Today, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. No matter whether it's for educational uses in creative or artistic projects, or just adding an individual touch to your home, printables for free can be an excellent resource. We'll take a dive to the depths of "Federal Tax Credit For Solar Panels 2023 Irs," exploring what they are, how you can find them, and how they can enhance various aspects of your daily life.

Get Latest Federal Tax Credit For Solar Panels 2023 Irs Below

Federal Tax Credit For Solar Panels 2023 Irs

Federal Tax Credit For Solar Panels 2023 Irs -

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Need to jump ahead Federal solar tax

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Federal Tax Credit For Solar Panels 2023 Irs provide a diverse assortment of printable materials online, at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages, and many more. The appeal of printables for free is their versatility and accessibility.

More of Federal Tax Credit For Solar Panels 2023 Irs

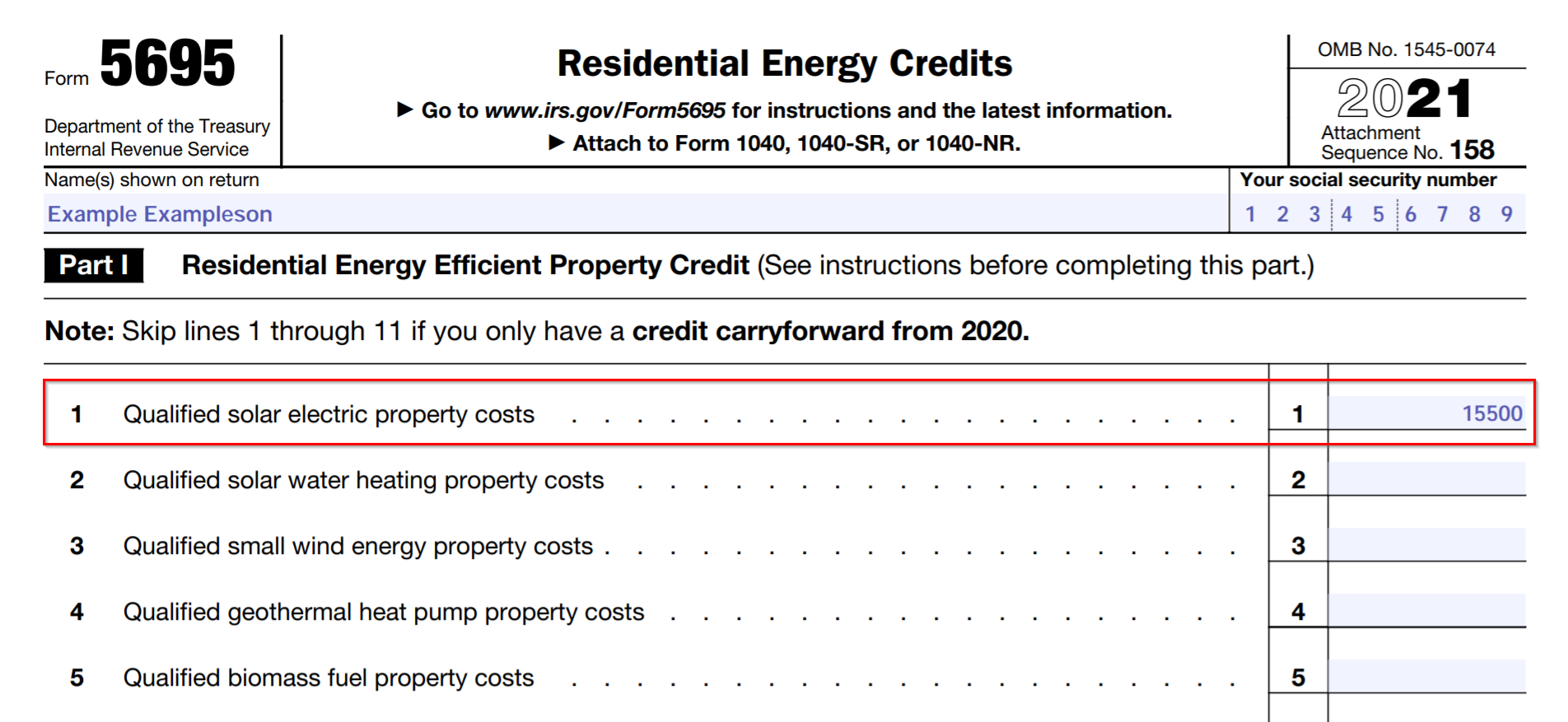

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

Federal Tax Credit For Solar Panels 2023 Irs have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

The ability to customize: You can tailor printed materials to meet your requirements whether it's making invitations making your schedule, or even decorating your house.

-

Educational Benefits: The free educational worksheets are designed to appeal to students of all ages, making them a vital instrument for parents and teachers.

-

Accessibility: You have instant access an array of designs and templates cuts down on time and efforts.

Where to Find more Federal Tax Credit For Solar Panels 2023 Irs

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Solar generation facilities were eligible for an ITC claim and subject to the standard phase out of that credit i e maximum credit of 26 in 2020 2022 which dropped to 22 in 2023 and then 10 in 2024 and thereafter Extension of ITC for Solar Energy Property

The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems

We've now piqued your curiosity about Federal Tax Credit For Solar Panels 2023 Irs Let's see where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Federal Tax Credit For Solar Panels 2023 Irs for various reasons.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free with flashcards and other teaching tools.

- It is ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a broad range of topics, including DIY projects to planning a party.

Maximizing Federal Tax Credit For Solar Panels 2023 Irs

Here are some innovative ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home and in class.

3. Event Planning

- Design invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Federal Tax Credit For Solar Panels 2023 Irs are a treasure trove of creative and practical resources that can meet the needs of a variety of people and interests. Their accessibility and versatility make them an invaluable addition to your professional and personal life. Explore the vast world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes they are! You can download and print these items for free.

-

Can I use free printables for commercial use?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright issues when you download Federal Tax Credit For Solar Panels 2023 Irs?

- Certain printables might have limitations on their use. Make sure you read the terms and conditions provided by the designer.

-

How do I print Federal Tax Credit For Solar Panels 2023 Irs?

- Print them at home with either a printer at home or in the local print shop for the highest quality prints.

-

What program do I need to run printables for free?

- The majority of PDF documents are provided in the PDF format, and can be opened using free software, such as Adobe Reader.

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Pricing Incentives Guide To Solar Panels In Georgia Forbes Home

Check more sample of Federal Tax Credit For Solar Panels 2023 Irs below

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Understanding The Federal Tax Credit For Solar Panels 2023 Update

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.irs.gov/credits-deductions/home-energy-tax-credits

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

https://www.energy.gov/eere/solar/homeowners-guide...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Understanding The Federal Tax Credit For Solar Panels 2023 Update

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

How To Get Free Solar Panels Installed In Pennsylvania October 2023

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Federal Solar Energy Tax Credit Sapling