In this age of electronic devices, where screens have become the dominant feature of our lives however, the attraction of tangible printed material hasn't diminished. If it's to aid in education or creative projects, or just adding a personal touch to your space, Federal Income Tax Deduction For Health Insurance Premiums are now an essential source. In this article, we'll take a dive in the world of "Federal Income Tax Deduction For Health Insurance Premiums," exploring their purpose, where you can find them, and the ways that they can benefit different aspects of your lives.

Get Latest Federal Income Tax Deduction For Health Insurance Premiums Below

Federal Income Tax Deduction For Health Insurance Premiums

Federal Income Tax Deduction For Health Insurance Premiums -

Verkko 9 tammik 2023 nbsp 0183 32 The Medical Expense Deduction Health insurance costs are included among expenses that are eligible for the medical expense deduction You must itemize to claim this deduction and

Verkko 12 hein 228 k 2023 nbsp 0183 32 You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who

Federal Income Tax Deduction For Health Insurance Premiums encompass a wide variety of printable, downloadable items that are available online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and many more. The appeal of printables for free is in their versatility and accessibility.

More of Federal Income Tax Deduction For Health Insurance Premiums

Self Employment Health Insurance Deductions

Self Employment Health Insurance Deductions

Verkko You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment

Verkko 26 syysk 2023 nbsp 0183 32 You itemize your deductions rather than take the standard deduction You pay your health insurance premiums directly not through your employer Your medical expenses totaled more than

Federal Income Tax Deduction For Health Insurance Premiums have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: The Customization feature lets you tailor designs to suit your personal needs such as designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free cater to learners of all ages. This makes these printables a powerful tool for teachers and parents.

-

The convenience of instant access an array of designs and templates reduces time and effort.

Where to Find more Federal Income Tax Deduction For Health Insurance Premiums

Are Health Insurance Premiums Deductible Exploring The Pros And Cons

Are Health Insurance Premiums Deductible Exploring The Pros And Cons

Verkko Enter email address Select a state By checking this box you consent to our data privacy policy You must file tax return for 2022 if enrolled in Health Insurance Marketplace 174

Verkko You can claim a tax deduction for contributions you make even if you don t itemize your deductions on Schedule A You don t pay federal income tax or employment taxes

We've now piqued your curiosity about Federal Income Tax Deduction For Health Insurance Premiums Let's take a look at where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Federal Income Tax Deduction For Health Insurance Premiums designed for a variety goals.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free as well as flashcards and other learning materials.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a wide array of topics, ranging that includes DIY projects to party planning.

Maximizing Federal Income Tax Deduction For Health Insurance Premiums

Here are some creative ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home as well as in the class.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Federal Income Tax Deduction For Health Insurance Premiums are an abundance of innovative and useful resources designed to meet a range of needs and preferences. Their availability and versatility make they a beneficial addition to both professional and personal life. Explore the vast collection of Federal Income Tax Deduction For Health Insurance Premiums to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes you can! You can download and print these files for free.

-

Can I download free printables to make commercial products?

- It's based on specific conditions of use. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may contain restrictions in their usage. You should read the terms and conditions set forth by the designer.

-

How can I print Federal Income Tax Deduction For Health Insurance Premiums?

- Print them at home using the printer, or go to a local print shop to purchase the highest quality prints.

-

What software do I need to run printables free of charge?

- Most printables come with PDF formats, which can be opened using free software like Adobe Reader.

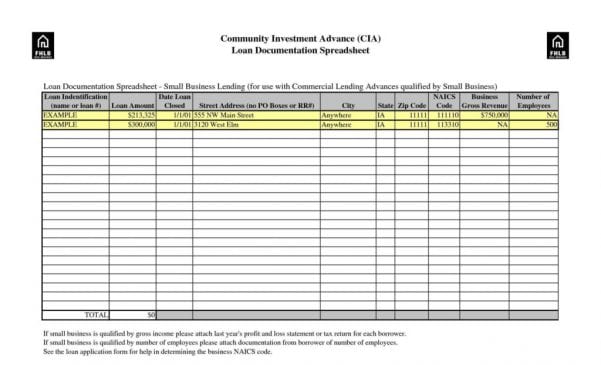

Tax Deductions You Can Deduct What Napkin Finance

Qualified Business Income Deduction And The Self Employed The CPA Journal

Check more sample of Federal Income Tax Deduction For Health Insurance Premiums below

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

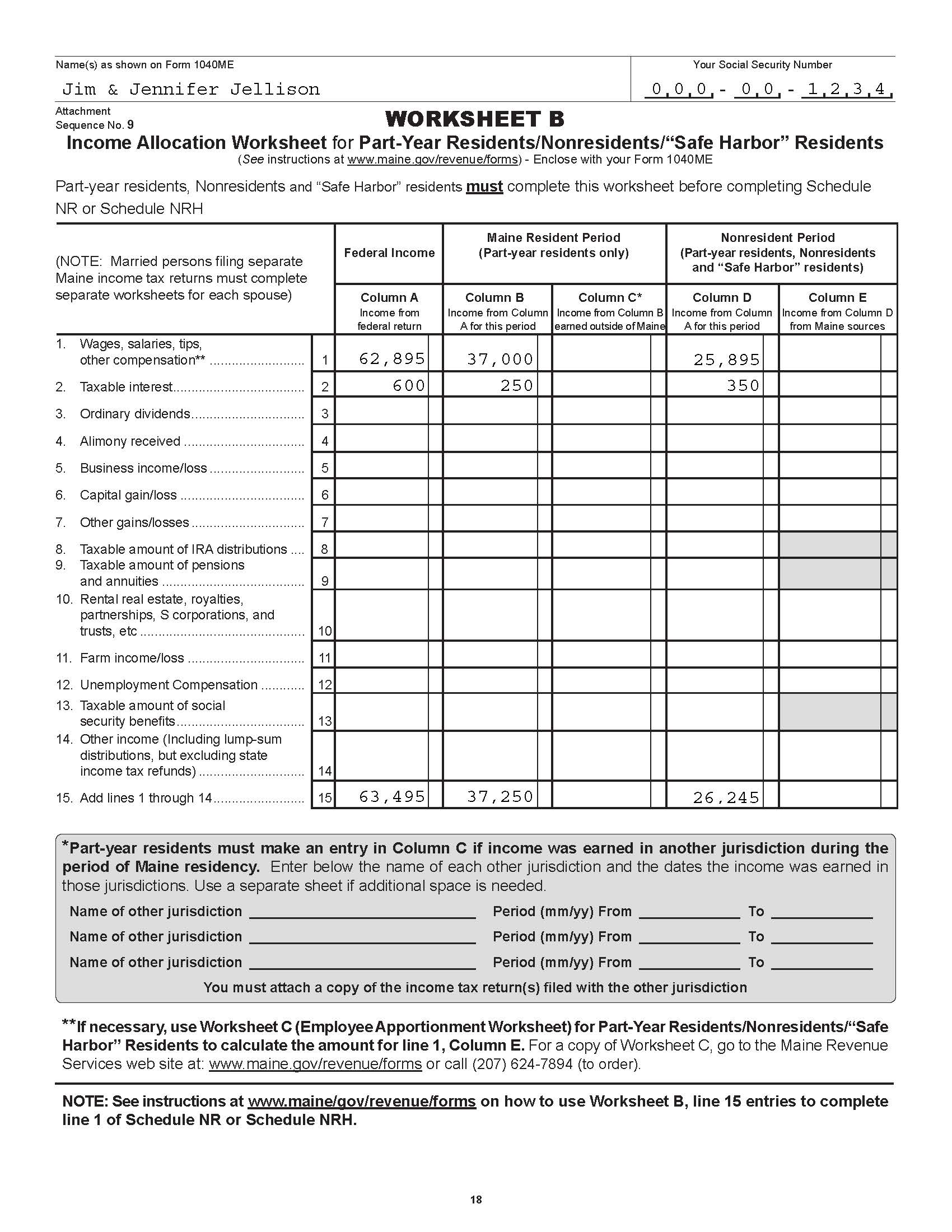

Federal Income Tax Deduction Worksheet Louisiana Excelxo

Irs Deduction For Health Insurance Premiums Dollar Keg

Income Tax Return Which Tax Regime Suits You Old Vs New

When Can You Claim A Tax Deduction For Health Insurance Yulianna FTP

https://www.investopedia.com/are-health-ins…

Verkko 12 hein 228 k 2023 nbsp 0183 32 You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who

https://www.irs.gov/taxtopics/tc502

Verkko 16 marrask 2023 nbsp 0183 32 The deduction applies only to expenses not compensated by insurance or otherwise regardless of whether you receive the reimbursement

Verkko 12 hein 228 k 2023 nbsp 0183 32 You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who

Verkko 16 marrask 2023 nbsp 0183 32 The deduction applies only to expenses not compensated by insurance or otherwise regardless of whether you receive the reimbursement

Irs Deduction For Health Insurance Premiums Dollar Keg

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

Income Tax Return Which Tax Regime Suits You Old Vs New

When Can You Claim A Tax Deduction For Health Insurance Yulianna FTP

When Can You Claim A Tax Deduction For Health Insurance

When Can You Claim A Tax Deduction For Health Insurance The TurboTax

When Can You Claim A Tax Deduction For Health Insurance The TurboTax

14 Best Images Of IRS Itemized Deductions Worksheet Tax Itemized