In this day and age where screens rule our lives but the value of tangible printed materials isn't diminishing. In the case of educational materials as well as creative projects or simply adding an element of personalization to your area, Federal Tax Credit For Solar Energy are now a useful source. We'll take a dive through the vast world of "Federal Tax Credit For Solar Energy," exploring what they are, how to get them, as well as what they can do to improve different aspects of your life.

Get Latest Federal Tax Credit For Solar Energy Below

Federal Tax Credit For Solar Energy

Federal Tax Credit For Solar Energy -

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

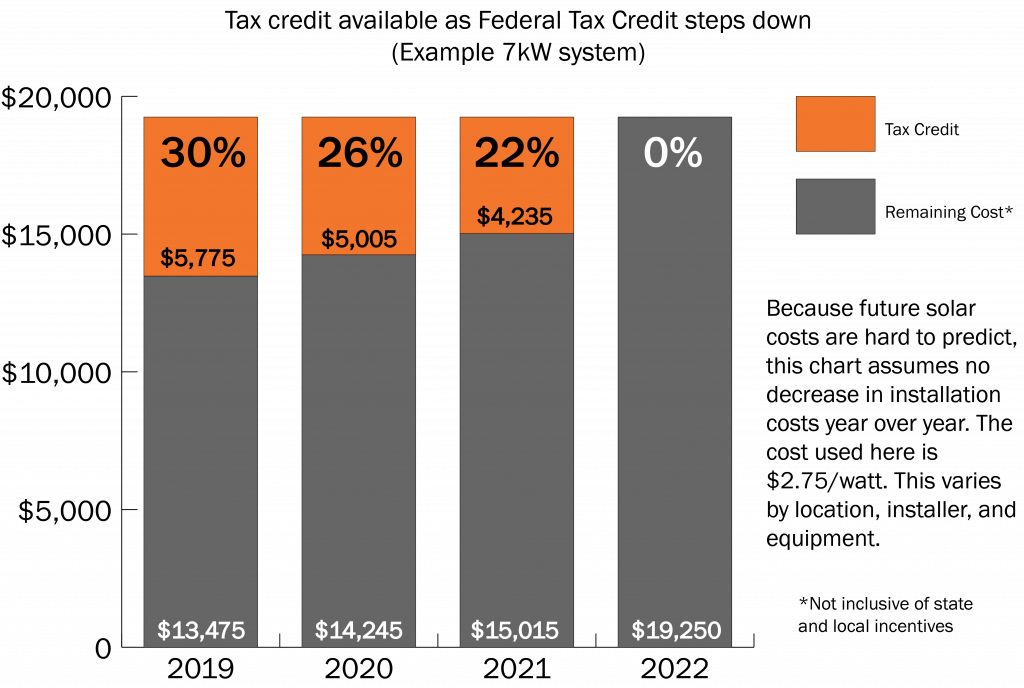

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Federal Tax Credit For Solar Energy include a broad array of printable documents that can be downloaded online at no cost. These resources come in many kinds, including worksheets templates, coloring pages and much more. The beauty of Federal Tax Credit For Solar Energy is their flexibility and accessibility.

More of Federal Tax Credit For Solar Energy

What You Need To Know About The ITC Solar Tax Credit Decreasing After

What You Need To Know About The ITC Solar Tax Credit Decreasing After

The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other types

The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and

Federal Tax Credit For Solar Energy have risen to immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

customization You can tailor the design to meet your needs in designing invitations making your schedule, or even decorating your house.

-

Educational Worth: Education-related printables at no charge cater to learners from all ages, making them a useful tool for parents and teachers.

-

Convenience: Instant access to numerous designs and templates reduces time and effort.

Where to Find more Federal Tax Credit For Solar Energy

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Solar Investment Tax Credit ITC is a federal tax credit for those who purchase solar energy systems for residential commercial or utility scale properties The credit which is

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost

Since we've got your interest in printables for free Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Federal Tax Credit For Solar Energy designed for a variety motives.

- Explore categories such as furniture, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs are a vast selection of subjects, including DIY projects to planning a party.

Maximizing Federal Tax Credit For Solar Energy

Here are some unique ways ensure you get the very most use of Federal Tax Credit For Solar Energy:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets for free to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Federal Tax Credit For Solar Energy are a treasure trove with useful and creative ideas for a variety of needs and hobbies. Their accessibility and flexibility make these printables a useful addition to both professional and personal lives. Explore the wide world that is Federal Tax Credit For Solar Energy today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I download free printables for commercial purposes?

- It depends on the specific rules of usage. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables may be subject to restrictions in their usage. You should read the terms and conditions set forth by the creator.

-

How can I print printables for free?

- Print them at home with either a printer at home or in the local print shop for superior prints.

-

What program do I need in order to open printables for free?

- Many printables are offered in the PDF format, and can be opened with free programs like Adobe Reader.

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

How To Claim The Federal Tax Credit For Solar Energy Freedom Forever

Check more sample of Federal Tax Credit For Solar Energy below

Federal Tax Credit For Saving Money On Solar Panels KC Green Energy

How Does The Federal Solar Tax Credit Work Nicki Karen

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

Congress Gets Renewable Tax Credit Extension Right Institute For

Federal Tax Credit For Residential Solar Energy Flipboard

Solar Tax Credit 2016 Solar Investment Tax Credit FAQ NATiVE

https://www.energy.gov/sites/default/files/2023-03/...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

https://www.energy.gov/sites/default/files/2021/02...

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2

Congress Gets Renewable Tax Credit Extension Right Institute For

How Does The Federal Solar Tax Credit Work Nicki Karen

Federal Tax Credit For Residential Solar Energy Flipboard

Solar Tax Credit 2016 Solar Investment Tax Credit FAQ NATiVE

The Federal Tax Credit For Solar ITC Is Phasing Out Freedom Forever

The Federal Solar Tax Credit Extension Can We Win If We Lose

The Federal Solar Tax Credit Extension Can We Win If We Lose

How Do I Claim The Federal Solar Tax Credit