit Calculator Below

Federal Earned Income Tax Credit Calculator

Federal Earned Income Tax Credit Calculator -

Bankrate provides a FREE earned income tax credit calculator and other EIC income tax calculators to help consumers determine the amount of income tax due or owed to the IRS

Use the EITC Assistant to see if you re eligible for this valuable credit calculate how much money you may get and find answers to questions The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break

Federal Earned Income Tax Credit Calculator encompass a wide assortment of printable content that can be downloaded from the internet at no cost. They come in many types, such as worksheets templates, coloring pages, and much more. The benefit of Federal Earned Income Tax Credit Calculator is their flexibility and accessibility.

More of Federal Earned Income Tax Credit Calculator

Earned Income Tax Credit Calculator 2022 2023 Internal Revenue Code

Earned Income Tax Credit Calculator 2022 2023 Internal Revenue Code

The EIC calculator otherwise known as the EITC Assistant is a tool supplied by the IRS that allows you to find out If you are eligible for EITC If you meet the tests for claiming qualifying child ren Estimate the amount of your credit

Employer s Quarterly Federal Tax Return Form W 2 Employers engaged in a trade or business who pay compensation Form 9465 Installment Agreement Request POPULAR FOR TAX PROS The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you qualify 1 General Info

Federal Earned Income Tax Credit Calculator have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

customization They can make printing templates to your own specific requirements in designing invitations planning your schedule or even decorating your home.

-

Educational Value Printing educational materials for no cost cater to learners from all ages, making them a valuable device for teachers and parents.

-

It's easy: Access to various designs and templates helps save time and effort.

Where to Find more Federal Earned Income Tax Credit Calculator

Eligible Taxpayers Can Claim Earned Income Tax Credit EITC

Eligible Taxpayers Can Claim Earned Income Tax Credit EITC

The earned income tax credit EIC or EITC is for low and moderate income workers See qualifications and credit amounts for 2024 2025

The EITC Assistant Use this calculator to find out if your client is eligible for the EITC Income Limits and Range of EITC Get income limits for claiming the EITC Nationwide Tax Forums Get professional education resources Awareness Day Spread the word about refundable credits Find more information about EITC on IRS gov

We hope we've stimulated your interest in Federal Earned Income Tax Credit Calculator We'll take a look around to see where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Federal Earned Income Tax Credit Calculator designed for a variety objectives.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free including flashcards, learning materials.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs covered cover a wide range of topics, that includes DIY projects to planning a party.

Maximizing Federal Earned Income Tax Credit Calculator

Here are some ideas ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home and in class.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Federal Earned Income Tax Credit Calculator are a treasure trove of useful and creative resources which cater to a wide range of needs and desires. Their availability and versatility make they a beneficial addition to each day life. Explore the endless world of Federal Earned Income Tax Credit Calculator right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Earned Income Tax Credit Calculator truly completely free?

- Yes they are! You can download and print these free resources for no cost.

-

Can I use free printables for commercial uses?

- It is contingent on the specific terms of use. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using Federal Earned Income Tax Credit Calculator?

- Some printables may contain restrictions on use. Always read the conditions and terms of use provided by the author.

-

How do I print Federal Earned Income Tax Credit Calculator?

- You can print them at home using any printer or head to the local print shops for more high-quality prints.

-

What software do I require to open printables at no cost?

- The majority are printed in the PDF format, and can be opened with free programs like Adobe Reader.

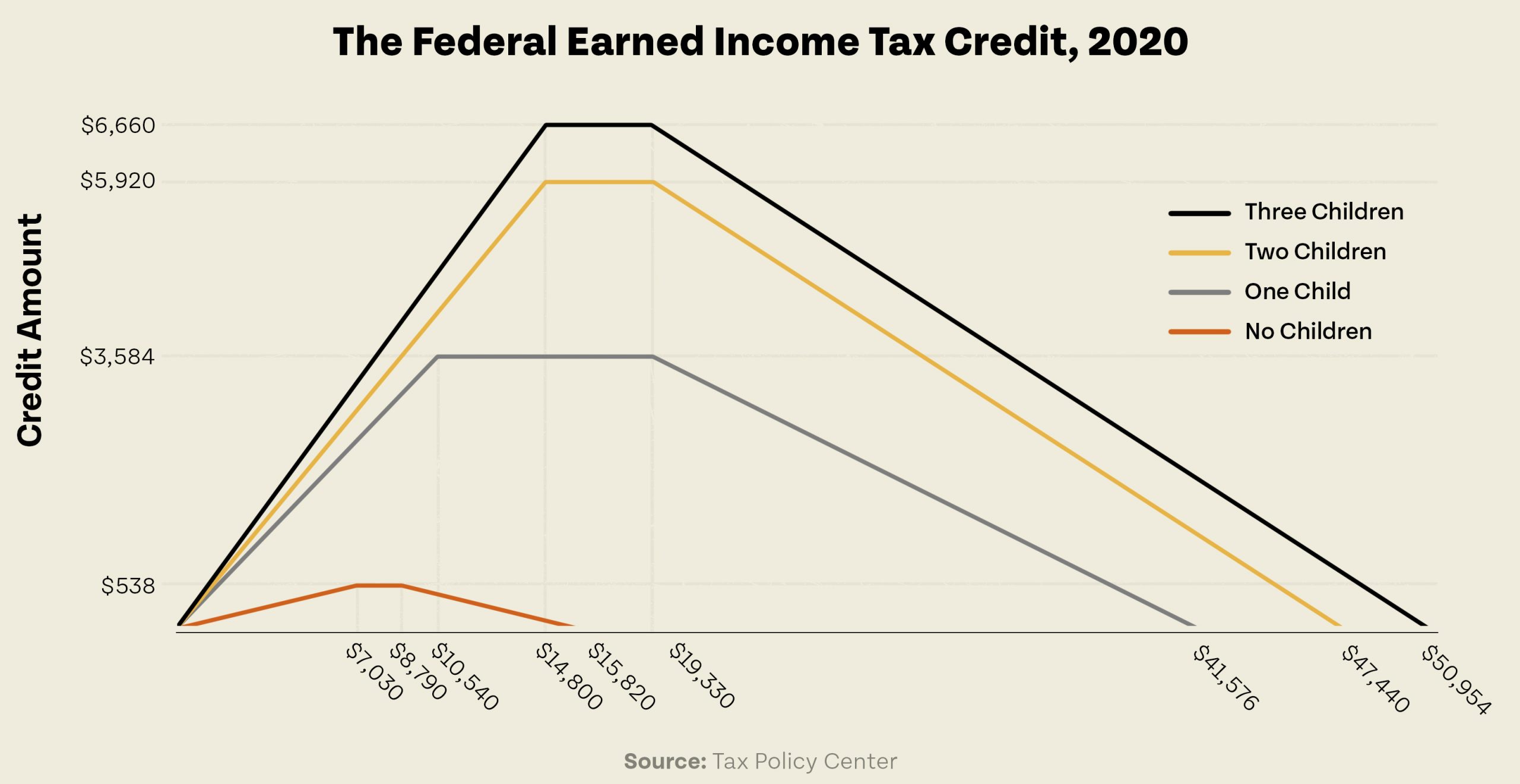

2020 Earned Income Credit Calculator NaidiaGelica

Earned Income Credit Calculator 2021 DannielleThalia

Check more sample of Federal Earned Income Tax Credit Calculator below

See The EIC Earned Income Credit Table Income Tax Return Income

Federal Earned Income Credit Table 2017 Brokeasshome

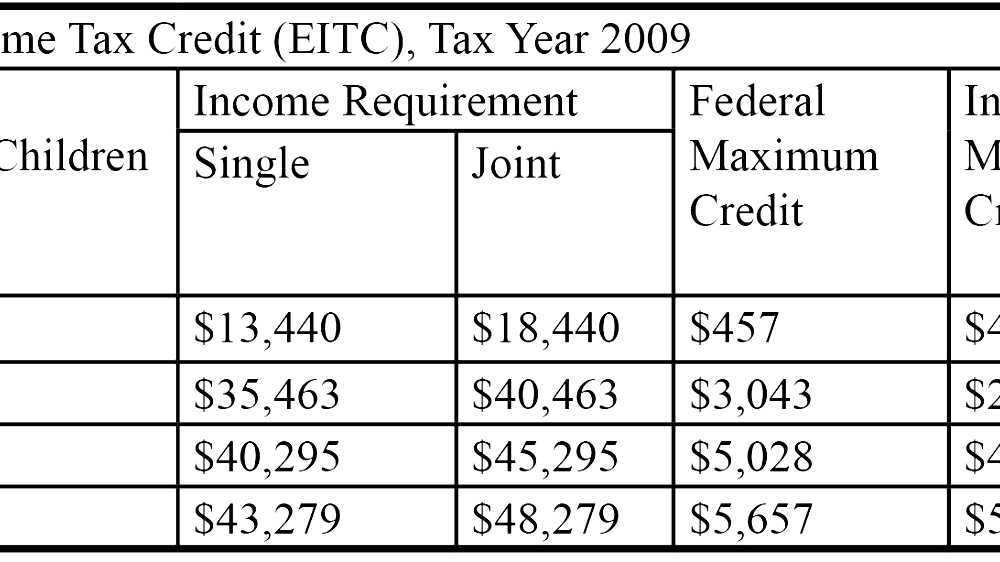

Federal Earned Income Tax Credit Maximum Credit By Number Of Children

Eic Worksheet A Instructions 2021 Tripmart

Earned Income Credit Table 2017 Pdf Brokeasshome

Irs Tax Table 2022 Married Filing Jointly Latest News Update

https://www.irs.gov › credits-deductions › individuals › ...

Use the EITC Assistant to see if you re eligible for this valuable credit calculate how much money you may get and find answers to questions The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break

https://www.irs.gov › credits-deductions › individuals...

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund Did you receive a

Use the EITC Assistant to see if you re eligible for this valuable credit calculate how much money you may get and find answers to questions The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund Did you receive a

Eic Worksheet A Instructions 2021 Tripmart

Federal Earned Income Credit Table 2017 Brokeasshome

Earned Income Credit Table 2017 Pdf Brokeasshome

Irs Tax Table 2022 Married Filing Jointly Latest News Update

Why Tax Credits For Working Families Matter

NYS Can Help Low income Working Families With Children By Increasing

NYS Can Help Low income Working Families With Children By Increasing

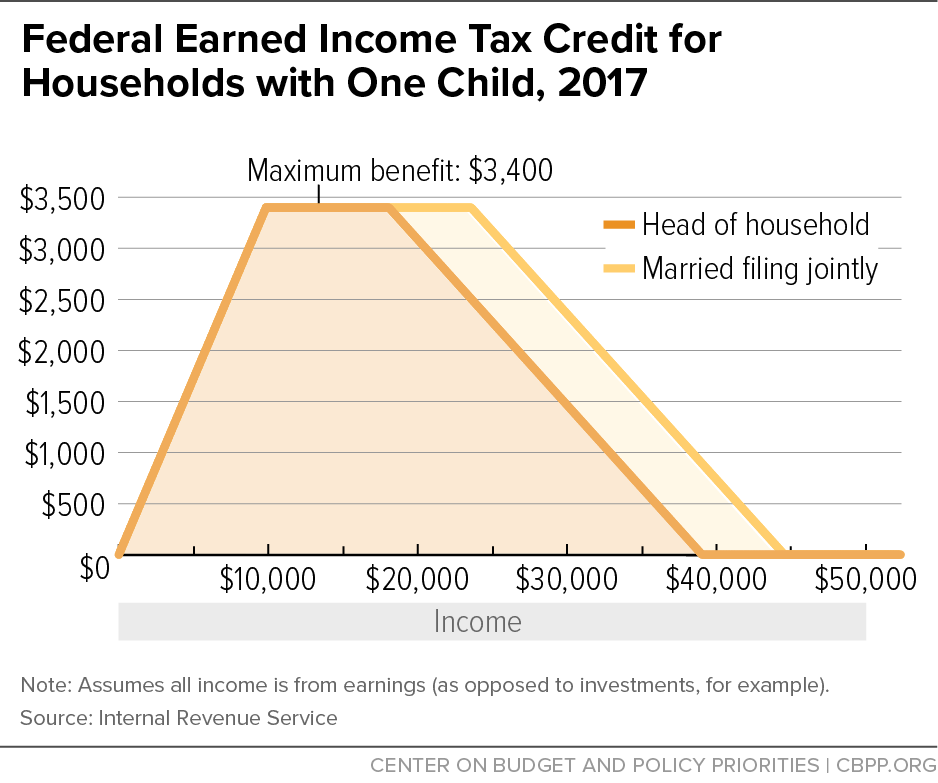

Federal Earned Income Tax Credit For Households With One Child 2017