In this age of technology, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes in creative or artistic projects, or just adding personal touches to your home, printables for free can be an excellent resource. The following article is a dive deeper into "Film Tax Relief Hmrc Manual," exploring what they are, how to find them, and how they can enrich various aspects of your life.

Get Latest Film Tax Relief Hmrc Manual Below

Film Tax Relief Hmrc Manual

Film Tax Relief Hmrc Manual -

UK qualifying production expenditure is defined as expenditure incurred on film activities pre production principal photography and post production which take place within the UK irrespective

Film Tax Relief FTR is a corporation tax relief The film production company FPC must claim the relief for each relevant accounting period through Corporation Tax Self

Film Tax Relief Hmrc Manual include a broad variety of printable, downloadable documents that can be downloaded online at no cost. These printables come in different designs, including worksheets coloring pages, templates and many more. The appeal of printables for free is in their variety and accessibility.

More of Film Tax Relief Hmrc Manual

HMRC Tax Form P87 Tax Relief For Employee Business Mileage

HMRC Tax Form P87 Tax Relief For Employee Business Mileage

Film tax relief is available for British qualifying films if they either pass the cultural test or qualify as an official co production are intended for theatrical release have a minimum UK core spend requirement of 10 including those made under official co production treaties

A The introduction of section 48 relief A short history of the tax treatment of film investment up to the introduction of section 48 relief in 1997 is given in HM Revenue Customs technical manual on business income

The Film Tax Relief Hmrc Manual have gained huge popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Customization: The Customization feature lets you tailor printing templates to your own specific requirements such as designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Impact: Education-related printables at no charge cater to learners of all ages, making them a great tool for parents and educators.

-

An easy way to access HTML0: The instant accessibility to an array of designs and templates can save you time and energy.

Where to Find more Film Tax Relief Hmrc Manual

COMMENT R D Tax Relief Superpower Your Business Place North West

COMMENT R D Tax Relief Superpower Your Business Place North West

FPC30000 Film Production Companies Losses FPC30000 FPC40000 Qualifying films FPC40000 FPC50000 Film Tax Relief Eligible Expenditure FPC50000

In simple terms the credit is paid by HMRC as part of the film production company s tax return From April 2014 film tax relief is available at an improved rate of 25 on the first 20 million of qualifying production expenditure and 20 thereafter for all films The minimum UK expenditure required to access the

We've now piqued your interest in printables for free Let's take a look at where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Film Tax Relief Hmrc Manual for various objectives.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning materials.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- These blogs cover a broad range of topics, ranging from DIY projects to planning a party.

Maximizing Film Tax Relief Hmrc Manual

Here are some ideas in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print free worksheets to reinforce learning at home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Film Tax Relief Hmrc Manual are a treasure trove of fun and practical tools that can meet the needs of a variety of people and hobbies. Their accessibility and flexibility make them an invaluable addition to the professional and personal lives of both. Explore the plethora of Film Tax Relief Hmrc Manual now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes you can! You can download and print these tools for free.

-

Do I have the right to use free templates for commercial use?

- It is contingent on the specific usage guidelines. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright problems with Film Tax Relief Hmrc Manual?

- Some printables may have restrictions concerning their use. Make sure to read the terms and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home using either a printer at home or in a local print shop for more high-quality prints.

-

What software do I require to open printables for free?

- The majority of PDF documents are provided in the format of PDF, which is open with no cost software such as Adobe Reader.

HMRC Offers Eclipse Partners A Settlement Nullifying dry Tax STEP

When Does A Partnership Exist GLX

Check more sample of Film Tax Relief Hmrc Manual below

Film Tax Relief What Projects Qualify

What Is UK Film Tax Relief And How Do I Claim TaxBite

Working From Home Tax Relief 0161 6767166 Timely

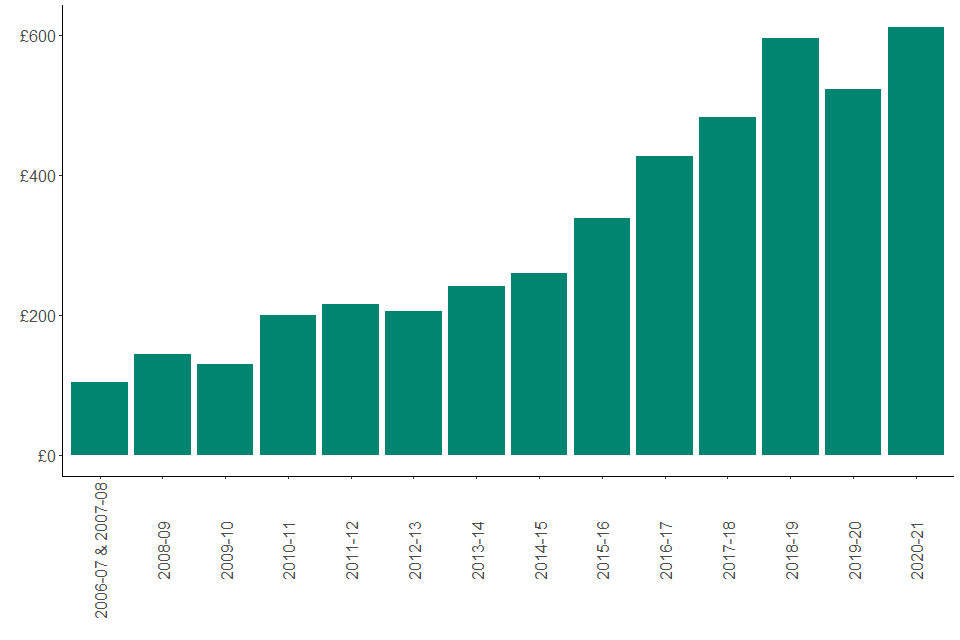

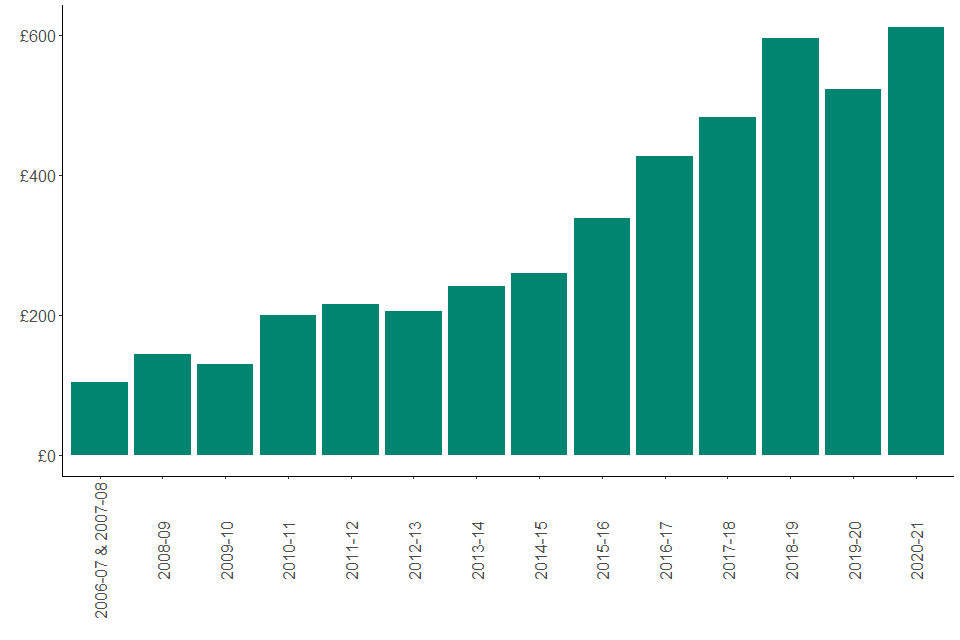

Creative Industries Statistics Commentary August 2021 GOV UK

Does My Client s Work Qualify For R D Tax Relief WhisperClaims

Film Tax Relief What Projects Qualify

https://www.gov.uk/hmrc-internal-manuals/film...

Film Tax Relief FTR is a corporation tax relief The film production company FPC must claim the relief for each relevant accounting period through Corporation Tax Self

https://www.gov.uk/guidance/claiming-film-tax-relief-for-corporation-tax

When you can claim You may make amend or withdraw a claim to Film Tax Relief up to one year after the company s filing date For accounting periods beginning on or after 1 April 2024 you

Film Tax Relief FTR is a corporation tax relief The film production company FPC must claim the relief for each relevant accounting period through Corporation Tax Self

When you can claim You may make amend or withdraw a claim to Film Tax Relief up to one year after the company s filing date For accounting periods beginning on or after 1 April 2024 you

Creative Industries Statistics Commentary August 2021 GOV UK

What Is UK Film Tax Relief And How Do I Claim TaxBite

Does My Client s Work Qualify For R D Tax Relief WhisperClaims

Film Tax Relief What Projects Qualify

Research And Development For The Construction Industry Explained

Claim Tax Relief As An Employee For Your Expenses Prestige Business

Claim Tax Relief As An Employee For Your Expenses Prestige Business

Investment Planning EIS Income Tax Relief HMRC Letter To Investors