In the age of digital, in which screens are the norm and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. For educational purposes project ideas, artistic or simply to add the personal touch to your space, First Recovery Rebate Credit are now an essential resource. With this guide, you'll take a dive to the depths of "First Recovery Rebate Credit," exploring the different types of printables, where they can be found, and how they can improve various aspects of your life.

Get Latest First Recovery Rebate Credit Below

First Recovery Rebate Credit

First Recovery Rebate Credit -

Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to

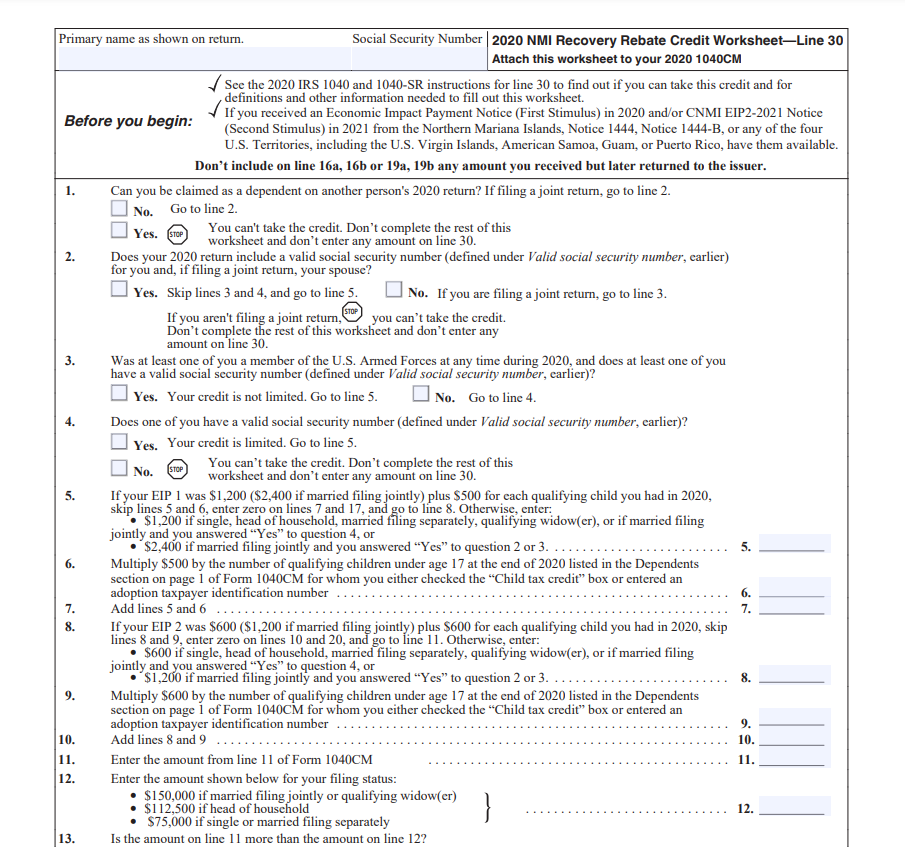

Web 10 d 233 c 2021 nbsp 0183 32 You were issued the full amount of the 2020 Recovery Rebate Credit if the first Economic Impact Payment was 1 200 2 400 if married filing jointly plus 500 for each qualifying child you had in 2020 and the second Economic Impact Payment was

First Recovery Rebate Credit encompass a wide assortment of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of forms, like worksheets templates, coloring pages, and many more. The great thing about First Recovery Rebate Credit lies in their versatility and accessibility.

More of First Recovery Rebate Credit

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Form Printable Rebate Form

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full First and Second Payments Claim the 2020 Recovery Rebate Credit You may be eligible to claim the 2020 Recovery Rebate Credit by filing a 2020 tax return Claim 2020

First Recovery Rebate Credit have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Flexible: It is possible to tailor printables to your specific needs in designing invitations and schedules, or even decorating your house.

-

Educational Value Education-related printables at no charge can be used by students from all ages, making these printables a powerful instrument for parents and teachers.

-

Easy to use: Fast access numerous designs and templates, which saves time as well as effort.

Where to Find more First Recovery Rebate Credit

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

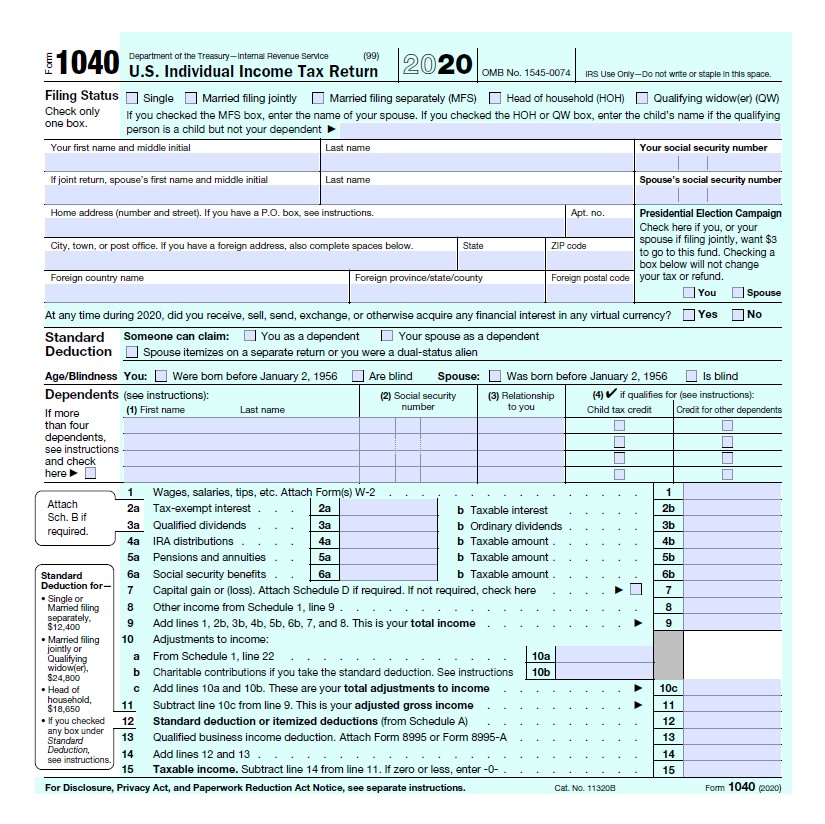

Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim the RRC on your 2020 Form 1040 U S Individual Income Tax Return or Form 1040 SR

Web 29 mars 2021 nbsp 0183 32 This tax season a recovery rebate credit has been added to returns in order for people to file for any unpaid stimulus check funds But you need to send in a 2020 federal tax return in order

We hope we've stimulated your curiosity about First Recovery Rebate Credit We'll take a look around to see where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection in First Recovery Rebate Credit for different objectives.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching tools.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- The blogs are a vast spectrum of interests, everything from DIY projects to planning a party.

Maximizing First Recovery Rebate Credit

Here are some fresh ways in order to maximize the use use of First Recovery Rebate Credit:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Utilize free printable worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

First Recovery Rebate Credit are a treasure trove of fun and practical tools designed to meet a range of needs and hobbies. Their accessibility and versatility make them a valuable addition to your professional and personal life. Explore the world of First Recovery Rebate Credit today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are First Recovery Rebate Credit truly completely free?

- Yes they are! You can print and download the resources for free.

-

Can I utilize free printables for commercial purposes?

- It depends on the specific rules of usage. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in First Recovery Rebate Credit?

- Certain printables could be restricted in their usage. Make sure to read the conditions and terms of use provided by the author.

-

How do I print First Recovery Rebate Credit?

- You can print them at home using an printer, or go to a print shop in your area for high-quality prints.

-

What software do I need to open printables that are free?

- Many printables are offered as PDF files, which can be opened using free software like Adobe Reader.

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Check more sample of First Recovery Rebate Credit below

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-f...

Web 10 d 233 c 2021 nbsp 0183 32 You were issued the full amount of the 2020 Recovery Rebate Credit if the first Economic Impact Payment was 1 200 2 400 if married filing jointly plus 500 for each qualifying child you had in 2020 and the second Economic Impact Payment was

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Web 10 d 233 c 2021 nbsp 0183 32 You were issued the full amount of the 2020 Recovery Rebate Credit if the first Economic Impact Payment was 1 200 2 400 if married filing jointly plus 500 for each qualifying child you had in 2020 and the second Economic Impact Payment was

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

How To Figure The Recovery Rebate Credit Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate