In the age of digital, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons, creative projects, or simply to add an extra personal touch to your area, Franking Credits Tax Deduction are a great resource. Here, we'll take a dive in the world of "Franking Credits Tax Deduction," exploring the different types of printables, where they can be found, and how they can improve various aspects of your life.

Get Latest Franking Credits Tax Deduction Below

Franking Credits Tax Deduction

Franking Credits Tax Deduction -

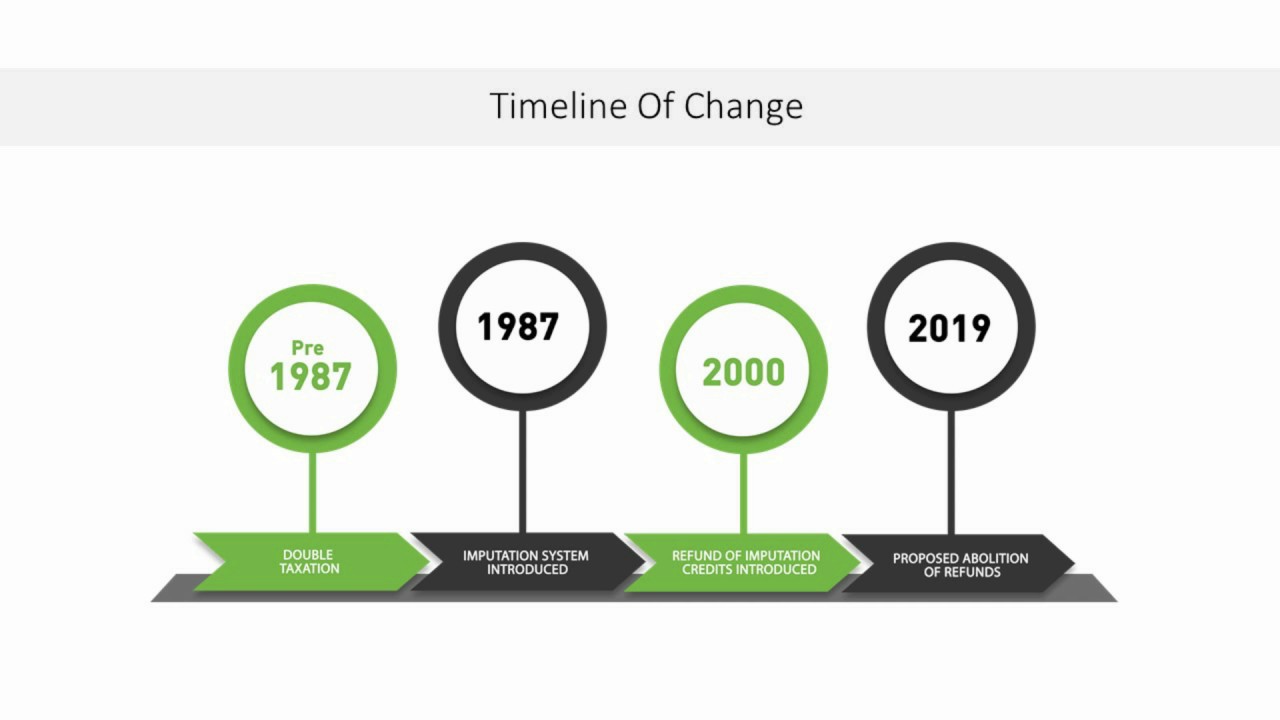

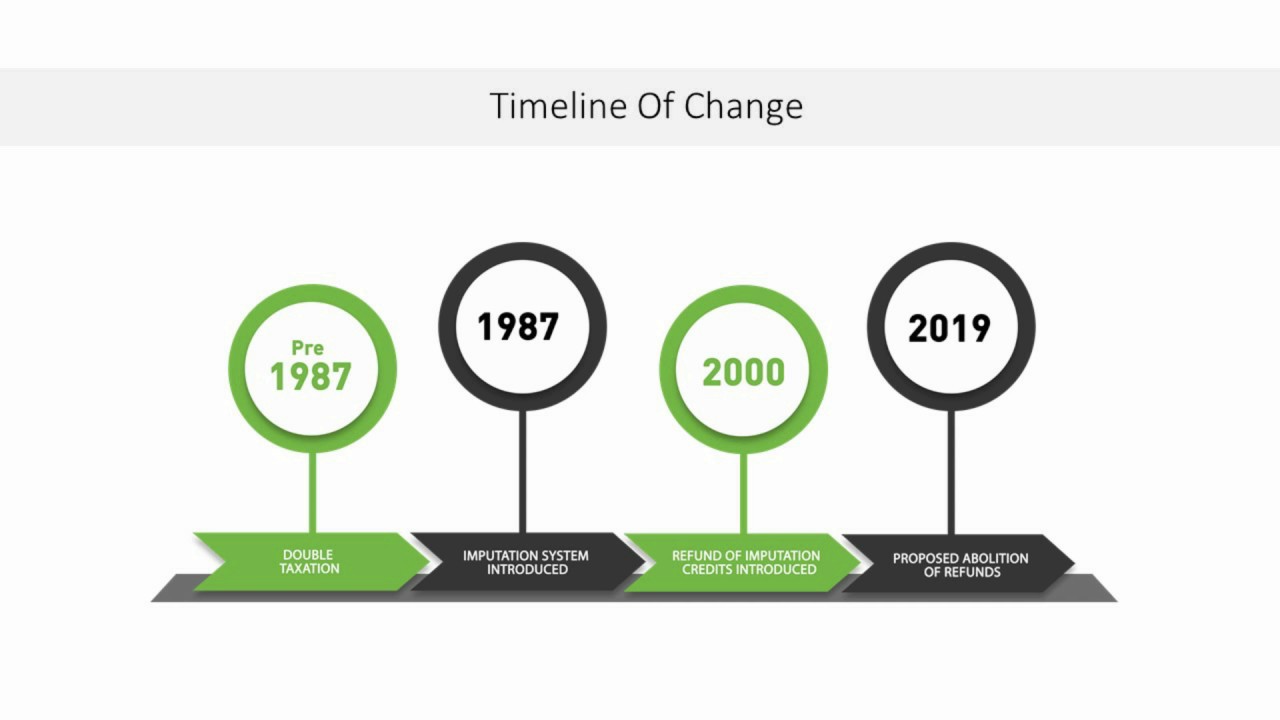

When a company distributes its after tax profits to shareholders in the form of a dividend franking credits can be attached that serve as a pre paid tax voucher which shareholders receive along with dividends

Only Australian resident taxpayers can claim a tax offset for a franking credit attached to a distribution For non residents a distribution is exempt from withholding tax to the extent that it s franked

Printables for free include a vast selection of printable and downloadable resources available online for download at no cost. They are available in numerous types, such as worksheets coloring pages, templates and many more. The appealingness of Franking Credits Tax Deduction lies in their versatility and accessibility.

More of Franking Credits Tax Deduction

Get A Tax REFUND On Franking Credits With Australian Dividends YouTube

Get A Tax REFUND On Franking Credits With Australian Dividends YouTube

Franking credits represent the tax a company has already paid on any profit it distributes to shareholders as a dividend The credits reduce a shareholder s tax liability at the end of the financial year and can result in an ATO refund

Franking credits are a reflection of tax already paid at the corporate level Attaching franking credits to dividends avoids double taxation of corporate profits distributed as dividends

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

customization: This allows you to modify the templates to meet your individual needs for invitations, whether that's creating them making your schedule, or even decorating your house.

-

Educational Impact: Downloads of educational content for free offer a wide range of educational content for learners from all ages, making them a useful instrument for parents and teachers.

-

The convenience of Fast access numerous designs and templates is time-saving and saves effort.

Where to Find more Franking Credits Tax Deduction

Effect Of Direct Perfusion With 21 M L Resveratrol And 2mM L CdCl2 On

Effect Of Direct Perfusion With 21 M L Resveratrol And 2mM L CdCl2 On

The impact of franking credits on your take home income depends on multiple things the percentage of franking your tax bracket and of course the dividend amount This article explains what franking credits are how to calculate franking credits and how our franking credits calculator works

Franking credits are an income tax deduction that refunds the portion of the dividend where the company has paid tax Also known as an imputation credit shareholders use franking credits to offset tax and prevent income from being taxed twice

After we've peaked your interest in printables for free Let's take a look at where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection with Franking Credits Tax Deduction for all goals.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a wide range of interests, that range from DIY projects to party planning.

Maximizing Franking Credits Tax Deduction

Here are some ideas create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Franking Credits Tax Deduction are a treasure trove filled with creative and practical information designed to meet a range of needs and hobbies. Their availability and versatility make them a fantastic addition to any professional or personal life. Explore the endless world of Franking Credits Tax Deduction right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes you can! You can print and download these tools for free.

-

Are there any free templates for commercial use?

- It's based on the conditions of use. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables might have limitations in their usage. Make sure you read the conditions and terms of use provided by the designer.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit a print shop in your area for the highest quality prints.

-

What program will I need to access printables at no cost?

- Most printables come in PDF format, which can be opened with free software like Adobe Reader.

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

Franking Credit Refund 2023 Atotaxrates info

Check more sample of Franking Credits Tax Deduction below

Franking Account Worksheet 2018 Free Download Goodimg co

Keating s Free Tax Franking Credits

Stream Franking Credits Program Tax Nuggets Academy Tax Nuggets

How To Stream Franking Credits Tax Nuggets Academy ABN 15647539802

The Tax Gift Of Franking Credits And How They Can Work For You

Labor s Proposed Tax Changes 4 5 Franking Credits YouTube

https://www.ato.gov.au/businesses-and...

Only Australian resident taxpayers can claim a tax offset for a franking credit attached to a distribution For non residents a distribution is exempt from withholding tax to the extent that it s franked

https://www.etax.com.au/franked-dividends-franking-credits

You receive a tax credit for the value of the franking credit which can be offset against other income Remember the company tax rate is 30 If your personal tax rate is 30 dividends are pretty much tax free as you get credit for the 30 tax the company has already paid

Only Australian resident taxpayers can claim a tax offset for a franking credit attached to a distribution For non residents a distribution is exempt from withholding tax to the extent that it s franked

You receive a tax credit for the value of the franking credit which can be offset against other income Remember the company tax rate is 30 If your personal tax rate is 30 dividends are pretty much tax free as you get credit for the 30 tax the company has already paid

How To Stream Franking Credits Tax Nuggets Academy ABN 15647539802

Keating s Free Tax Franking Credits

The Tax Gift Of Franking Credits And How They Can Work For You

Labor s Proposed Tax Changes 4 5 Franking Credits YouTube

What Are Franking Credits And How Do They Work Financial Autonomy

Franking Credits In Australia What Are They And How Do They Work

Franking Credits In Australia What Are They And How Do They Work

Franking Credits Everything You Need To Know Tax The Guardian