In this age of technology, in which screens are the norm The appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses in creative or artistic projects, or simply to add personal touches to your home, printables for free have become an invaluable source. For this piece, we'll take a dive into the world of "Federal Tax Break For Electric Cars," exploring their purpose, where they are available, and ways they can help you improve many aspects of your lives.

Get Latest Federal Tax Break For Electric Cars Below

Federal Tax Break For Electric Cars

Federal Tax Break For Electric Cars -

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

Federal Tax Break For Electric Cars provide a diverse assortment of printable, downloadable content that can be downloaded from the internet at no cost. These resources come in many types, such as worksheets templates, coloring pages and more. The beauty of Federal Tax Break For Electric Cars is in their variety and accessibility.

More of Federal Tax Break For Electric Cars

Federal Tax Break For Electric Cars At Risk In Washington Bellingham

Federal Tax Break For Electric Cars At Risk In Washington Bellingham

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household 75 000 for a

Federal Tax Break For Electric Cars have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization: It is possible to tailor printables to fit your particular needs whether it's making invitations to organize your schedule or even decorating your home.

-

Educational Worth: Free educational printables can be used by students from all ages, making these printables a powerful source for educators and parents.

-

It's easy: Instant access to a variety of designs and templates helps save time and effort.

Where to Find more Federal Tax Break For Electric Cars

It Doesn t Make Sense For EVs To Look Different Than ICE Cars Just For

It Doesn t Make Sense For EVs To Look Different Than ICE Cars Just For

If you re shopping for or researching an electric vehicle in 2024 you ve probably heard that significant changes in the federal tax credit of up to 7 500 for EVs and plug in hybrids took

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

We hope we've stimulated your curiosity about Federal Tax Break For Electric Cars Let's take a look at where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Federal Tax Break For Electric Cars for various goals.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free including flashcards, learning materials.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs are a vast spectrum of interests, starting from DIY projects to party planning.

Maximizing Federal Tax Break For Electric Cars

Here are some fresh ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Federal Tax Break For Electric Cars are an abundance with useful and creative ideas that meet a variety of needs and preferences. Their access and versatility makes them a valuable addition to the professional and personal lives of both. Explore the vast array of Federal Tax Break For Electric Cars right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Tax Break For Electric Cars truly free?

- Yes, they are! You can download and print these files for free.

-

Does it allow me to use free printables in commercial projects?

- It depends on the specific rules of usage. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may come with restrictions regarding their use. Always read the terms and conditions provided by the creator.

-

How can I print printables for free?

- Print them at home with a printer or visit any local print store for higher quality prints.

-

What program do I require to open printables at no cost?

- The majority of printed documents are in PDF format. These can be opened using free software like Adobe Reader.

PSDcast HIL Simulation For Electric Cars Renewable Energy

Goodyear Launches New Tire Optimized For Teslas And Other Electric Cars

Check more sample of Federal Tax Break For Electric Cars below

Jinger Duggar s New Book Stepford Wife Comparisons More Revelations

Celebs Who Were Booed At Sports Games Kim Kardashian Emma Stone And

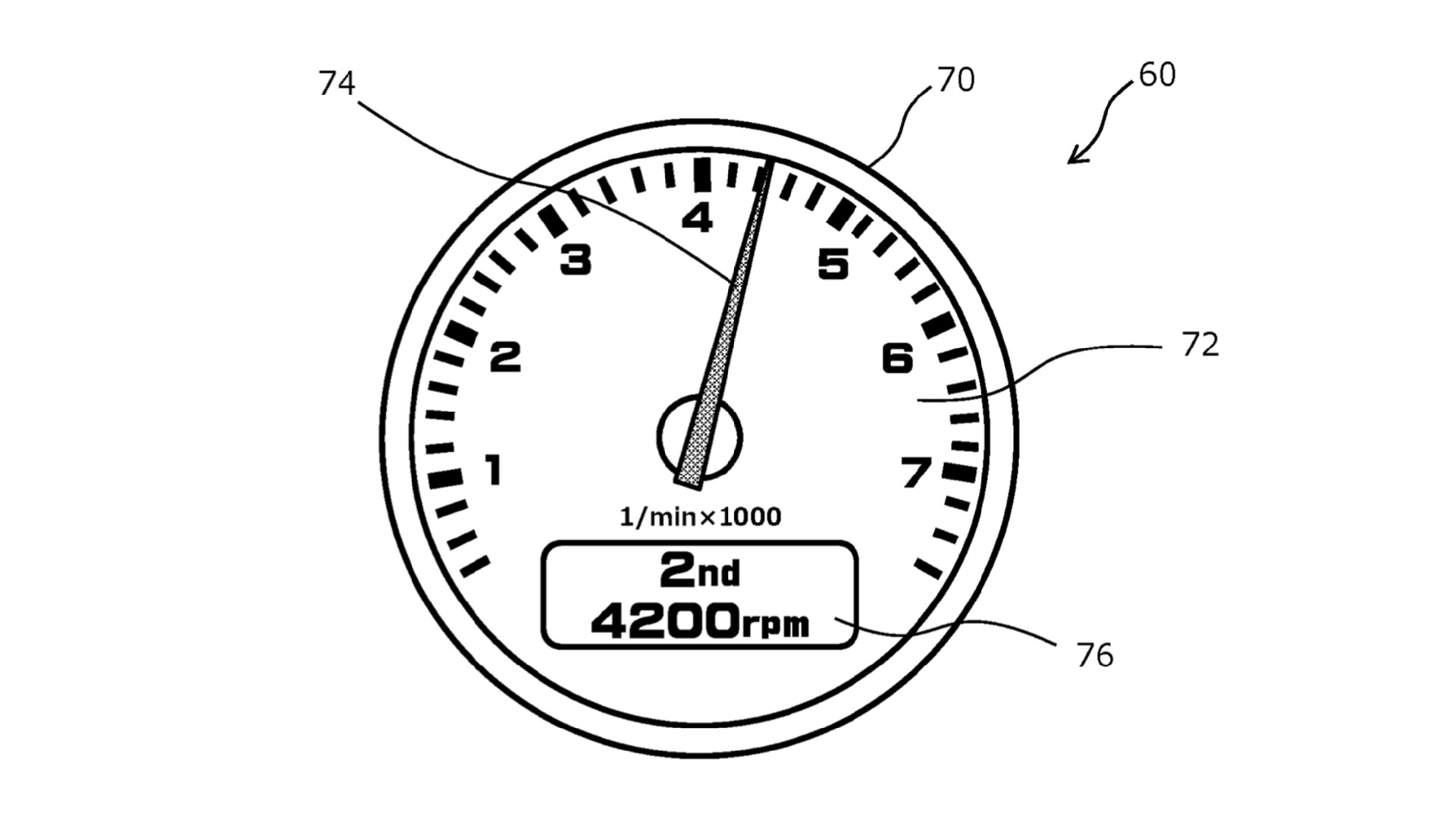

Toyota Patented A Manual Transmission For Electric Cars

Tesla Model S 50 000 Electric Car That Seats Seven

New Analysis Electric Cars In China Cheaper Than Petrol Ones

Ada Nya Begini Entertainers Working In Multiple States Run Into Tax

https://www.nerdwallet.com/article/taxes/ev-tax...

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Tesla Model S 50 000 Electric Car That Seats Seven

Celebs Who Were Booed At Sports Games Kim Kardashian Emma Stone And

New Analysis Electric Cars In China Cheaper Than Petrol Ones

Ada Nya Begini Entertainers Working In Multiple States Run Into Tax

Grand Forks City Council Questions Tax Break For Housing Grand Forks

Sona Comstar Tech Deals With Equipmake To Make E powertrains For

Sona Comstar Tech Deals With Equipmake To Make E powertrains For

Wireless Electric Car Charging Pads Now Available For Drivers Of