In this age of electronic devices, when screens dominate our lives however, the attraction of tangible printed items hasn't gone away. Whatever the reason, whether for education or creative projects, or simply to add the personal touch to your space, First Home Buyer Tax Deduction Australia have become a valuable source. Here, we'll dive in the world of "First Home Buyer Tax Deduction Australia," exploring the different types of printables, where to get them, as well as how they can be used to enhance different aspects of your life.

Get Latest First Home Buyer Tax Deduction Australia Below

First Home Buyer Tax Deduction Australia

First Home Buyer Tax Deduction Australia -

Page last updated 17 January 2024 Find out about first home buyer grants and saving for a house deposit

The first home super saver FHSS scheme allows people to save money for their first home inside their super fund Completing this section You will need your payment summary showing your assessable FHSS released amount We pre fill your tax return with the FHSS released amount shown on your payment

First Home Buyer Tax Deduction Australia encompass a wide collection of printable content that can be downloaded from the internet at no cost. These resources come in various kinds, including worksheets templates, coloring pages and many more. The beauty of First Home Buyer Tax Deduction Australia lies in their versatility as well as accessibility.

More of First Home Buyer Tax Deduction Australia

How The Proposed 15 000 First Time Home Buyer Tax Credit Works PMR Loans

How The Proposed 15 000 First Time Home Buyer Tax Credit Works PMR Loans

This 15 tax rate may be lower than the normal marginal tax rate you pay on your income Taxed coming out The FHSS release amount that you eventually withdraw from your fund for the purchase together with associated earnings will be subject to withholding tax at your marginal tax rate less a 30 tax offset

Last updated 07 February 2023 Fact checked Need to know This little known scheme lets you use your super account as a savings vehicle It can save you on tax but it can be complex You ll need to start planning well ahead of buying a house to make the most of the scheme

First Home Buyer Tax Deduction Australia have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization Your HTML0 customization options allow you to customize designs to suit your personal needs, whether it's designing invitations making your schedule, or decorating your home.

-

Educational Value These First Home Buyer Tax Deduction Australia cater to learners of all ages. This makes them an invaluable aid for parents as well as educators.

-

Affordability: The instant accessibility to a variety of designs and templates will save you time and effort.

Where to Find more First Home Buyer Tax Deduction Australia

How To Qualify For First Time Home Buyer Tax Credit TaxesTalk

How To Qualify For First Time Home Buyer Tax Credit TaxesTalk

The First Time Homebuyer Act introduced by Congress proposes a significant expansion of the tax credit Under this new legislation first time homebuyers could potentially receive up to 15 000 in refundable federal tax credits Yes you read that right 15 000

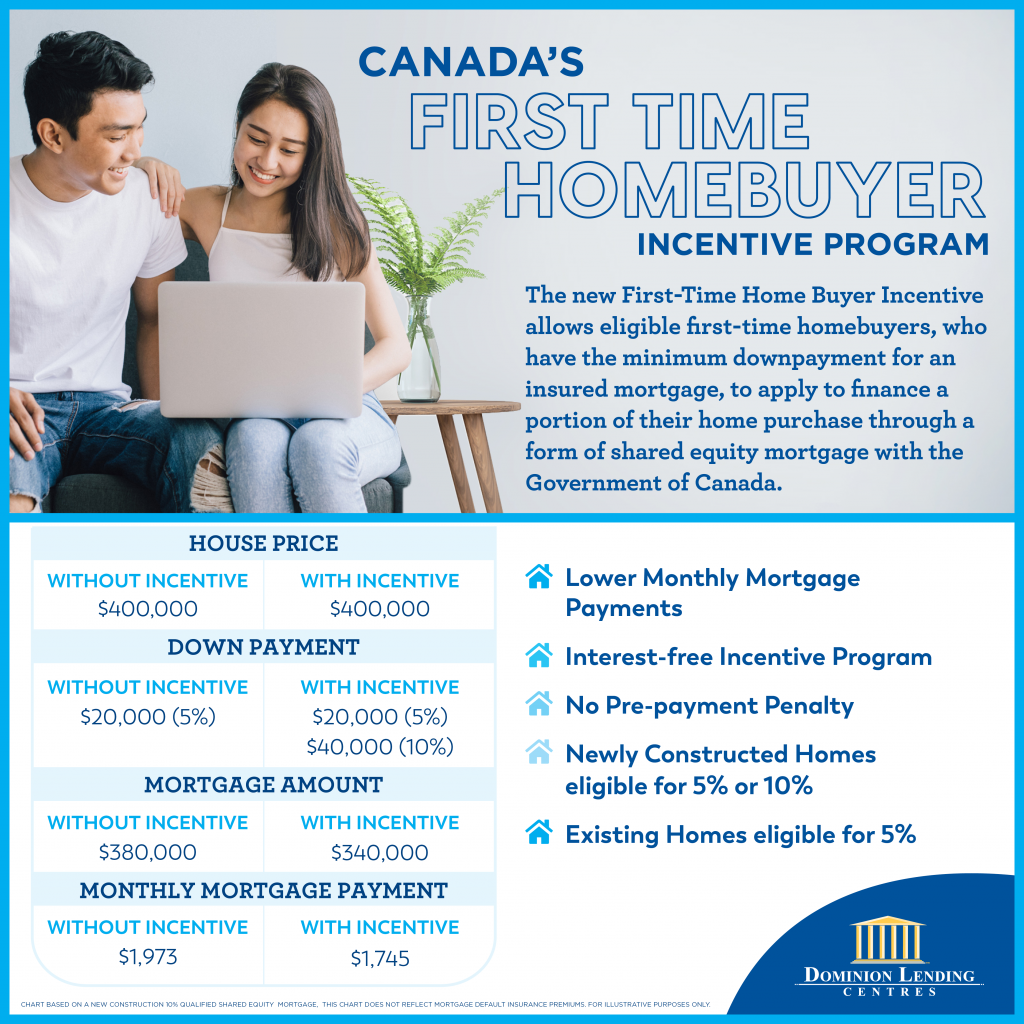

By Vincent Young Vincent Young From 16 January 2023 eligible first home buyers will have a choice between paying stamp duty on the transfer of the land or an ongoing property tax It is estimated that it takes the median NSW household around 10 years to save for a 20 per cent deposit and two years to

In the event that we've stirred your curiosity about First Home Buyer Tax Deduction Australia We'll take a look around to see where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of First Home Buyer Tax Deduction Australia designed for a variety motives.

- Explore categories such as decoration for your home, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free including flashcards, learning materials.

- Great for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide range of interests, including DIY projects to planning a party.

Maximizing First Home Buyer Tax Deduction Australia

Here are some ideas in order to maximize the use use of First Home Buyer Tax Deduction Australia:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print free worksheets for teaching at-home also in the classes.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

First Home Buyer Tax Deduction Australia are a treasure trove of practical and innovative resources that cater to various needs and hobbies. Their accessibility and versatility make them an invaluable addition to any professional or personal life. Explore the vast collection of First Home Buyer Tax Deduction Australia today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are First Home Buyer Tax Deduction Australia truly completely free?

- Yes you can! You can print and download these items for free.

-

Can I use the free printables in commercial projects?

- It's contingent upon the specific rules of usage. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with First Home Buyer Tax Deduction Australia?

- Some printables could have limitations on usage. You should read the terms and conditions provided by the designer.

-

How can I print First Home Buyer Tax Deduction Australia?

- Print them at home using an printer, or go to the local print shop for the highest quality prints.

-

What software do I require to view printables for free?

- Many printables are offered with PDF formats, which is open with no cost software like Adobe Reader.

First Time Home Buyer Tax Credit USDA LOANS USDA Home Loan USDA

Rhode Island Real Estate The MCC First Home Buyer Tax Credit YouTube

Check more sample of First Home Buyer Tax Deduction Australia below

Changes To Debt Deduction Rules 1 June 2022 Deloitte Australia

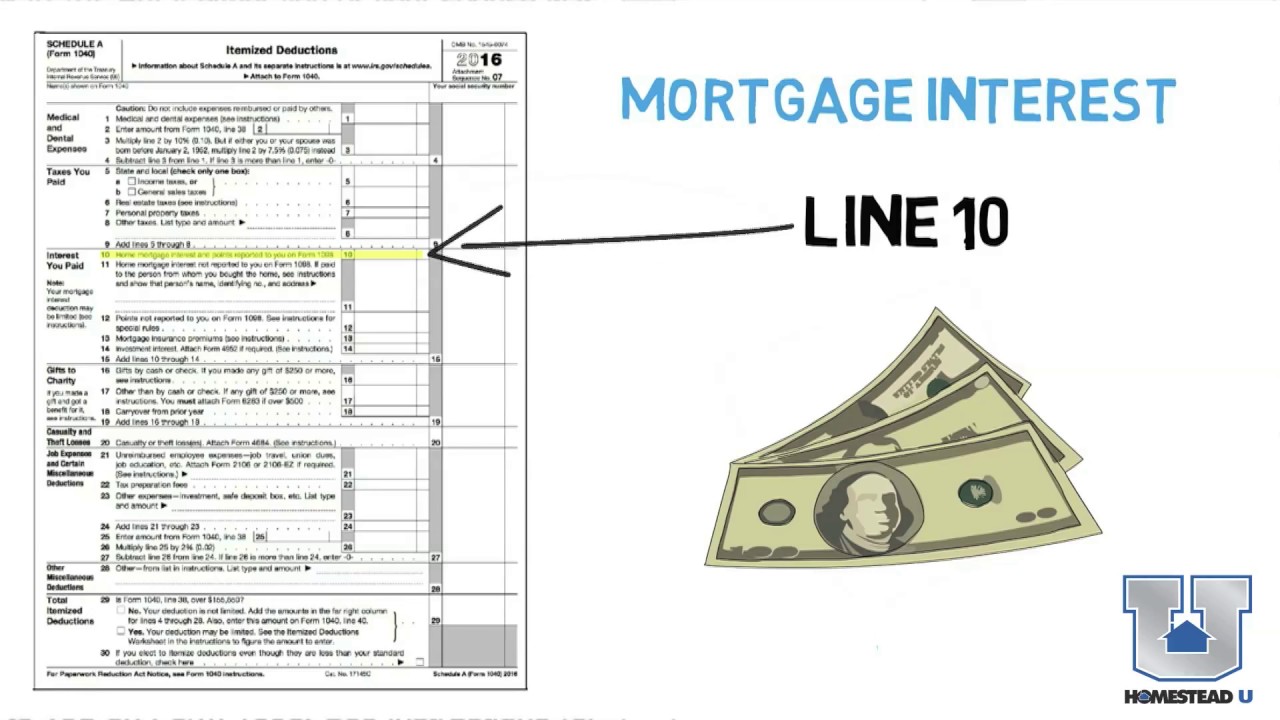

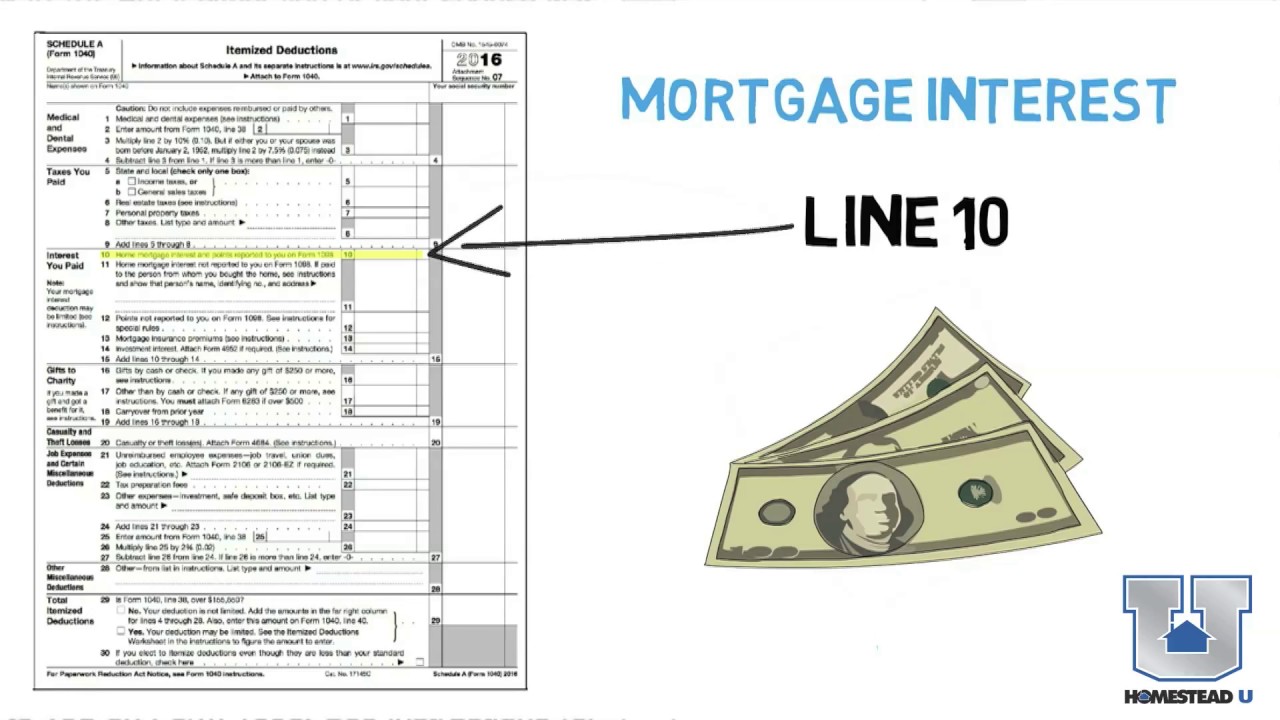

First Time Home Buyer Tax Preparation YouTube

First Time Home Buyer Tax Credit 2009 Highlights HomesMSP Real

What Is A Tax Deduction For Small Business Payroller Australia

Can You Receive A Tax Deduction For Your Home Loan Interest Guidance

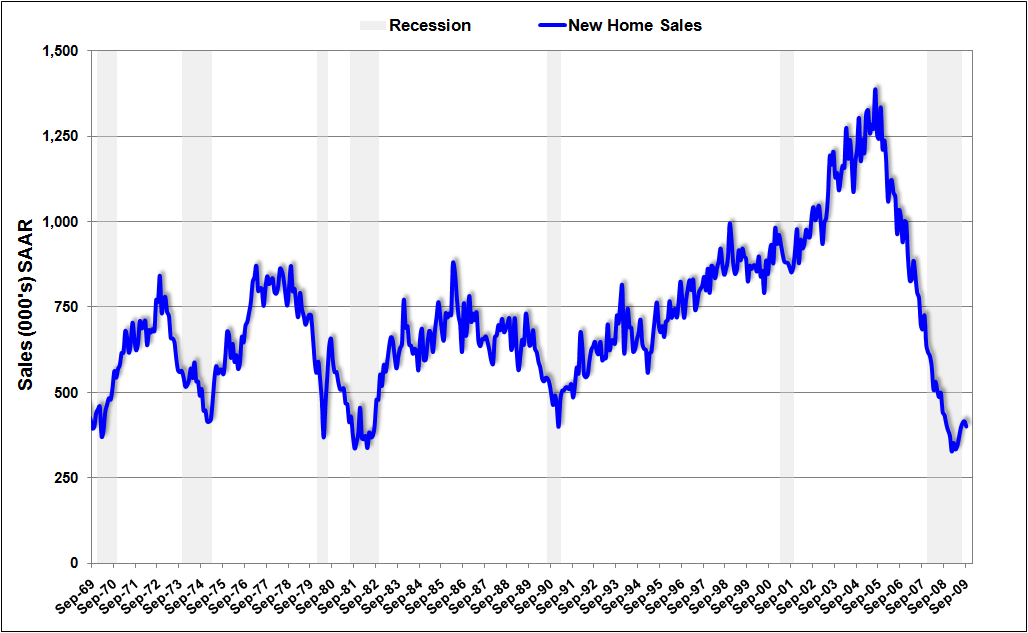

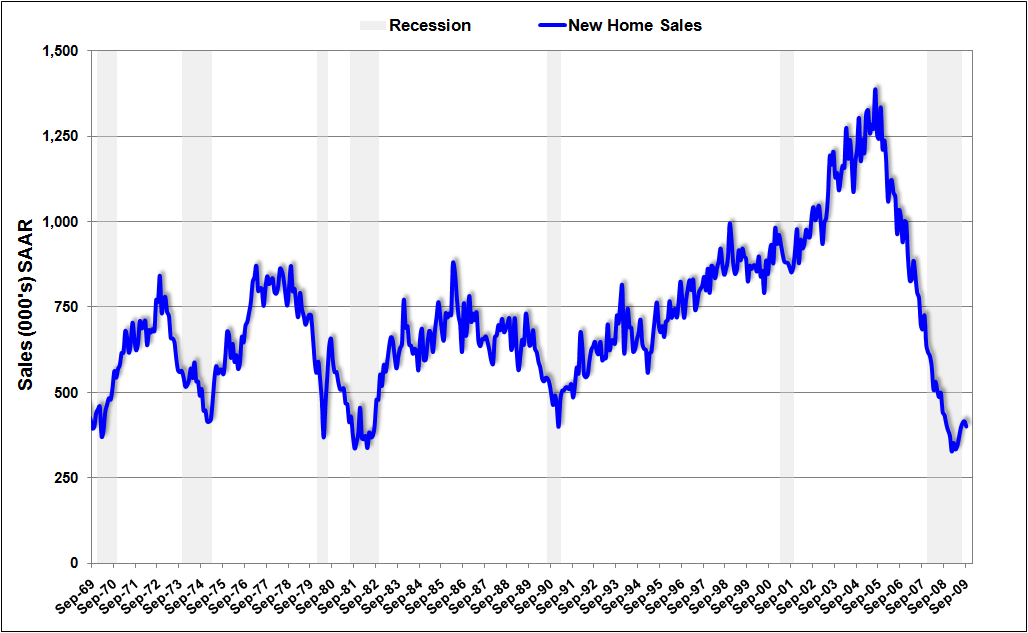

New Home Sales Dip In September Seeking Alpha

https://www.ato.gov.au/.../first-home-super-saver-scheme

The first home super saver FHSS scheme allows people to save money for their first home inside their super fund Completing this section You will need your payment summary showing your assessable FHSS released amount We pre fill your tax return with the FHSS released amount shown on your payment

https://www.realestate.com.au/advice/first-home...

The FHSS Scheme is designed to let first home buyers save a deposit faster by making additional contributions into their super in order to take advantage of the favourable tax treatment superannuation receives The first 25 000 that goes into your super account each year is taxed at just 15 and not

The first home super saver FHSS scheme allows people to save money for their first home inside their super fund Completing this section You will need your payment summary showing your assessable FHSS released amount We pre fill your tax return with the FHSS released amount shown on your payment

The FHSS Scheme is designed to let first home buyers save a deposit faster by making additional contributions into their super in order to take advantage of the favourable tax treatment superannuation receives The first 25 000 that goes into your super account each year is taxed at just 15 and not

What Is A Tax Deduction For Small Business Payroller Australia

First Time Home Buyer Tax Preparation YouTube

Can You Receive A Tax Deduction For Your Home Loan Interest Guidance

New Home Sales Dip In September Seeking Alpha

Biden s 25 000 First Time Home Buyer Tax Credit Downpayment Toward

The IRS Is Cracking Down On First Time Home Buyer Tax Credit Fraud

The IRS Is Cracking Down On First Time Home Buyer Tax Credit Fraud

20 Bonus Tax Deduction On Your Training PRAXIS Australia