In this day and age where screens dominate our lives but the value of tangible printed materials hasn't faded away. Whatever the reason, whether for education as well as creative projects or simply adding a personal touch to your home, printables for free are now a vital resource. Here, we'll dive through the vast world of "Foreign Tax Credit Iras Individual," exploring what they are, how to locate them, and ways they can help you improve many aspects of your lives.

Get Latest Foreign Tax Credit Iras Individual Below

Foreign Tax Credit Iras Individual

Foreign Tax Credit Iras Individual -

The foreign tax credit is a U S tax credit used to offset income tax paid abroad U S citizens and resident aliens who pay income taxes imposed by a foreign country or U S possession can

If you choose to claim a credit for your foreign taxes in 2023 you would be allowed a credit of 700 consisting of 600 paid in 2023 and 100 of the 200 carried over from 2022 You will have a credit carryover to 2024 of 100 which is

Foreign Tax Credit Iras Individual provide a diverse range of printable, free items that are available online at no cost. They come in many designs, including worksheets templates, coloring pages, and more. The attraction of printables that are free is in their versatility and accessibility.

More of Foreign Tax Credit Iras Individual

Income Taxes In Singapore You Need To Know About Procosec Asia

Income Taxes In Singapore You Need To Know About Procosec Asia

You can claim a foreign tax credit only for foreign taxes on income war profits or excess profits or taxes in lieu of those taxes In addition there is a limit on the amount of the credit that you can claim

What is the foreign tax credit The foreign tax credit is a U S tax credit for income tax paid to other countries The general objective is to help taxpayers avoid double taxation on

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Flexible: There is the possibility of tailoring printing templates to your own specific requirements be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational value: Free educational printables provide for students of all ages, which makes them a vital instrument for parents and teachers.

-

Accessibility: Fast access a plethora of designs and templates is time-saving and saves effort.

Where to Find more Foreign Tax Credit Iras Individual

What Is A Roth IRA And Why Is It So Powerful

What Is A Roth IRA And Why Is It So Powerful

The foreign tax credit reduces an individual s US tax liability dollar for dollar Individuals who choose to take the foreign tax credit complete IRS Form 1116 Foreign Tax Credit see below and attach it to their Form 1040 or Form 1040 SR

Foreign tax credit FTC This refers to the tax credit given for the foreign tax paid on the foreign income that is allowed as an offset against the Singapore tax payable on the same income The tax credit to be granted is the lower of

We hope we've stimulated your interest in printables for free Let's see where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and Foreign Tax Credit Iras Individual for a variety objectives.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs are a vast spectrum of interests, starting from DIY projects to party planning.

Maximizing Foreign Tax Credit Iras Individual

Here are some ideas of making the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print worksheets that are free to reinforce learning at home or in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Foreign Tax Credit Iras Individual are an abundance filled with creative and practical information for a variety of needs and interests. Their availability and versatility make them a valuable addition to each day life. Explore the endless world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can print and download these tools for free.

-

Can I use the free printables in commercial projects?

- It's determined by the specific conditions of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with Foreign Tax Credit Iras Individual?

- Some printables could have limitations regarding usage. Be sure to check these terms and conditions as set out by the creator.

-

How do I print Foreign Tax Credit Iras Individual?

- Print them at home with any printer or head to the local print shops for premium prints.

-

What program will I need to access printables that are free?

- A majority of printed materials are in the format of PDF, which is open with no cost programs like Adobe Reader.

IRAS Understanding My Tax Assessment

How To Open A Roth IRA In 2022 Dividend Diaries

Check more sample of Foreign Tax Credit Iras Individual below

Flavia Sobral On LinkedIn tax data webinar

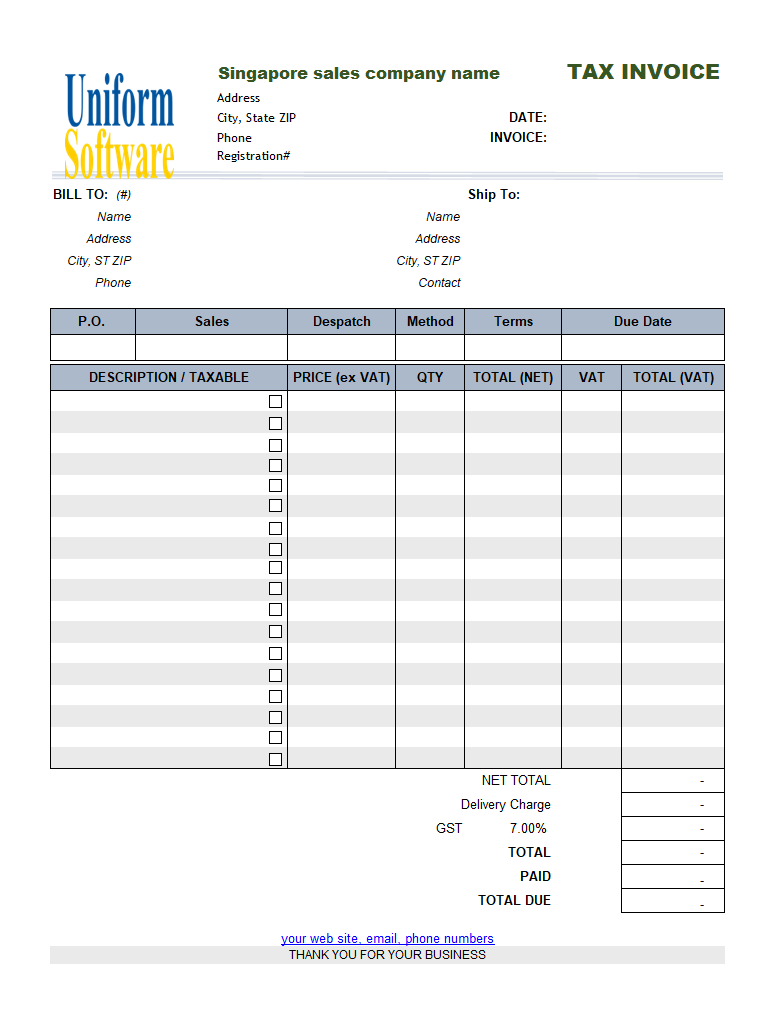

Solved Scenario 1 Individual Retirement Accounts IRAS Chegg

IRAs Lifetime Federal Credit Union

Solved Scenario 1 Individual Retirement Accounts IRAs Chegg

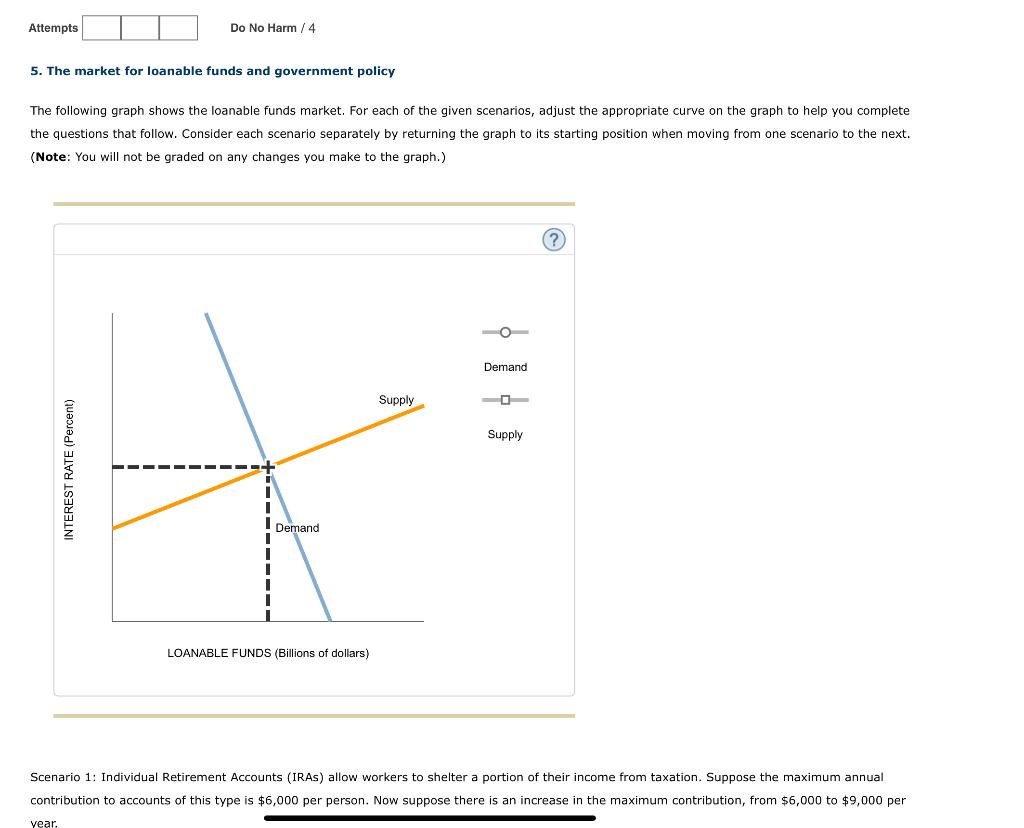

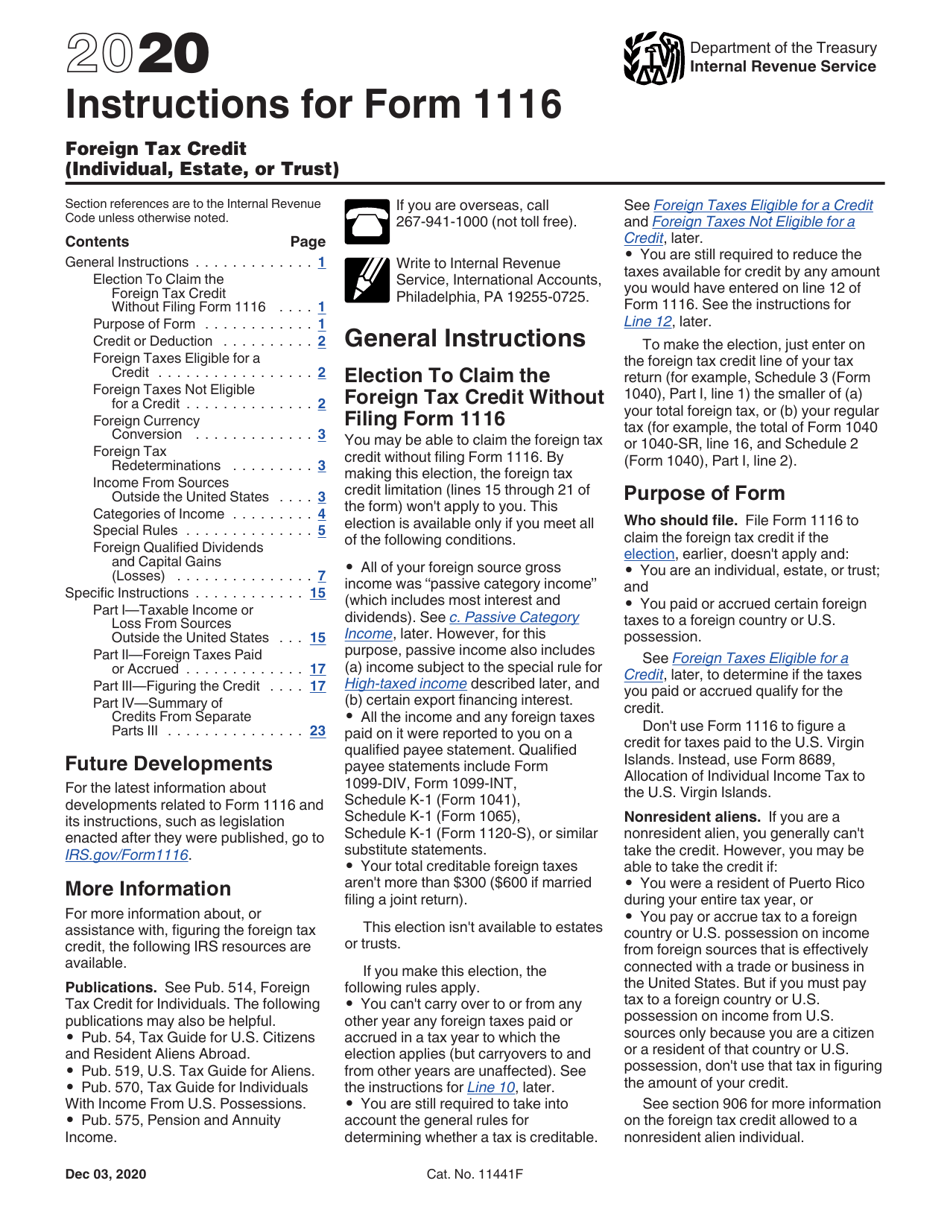

Form 1116 Foreign Tax Credit Individual Estate Or Trust Editorial

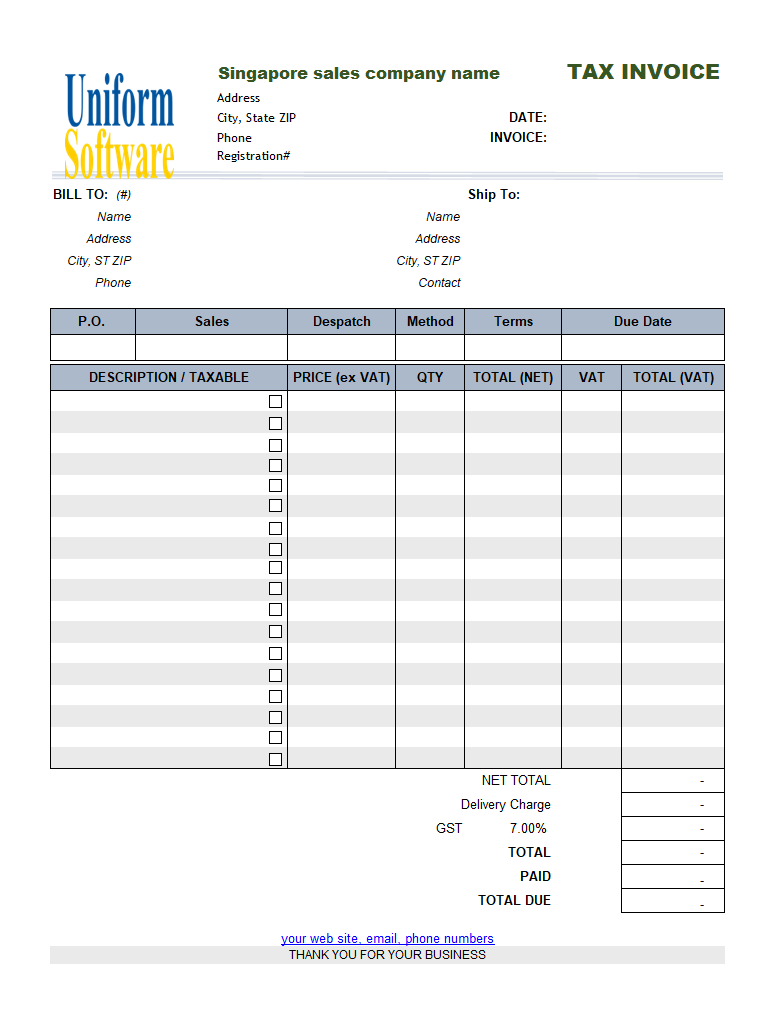

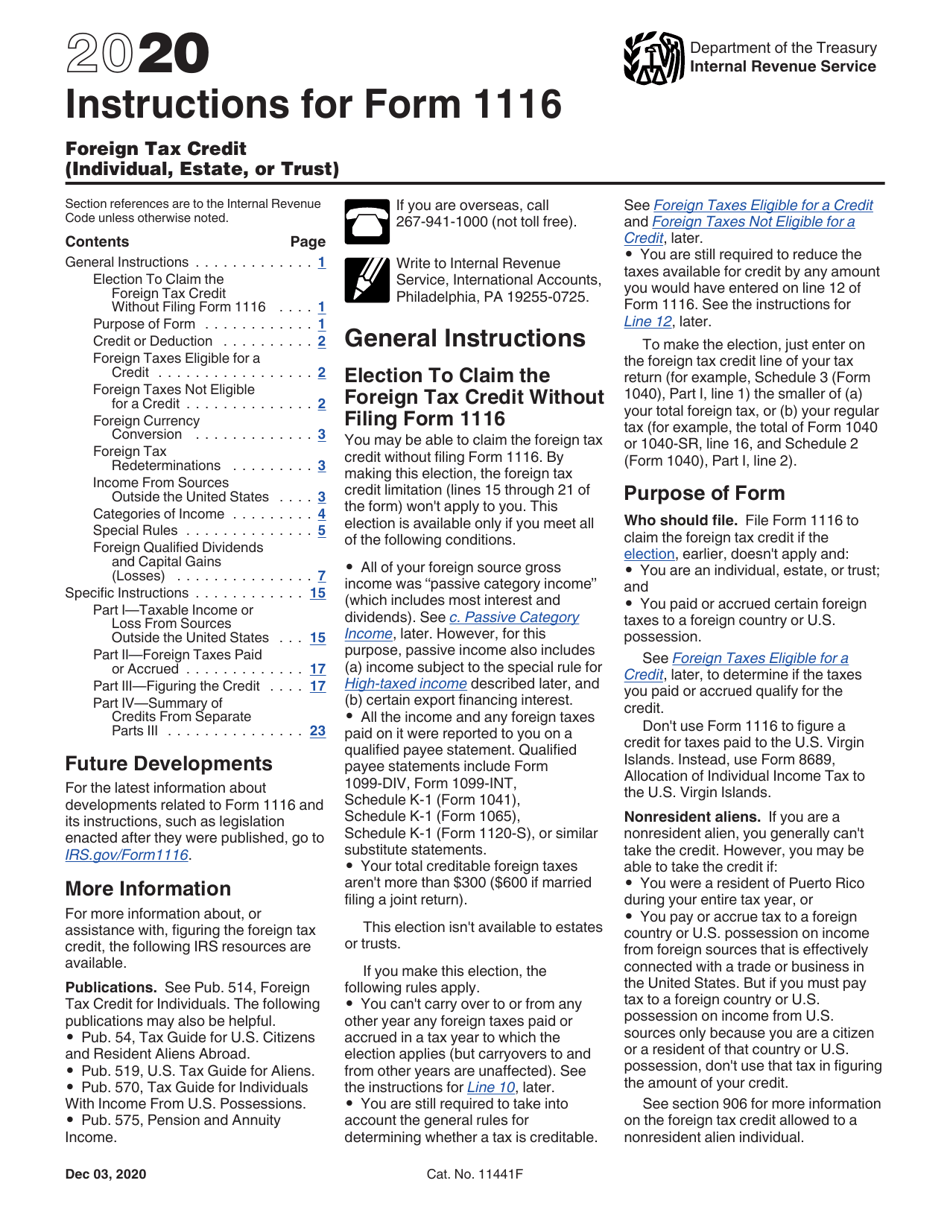

Invoice Template Singapore

https://www.irs.gov/publications/p514

If you choose to claim a credit for your foreign taxes in 2023 you would be allowed a credit of 700 consisting of 600 paid in 2023 and 100 of the 200 carried over from 2022 You will have a credit carryover to 2024 of 100 which is

https://www.irs.gov/.../foreign-tax-credit

File Form 1116 Foreign Tax Credit to claim the foreign tax credit if you are an individual estate or trust and you paid or accrued certain foreign taxes to a foreign country or U S possession Corporations file Form 1118 Foreign Tax Credit Corporations to claim a foreign tax credit

If you choose to claim a credit for your foreign taxes in 2023 you would be allowed a credit of 700 consisting of 600 paid in 2023 and 100 of the 200 carried over from 2022 You will have a credit carryover to 2024 of 100 which is

File Form 1116 Foreign Tax Credit to claim the foreign tax credit if you are an individual estate or trust and you paid or accrued certain foreign taxes to a foreign country or U S possession Corporations file Form 1118 Foreign Tax Credit Corporations to claim a foreign tax credit

Solved Scenario 1 Individual Retirement Accounts IRAs Chegg

Solved Scenario 1 Individual Retirement Accounts IRAS Chegg

Form 1116 Foreign Tax Credit Individual Estate Or Trust Editorial

Invoice Template Singapore

Pin On Webinars Presentations On Demand

Irs Form 1116 Printable Printable Forms Free Online

Irs Form 1116 Printable Printable Forms Free Online

Income Tax Treatment Of Foreign Exchange Gains Or Losses IRAS