Today, where screens rule our lives however, the attraction of tangible printed materials hasn't faded away. Be it for educational use as well as creative projects or simply to add an extra personal touch to your home, printables for free are a great resource. The following article is a take a dive into the sphere of "Federal Tax Credit For Solar Panels And Batteries," exploring their purpose, where to find them, and ways they can help you improve many aspects of your life.

Get Latest Federal Tax Credit For Solar Panels And Batteries Below

Federal Tax Credit For Solar Panels And Batteries

Federal Tax Credit For Solar Panels And Batteries -

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

Federal Tax Credit For Solar Panels And Batteries include a broad assortment of printable, downloadable resources available online for download at no cost. These materials come in a variety of kinds, including worksheets templates, coloring pages, and much more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Federal Tax Credit For Solar Panels And Batteries

10 FAQs About The Federal Solar Tax Credit Answered

10 FAQs About The Federal Solar Tax Credit Answered

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also

The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization We can customize printables to fit your particular needs, whether it's designing invitations to organize your schedule or decorating your home.

-

Educational Benefits: Downloads of educational content for free are designed to appeal to students of all ages, which makes them a vital instrument for parents and teachers.

-

Easy to use: Access to many designs and templates can save you time and energy.

Where to Find more Federal Tax Credit For Solar Panels And Batteries

Texas Solar Panel Incentives Tax Credits Rebates And Buyback Programs

Texas Solar Panel Incentives Tax Credits Rebates And Buyback Programs

The current federal clean energy tax credit gives homeowners back 30 of the upfront cost to install solar panels at tax time the year after they re installed Luckily batteries also qualify for the tax credit whether or not they re installed with solar panels Before 2022 a battery storage system had to charge exclusively from solar

To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence Eligible equipment for the federal tax credit includes photovoltaic solar installations battery storage solar water heaters geothermal pumps fuel cells and wind turbines

Since we've got your interest in Federal Tax Credit For Solar Panels And Batteries we'll explore the places you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of goals.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free as well as flashcards and other learning materials.

- It is ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- The blogs are a vast range of interests, everything from DIY projects to planning a party.

Maximizing Federal Tax Credit For Solar Panels And Batteries

Here are some innovative ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Federal Tax Credit For Solar Panels And Batteries are a treasure trove filled with creative and practical information that meet a variety of needs and passions. Their accessibility and versatility make them a wonderful addition to every aspect of your life, both professional and personal. Explore the endless world of Federal Tax Credit For Solar Panels And Batteries and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Tax Credit For Solar Panels And Batteries really absolutely free?

- Yes you can! You can print and download these resources at no cost.

-

Can I make use of free printables to make commercial products?

- It's based on the terms of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns when using Federal Tax Credit For Solar Panels And Batteries?

- Certain printables may be subject to restrictions regarding usage. Check the conditions and terms of use provided by the designer.

-

How can I print Federal Tax Credit For Solar Panels And Batteries?

- You can print them at home using either a printer at home or in a local print shop to purchase the highest quality prints.

-

What software do I require to open printables that are free?

- A majority of printed materials are in PDF format, which is open with no cost programs like Adobe Reader.

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

Check more sample of Federal Tax Credit For Solar Panels And Batteries below

Homeowner s Guide To The Federal Tax Credit For Solar Photovoltaics

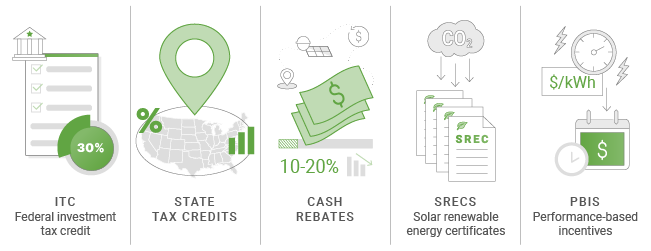

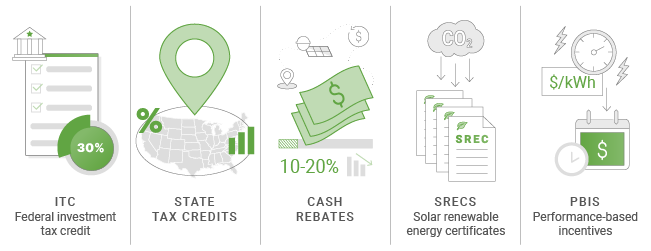

Solar Rebates And Incentives EnergySage

Federal Tax Credit For Solar Panels In 2023

Pennsylvania Solar Incentives Tax Credits For 2023 LeafScore

How To Get Free Solar Panels Installed In Pennsylvania October 2023

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

https://www.solar.com/learn/how-getting-a-home...

So if you purchased solar and or battery in 2022 your available federal tax credit increases from 26 to 30 of the gross cost of the project Related reading Solar Rebates and Incentives Does All Battery Storage Qualify for the Federal Tax Credit OK so there is clearly a 30 tax credit for solar battery storage

About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

So if you purchased solar and or battery in 2022 your available federal tax credit increases from 26 to 30 of the gross cost of the project Related reading Solar Rebates and Incentives Does All Battery Storage Qualify for the Federal Tax Credit OK so there is clearly a 30 tax credit for solar battery storage

Pennsylvania Solar Incentives Tax Credits For 2023 LeafScore

Solar Rebates And Incentives EnergySage

How To Get Free Solar Panels Installed In Pennsylvania October 2023

Solar Tax Credit 2022 Incentives For Solar Panel Installations

10 FAQs About The Federal Solar Tax Credit Answered

How Much Tax Credit For Solar Panels In Texas TAXIRIN

How Much Tax Credit For Solar Panels In Texas TAXIRIN

Congress Extends Federal Tax Credit For Solar Panels Through 2024 A