In the digital age, where screens have become the dominant feature of our lives and the appeal of physical, printed materials hasn't diminished. No matter whether it's for educational uses project ideas, artistic or simply adding an extra personal touch to your space, Federal Ev Tax Credit Meaning can be an excellent resource. We'll take a dive deeper into "Federal Ev Tax Credit Meaning," exploring what they are, how they are, and how they can enhance various aspects of your life.

Get Latest Federal Ev Tax Credit Meaning Below

Federal Ev Tax Credit Meaning

Federal Ev Tax Credit Meaning -

The EV tax credit is a federal incentive to encourage consumers to purchase EVs Taxpayers who meet the income requirements and buy a vehicle that satisfies the price battery and

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Federal Ev Tax Credit Meaning provide a diverse assortment of printable, downloadable content that can be downloaded from the internet at no cost. They are available in a variety of designs, including worksheets templates, coloring pages and much more. The appealingness of Federal Ev Tax Credit Meaning lies in their versatility as well as accessibility.

More of Federal Ev Tax Credit Meaning

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

In 2024 several EVs are eligible for the federal government s tax credit program which can reduce what you owe the IRS by up to 7500 for a single tax year

A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500 for certain electric

Federal Ev Tax Credit Meaning have risen to immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Modifications: They can make printables to fit your particular needs such as designing invitations or arranging your schedule or even decorating your house.

-

Education Value These Federal Ev Tax Credit Meaning provide for students of all ages, which makes them a useful device for teachers and parents.

-

Convenience: The instant accessibility to a variety of designs and templates cuts down on time and efforts.

Where to Find more Federal Ev Tax Credit Meaning

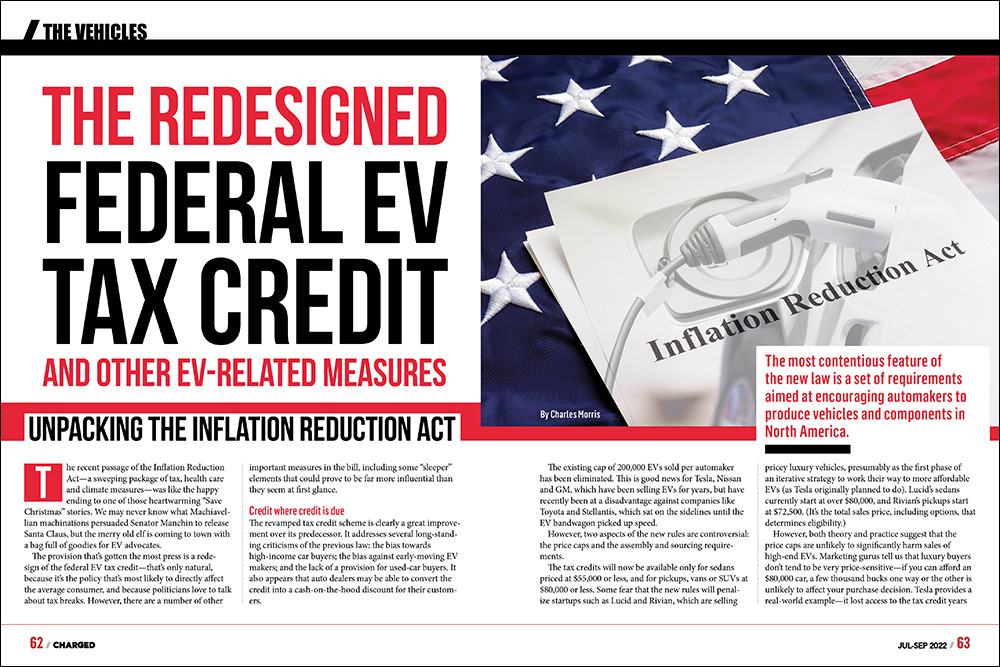

The Redesigned Federal EV Tax Credit And Other EV Related Measures

The Redesigned Federal EV Tax Credit And Other EV Related Measures

The IRS has made the EV tax credit easier to obtain and in 2024 it s redeemable for cash or as a credit toward the down payment on your vehicle Here s what you ll need to qualify for this

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

We hope we've stimulated your curiosity about Federal Ev Tax Credit Meaning Let's find out where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and Federal Ev Tax Credit Meaning for a variety purposes.

- Explore categories like decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets along with flashcards, as well as other learning materials.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- The blogs are a vast range of interests, starting from DIY projects to party planning.

Maximizing Federal Ev Tax Credit Meaning

Here are some ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to aid in learning at your home and in class.

3. Event Planning

- Make invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Federal Ev Tax Credit Meaning are a treasure trove with useful and creative ideas catering to different needs and pursuits. Their accessibility and flexibility make them a great addition to the professional and personal lives of both. Explore the vast world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I use free printables for commercial use?

- It's based on specific rules of usage. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright problems with Federal Ev Tax Credit Meaning?

- Certain printables may be subject to restrictions on usage. Make sure to read the terms of service and conditions provided by the designer.

-

How can I print Federal Ev Tax Credit Meaning?

- Print them at home using a printer or visit any local print store for higher quality prints.

-

What software do I require to open printables free of charge?

- The majority of printables are in the PDF format, and is open with no cost software such as Adobe Reader.

4 Ways How Does The Federal Ev Tax Credit Work Alproject

Has Federal EV Tax Credit Been Saved The Green Car Guy

Check more sample of Federal Ev Tax Credit Meaning below

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

Is The 2023 Toyota BZ4X Eligible For The Federal EV Tax Credit

2 Automotive Companies Have Already Used Up All Their EV Tax Credits

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

The Lowdown On The Federal EV Tax Credit

3 Scenarios That Would Make An EV Ineligible For The Federal EV Tax

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

https://www.irs.gov/newsroom/topic-a-frequently...

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the section 30D tax credit

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the section 30D tax credit

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Is The 2023 Toyota BZ4X Eligible For The Federal EV Tax Credit

The Lowdown On The Federal EV Tax Credit

3 Scenarios That Would Make An EV Ineligible For The Federal EV Tax

Tell Your Senator We Need An Expanded Federal EV Tax Credit

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

Charged EVs The Redesigned Federal EV Tax Credit And Other EV related