In this digital age, where screens have become the dominant feature of our lives but the value of tangible printed objects hasn't waned. If it's to aid in education for creative projects, simply to add some personal flair to your area, Fixed Deposit Tax Deduction India are now a vital resource. This article will take a dive into the world of "Fixed Deposit Tax Deduction India," exploring the benefits of them, where you can find them, and the ways that they can benefit different aspects of your life.

Get Latest Fixed Deposit Tax Deduction India Below

Fixed Deposit Tax Deduction India

Fixed Deposit Tax Deduction India -

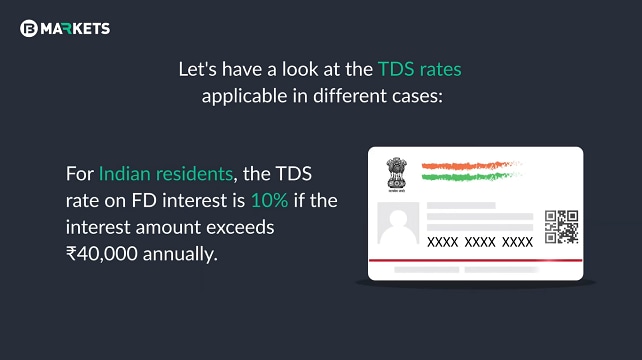

Verkko What is TDS on Fixed Deposit Essentially it is a form of tax that is subtracted at the source from the interest earnings accrued on a fixed deposit account However TDS

Verkko 14 huhtik 2017 nbsp 0183 32 Fixed Deposits FDs allow you to exploit the complete potential of Section 80C to deduct Rs 1 5 lakh from your taxable income It also ensures capital

Fixed Deposit Tax Deduction India encompass a wide variety of printable, downloadable materials online, at no cost. These resources come in many forms, like worksheets templates, coloring pages, and much more. The beauty of Fixed Deposit Tax Deduction India is their flexibility and accessibility.

More of Fixed Deposit Tax Deduction India

Fd Tds Rules 2023 Fd Tds Calculation Fixed Deposit Tax Deduction

Fd Tds Rules 2023 Fd Tds Calculation Fixed Deposit Tax Deduction

Verkko 29 kes 228 k 2022 nbsp 0183 32 You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed

Verkko No the income earned from a fixed deposit is not exempt from taxes Income tax on fd interest is applicable as per the income tax rates Additionally investing in a tax

Fixed Deposit Tax Deduction India have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: Your HTML0 customization options allow you to customize designs to suit your personal needs in designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value Educational printables that can be downloaded for free cater to learners of all ages. This makes these printables a powerful resource for educators and parents.

-

The convenience of You have instant access various designs and templates, which saves time as well as effort.

Where to Find more Fixed Deposit Tax Deduction India

Fixed Deposit Tax Benefits In Tamil FD In Tamil Save Tax In Tamil

Fixed Deposit Tax Benefits In Tamil FD In Tamil Save Tax In Tamil

Verkko 7 hein 228 k 2022 nbsp 0183 32 If your interest amount surpasses Rs 5 lakh then you will be charged with an additional 10 rate to TDS FD interest over 10 lakh will be eligible for an extra

Verkko Fixed Deposit interest is added to your total income and taxed at your applicable income tax slab rate Example Let s say you earn 50 000 in Fixed Deposit interest and fall

Since we've got your interest in printables for free Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of motives.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free with flashcards and other teaching tools.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs covered cover a wide spectrum of interests, that range from DIY projects to party planning.

Maximizing Fixed Deposit Tax Deduction India

Here are some unique ways that you can make use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Fixed Deposit Tax Deduction India are a treasure trove of practical and imaginative resources that meet a variety of needs and needs and. Their accessibility and flexibility make them a wonderful addition to both personal and professional life. Explore the endless world of Fixed Deposit Tax Deduction India now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I utilize free printables for commercial uses?

- It depends on the specific conditions of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Are there any copyright issues in Fixed Deposit Tax Deduction India?

- Certain printables might have limitations in their usage. Make sure you read the terms and condition of use as provided by the creator.

-

How do I print Fixed Deposit Tax Deduction India?

- You can print them at home using either a printer at home or in an in-store print shop to get the highest quality prints.

-

What software do I require to view printables free of charge?

- The majority of printed documents are in PDF format. They can be opened with free software, such as Adobe Reader.

A Detailed Guide To Income Tax Deductions In India Fibe Formerly

A Guide To Investments In Indian Real Estate Rate exchange

Check more sample of Fixed Deposit Tax Deduction India below

TDS On Fixed Deposit Tax Deduction On FD Interest

Higher Income Tax Deduction On NPS Likely For Private Sector Employees

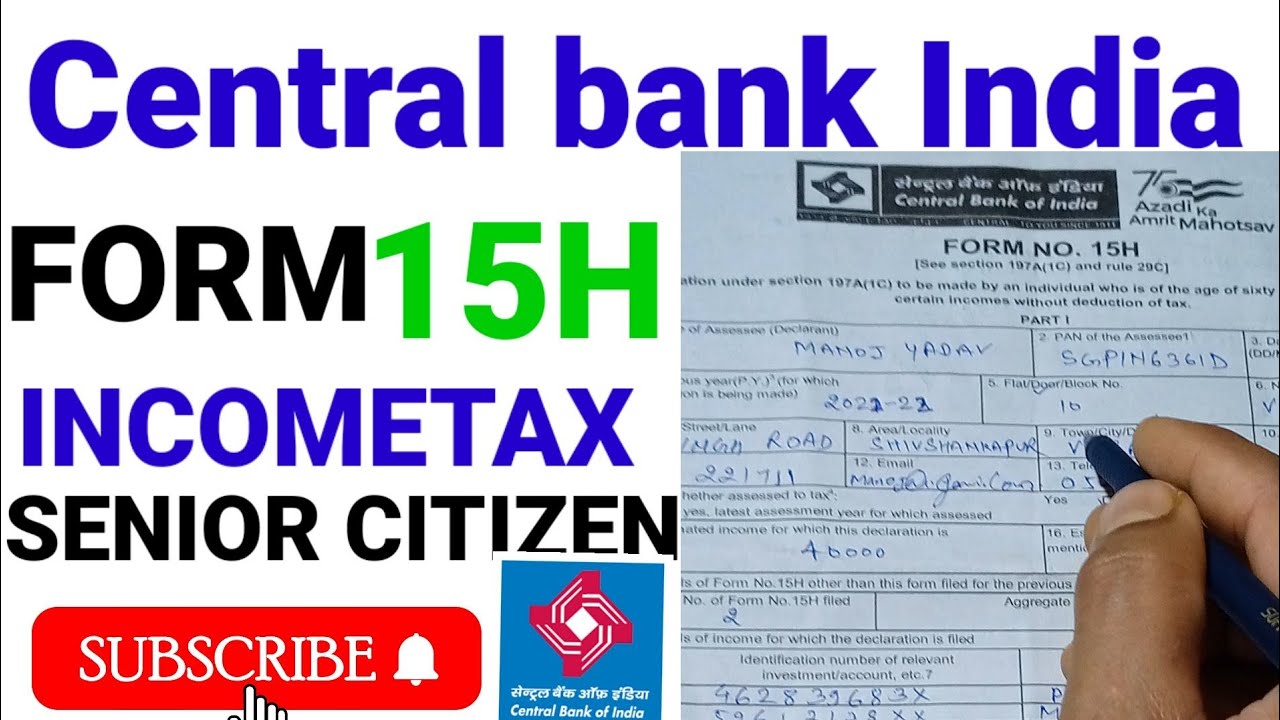

Central Bank F D 15H Ll Form Fill Every April Month 15H Fill Ll Central

Tax Deduction India 2023

Tuition Fees Deduction India

Section 80C Deduction Tax Saving Investment Options Under Section 80C

https://cleartax.in/s/income-tax-on-fixed-deposit-interest

Verkko 14 huhtik 2017 nbsp 0183 32 Fixed Deposits FDs allow you to exploit the complete potential of Section 80C to deduct Rs 1 5 lakh from your taxable income It also ensures capital

https://www.icicibank.com/blogs/fixed-deposits/tax-deduction-on-fixed...

Verkko The bank doesn t charge tax on Fixed Deposit if your overall income is less than Rs 2 5 lakh in a year However some lenders may ask you to submit Form 15G or 15H to

Verkko 14 huhtik 2017 nbsp 0183 32 Fixed Deposits FDs allow you to exploit the complete potential of Section 80C to deduct Rs 1 5 lakh from your taxable income It also ensures capital

Verkko The bank doesn t charge tax on Fixed Deposit if your overall income is less than Rs 2 5 lakh in a year However some lenders may ask you to submit Form 15G or 15H to

Tax Deduction India 2023

Higher Income Tax Deduction On NPS Likely For Private Sector Employees

Tuition Fees Deduction India

Section 80C Deduction Tax Saving Investment Options Under Section 80C

Tax Saving FD Tax Saving FD Interest Rates In 2021 I Paisabazaar

How Much Does An Architect Make In Nyc

How Much Does An Architect Make In Nyc

Standard Deduction 2020 Self Employed Standard Deduction 2021