In the digital age, with screens dominating our lives and the appeal of physical printed items hasn't gone away. No matter whether it's for educational uses project ideas, artistic or simply adding an extra personal touch to your space, First Time Homebuyer Tax Credit 2023 Irs can be an excellent source. Through this post, we'll take a dive deeper into "First Time Homebuyer Tax Credit 2023 Irs," exploring what they are, where they can be found, and how they can enhance various aspects of your daily life.

Get Latest First Time Homebuyer Tax Credit 2023 Irs Below

.png)

First Time Homebuyer Tax Credit 2023 Irs

First Time Homebuyer Tax Credit 2023 Irs -

Under Biden s new proposal eligible home buyers could receive a tax credit equal to 10 of the purchase price of their home capped at 15 000 Unlike a loan or cash grant this refundable

Go to our First Time Homebuyer Credit account look up to receive Balance of your First Time Homebuyer Credit Amount you paid back to date Total amount of the credit you received Annual installment repayment amount

First Time Homebuyer Tax Credit 2023 Irs offer a wide assortment of printable material that is available online at no cost. These resources come in many forms, including worksheets, coloring pages, templates and much more. One of the advantages of First Time Homebuyer Tax Credit 2023 Irs is in their variety and accessibility.

More of First Time Homebuyer Tax Credit 2023 Irs

Clock Ticking On First time Homebuyer Tax Credit

Clock Ticking On First time Homebuyer Tax Credit

The first time homebuyer tax credit has been reintroduced for 2023 Learn how it works and how it could help you to save money when you buy your first home

A first time homebuyer tax credit offers a direct reduction of the amount of income tax you owe The U S federal government offered a tax credit program to first time

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

The ability to customize: There is the possibility of tailoring designs to suit your personal needs in designing invitations and schedules, or decorating your home.

-

Educational Impact: Downloads of educational content for free are designed to appeal to students from all ages, making them an invaluable instrument for parents and teachers.

-

An easy way to access HTML0: Fast access various designs and templates can save you time and energy.

Where to Find more First Time Homebuyer Tax Credit 2023 Irs

The First Time Homebuyer Tax Credit Explained Jeanine Hemingway CPA

The First Time Homebuyer Tax Credit Explained Jeanine Hemingway CPA

The first time homebuyer credit isn t available for current tax years This credit was only applicable for homes purchased between 2008 and 2010 If you claimed the credit during those years you might still be repaying it

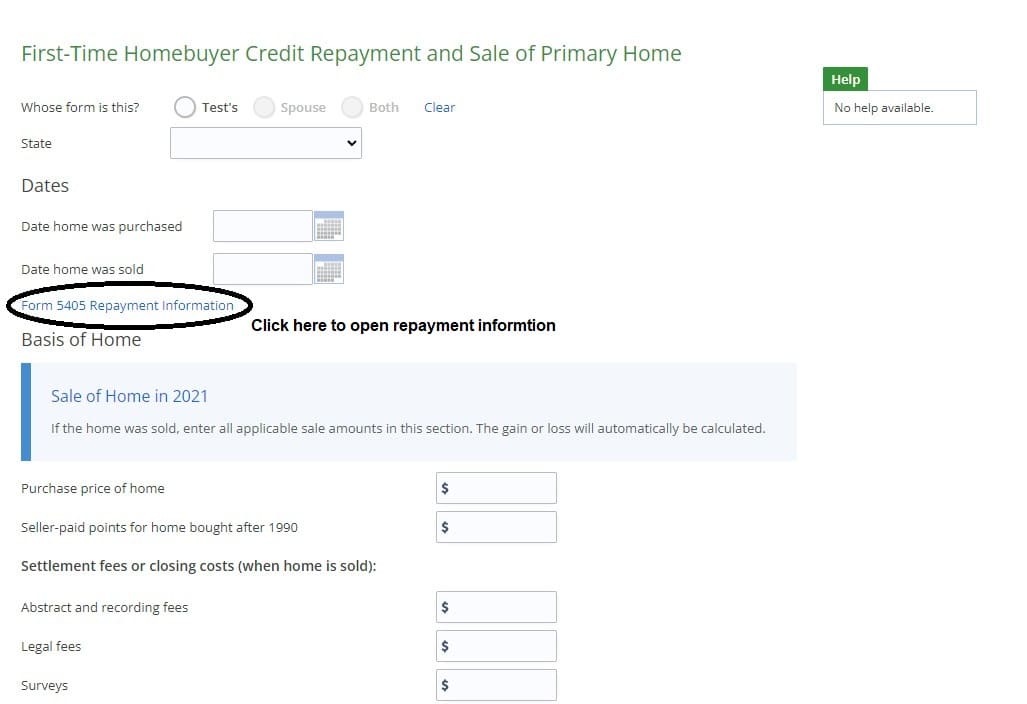

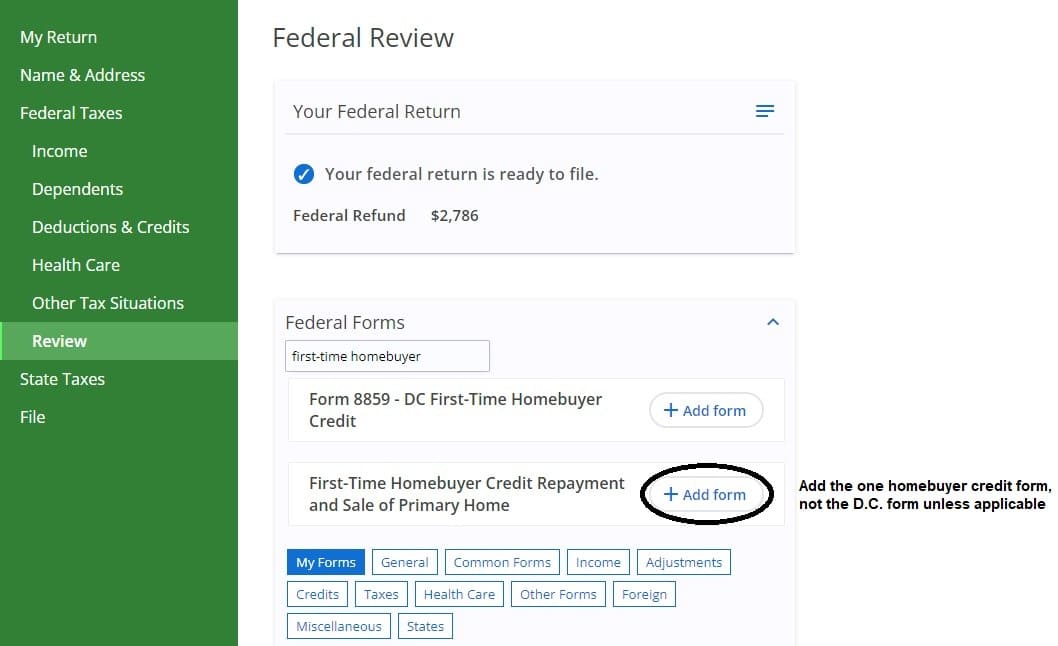

You need to file Form 5405 with your 2023 taxes if you claimed the First Time Homebuyer Credit in 2008 and You sold or otherwise disposed of that home for a gain You

If we've already piqued your curiosity about First Time Homebuyer Tax Credit 2023 Irs Let's see where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of First Time Homebuyer Tax Credit 2023 Irs to suit a variety of needs.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- These blogs cover a broad range of interests, all the way from DIY projects to planning a party.

Maximizing First Time Homebuyer Tax Credit 2023 Irs

Here are some unique ways create the maximum value use of First Time Homebuyer Tax Credit 2023 Irs:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets for free to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars with to-do lists, planners, and meal planners.

Conclusion

First Time Homebuyer Tax Credit 2023 Irs are an abundance of practical and innovative resources designed to meet a range of needs and preferences. Their accessibility and versatility make these printables a useful addition to both professional and personal life. Explore the vast collection of First Time Homebuyer Tax Credit 2023 Irs now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes, they are! You can download and print these files for free.

-

Do I have the right to use free printouts for commercial usage?

- It's based on the rules of usage. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables might have limitations in their usage. You should read the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home with printing equipment or visit a print shop in your area for higher quality prints.

-

What software is required to open printables free of charge?

- Many printables are offered in the format PDF. This can be opened using free software such as Adobe Reader.

First Time Homebuyer Tax Credit Explained YouTube

What Is The First Time Homebuyer Tax Credit Does It Still Exist

Check more sample of First Time Homebuyer Tax Credit 2023 Irs below

Add IRS Form 5405 To Repay First Time Homebuyer Credit

Add IRS Form 5405 To Repay First Time Homebuyer Credit

First Time Homebuyer Tax Credit 2022 All That You Need To Know

How The First time Homebuyer Tax Credit Worked HowStuffWorks

Another 15K First time Homebuyer Tax Credit Bill Emerges Michael Gersitz

No There Is No First time Homebuyer Tax Credit With The IRS IRS

.png?w=186)

https://www.irs.gov › credits-deduction…

Go to our First Time Homebuyer Credit account look up to receive Balance of your First Time Homebuyer Credit Amount you paid back to date Total amount of the credit you received Annual installment repayment amount

https://www.irs.gov › instructions

You must file Form 5405 with your 2023 tax return if you purchased your home in 2008 and you meet either of the following conditions You disposed of it in 2023 You ceased

Go to our First Time Homebuyer Credit account look up to receive Balance of your First Time Homebuyer Credit Amount you paid back to date Total amount of the credit you received Annual installment repayment amount

You must file Form 5405 with your 2023 tax return if you purchased your home in 2008 and you meet either of the following conditions You disposed of it in 2023 You ceased

How The First time Homebuyer Tax Credit Worked HowStuffWorks

Add IRS Form 5405 To Repay First Time Homebuyer Credit

Another 15K First time Homebuyer Tax Credit Bill Emerges Michael Gersitz

No There Is No First time Homebuyer Tax Credit With The IRS IRS

The HELPER Act Mortgage Explained

Biden s First Time Homebuyer Tax Credit Program How To Benefit The

Biden s First Time Homebuyer Tax Credit Program How To Benefit The

First Time Homebuyer Tax Credit The Snyder Team