Today, when screens dominate our lives The appeal of tangible printed items hasn't gone away. Whether it's for educational purposes project ideas, artistic or simply adding the personal touch to your area, Federal Tax Credits For Energy Efficiency 2023 are now a useful source. We'll take a dive to the depths of "Federal Tax Credits For Energy Efficiency 2023," exploring what they are, how to find them, and what they can do to improve different aspects of your daily life.

Get Latest Federal Tax Credits For Energy Efficiency 2023 Below

Federal Tax Credits For Energy Efficiency 2023

Federal Tax Credits For Energy Efficiency 2023 -

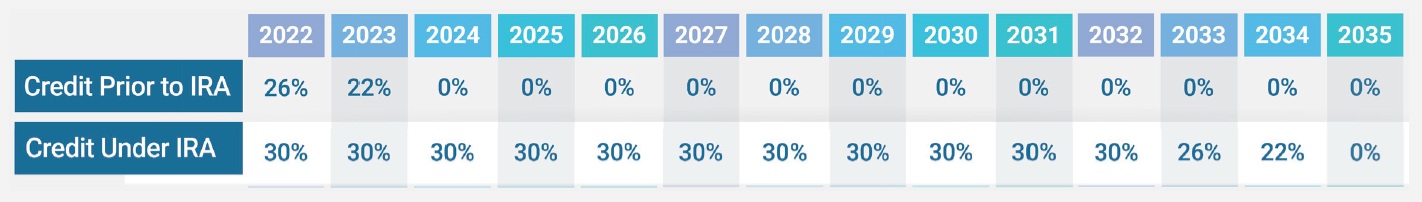

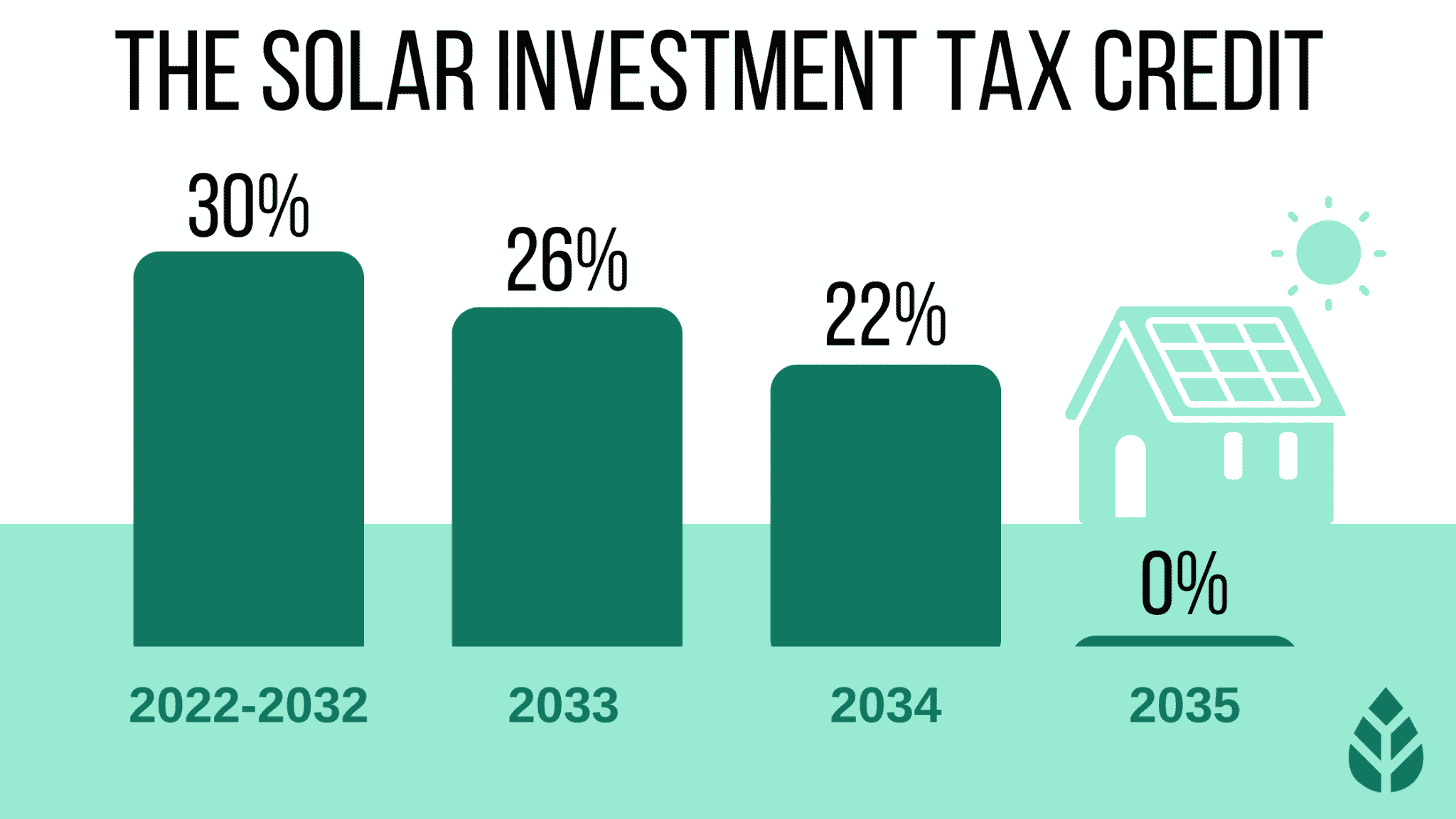

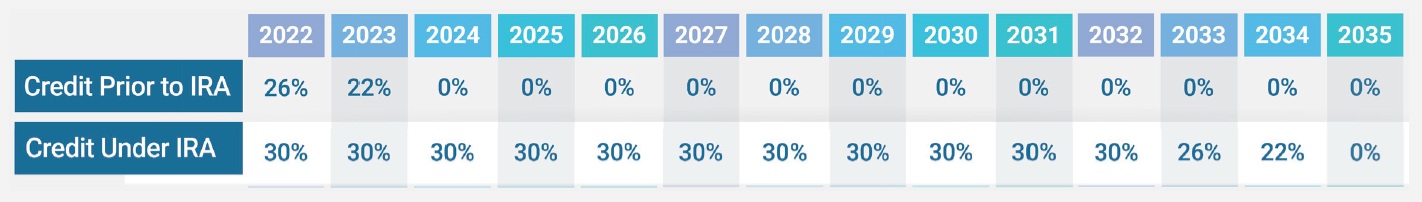

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30

Federal Tax Credits For Energy Efficiency 2023 include a broad range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in numerous formats, such as worksheets, coloring pages, templates and much more. One of the advantages of Federal Tax Credits For Energy Efficiency 2023 is in their versatility and accessibility.

More of Federal Tax Credits For Energy Efficiency 2023

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Federal Energy Tax Credits for Calendar Year 2023 Note These tax credits do not disqualify a utility from claiming EEI incentives for these measures as long as they also

1 Go Renewable One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30 percent of the cost of installing clean energy

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Individualization You can tailor designs to suit your personal needs in designing invitations as well as organizing your calendar, or even decorating your house.

-

Education Value The free educational worksheets can be used by students of all ages. This makes them an essential instrument for parents and teachers.

-

Convenience: Quick access to a plethora of designs and templates saves time and effort.

Where to Find more Federal Tax Credits For Energy Efficiency 2023

Federal Solar Tax Credits For Businesses Department Of Energy

Federal Solar Tax Credits For Businesses Department Of Energy

The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032 The maximum credit

Jan 10 2023 Business tax Policy Private client services Tax policy Executive summary The Inflation Reduction Act of 2022 IRA amended the existing credit for energy efficient home improvements under section

We've now piqued your interest in Federal Tax Credits For Energy Efficiency 2023 We'll take a look around to see where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection with Federal Tax Credits For Energy Efficiency 2023 for all reasons.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs covered cover a wide spectrum of interests, starting from DIY projects to planning a party.

Maximizing Federal Tax Credits For Energy Efficiency 2023

Here are some fresh ways that you can make use use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Federal Tax Credits For Energy Efficiency 2023 are a treasure trove of useful and creative resources catering to different needs and interest. Their availability and versatility make them an invaluable addition to both professional and personal lives. Explore the wide world of Federal Tax Credits For Energy Efficiency 2023 to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes they are! You can print and download these items for free.

-

Can I use the free printing templates for commercial purposes?

- It's determined by the specific usage guidelines. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables might have limitations on use. Be sure to review the terms and conditions offered by the creator.

-

How do I print Federal Tax Credits For Energy Efficiency 2023?

- You can print them at home using your printer or visit the local print shop for more high-quality prints.

-

What software do I need in order to open printables at no cost?

- The majority of PDF documents are provided with PDF formats, which is open with no cost programs like Adobe Reader.

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Expired Energy Efficiency Tax Credits Renewed Under Inflation Reduction

Check more sample of Federal Tax Credits For Energy Efficiency 2023 below

Save Money With Federal Tax Credits For Energy Efficiency Green

The Inflation Reduction Act You Sapling

2022 Tax Credits For Residential Energy Efficiency Improvements Ciel

Tax Equity In A Direct pay World EY US

Let Them Eat ITCs Buttondown

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://www.energystar.gov/about/federal-tax-credits

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30

https://www.energy.gov/sites/default/files/2023-02...

Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost up to 2 000 per year 30 of cost up to 600 Subject to cap of 1 200 year

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30

Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost up to 2 000 per year 30 of cost up to 600 Subject to cap of 1 200 year

Tax Equity In A Direct pay World EY US

The Inflation Reduction Act You Sapling

Let Them Eat ITCs Buttondown

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Federal Tax Credits For Energy Efficiency Waverly Utilities

Energy Efficiency Opportunities Waverly Utilities

Energy Efficiency Opportunities Waverly Utilities

Tax Credits For Energy Efficient Home Improvements Kiplinger