In this digital age, in which screens are the norm however, the attraction of tangible printed materials isn't diminishing. If it's to aid in education as well as creative projects or just adding an individual touch to your home, printables for free are now a useful source. Through this post, we'll dive in the world of "Federal Tax Credit For New Air Conditioner," exploring their purpose, where to locate them, and how they can enrich various aspects of your life.

Get Latest Federal Tax Credit For New Air Conditioner Below

Federal Tax Credit For New Air Conditioner

Federal Tax Credit For New Air Conditioner -

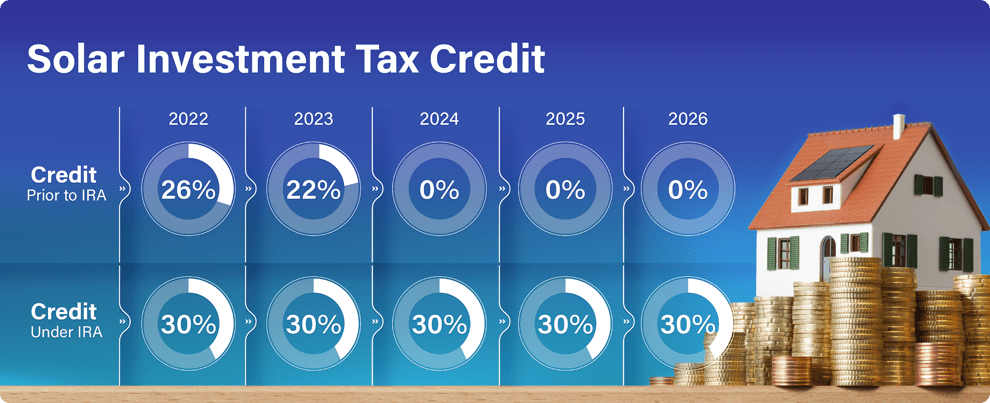

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights

Federal Tax Credit For New Air Conditioner include a broad selection of printable and downloadable documents that can be downloaded online at no cost. These resources come in many types, such as worksheets templates, coloring pages, and much more. One of the advantages of Federal Tax Credit For New Air Conditioner lies in their versatility as well as accessibility.

More of Federal Tax Credit For New Air Conditioner

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s

The renewed Energy Efficient Home Improvement Tax Credit 25C program increases the HVAC tax credit limit for installing CEE Top Tier high efficiency equipment it is retroactive to

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization: We can customize the design to meet your needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Worth: Downloads of educational content for free offer a wide range of educational content for learners of all ages, making them a useful tool for parents and teachers.

-

Easy to use: immediate access the vast array of design and templates can save you time and energy.

Where to Find more Federal Tax Credit For New Air Conditioner

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

In the event that we've stirred your curiosity about Federal Tax Credit For New Air Conditioner and other printables, let's discover where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection and Federal Tax Credit For New Air Conditioner for a variety needs.

- Explore categories such as the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- These blogs cover a broad range of topics, that includes DIY projects to party planning.

Maximizing Federal Tax Credit For New Air Conditioner

Here are some fresh ways that you can make use of Federal Tax Credit For New Air Conditioner:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Federal Tax Credit For New Air Conditioner are an abundance filled with creative and practical information that cater to various needs and interest. Their accessibility and versatility make they a beneficial addition to the professional and personal lives of both. Explore the vast array of Federal Tax Credit For New Air Conditioner to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes you can! You can download and print these free resources for no cost.

-

Does it allow me to use free templates for commercial use?

- It depends on the specific usage guidelines. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright concerns when using Federal Tax Credit For New Air Conditioner?

- Some printables may come with restrictions regarding their use. Make sure to read the conditions and terms of use provided by the creator.

-

How do I print Federal Tax Credit For New Air Conditioner?

- You can print them at home using the printer, or go to a local print shop for superior prints.

-

What program is required to open Federal Tax Credit For New Air Conditioner?

- A majority of printed materials are in PDF format. These can be opened with free software like Adobe Reader.

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Federal Tax Credit For Electric Cars OsVehicle

Check more sample of Federal Tax Credit For New Air Conditioner below

How To Calculate The Federal Tax Credit For Electric Cars GreenCars

US Hyundai Ioniq 5 Sales Decreased To The Lowest Level Since January

Request Letter Format For Air Conditioner In Office Letter For New

How To Claim The 3 600 Child Tax Credit For A Baby Born In 2021 YouTube

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022

From Rooftops To Roadways What The Inflation Reduction Act Means For

https://www.energystar.gov/about/federal-tax...

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights

https://www.irs.gov/credits-deductions/home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were

How To Claim The 3 600 Child Tax Credit For A Baby Born In 2021 YouTube

US Hyundai Ioniq 5 Sales Decreased To The Lowest Level Since January

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022

From Rooftops To Roadways What The Inflation Reduction Act Means For

Ev Tax Credit 2022 Cap Clement Wesley

Air Conditioner Tax Credit Details In 2023 How To Apply

Air Conditioner Tax Credit Details In 2023 How To Apply

Federal Tax Credit For Solar Installation Local Pro Solar