Today, where screens dominate our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes and creative work, or simply to add an extra personal touch to your home, printables for free have proven to be a valuable resource. This article will dive into the sphere of "Federal Tax Credit For Solar Form," exploring the benefits of them, where to find them and how they can be used to enhance different aspects of your lives.

Get Latest Federal Tax Credit For Solar Form Below

Federal Tax Credit For Solar Form

Federal Tax Credit For Solar Form -

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Credit carryforward from 2022 Enter the complete address of the home where you installed the property and or technology associated with lines 1 through 4 and 5b For more than one home see instructions Number and street Unit no City or town State ZIP code1 Qualified solar electric property costs

Federal Tax Credit For Solar Form cover a large collection of printable materials available online at no cost. These materials come in a variety of types, like worksheets, coloring pages, templates and many more. The attraction of printables that are free is in their versatility and accessibility.

More of Federal Tax Credit For Solar Form

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

Your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 0 26 18 000 4 680 State Tax Credit

To claim the solar tax credit you ll need all the receipts from your solar installation as well as IRS form 1040 and form 5695 and instructions for both of those forms We ve included an example below of how to fill out the tax forms

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization This allows you to modify the design to meet your needs whether it's making invitations and schedules, or even decorating your house.

-

Educational value: Free educational printables cater to learners of all ages, making them an essential tool for parents and educators.

-

Easy to use: You have instant access numerous designs and templates helps save time and effort.

Where to Find more Federal Tax Credit For Solar Form

Federal Solar Tax Credit For Homeowners 2023

Federal Solar Tax Credit For Homeowners 2023

Form 5695 is the official IRS tax form you must use to claim the federal solar tax credit when you file your taxes You can download a copy of Form 5695 PDF on the IRS website The form is updated every year so make

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

Now that we've ignited your curiosity about Federal Tax Credit For Solar Form we'll explore the places you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Federal Tax Credit For Solar Form designed for a variety motives.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- These blogs cover a broad selection of subjects, that range from DIY projects to party planning.

Maximizing Federal Tax Credit For Solar Form

Here are some unique ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home also in the classes.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Federal Tax Credit For Solar Form are an abundance of innovative and useful resources that satisfy a wide range of requirements and passions. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the vast collection of Federal Tax Credit For Solar Form right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I download free templates for commercial use?

- It depends on the specific usage guidelines. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with Federal Tax Credit For Solar Form?

- Some printables may contain restrictions regarding their use. Make sure to read the terms of service and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home with the printer, or go to an in-store print shop to get top quality prints.

-

What software do I require to view printables that are free?

- The majority are printed with PDF formats, which can be opened with free software like Adobe Reader.

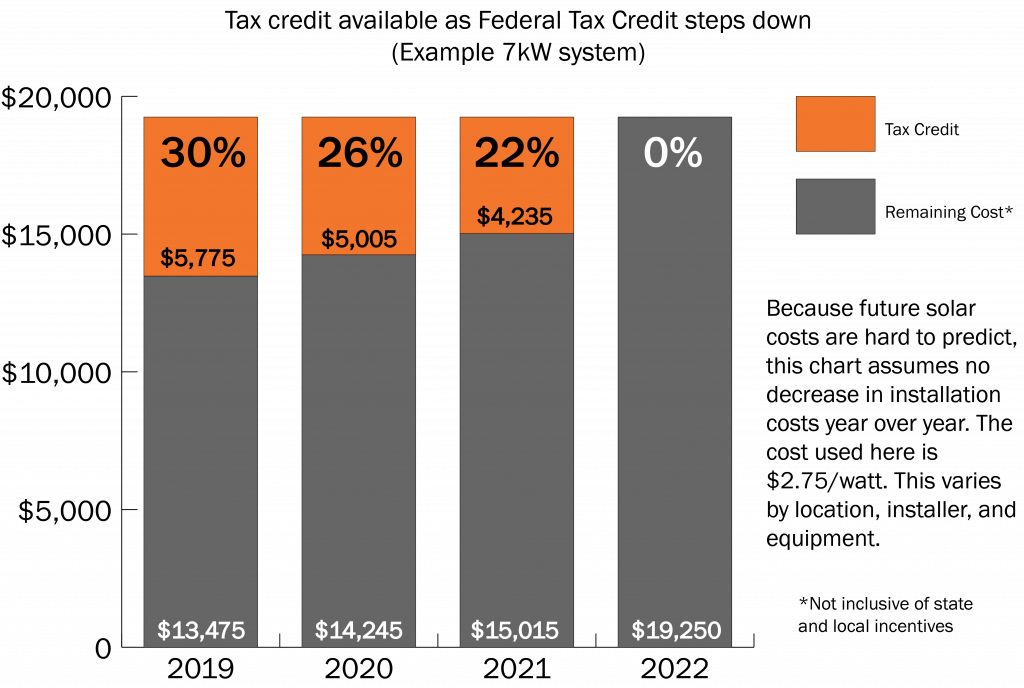

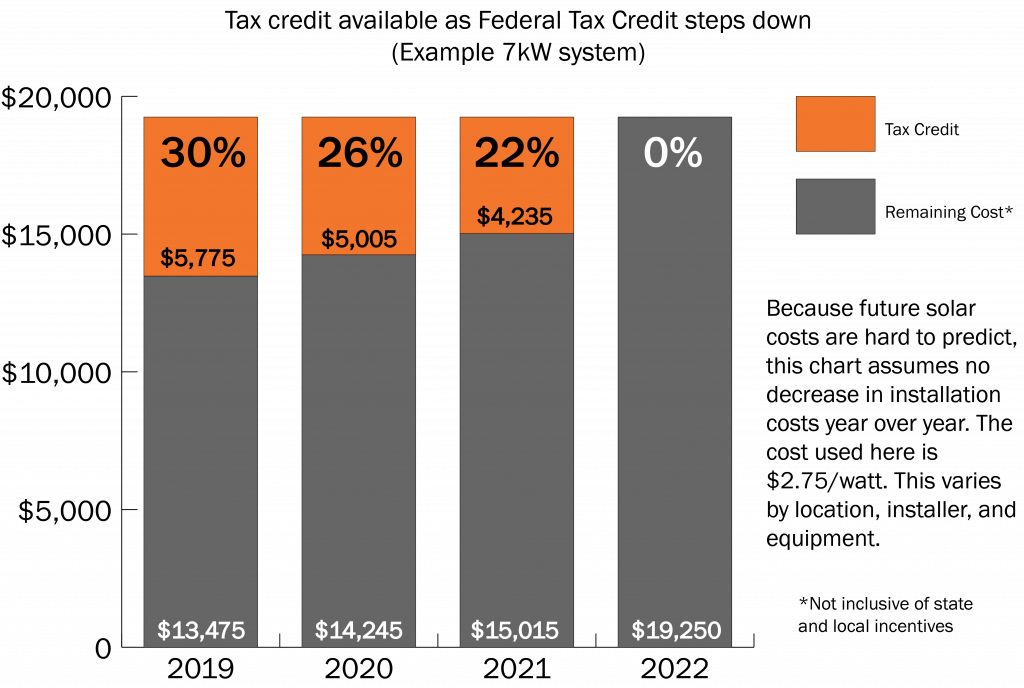

When Does Solar Tax Credit End SolarProGuide 2022

What You Need To Know About The ITC Solar Tax Credit Decreasing After

Check more sample of Federal Tax Credit For Solar Form below

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Solar Tax Credit 2022 Incentives For Solar Panel Installations

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

https://www.irs.gov/pub/irs-pdf/f5695.pdf

Credit carryforward from 2022 Enter the complete address of the home where you installed the property and or technology associated with lines 1 through 4 and 5b For more than one home see instructions Number and street Unit no City or town State ZIP code1 Qualified solar electric property costs

https://www.irs.gov/instructions/i5695

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

Credit carryforward from 2022 Enter the complete address of the home where you installed the property and or technology associated with lines 1 through 4 and 5b For more than one home see instructions Number and street Unit no City or town State ZIP code1 Qualified solar electric property costs

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Solar Tax Credit 2022 Incentives For Solar Panel Installations

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

Federal Tax Credit For Saving Money On Solar Panels KC Green Energy

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Federal Solar Tax Credit A Quick Rundown Next Energy Solution