In this day and age in which screens are the norm yet the appeal of tangible printed objects hasn't waned. Whether it's for educational purposes as well as creative projects or simply adding an extra personal touch to your home, printables for free are now an essential source. Here, we'll dive through the vast world of "Foreign Tax Credit Iras Formula," exploring the different types of printables, where to locate them, and how they can be used to enhance different aspects of your daily life.

Get Latest Foreign Tax Credit Iras Formula Below

Foreign Tax Credit Iras Formula

Foreign Tax Credit Iras Formula -

You can claim a credit only for foreign taxes that are imposed on you by a foreign country or U S possession Generally only income war profits and excess profits taxes qualify for the credit See Foreign Taxes that Qualify For The Foreign Tax Credit for more information

Taxes Individual Income Tax Basics of Individual Income Tax Tax residency and tax rates Claiming foreign tax credit If you are a Singapore tax resident you may claim foreign tax credit if you have been taxed twice on the same income On this page Double taxation on foreign income Conditions for claiming FTC

The Foreign Tax Credit Iras Formula are a huge array of printable items that are available online at no cost. The resources are offered in a variety types, such as worksheets templates, coloring pages and many more. One of the advantages of Foreign Tax Credit Iras Formula lies in their versatility and accessibility.

More of Foreign Tax Credit Iras Formula

How To Calculate Foreign Tax Credit Iras TAXIRIN

How To Calculate Foreign Tax Credit Iras TAXIRIN

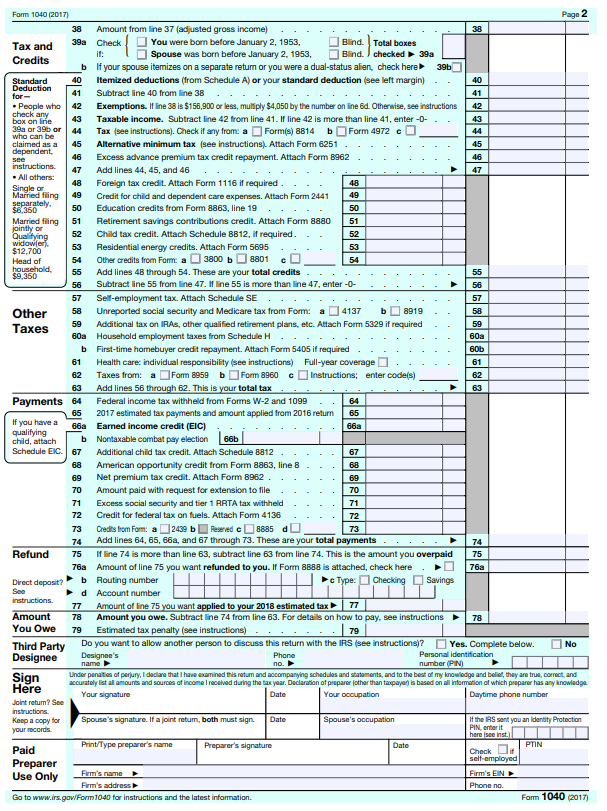

Your foreign tax credit is the amount of foreign tax you paid or accrued or if smaller the foreign tax credit limit You figure your foreign tax credit and the foreign tax credit limit on Form 1116 Foreign Tax Credit Foreign Tax Credit Limit Your foreign tax credit cannot be more than your total U S tax liability multiplied by a fraction

Janet Berry Johnson Fact checked by Vikki Velasquez What Is the Foreign Tax Credit The foreign tax credit is a U S tax credit used to offset income tax paid abroad U S citizens and

Foreign Tax Credit Iras Formula have garnered immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Flexible: This allows you to modify printing templates to your own specific requirements whether you're designing invitations and schedules, or even decorating your home.

-

Educational Value These Foreign Tax Credit Iras Formula are designed to appeal to students of all ages, which makes the perfect aid for parents as well as educators.

-

Easy to use: Quick access to many designs and templates can save you time and energy.

Where to Find more Foreign Tax Credit Iras Formula

How To Calculate Your Foreign Tax Credits Carryover With Examples

How To Calculate Your Foreign Tax Credits Carryover With Examples

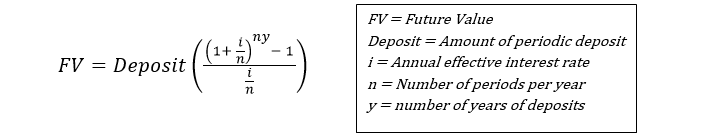

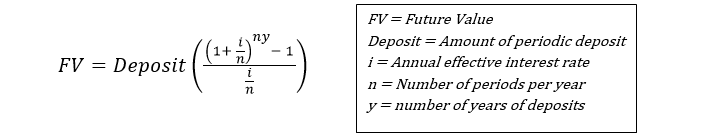

Calculating your Foreign Tax Credit FTC and carryover Here s the formula you should use to calculate the maximum foreign tax credits you can use Foreign sourced income total taxable income US tax liability Maximum FTC you are allowed to take If the foreign tax you paid is less than this then FTC Foreign tax paid

Taxpayers can deduct the foreign income tax they paid or claim those taxes as a foreign tax credit What follows is a general overview of the basics of taxes on foreign income

If we've already piqued your interest in printables for free Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of reasons.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs are a vast spectrum of interests, all the way from DIY projects to party planning.

Maximizing Foreign Tax Credit Iras Formula

Here are some ways in order to maximize the use of Foreign Tax Credit Iras Formula:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to build your knowledge at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Foreign Tax Credit Iras Formula are an abundance with useful and creative ideas catering to different needs and passions. Their access and versatility makes them a valuable addition to any professional or personal life. Explore the vast collection of Foreign Tax Credit Iras Formula today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes they are! You can download and print the resources for free.

-

Does it allow me to use free templates for commercial use?

- It depends on the specific usage guidelines. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns when using Foreign Tax Credit Iras Formula?

- Certain printables may be subject to restrictions on usage. Make sure to read the terms and condition of use as provided by the designer.

-

How do I print Foreign Tax Credit Iras Formula?

- You can print them at home using any printer or head to an area print shop for top quality prints.

-

What program do I need in order to open printables at no cost?

- The majority of printed documents are in PDF format. These is open with no cost software such as Adobe Reader.

GET SUPPORT FROM SINGAPORE New

How To Calculate Foreign Tax Credit Iras TAXIRIN

Check more sample of Foreign Tax Credit Iras Formula below

Income Taxes In Singapore You Need To Know About Procosec Asia

The Real Value Of An IRA The Magic Of Tax Deferred Compounding

Solved Required Information The Following Information Chegg

Claiming The Foreign Tax Credit Vs The Foreign Earned Income Exclusion

Foreign Tax Credit Income Tax Rules IndiaFilings

Pin On Webinars Presentations On Demand

https://www.iras.gov.sg/taxes/individual-income...

Taxes Individual Income Tax Basics of Individual Income Tax Tax residency and tax rates Claiming foreign tax credit If you are a Singapore tax resident you may claim foreign tax credit if you have been taxed twice on the same income On this page Double taxation on foreign income Conditions for claiming FTC

https://www.iras.gov.sg/media/docs/default-source/...

Foreign tax credit FTC This refers to the tax credit given for the foreign tax paid on the foreign income that is allowed as an offset against the Singapore tax payable on the same income The tax credit to be granted is the lower of the foreign tax paid and Singapore tax payable

Taxes Individual Income Tax Basics of Individual Income Tax Tax residency and tax rates Claiming foreign tax credit If you are a Singapore tax resident you may claim foreign tax credit if you have been taxed twice on the same income On this page Double taxation on foreign income Conditions for claiming FTC

Foreign tax credit FTC This refers to the tax credit given for the foreign tax paid on the foreign income that is allowed as an offset against the Singapore tax payable on the same income The tax credit to be granted is the lower of the foreign tax paid and Singapore tax payable

Claiming The Foreign Tax Credit Vs The Foreign Earned Income Exclusion

The Real Value Of An IRA The Magic Of Tax Deferred Compounding

Foreign Tax Credit Income Tax Rules IndiaFilings

Pin On Webinars Presentations On Demand

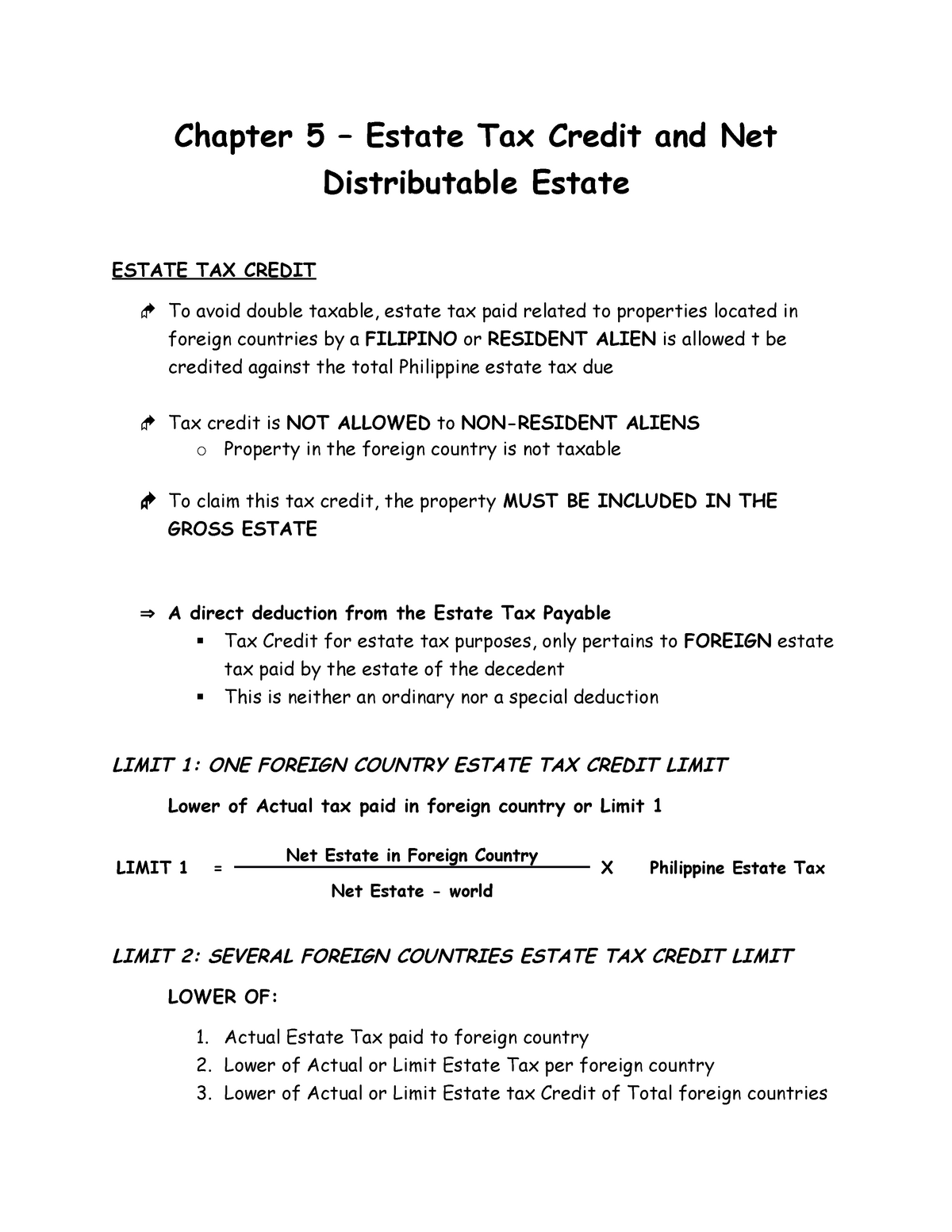

Business Taxation chapter 5 Chapter 5 Estate Tax Credit And Net

Income Tax Treatment Of Foreign Exchange Gains Or Losses IRAS

Income Tax Treatment Of Foreign Exchange Gains Or Losses IRAS

Compound Interest YouTube