In this day and age when screens dominate our lives and the appeal of physical, printed materials hasn't diminished. It doesn't matter if it's for educational reasons for creative projects, simply adding personal touches to your home, printables for free are now an essential source. With this guide, you'll take a dive into the sphere of "Federal Personal Tax Credit Amount 2022," exploring the different types of printables, where you can find them, and how they can improve various aspects of your life.

Get Latest Federal Personal Tax Credit Amount 2022 Below

Federal Personal Tax Credit Amount 2022

Federal Personal Tax Credit Amount 2022 -

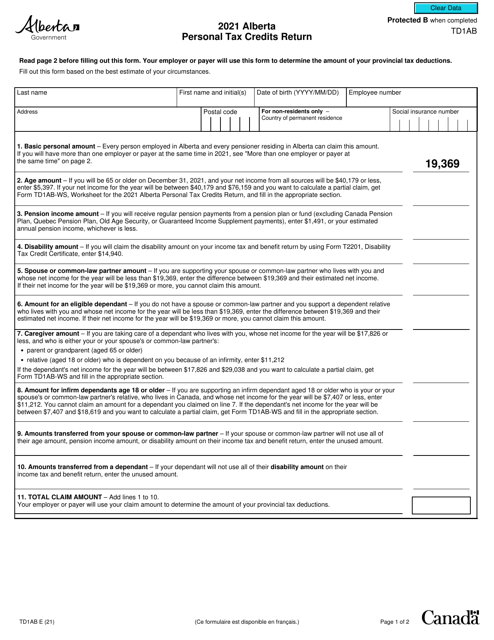

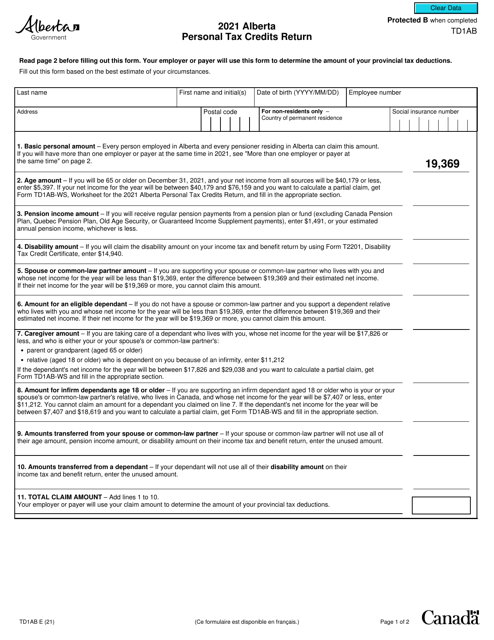

Manitoba only indexes the basic personal amount and their other tax credits are not indexed 7 The Alberta 2023 Budget announced an increase in the Adoption Tax

The additional tax credit amounts are not reflected above 4 The PEI 2021 budget increases the basic personal amount to 11 250 for 2022 with the spouse and

Federal Personal Tax Credit Amount 2022 include a broad assortment of printable items that are available online at no cost. These resources come in many formats, such as worksheets, templates, coloring pages and much more. The appealingness of Federal Personal Tax Credit Amount 2022 is their flexibility and accessibility.

More of Federal Personal Tax Credit Amount 2022

How To Set Up Federal Personal Tax Credits

How To Set Up Federal Personal Tax Credits

PDF fillable saveable td1 fill 24e pdf For people with visual impairments the following alternate formats are also available E text td1 24e txt Large print td1 lp

Completing your tax return Enter the basic personal amount on line 30000 of your return If your net income at line 23600 of your return is 165 430 or less enter 15 000 on line

Federal Personal Tax Credit Amount 2022 have garnered immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization They can make the templates to meet your individual needs when it comes to designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: The free educational worksheets are designed to appeal to students of all ages, which makes these printables a powerful device for teachers and parents.

-

Affordability: instant access an array of designs and templates can save you time and energy.

Where to Find more Federal Personal Tax Credit Amount 2022

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

Different tax brackets or ranges of income are taxed at different rates These are broken down into seven 7 taxable income groups based on your federal

28 AMT Tax Bracket Normally AMT is taxed at a flat rate of 26 For high income taxpayers however a 28 tax is applied to income in excess of the

Since we've got your interest in Federal Personal Tax Credit Amount 2022 we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection with Federal Personal Tax Credit Amount 2022 for all applications.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a wide range of topics, starting from DIY projects to planning a party.

Maximizing Federal Personal Tax Credit Amount 2022

Here are some unique ways in order to maximize the use of Federal Personal Tax Credit Amount 2022:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Federal Personal Tax Credit Amount 2022 are an abundance of fun and practical tools catering to different needs and hobbies. Their accessibility and versatility make them an essential part of each day life. Explore the world of Federal Personal Tax Credit Amount 2022 to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes, they are! You can print and download the resources for free.

-

Can I download free templates for commercial use?

- It's based on the terms of use. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with Federal Personal Tax Credit Amount 2022?

- Some printables may contain restrictions regarding their use. Always read the terms and conditions provided by the author.

-

How do I print Federal Personal Tax Credit Amount 2022?

- Print them at home with either a printer at home or in a local print shop for high-quality prints.

-

What software will I need to access printables for free?

- Most PDF-based printables are available in the format of PDF, which can be opened with free software like Adobe Reader.

Irs Tax Table 2022 Married Filing Jointly Latest News Update

How To Set Up Federal Personal Tax Credits

Check more sample of Federal Personal Tax Credit Amount 2022 below

Solved The TD1 Form Is Used By Employees To Claim Federal Personal

Aca Percentage Of Income 2022 INCOMUNTA

Solved The TD1 Form Is Used By Employees To Claim Federal Personal

Printable Td1 Form Printable Blank World

Solved The United States Federal Personal Income Tax Is Chegg

Free Tax Preparation Worksheets

https://www.taxtips.ca/nrcredits/tax-credits-2022-base.htm

The additional tax credit amounts are not reflected above 4 The PEI 2021 budget increases the basic personal amount to 11 250 for 2022 with the spouse and

https://www.irs.gov/credits

Standard deduction amounts The standard deduction for 2023 is 13 850 for single or married filing separately 27 700 for married couples filing jointly or

The additional tax credit amounts are not reflected above 4 The PEI 2021 budget increases the basic personal amount to 11 250 for 2022 with the spouse and

Standard deduction amounts The standard deduction for 2023 is 13 850 for single or married filing separately 27 700 for married couples filing jointly or

Printable Td1 Form Printable Blank World

Aca Percentage Of Income 2022 INCOMUNTA

Solved The United States Federal Personal Income Tax Is Chegg

Free Tax Preparation Worksheets

Homepage Herndon Chevrolet

Child Tax Credit 2020 Form 1040 8 Photos Earned Income Credit Table

Child Tax Credit 2020 Form 1040 8 Photos Earned Income Credit Table

Analysis Of The Cost of Living Refund Act Of 2019 Tax Foundation