In a world when screens dominate our lives it's no wonder that the appeal of tangible printed items hasn't gone away. If it's to aid in education, creative projects, or just adding a personal touch to your space, Federal Income Tax Credit For Purchase Of Electric Vehicle have become a valuable source. Here, we'll dive in the world of "Federal Income Tax Credit For Purchase Of Electric Vehicle," exploring the different types of printables, where they are available, and how they can enhance various aspects of your life.

Get Latest Federal Income Tax Credit For Purchase Of Electric Vehicle Below

Federal Income Tax Credit For Purchase Of Electric Vehicle

Federal Income Tax Credit For Purchase Of Electric Vehicle -

Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code

The Federal Income Tax Credit For Purchase Of Electric Vehicle are a huge range of printable, free content that can be downloaded from the internet at no cost. The resources are offered in a variety styles, from worksheets to coloring pages, templates and much more. The appealingness of Federal Income Tax Credit For Purchase Of Electric Vehicle is their versatility and accessibility.

More of Federal Income Tax Credit For Purchase Of Electric Vehicle

Income Tax Credit For Purchase Of Electric Vehicle Nissan USA

Income Tax Credit For Purchase Of Electric Vehicle Nissan USA

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

No If you entered into a written binding contract to purchase a qualifying electric vehicle before the date of enactment of the Inflation Reduction Act August 16 2022 the

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization It is possible to tailor printables to fit your particular needs such as designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value: The free educational worksheets provide for students from all ages, making these printables a powerful resource for educators and parents.

-

An easy way to access HTML0: The instant accessibility to the vast array of design and templates will save you time and effort.

Where to Find more Federal Income Tax Credit For Purchase Of Electric Vehicle

Excise Tax VAT Holiday On Purchase Of Electric Vehicles Caribbean

Excise Tax VAT Holiday On Purchase Of Electric Vehicles Caribbean

The idea in theory is quite simple per the IRS You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug

The credit of up to 7 500 for certain electric vehicles called clean vehicles is supposed to encourage more people to use EVs However there are many questions

Now that we've piqued your interest in Federal Income Tax Credit For Purchase Of Electric Vehicle and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Federal Income Tax Credit For Purchase Of Electric Vehicle to suit a variety of needs.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing including flashcards, learning tools.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs are a vast range of topics, that includes DIY projects to party planning.

Maximizing Federal Income Tax Credit For Purchase Of Electric Vehicle

Here are some new ways to make the most of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Federal Income Tax Credit For Purchase Of Electric Vehicle are a treasure trove of practical and innovative resources for a variety of needs and interests. Their availability and versatility make them a wonderful addition to every aspect of your life, both professional and personal. Explore the wide world of Federal Income Tax Credit For Purchase Of Electric Vehicle today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I make use of free printables to make commercial products?

- It's contingent upon the specific usage guidelines. Always consult the author's guidelines before using any printables on commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may come with restrictions in use. Check the conditions and terms of use provided by the creator.

-

How do I print Federal Income Tax Credit For Purchase Of Electric Vehicle?

- Print them at home with an printer, or go to the local print shops for premium prints.

-

What software is required to open printables at no cost?

- A majority of printed materials are in PDF format, which is open with no cost software like Adobe Reader.

Income Tax Credit For Electric Vehicle Purchase Nissan USA

Federal Income Tax Credit Electric Vehicle Todrivein

Check more sample of Federal Income Tax Credit For Purchase Of Electric Vehicle below

Income Tax Credit For Purchase Of Electric Vehicle Chargers

Income Tax Credit For Purchase Of Electric Vehicle Nissan USA

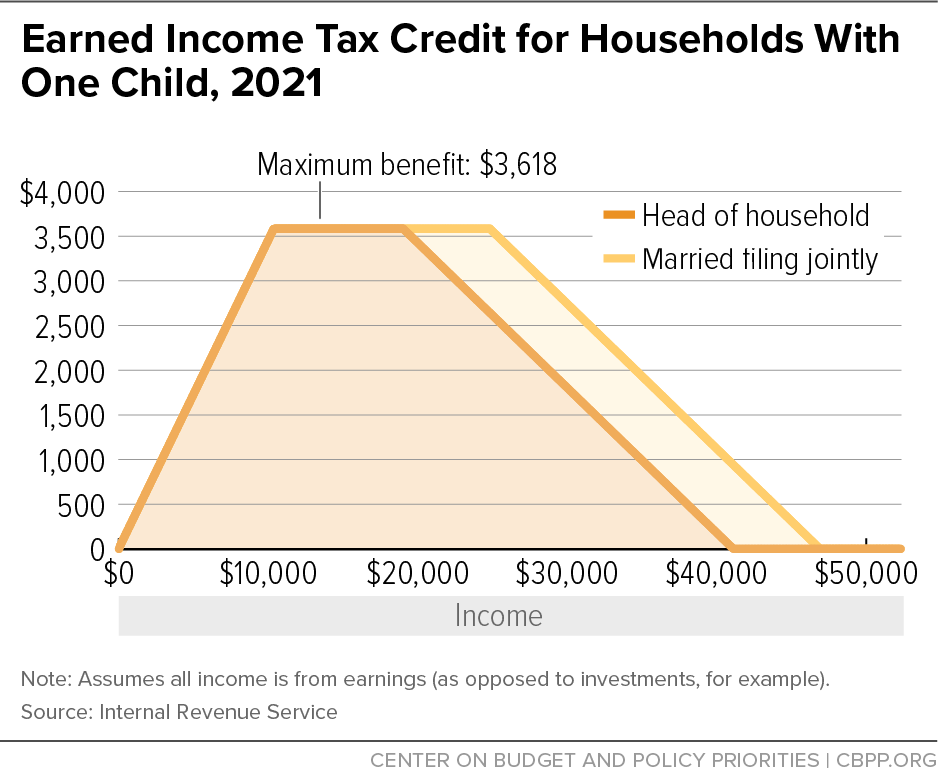

Earned Income Tax Credit For Households With One Child 2021 Center

The 2018 Electric Vehicle Tax Credit OsVehicle

Products TAV Systems Australian E Bike Drive Company

Adilabad DCCB Recruitment 2023 Adilabad District Cooperative Bank

https://www.irs.gov/credits-deductions/credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code

https://www.nerdwallet.com/article/taxes/ev-tax...

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit

The 2018 Electric Vehicle Tax Credit OsVehicle

Income Tax Credit For Purchase Of Electric Vehicle Nissan USA

Products TAV Systems Australian E Bike Drive Company

Adilabad DCCB Recruitment 2023 Adilabad District Cooperative Bank

Cabinet Approves FAME II Scheme For Electric Vehicles Pv Magazine India

Debit Vs Credit For Purchases WazzCards

Debit Vs Credit For Purchases WazzCards

Finamerica Compa a De Financiamiento Comercial