Today, in which screens are the norm it's no wonder that the appeal of tangible printed material hasn't diminished. Be it for educational use for creative projects, just adding an individual touch to your space, Federal Tax Credits For Energy Efficient Air Conditioners are a great resource. This article will dive to the depths of "Federal Tax Credits For Energy Efficient Air Conditioners," exploring the benefits of them, where to locate them, and the ways that they can benefit different aspects of your life.

Get Latest Federal Tax Credits For Energy Efficient Air Conditioners Below

Federal Tax Credits For Energy Efficient Air Conditioners

Federal Tax Credits For Energy Efficient Air Conditioners -

Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Printables for free include a vast range of printable, free content that can be downloaded from the internet at no cost. They come in many styles, from worksheets to templates, coloring pages and more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Federal Tax Credits For Energy Efficient Air Conditioners

Top 3 Most Energy Efficient Air Conditioners For Summer 2019

Top 3 Most Energy Efficient Air Conditioners For Summer 2019

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization Your HTML0 customization options allow you to customize printables to fit your particular needs such as designing invitations and schedules, or decorating your home.

-

Educational Value Downloads of educational content for free cater to learners of all ages. This makes them a useful tool for teachers and parents.

-

It's easy: Quick access to a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Federal Tax Credits For Energy Efficient Air Conditioners

Home Energy Improvements Lead To Real Savings Infographic Solar

Home Energy Improvements Lead To Real Savings Infographic Solar

30 of cost up to 600 each for a qualified air conditioner or gas furnace with an annual cap of 1 200 Up to 2 000 with a qualified heat pump heat pump water heater or boiler Gas furnace and air conditioner can be combined for a total credit up to 1 200

Efficient air conditioners 300 30 of cost up to 600 Efficient heating equipment Efficient water heating equipment 150 30 of cost up to 600 More information on the energy efficient home improvement credit and residential clean energy property credit is available for tax professionals building contractors and others at IRS

Now that we've ignited your interest in printables for free Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection and Federal Tax Credits For Energy Efficient Air Conditioners for a variety purposes.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a broad selection of subjects, that range from DIY projects to planning a party.

Maximizing Federal Tax Credits For Energy Efficient Air Conditioners

Here are some ideas how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Federal Tax Credits For Energy Efficient Air Conditioners are a treasure trove of fun and practical tools that can meet the needs of a variety of people and hobbies. Their access and versatility makes they a beneficial addition to your professional and personal life. Explore the endless world of Federal Tax Credits For Energy Efficient Air Conditioners and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes, they are! You can print and download these free resources for no cost.

-

Do I have the right to use free printing templates for commercial purposes?

- It is contingent on the specific terms of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download Federal Tax Credits For Energy Efficient Air Conditioners?

- Certain printables could be restricted on use. Check the terms and regulations provided by the designer.

-

How do I print Federal Tax Credits For Energy Efficient Air Conditioners?

- You can print them at home using any printer or head to a print shop in your area for high-quality prints.

-

What software is required to open printables at no cost?

- The majority of PDF documents are provided in PDF format. They can be opened with free software such as Adobe Reader.

Federal Tax Credits For Energy Efficient Home Improvements West

Are More Efficient Air Conditioners On The Horizon

Check more sample of Federal Tax Credits For Energy Efficient Air Conditioners below

Most Efficient Central Air Conditioners For 2015

The 5 Best Energy Efficient Air Conditioners To Keep You And The

Energy Efficient Home Improvement Credits In 2023 SVA

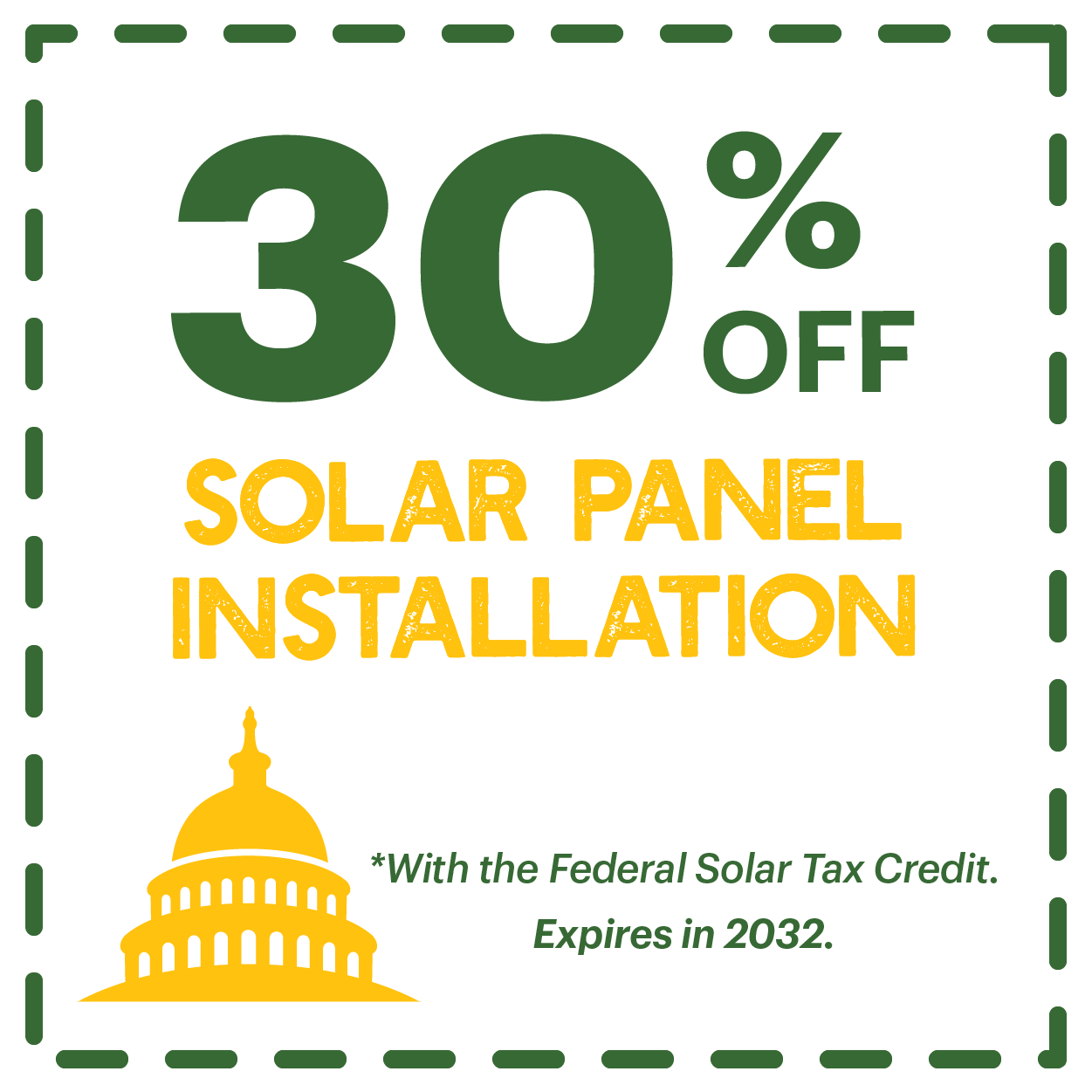

Federal Solar Tax Credits For Businesses Department Of Energy

5 Tips You Need To Choose An Energy Efficient AC R R Heating And Air

Carrier Launches The Most Efficient Air Conditioner You Can Buy In America

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Energy Efficient Home Improvement Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation materials Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Energy Efficient Home Improvement Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation materials Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits

Federal Solar Tax Credits For Businesses Department Of Energy

The 5 Best Energy Efficient Air Conditioners To Keep You And The

5 Tips You Need To Choose An Energy Efficient AC R R Heating And Air

Carrier Launches The Most Efficient Air Conditioner You Can Buy In America

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Federal Solar Tax Credit What It Is How To Claim It For 2023

Federal Solar Tax Credit What It Is How To Claim It For 2023

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse