In this age of technology, where screens dominate our lives The appeal of tangible printed objects isn't diminished. Be it for educational use project ideas, artistic or simply adding a personal touch to your area, Florida Homestead Tax Exemption Deadline 2023 have proven to be a valuable resource. This article will take a dive in the world of "Florida Homestead Tax Exemption Deadline 2023," exploring the different types of printables, where to locate them, and how they can enhance various aspects of your life.

Get Latest Florida Homestead Tax Exemption Deadline 2023 Below

Florida Homestead Tax Exemption Deadline 2023

Florida Homestead Tax Exemption Deadline 2023 -

State law allows Florida homeowners to claim up to a 50 000 Homestead Exemption on their primary residence

Every person who owns real property in Florida on January 1 makes the property his or her permanent residenceor the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to

Florida Homestead Tax Exemption Deadline 2023 provide a diverse assortment of printable, downloadable content that can be downloaded from the internet at no cost. These printables come in different forms, like worksheets coloring pages, templates and much more. The attraction of printables that are free is in their variety and accessibility.

More of Florida Homestead Tax Exemption Deadline 2023

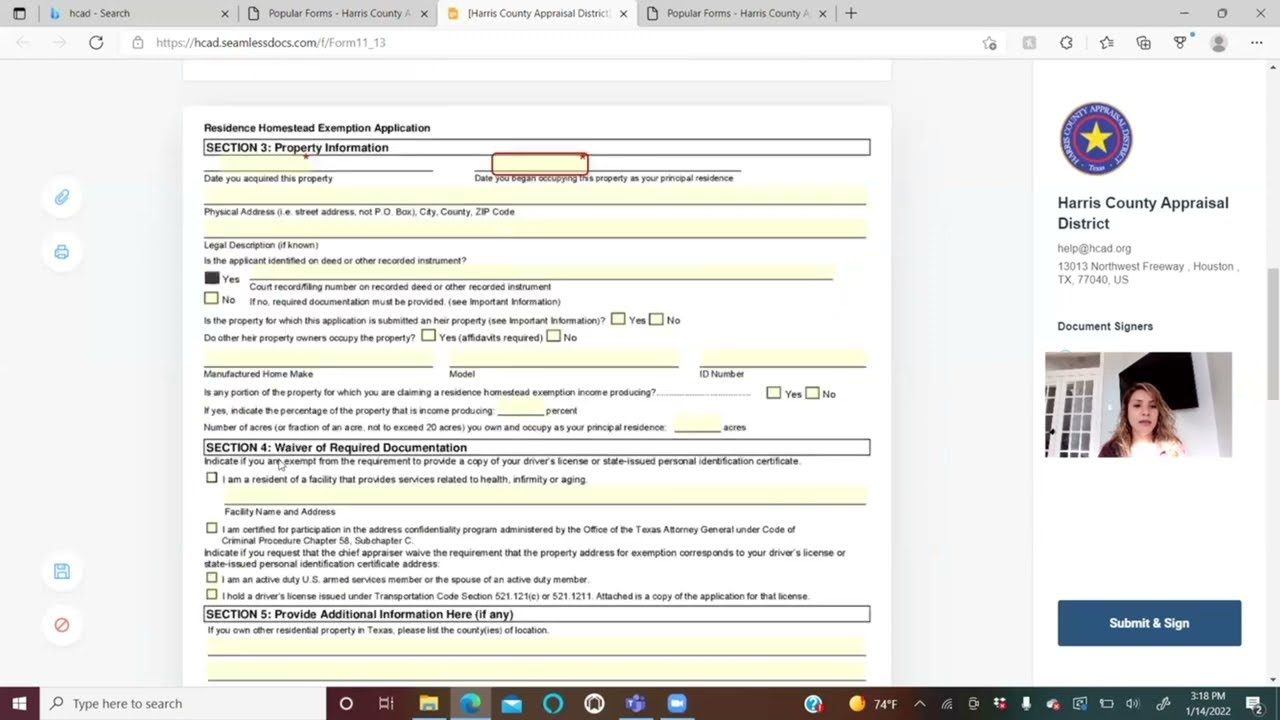

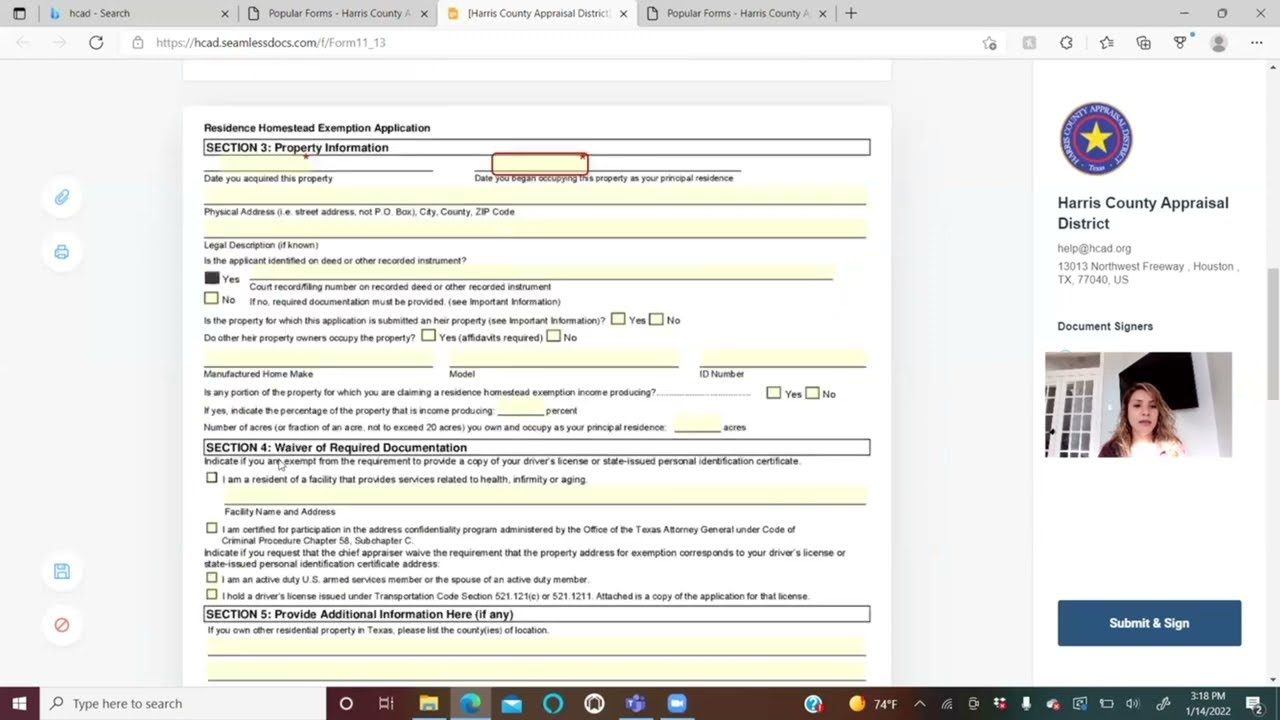

Homestead Exemption Changes In Texas 2022

Homestead Exemption Changes In Texas 2022

Exemptions reduce the taxable value of your property They must be applied for and are not granted retroactively The State s deadline to apply for exemptions is March 1 Most exemptions renew annually on January 1st as long as there are no changes in ownership or in residency

File for Your Homestead Exemption Before March 1 2023 Save on Your Property Taxes If you bought a home in Florida in 2022 you likely qualify for a homestead exemption of up to 50 000 That means that your property tax will be based on your home s assessed value minus the amount of your exemption up to 50 000

Florida Homestead Tax Exemption Deadline 2023 have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization You can tailor printed materials to meet your requirements such as designing invitations making your schedule, or even decorating your home.

-

Educational Value: Education-related printables at no charge cater to learners of all ages, which makes them a vital aid for parents as well as educators.

-

Easy to use: Access to various designs and templates reduces time and effort.

Where to Find more Florida Homestead Tax Exemption Deadline 2023

Homestead Exemption Deadline Is March 1

Homestead Exemption Deadline Is March 1

There are several personal tax exemptions that may be available to you as a residential property owner if you qualify and apply for them o n l i n e or in person by the MARCH 1 DEADLINE In order to qualify for homestead exemption permanent Florida residency must be established as of

All legal Florida residents are eligible for a Homestead Exemption on their homes condominiums co op apartments and certain mobile home lots if they qualify The Florida Constitution provides this tax saving exemption on the first and third 25 000 of the assessed value of an owner occupied residence

We've now piqued your curiosity about Florida Homestead Tax Exemption Deadline 2023 Let's find out where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection and Florida Homestead Tax Exemption Deadline 2023 for a variety motives.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free as well as flashcards and other learning tools.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs are a vast variety of topics, including DIY projects to party planning.

Maximizing Florida Homestead Tax Exemption Deadline 2023

Here are some fresh ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Florida Homestead Tax Exemption Deadline 2023 are a treasure trove of practical and imaginative resources that meet a variety of needs and preferences. Their access and versatility makes them a great addition to every aspect of your life, both professional and personal. Explore the endless world of Florida Homestead Tax Exemption Deadline 2023 and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Florida Homestead Tax Exemption Deadline 2023 truly cost-free?

- Yes they are! You can download and print these free resources for no cost.

-

Are there any free printables to make commercial products?

- It is contingent on the specific terms of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright problems with Florida Homestead Tax Exemption Deadline 2023?

- Some printables may contain restrictions on use. Be sure to read the terms and conditions set forth by the designer.

-

How can I print printables for free?

- Print them at home with a printer or visit an area print shop for more high-quality prints.

-

What software do I need in order to open printables for free?

- Most PDF-based printables are available in PDF format. They is open with no cost software, such as Adobe Reader.

HOMESTEAD EXEMPTION DEADLINE JUNE 30 2022 Cuming County Government

Florida Homestead Exemption Application Deadline ASR Law Firm

Check more sample of Florida Homestead Tax Exemption Deadline 2023 below

How To Fill Out Texas Homestead Exemption Form 50 114 The Complete

How To File For Harris County Homestead Exemption Deadline April 30th

How Do I Register For Florida Homestead Tax Exemption

Dallas Homestead Exemption Explained FAQs How To File

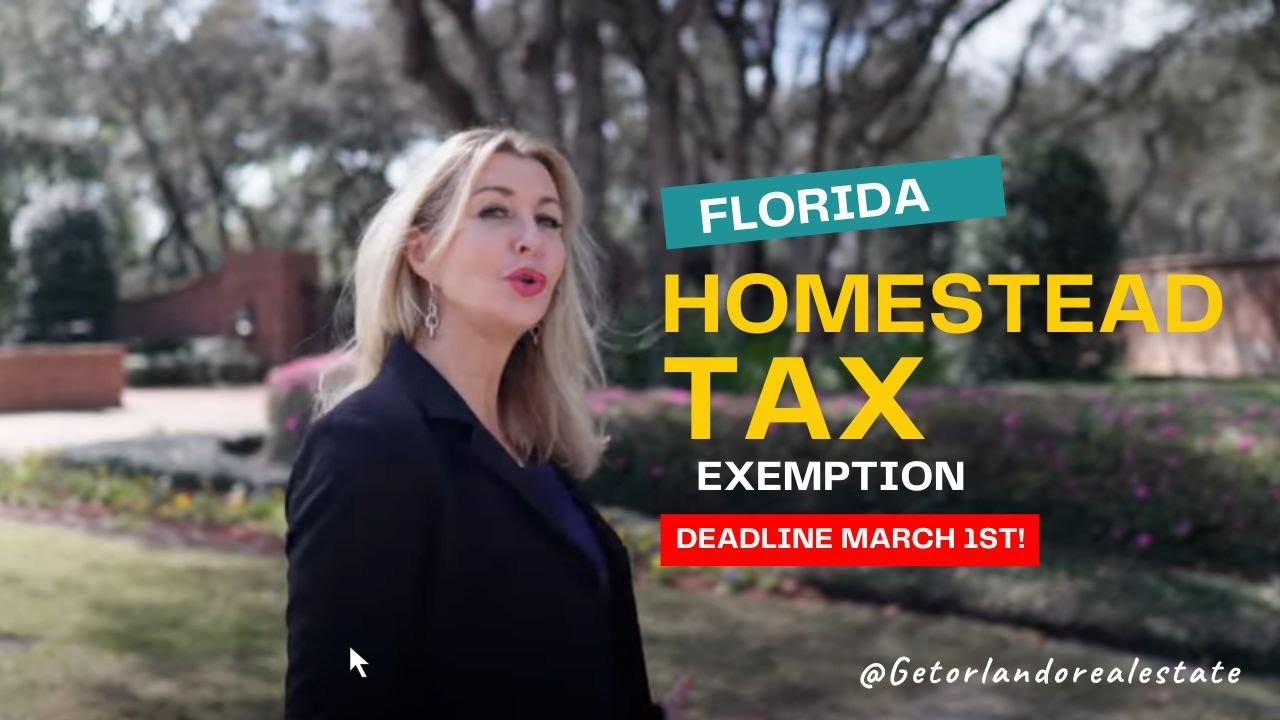

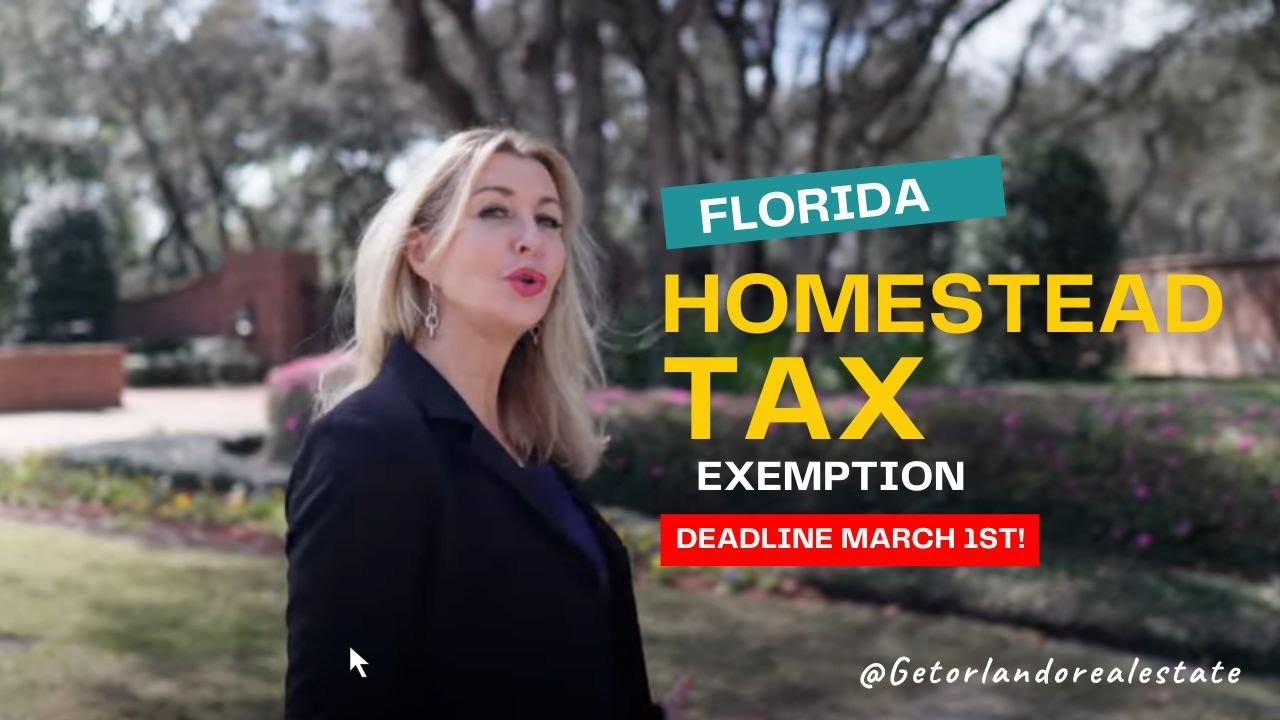

Florida Homestead Tax Exemption Deadline March 1st YouTube

Homestead Tax Exemption Deadline To Apply Is This Week WHIO TV 7 And

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/5P7OT6B7WJBD3HP4AB6FSFSOQQ.jpg)

https://floridarevenue.com/property/Documents/dr501.pdf

Every person who owns real property in Florida on January 1 makes the property his or her permanent residenceor the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to

https://pbcpao.gov/homestead-exemption.htm

All homestead exemption applications must be eligible as of January 1 and submitted by March 1 of the year in which the benefit will be applied A 25 000 exemption is applied to the first 50 000 of your property s assessed value

Every person who owns real property in Florida on January 1 makes the property his or her permanent residenceor the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to

All homestead exemption applications must be eligible as of January 1 and submitted by March 1 of the year in which the benefit will be applied A 25 000 exemption is applied to the first 50 000 of your property s assessed value

Dallas Homestead Exemption Explained FAQs How To File

How To File For Harris County Homestead Exemption Deadline April 30th

Florida Homestead Tax Exemption Deadline March 1st YouTube

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/5P7OT6B7WJBD3HP4AB6FSFSOQQ.jpg)

Homestead Tax Exemption Deadline To Apply Is This Week WHIO TV 7 And

Why Is Closing By December 31 So Important For The Florida Homestead

Florida Property Tax Lawyer FLORIDA PROPERTY TAX NEWS MARCH 1 IS

Florida Property Tax Lawyer FLORIDA PROPERTY TAX NEWS MARCH 1 IS

Florida Homestead Tax Exemption What Is It