In this day and age when screens dominate our lives however, the attraction of tangible printed material hasn't diminished. For educational purposes in creative or artistic projects, or simply adding an extra personal touch to your home, printables for free have become a valuable resource. Here, we'll take a dive into the world of "First Time Home Buyer Ira Withdrawal Tax Form," exploring what they are, where to find them and how they can enrich various aspects of your daily life.

Get Latest First Time Home Buyer Ira Withdrawal Tax Form Below

First Time Home Buyer Ira Withdrawal Tax Form

First Time Home Buyer Ira Withdrawal Tax Form -

You can yes But it must be your first home or your first primary residence in at least two years there is a 10 000 lifetime limit and there may be penalties for withdrawing early

File the return Submit the transfer tax return in 2 months after you have signed the deed of sale or other contract if no realtor assisted you The transfer tax return contains a field where you must fill in your affirmation that this is your first time home If you buy with the assistance of a realtor when he or she has done that you will

First Time Home Buyer Ira Withdrawal Tax Form cover a large range of printable, free materials that are accessible online for free cost. These resources come in many kinds, including worksheets templates, coloring pages and many more. The appealingness of First Time Home Buyer Ira Withdrawal Tax Form is their versatility and accessibility.

More of First Time Home Buyer Ira Withdrawal Tax Form

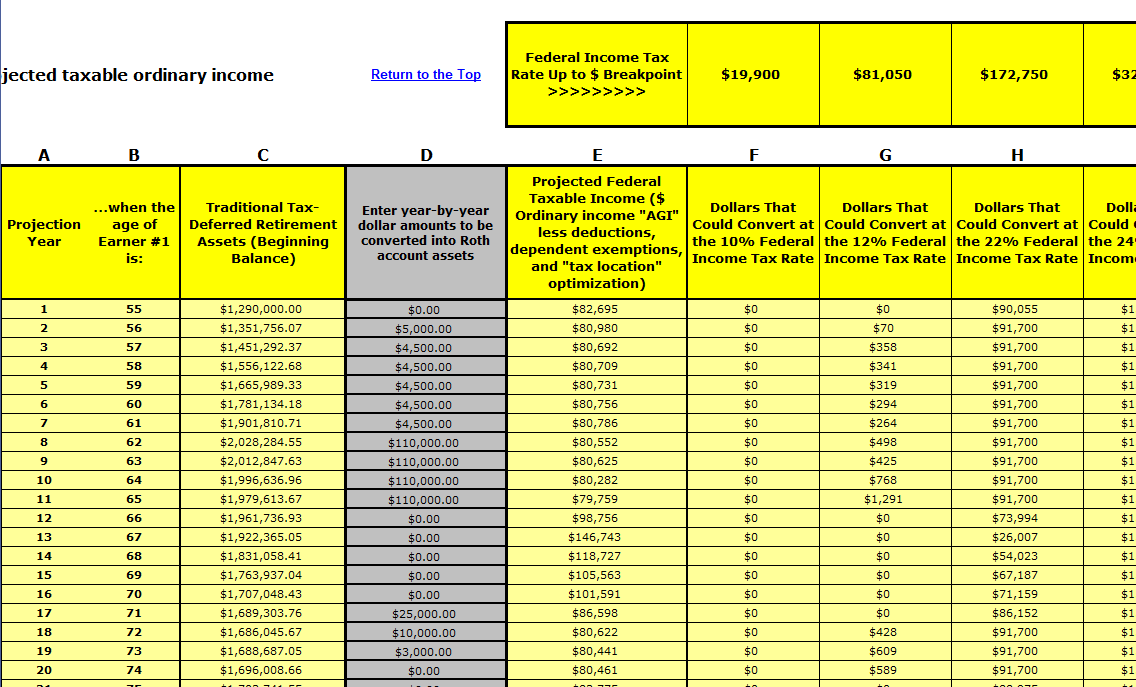

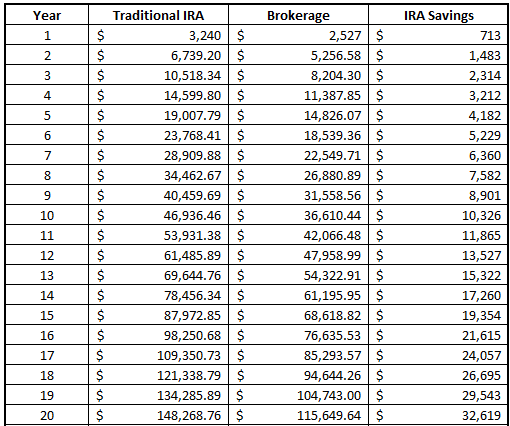

Simple Ira Withdrawal Rules First time Home Buyer Choosing Your Gold IRA

Simple Ira Withdrawal Rules First time Home Buyer Choosing Your Gold IRA

If you didn t have a qualified first time homebuyer distribution in 2023 and you didn t convert or roll over an amount to your Roth IRAs in 2019 through 2023 you only need to include the amount from line 25c of your 2023 Form 8606 on line 1 of this form

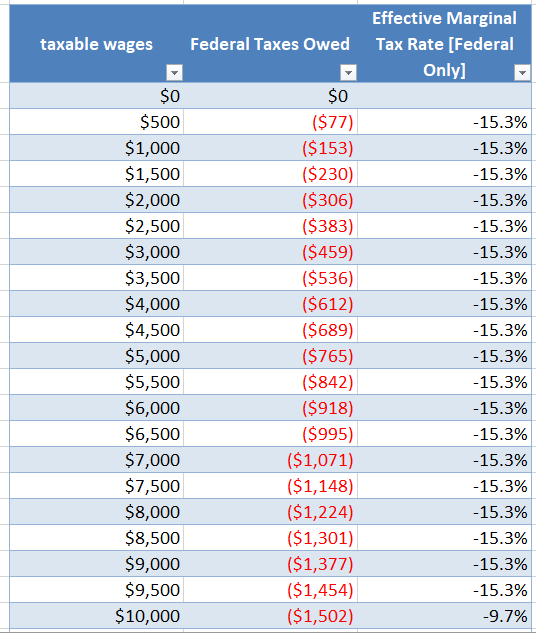

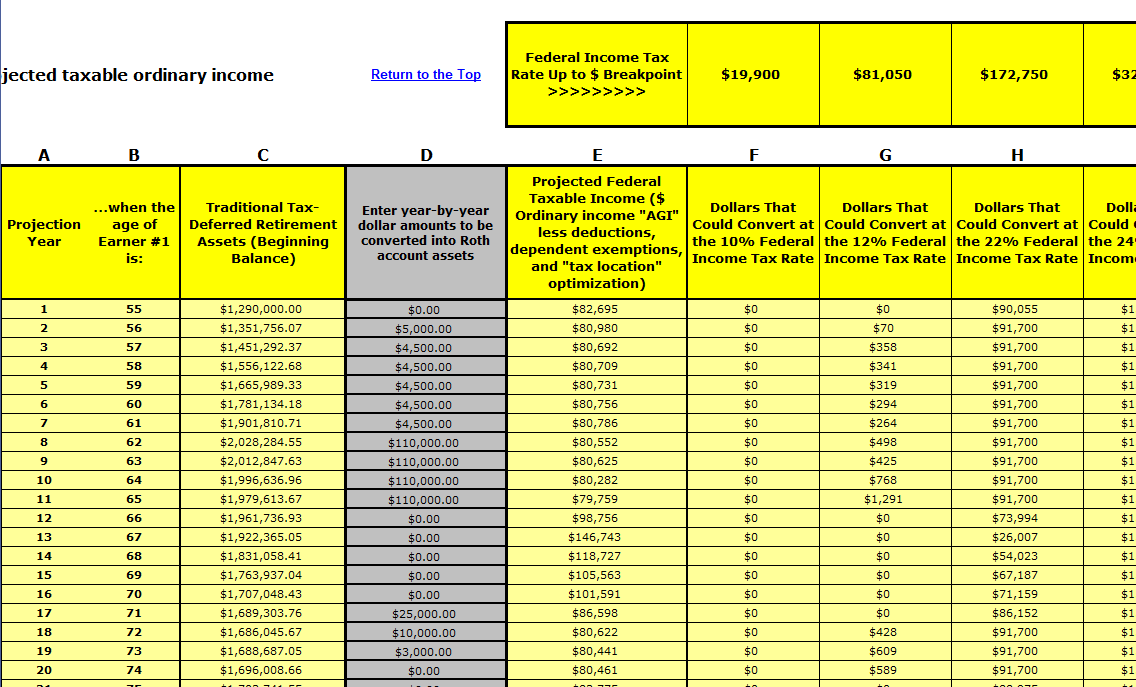

When taking an IRA distribution for a first time home purchase you can t escape paying tax entirely but you can avoid paying the 10 penalty Here s how it works

First Time Home Buyer Ira Withdrawal Tax Form have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization We can customize designs to suit your personal needs be it designing invitations to organize your schedule or even decorating your house.

-

Educational value: Printing educational materials for no cost cater to learners of all ages. This makes them a vital resource for educators and parents.

-

An easy way to access HTML0: The instant accessibility to various designs and templates cuts down on time and efforts.

Where to Find more First Time Home Buyer Ira Withdrawal Tax Form

This Lesser Known Roth IRA Benefit Could Leave You Richer In Retirement

This Lesser Known Roth IRA Benefit Could Leave You Richer In Retirement

As long as the funds are being used to buy a primary residence the IRS permits first time homebuyers to withdraw up to 10 000 from their traditional IRA without paying the customary 10

How to Tap an IRA for a Home Purchase You can withdraw up to 10 000 penalty free to buy or build a first home but make sure you know the rules

Since we've got your interest in First Time Home Buyer Ira Withdrawal Tax Form and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of First Time Home Buyer Ira Withdrawal Tax Form to suit a variety of purposes.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing, flashcards, and learning materials.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a wide range of topics, that includes DIY projects to party planning.

Maximizing First Time Home Buyer Ira Withdrawal Tax Form

Here are some new ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge for teaching at-home or in the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

First Time Home Buyer Ira Withdrawal Tax Form are a treasure trove of practical and innovative resources for a variety of needs and interests. Their availability and versatility make them a great addition to both professional and personal life. Explore the wide world of First Time Home Buyer Ira Withdrawal Tax Form right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes you can! You can print and download the resources for free.

-

Can I download free printables to make commercial products?

- It's determined by the specific conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables may be subject to restrictions on use. Be sure to check the conditions and terms of use provided by the author.

-

How do I print First Time Home Buyer Ira Withdrawal Tax Form?

- You can print them at home with any printer or head to a print shop in your area for better quality prints.

-

What software is required to open printables at no cost?

- Most PDF-based printables are available in PDF format. They can be opened with free software, such as Adobe Reader.

IRA Withdrawal Form Prudential

Tsp Early Withdrawal Tax Calculator Veche

Check more sample of First Time Home Buyer Ira Withdrawal Tax Form below

Ira Withdrawal Tax Calculator 2021 DionKavish

Traditional Ira Withdrawal Tax Calculator BelleKhalari

Open An Ira Account In 3 Easy Steps In Lakewood Colorado Gold IRA

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Roth Ira Withdrawal Tax Calculator TaniyaSuphi

The Tax Impact Of IRA Withdrawal For A First Time Home Buyer YouTube

Traditional Ira Withdrawal Tax Calculator BelleKhalari

https://www.vero.fi/en/individuals/property/...

File the return Submit the transfer tax return in 2 months after you have signed the deed of sale or other contract if no realtor assisted you The transfer tax return contains a field where you must fill in your affirmation that this is your first time home If you buy with the assistance of a realtor when he or she has done that you will

https://www.rocketmortgage.com/learn/ira...

First Time Home Buyers Qualified first time buyers can withdraw up to 10 000 from their IRA penalty free to buy build or rebuild a first home You must close on the transaction within 120 days of receiving the funds

File the return Submit the transfer tax return in 2 months after you have signed the deed of sale or other contract if no realtor assisted you The transfer tax return contains a field where you must fill in your affirmation that this is your first time home If you buy with the assistance of a realtor when he or she has done that you will

First Time Home Buyers Qualified first time buyers can withdraw up to 10 000 from their IRA penalty free to buy build or rebuild a first home You must close on the transaction within 120 days of receiving the funds

Roth Ira Withdrawal Tax Calculator TaniyaSuphi

Traditional Ira Withdrawal Tax Calculator BelleKhalari

The Tax Impact Of IRA Withdrawal For A First Time Home Buyer YouTube

Traditional Ira Withdrawal Tax Calculator BelleKhalari

Roth Ira Withdrawal Tax Calculator TaniyaSuphi

Roth IRA Withdrawal Rules And Penalties Tax Beasts

Roth IRA Withdrawal Rules And Penalties Tax Beasts

First Time Home Buyer 401k Withdrawal Options FHA Lenders