In this age of electronic devices, in which screens are the norm and the appeal of physical printed objects hasn't waned. No matter whether it's for educational uses in creative or artistic projects, or just adding a personal touch to your area, Federal Tax Deduction Amount Meaning have become an invaluable source. Here, we'll take a dive deeper into "Federal Tax Deduction Amount Meaning," exploring the different types of printables, where to locate them, and how they can add value to various aspects of your daily life.

Get Latest Federal Tax Deduction Amount Meaning Below

Federal Tax Deduction Amount Meaning

Federal Tax Deduction Amount Meaning -

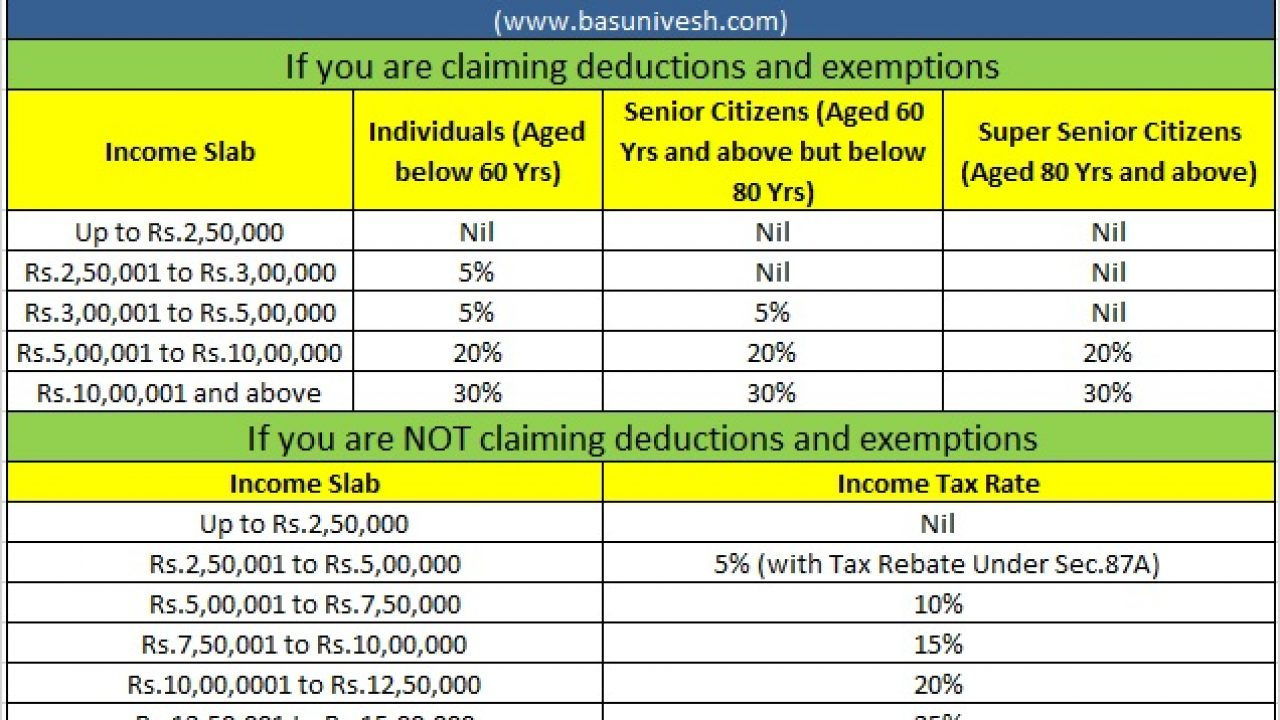

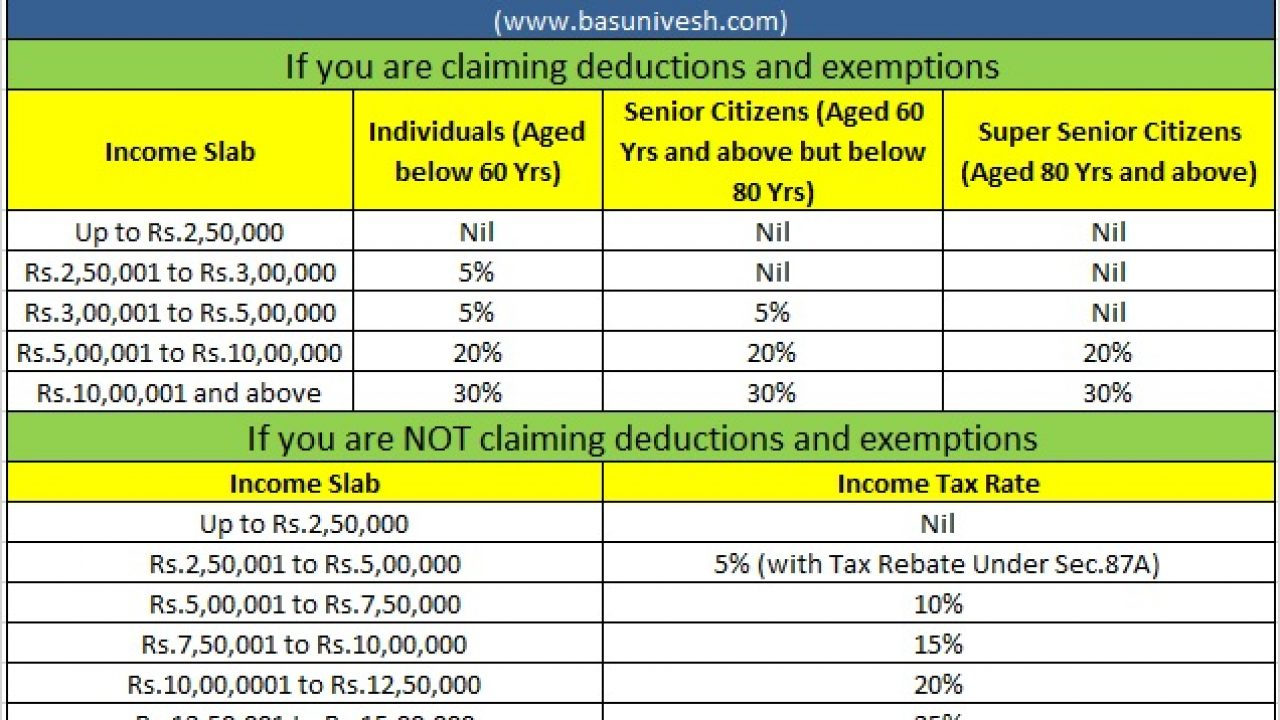

A tax deduction is a provision that reduces taxable income A standard deduction is a single deduction at a fixed amount Itemized deductions are popular among higher income taxpayers who often have significant deductible

Key Takeaways The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill For 2023 the standard deduction was 13 850 for individuals 27 700

Federal Tax Deduction Amount Meaning provide a diverse assortment of printable, downloadable material that is available online at no cost. These materials come in a variety of forms, including worksheets, templates, coloring pages and more. The appeal of printables for free is their flexibility and accessibility.

More of Federal Tax Deduction Amount Meaning

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

Put simply tax deductions lower the amount of money you must pay taxes on A tax deduction is also referred to as a tax write off This is because you can write off or subtract these amounts from your personal

The Standard Deduction for tax year 2024 is 14 600 for Single and Married Filing Separately filers 21 900 for those who file as Head of Household and 29 200 for Married Filing Jointly filers Additional deductions

Federal Tax Deduction Amount Meaning have garnered immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Individualization They can make designs to suit your personal needs, whether it's designing invitations making your schedule, or even decorating your house.

-

Educational value: Printing educational materials for no cost can be used by students of all ages, which makes them an invaluable tool for parents and educators.

-

Affordability: Fast access an array of designs and templates cuts down on time and efforts.

Where to Find more Federal Tax Deduction Amount Meaning

10 Business Tax Deductions Worksheet Worksheeto

10 Business Tax Deductions Worksheet Worksheeto

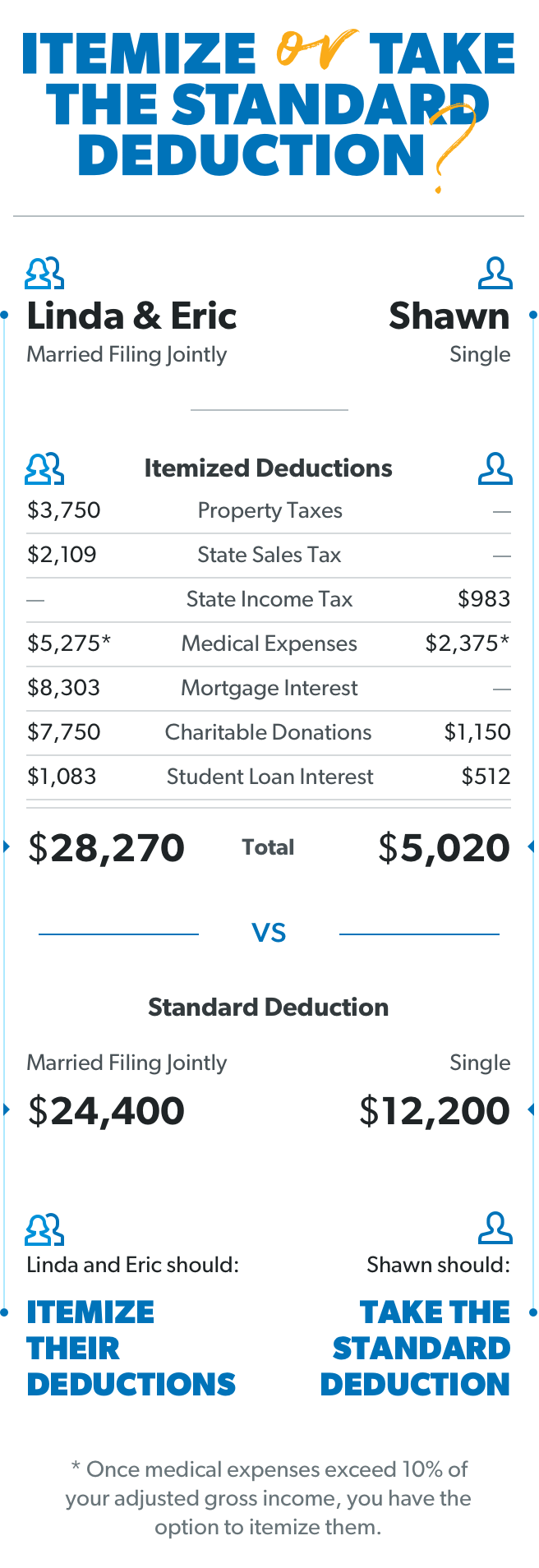

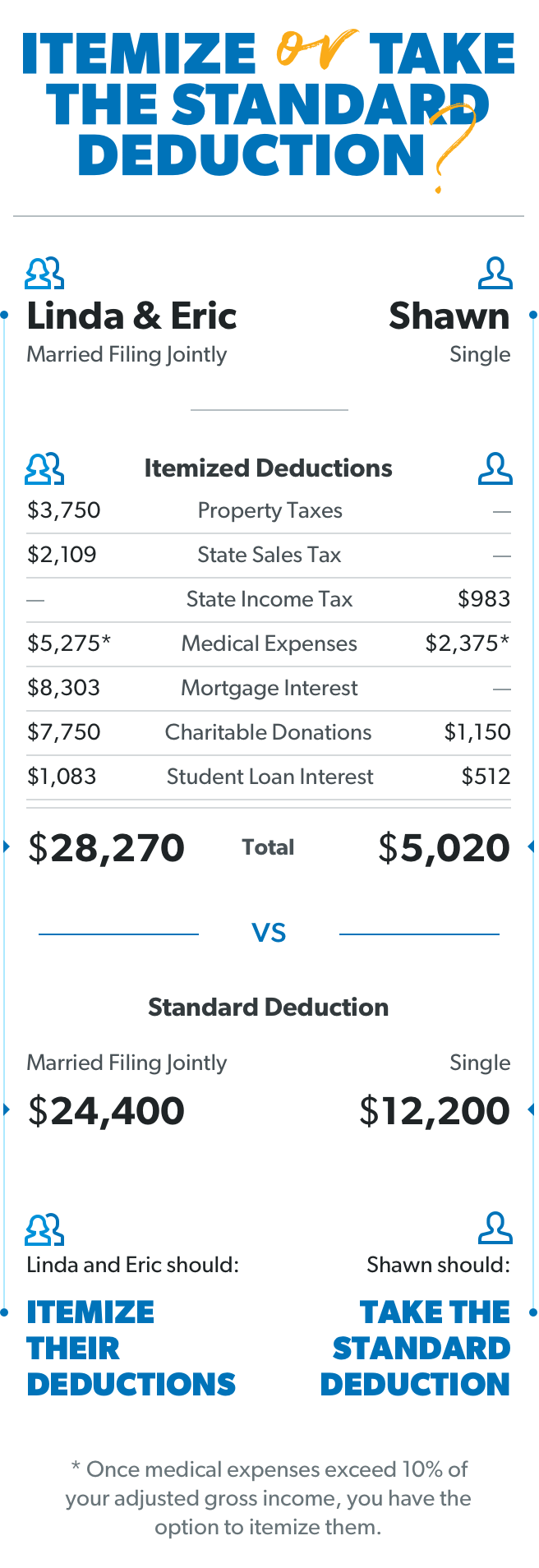

Itemized deductions are IRS allowed expenses that can directly reduce your taxable income You may consider itemizing your deductions if your individual expenses add up to more than the

A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly Learn more about common tax breaks and how to claim them

In the event that we've stirred your interest in printables for free Let's take a look at where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety in Federal Tax Deduction Amount Meaning for different uses.

- Explore categories such as furniture, education, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free including flashcards, learning materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- The blogs covered cover a wide range of interests, that includes DIY projects to planning a party.

Maximizing Federal Tax Deduction Amount Meaning

Here are some fresh ways of making the most use of Federal Tax Deduction Amount Meaning:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home as well as in the class.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Federal Tax Deduction Amount Meaning are a treasure trove of innovative and useful resources catering to different needs and pursuits. Their access and versatility makes them a fantastic addition to both personal and professional life. Explore the endless world of Federal Tax Deduction Amount Meaning today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Tax Deduction Amount Meaning really available for download?

- Yes they are! You can print and download these materials for free.

-

Can I utilize free printables for commercial uses?

- It's based on the terms of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may have restrictions on usage. Make sure you read the terms and regulations provided by the designer.

-

How can I print printables for free?

- You can print them at home using either a printer or go to the local print shops for premium prints.

-

What program do I require to view Federal Tax Deduction Amount Meaning?

- A majority of printed materials are in the format of PDF, which can be opened with free software like Adobe Reader.

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Standard Deduction 2020 Self Employed Standard Deduction 2021

Check more sample of Federal Tax Deduction Amount Meaning below

Tax Rates Absolute Accounting Services

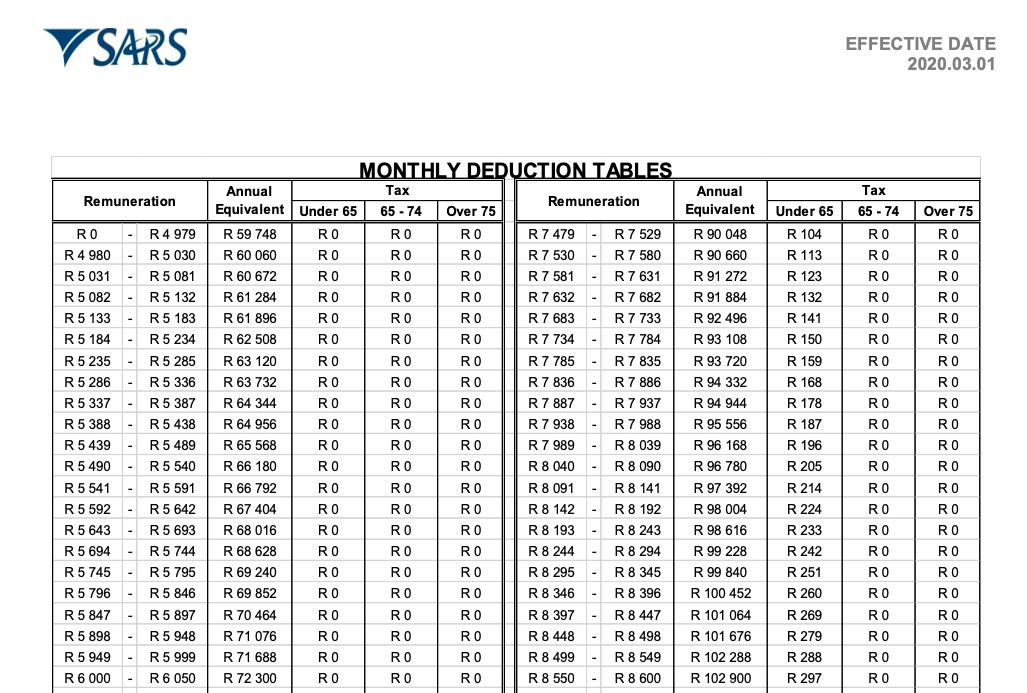

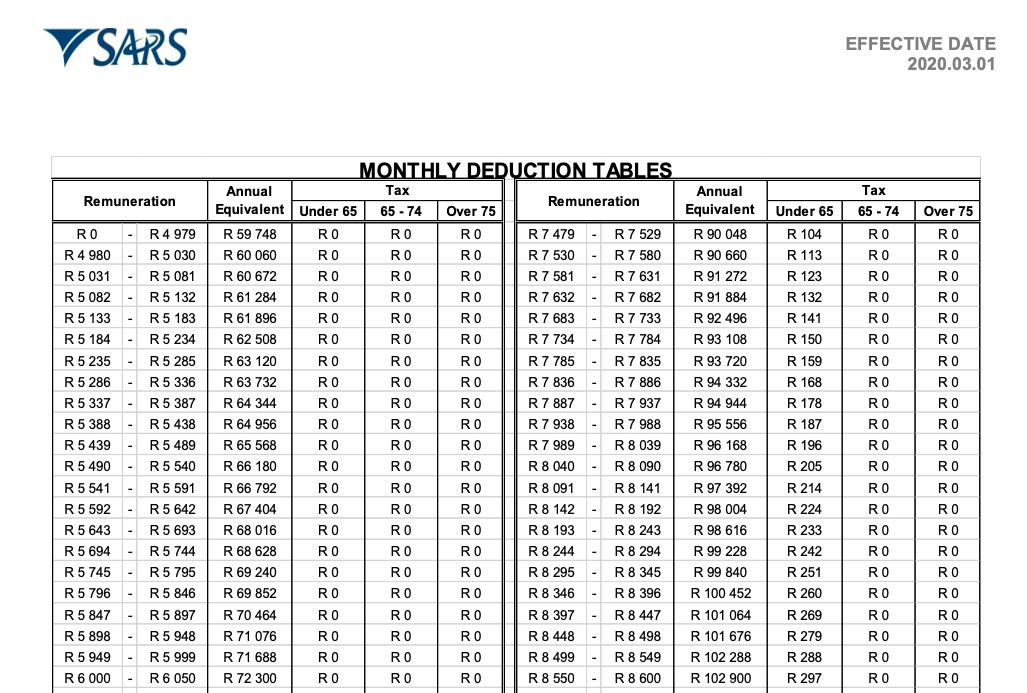

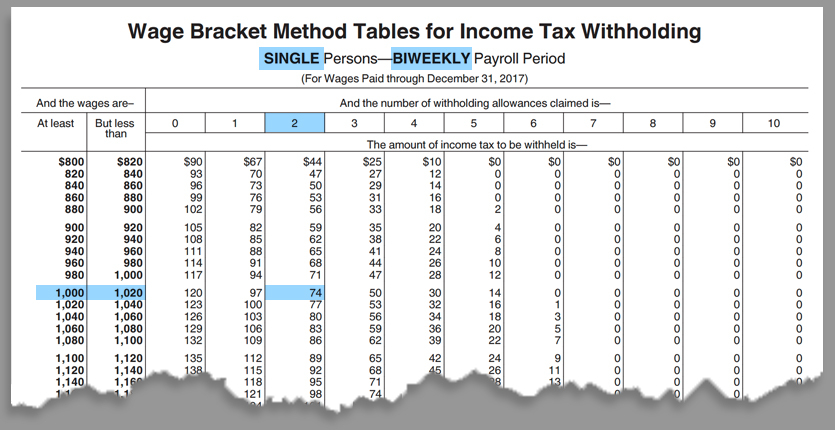

Biweekly Payroll Tax Table 2021 Federal Withholding Tables 2021

What Is The Standard Federal Tax Deduction Ericvisser

What Is Standard Deduction Amount Chapter 5 Income From Salary Ded

Writing Displaying Text Tax Deduction Concept Meaning Amount

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

https://www.investopedia.com › ... › st…

Key Takeaways The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill For 2023 the standard deduction was 13 850 for individuals 27 700

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://www.nerdwallet.com › article › t…

The standard deduction is a specific dollar amount that filers can subtract from their adjusted gross income to lower how much of their income is subject to tax The IRS adjusts the standard

Key Takeaways The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill For 2023 the standard deduction was 13 850 for individuals 27 700

The standard deduction is a specific dollar amount that filers can subtract from their adjusted gross income to lower how much of their income is subject to tax The IRS adjusts the standard

What Is Standard Deduction Amount Chapter 5 Income From Salary Ded

Biweekly Payroll Tax Table 2021 Federal Withholding Tables 2021

Writing Displaying Text Tax Deduction Concept Meaning Amount

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Kitchen Tables 2021 Ikea 2021 Brochure Kitchen Kitchens Cuisines

What Is A Tax Deduction DaveRamsey

What Is A Tax Deduction DaveRamsey

2020 Tax Deduction Amounts And More Heather