In this age of electronic devices, where screens dominate our lives yet the appeal of tangible printed material hasn't diminished. In the case of educational materials in creative or artistic projects, or simply to add the personal touch to your area, Federal Solar Tax Credit Rules are a great source. We'll take a dive deep into the realm of "Federal Solar Tax Credit Rules," exploring what they are, where to find them, and the ways that they can benefit different aspects of your life.

Get Latest Federal Solar Tax Credit Rules Below

Federal Solar Tax Credit Rules

Federal Solar Tax Credit Rules -

WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements

Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

Federal Solar Tax Credit Rules include a broad selection of printable and downloadable materials that are accessible online for free cost. These printables come in different kinds, including worksheets coloring pages, templates and many more. The benefit of Federal Solar Tax Credit Rules is in their versatility and accessibility.

More of Federal Solar Tax Credit Rules

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

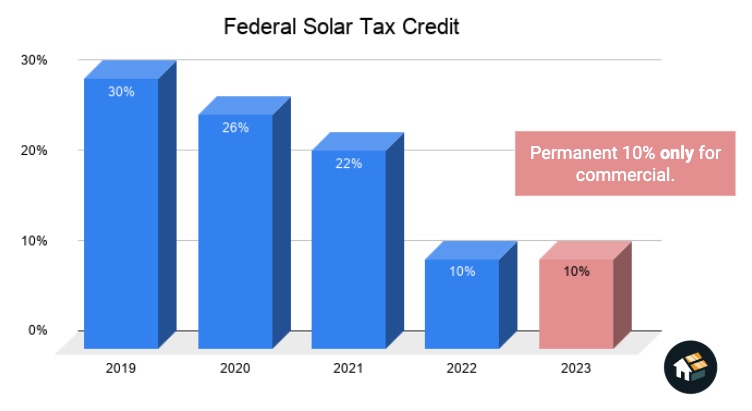

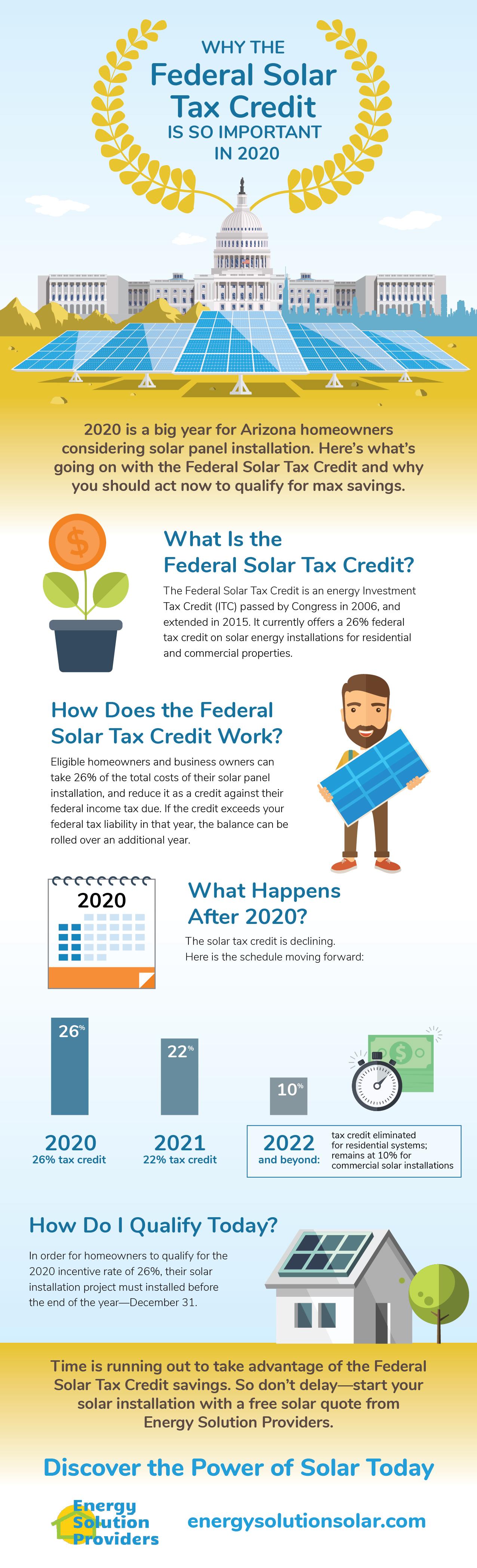

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill

Federal Solar Tax Credit Rules have gained a lot of recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

The ability to customize: Your HTML0 customization options allow you to customize the design to meet your needs for invitations, whether that's creating them and schedules, or even decorating your home.

-

Educational Value Educational printables that can be downloaded for free cater to learners of all ages, which makes the perfect device for teachers and parents.

-

Accessibility: instant access a variety of designs and templates is time-saving and saves effort.

Where to Find more Federal Solar Tax Credit Rules

Federal Tax Credit For Installing Solar Panels Tax Walls

Federal Tax Credit For Installing Solar Panels Tax Walls

How to File for the Federal Solar Tax Credit Step by Step Fill in Form 1040 as you normally would When you get to line 5 of Schedule 3 Form 1040 shown below it s time to switch to Form 5695 Step 1 Calculate how much your solar tax credit is worth On Form 5695 enter the full amount you paid to have your solar system installed

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar

Since we've got your curiosity about Federal Solar Tax Credit Rules Let's see where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Federal Solar Tax Credit Rules suitable for many uses.

- Explore categories like interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets, flashcards, and learning tools.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a wide variety of topics, all the way from DIY projects to planning a party.

Maximizing Federal Solar Tax Credit Rules

Here are some ways create the maximum value use of Federal Solar Tax Credit Rules:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Federal Solar Tax Credit Rules are a treasure trove of fun and practical tools that cater to various needs and hobbies. Their access and versatility makes these printables a useful addition to your professional and personal life. Explore the vast collection of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes they are! You can download and print these resources at no cost.

-

Does it allow me to use free printouts for commercial usage?

- It's contingent upon the specific rules of usage. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may come with restrictions on usage. Make sure you read the terms and conditions provided by the designer.

-

How can I print Federal Solar Tax Credit Rules?

- You can print them at home using an printer, or go to any local print store for better quality prints.

-

What program is required to open printables free of charge?

- Many printables are offered in PDF format. These can be opened with free software like Adobe Reader.

Applying For The Solar Tax Credit Is As Easy As 123 ARE Solar

The Federal Solar Tax Credit In 2020 Green Needham

Check more sample of Federal Solar Tax Credit Rules below

Your Guide To The Increased 30 Federal Solar Tax Credit Absolute

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

2020 Federal Solar Tax Credit Guide For Homeowners

Federal Solar Tax Credit Everything You Need To Know

Explaining The Federal Solar Tax Credit Solaria

How Does The Federal Solar Tax Credit Work In 2023

![]()

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

https://www.energy.gov/sites/default/files/2021/02...

What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Federal Solar Tax Credit Everything You Need To Know

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Explaining The Federal Solar Tax Credit Solaria

How Does The Federal Solar Tax Credit Work In 2023

The 2020 Federal Solar Tax Credit Explained YouTube

Everything You Need To Know About The Federal Solar Tax Credit

Everything You Need To Know About The Federal Solar Tax Credit

Federal Solar Tax Credit Explained YouTube