In a world where screens have become the dominant feature of our lives, the charm of tangible printed materials hasn't faded away. In the case of educational materials such as creative projects or simply to add an extra personal touch to your space, Federal Tax Credits For Ev Charging Stations can be an excellent resource. The following article is a take a dive into the world of "Federal Tax Credits For Ev Charging Stations," exploring what they are, how to get them, as well as the ways that they can benefit different aspects of your lives.

Get Latest Federal Tax Credits For Ev Charging Stations Below

Federal Tax Credits For Ev Charging Stations

Federal Tax Credits For Ev Charging Stations -

You May Get Federal Tax Credit for Your Home EV Charger During the 2023 tax season taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed at

To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return

Federal Tax Credits For Ev Charging Stations offer a wide range of downloadable, printable material that is available online at no cost. These materials come in a variety of types, like worksheets, coloring pages, templates and more. The attraction of printables that are free is in their versatility and accessibility.

More of Federal Tax Credits For Ev Charging Stations

Federal Tax Credits For EV Charging Stations Installation Extended

Federal Tax Credits For EV Charging Stations Installation Extended

This incentive provides a credit for up to 30 of the cost of qualified alternative fuel vehicle refueling property placed in service by the taxpayer The credit may be claimed by

If you purchase EV charging equipment for a business fleet or tax exempt entity you may be eligible for a tax credit Starting on Jan 1 2023 the value of this credit is 6 of the cost of

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: Your HTML0 customization options allow you to customize printables to your specific needs whether it's making invitations to organize your schedule or even decorating your home.

-

Educational Impact: These Federal Tax Credits For Ev Charging Stations offer a wide range of educational content for learners of all ages, which makes them a vital aid for parents as well as educators.

-

Accessibility: Fast access many designs and templates, which saves time as well as effort.

Where to Find more Federal Tax Credits For Ev Charging Stations

Inflation Reduction Act Commercial EV Charging Station Tax Credits

Inflation Reduction Act Commercial EV Charging Station Tax Credits

As expanded by the Inflation Reduction Act IRA EV charging infrastructure installed through December 31 2032 is eligible for a tax credit of 30 percent of the cost not to exceed

You could save up to 1 000 on your federal taxes with the recently renewed EV charger tax credit Here s how to claim it

Now that we've ignited your interest in printables for free we'll explore the places they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in Federal Tax Credits For Ev Charging Stations for different motives.

- Explore categories like design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free, flashcards, and learning materials.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a wide array of topics, ranging everything from DIY projects to party planning.

Maximizing Federal Tax Credits For Ev Charging Stations

Here are some creative ways create the maximum value of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print free worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Federal Tax Credits For Ev Charging Stations are an abundance of innovative and useful resources that satisfy a wide range of requirements and interests. Their accessibility and versatility make these printables a useful addition to every aspect of your life, both professional and personal. Explore the endless world of Federal Tax Credits For Ev Charging Stations right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes you can! You can print and download the resources for free.

-

Can I use free printables for commercial uses?

- It depends on the specific rules of usage. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may come with restrictions concerning their use. Make sure you read these terms and conditions as set out by the author.

-

How do I print Federal Tax Credits For Ev Charging Stations?

- Print them at home using either a printer or go to a local print shop for the highest quality prints.

-

What software do I need to run printables at no cost?

- Many printables are offered in the format of PDF, which is open with no cost software, such as Adobe Reader.

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

2 Automotive Companies Have Already Used Up All Their EV Tax Credits

Check more sample of Federal Tax Credits For Ev Charging Stations below

Enterprise Value Check Your Credit Score Ev Charging Stations Tax

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y

US Extends Tax Credits For EV Chargers Motorcycles Fuel Cells Again

Extension Of Section 30C Tax Credit For EV Charging Stations Foley

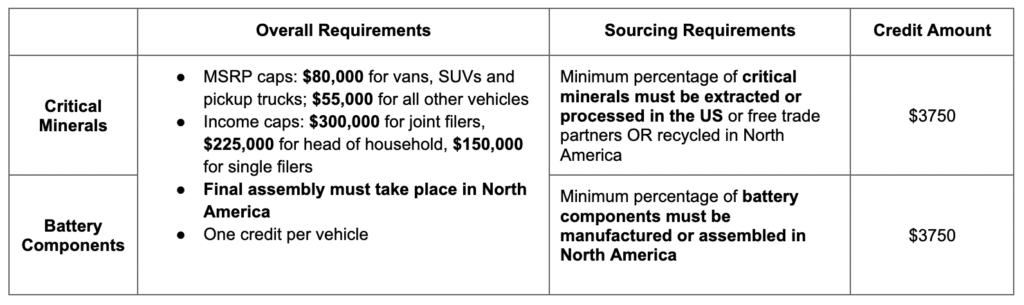

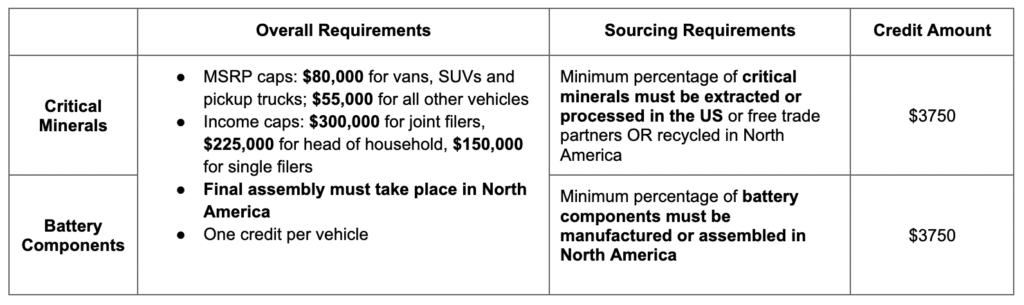

2022 EV Tax Credits From Inflation Reduction Act Plug In America

EV Tax Credit 2022 Updates Shared Economy Tax

https://www.kiplinger.com/taxes/60520…

To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return

https://electrek.co/us-treasury-released-…

The US Treasury s EV charger tax credit which is claimed using IRS Form 8911 is limited to 1 000 for individuals claiming for home EV chargers and 100 000 up from 30 000 for business

To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return

The US Treasury s EV charger tax credit which is claimed using IRS Form 8911 is limited to 1 000 for individuals claiming for home EV chargers and 100 000 up from 30 000 for business

Extension Of Section 30C Tax Credit For EV Charging Stations Foley

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y

2022 EV Tax Credits From Inflation Reduction Act Plug In America

EV Tax Credit 2022 Updates Shared Economy Tax

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Leased And Used Electric Vehicles Now Qualify For Federal Tax Credits

Leased And Used Electric Vehicles Now Qualify For Federal Tax Credits

Audi Federal Tax Credits For EV Models Queens