Today, where screens dominate our lives, the charm of tangible printed objects isn't diminished. Be it for educational use for creative projects, simply to add an element of personalization to your area, Fringe Benefits Reduce Employer Tax Rebatable are now a useful source. Through this post, we'll dive into the world "Fringe Benefits Reduce Employer Tax Rebatable," exploring what they are, how to find them, and how they can enrich various aspects of your daily life.

Get Latest Fringe Benefits Reduce Employer Tax Rebatable Below

Fringe Benefits Reduce Employer Tax Rebatable

Fringe Benefits Reduce Employer Tax Rebatable -

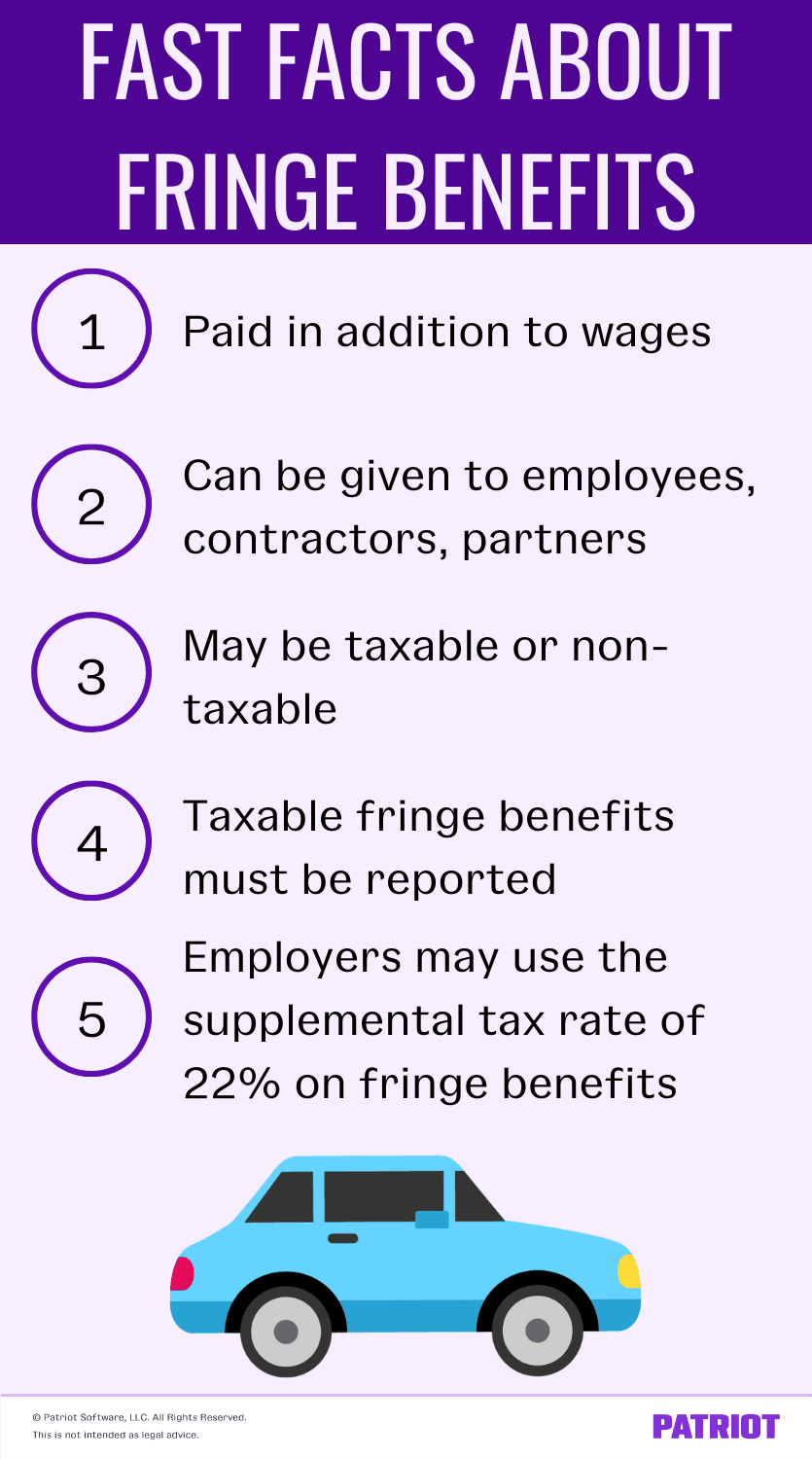

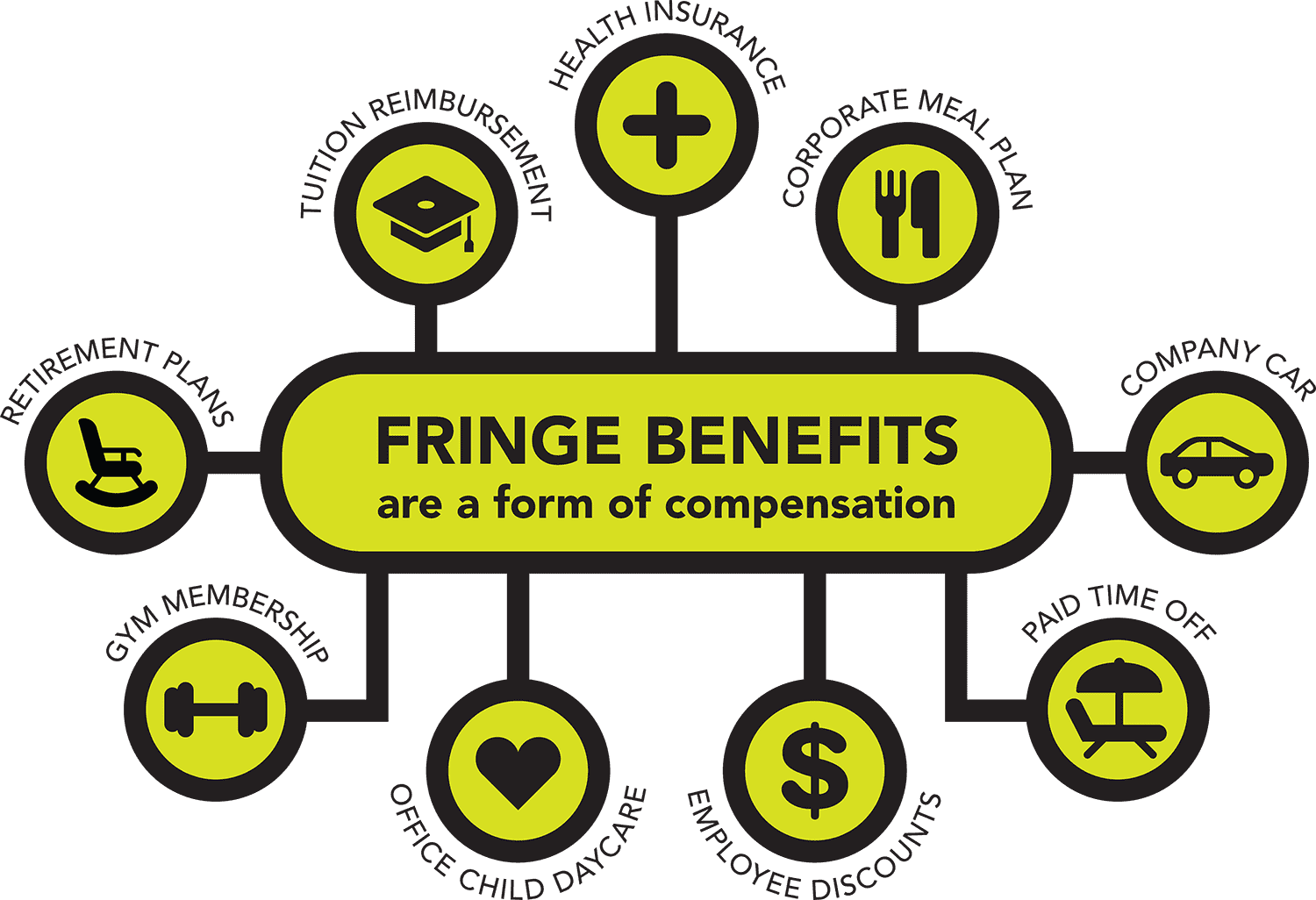

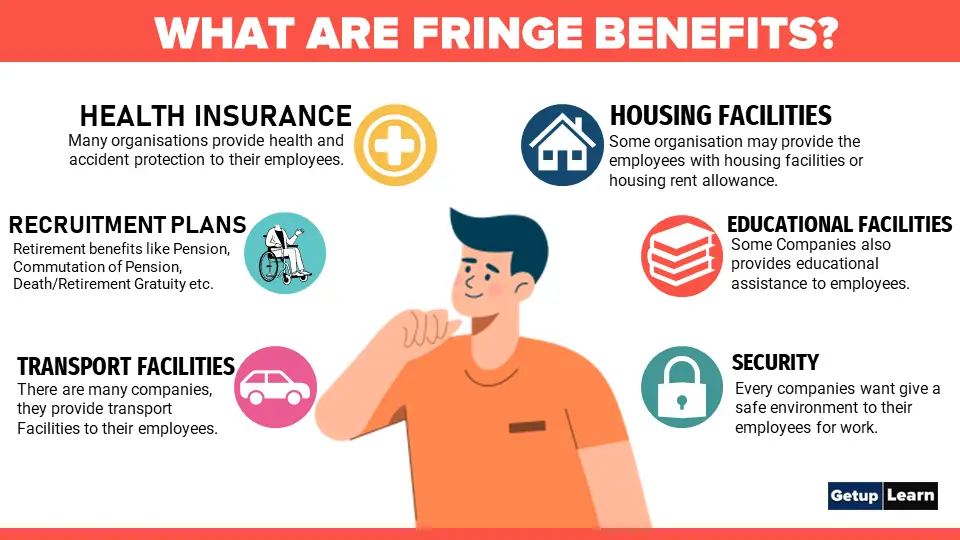

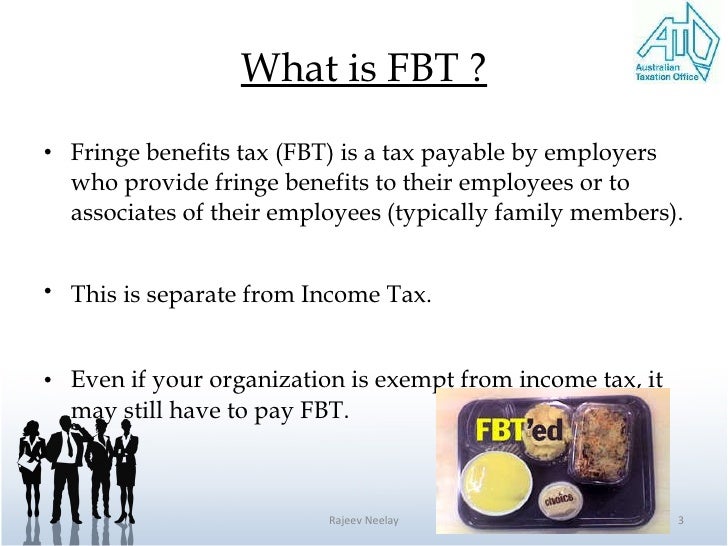

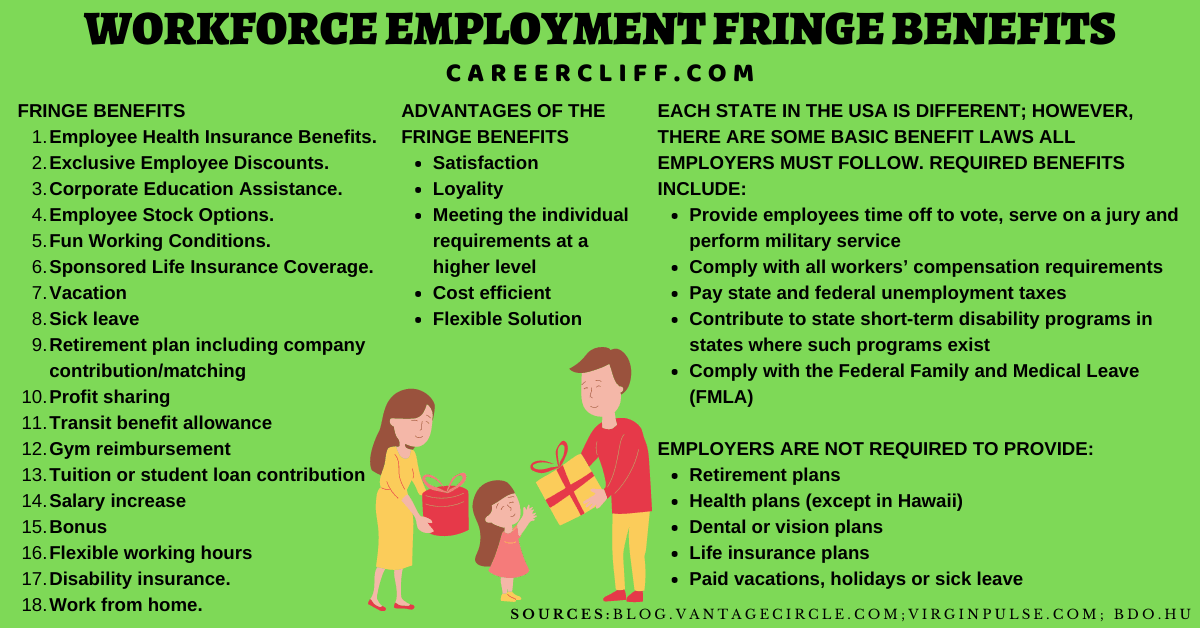

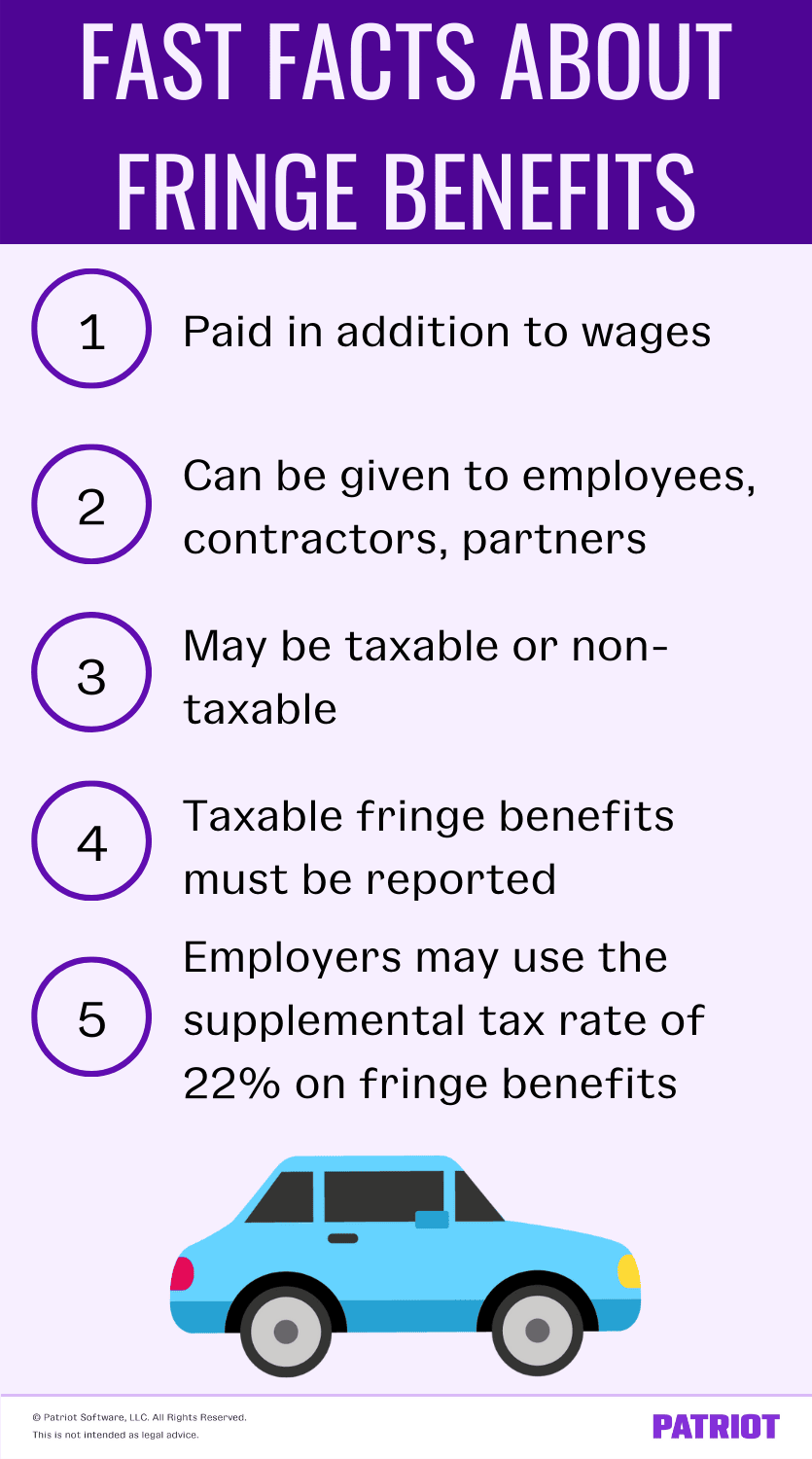

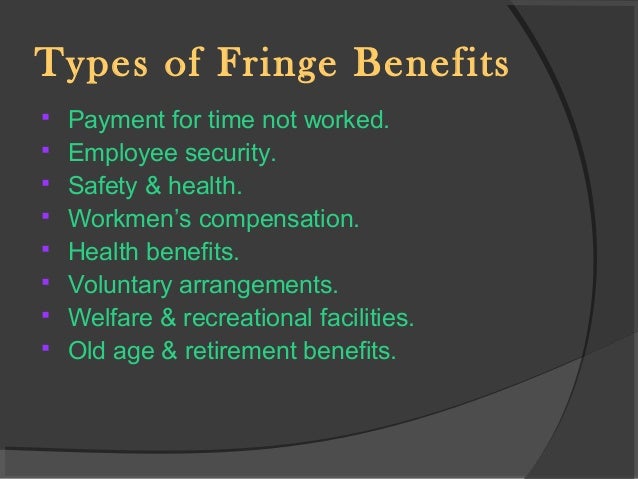

Web 12 mars 2022 nbsp 0183 32 Fringe benefits are generally considered taxable income if the employer pays them to their employees in cash So bonuses or reimbursements for expenses paid

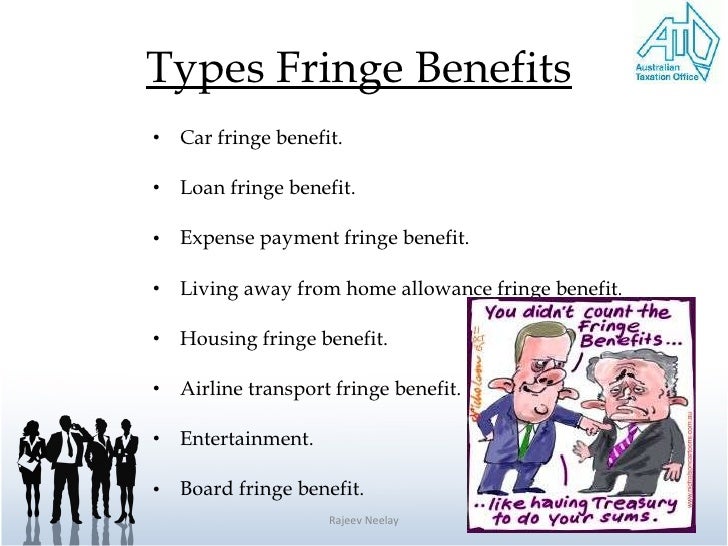

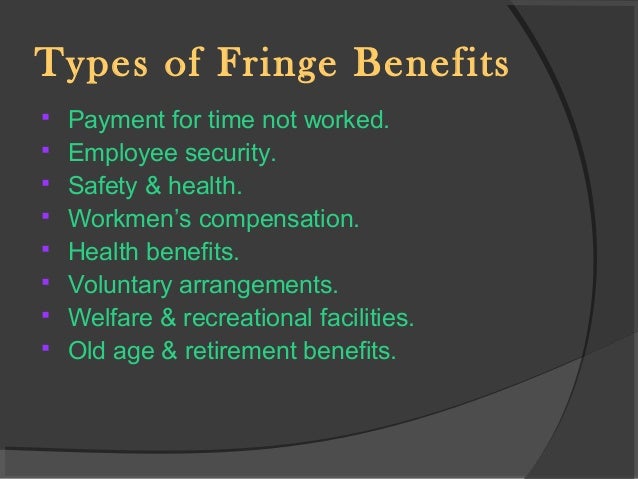

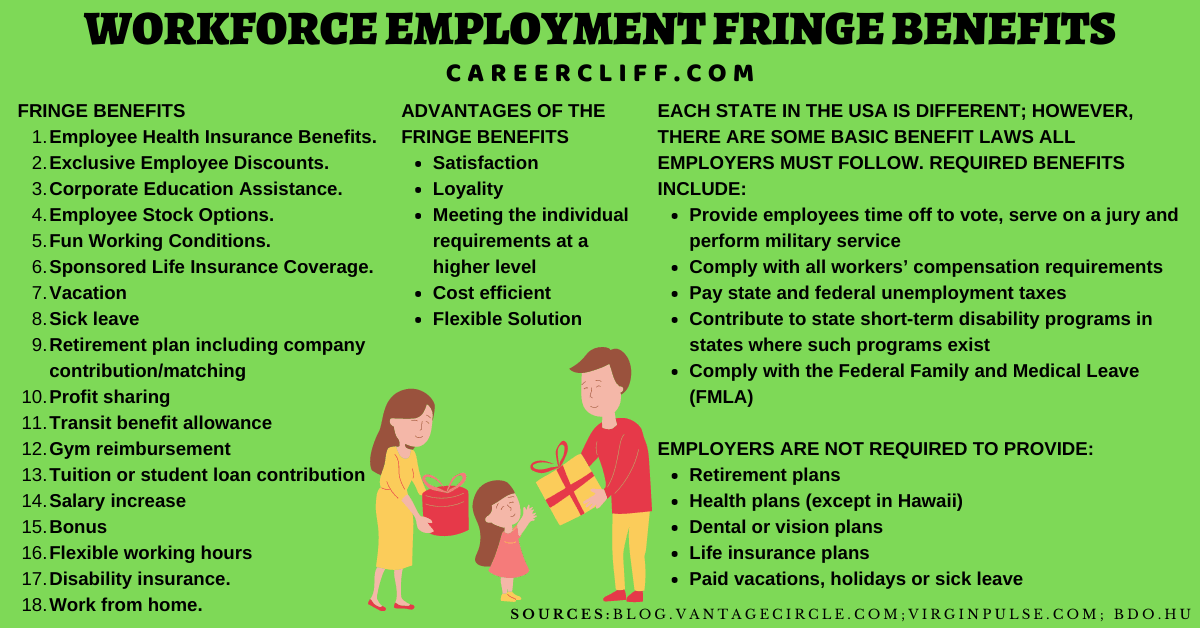

Web The car fringe benefits are type 1 benefits because they are GST taxable supplies with an entitlement to a GST credit Mark s car fringe benefit calculated using the statutory

Fringe Benefits Reduce Employer Tax Rebatable include a broad array of printable material that is available online at no cost. These resources come in many designs, including worksheets templates, coloring pages and more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Fringe Benefits Reduce Employer Tax Rebatable

All About Fringe Benefits For Employees CohaiTungChi Tech

All About Fringe Benefits For Employees CohaiTungChi Tech

Web The changes to the method for calculating the amount of the rebate will improve the equity of the tax system while recognising the special needs of the rebatable employers who

Web Your aggregate non rebatable amount is the total grossed up taxable value of the fringe benefits you provide to an individual employee exceeding 30 000 You are entitled to a

Fringe Benefits Reduce Employer Tax Rebatable have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Individualization You can tailor designs to suit your personal needs whether it's making invitations, organizing your schedule, or even decorating your house.

-

Educational Impact: These Fringe Benefits Reduce Employer Tax Rebatable can be used by students from all ages, making them a valuable tool for parents and educators.

-

It's easy: Access to numerous designs and templates can save you time and energy.

Where to Find more Fringe Benefits Reduce Employer Tax Rebatable

What Are Taxable Fringe Benefits

What Are Taxable Fringe Benefits

Web FBT rebatable employers e g certain societies associations or clubs are subject to a 30 000 cap on the amount of fringe benefits which are eligible for an FBT rebate they

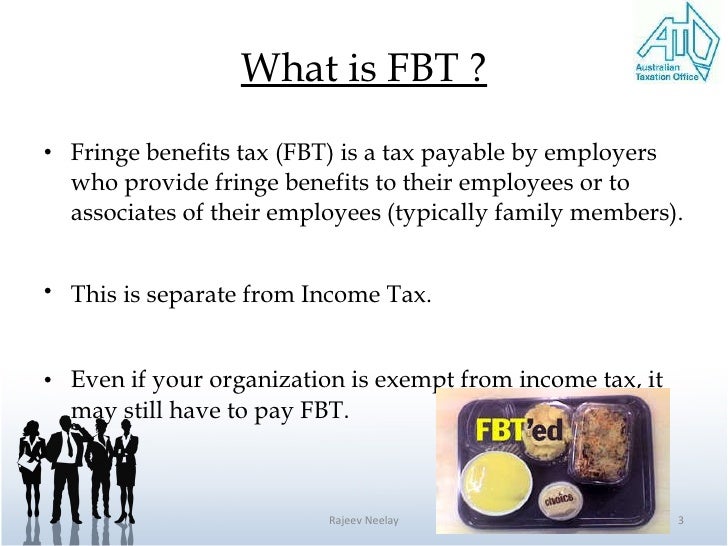

Web collecting the tax The Act is quite separate from the income tax assessment Acts Fringe Benefits Tax Act 1986 imposes tax on t he taxable value of fringe benefits Any

Now that we've ignited your curiosity about Fringe Benefits Reduce Employer Tax Rebatable and other printables, let's discover where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Fringe Benefits Reduce Employer Tax Rebatable to suit a variety of goals.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free with flashcards and other teaching tools.

- Perfect for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad range of topics, all the way from DIY projects to party planning.

Maximizing Fringe Benefits Reduce Employer Tax Rebatable

Here are some new ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Fringe Benefits Reduce Employer Tax Rebatable are a treasure trove filled with creative and practical information for a variety of needs and passions. Their accessibility and flexibility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the endless world of Fringe Benefits Reduce Employer Tax Rebatable to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes they are! You can print and download these tools for free.

-

Are there any free printables in commercial projects?

- It's dependent on the particular usage guidelines. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright problems with Fringe Benefits Reduce Employer Tax Rebatable?

- Certain printables might have limitations concerning their use. Check the terms and conditions set forth by the author.

-

How can I print printables for free?

- Print them at home with your printer or visit a print shop in your area for premium prints.

-

What software will I need to access printables free of charge?

- Many printables are offered in the PDF format, and is open with no cost software such as Adobe Reader.

The Comprehensive Guide To Fringe Benefits AttendanceBot

Fringe Benefit Kimberlie Hancock

Check more sample of Fringe Benefits Reduce Employer Tax Rebatable below

Employee Fringe Benefits How To Use Them To Reduce Your Taxes

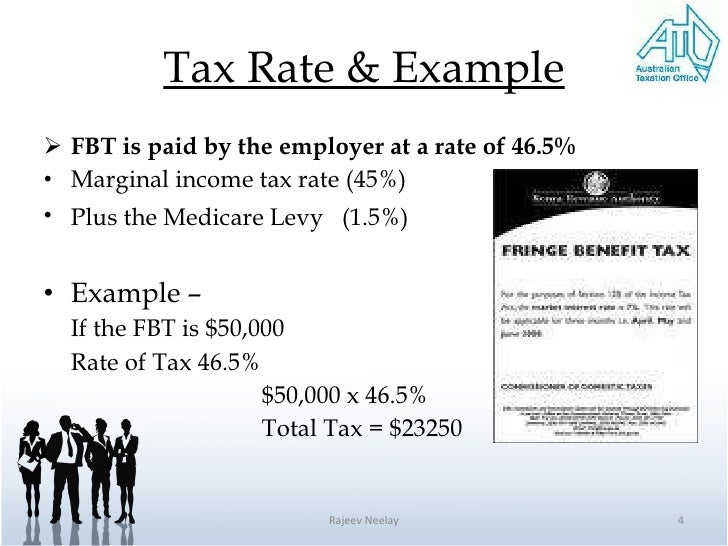

Fringe Benefits Tax Rajeev Final

How To Calculate Fringe Benefit Tax

You Have Grown Up Record Slideshow

SME Guide To Fringe Benefits Tax Noteworthy At Officeworks

![]()

Fringe Benefit

https://www.ato.gov.au/Forms/2021-Fringe-benefits-tax-return...

Web The car fringe benefits are type 1 benefits because they are GST taxable supplies with an entitlement to a GST credit Mark s car fringe benefit calculated using the statutory

https://www.ato.gov.au/Individuals/Jobs-and-employment-types/Working...

Web If you receive fringe benefits with a total taxable value of more than 2 000 in a fringe benefits tax FBT year 1 April to 31 March your employer will report this amount to

Web The car fringe benefits are type 1 benefits because they are GST taxable supplies with an entitlement to a GST credit Mark s car fringe benefit calculated using the statutory

Web If you receive fringe benefits with a total taxable value of more than 2 000 in a fringe benefits tax FBT year 1 April to 31 March your employer will report this amount to

You Have Grown Up Record Slideshow

Fringe Benefits Tax Rajeev Final

SME Guide To Fringe Benefits Tax Noteworthy At Officeworks

Fringe Benefit

Fringe Benefits Tax Rajeev Final

FRINGE BENEFITS TAX AND EMPLOYEE WITHHOLDING 2014 ARIVA Academy

FRINGE BENEFITS TAX AND EMPLOYEE WITHHOLDING 2014 ARIVA Academy

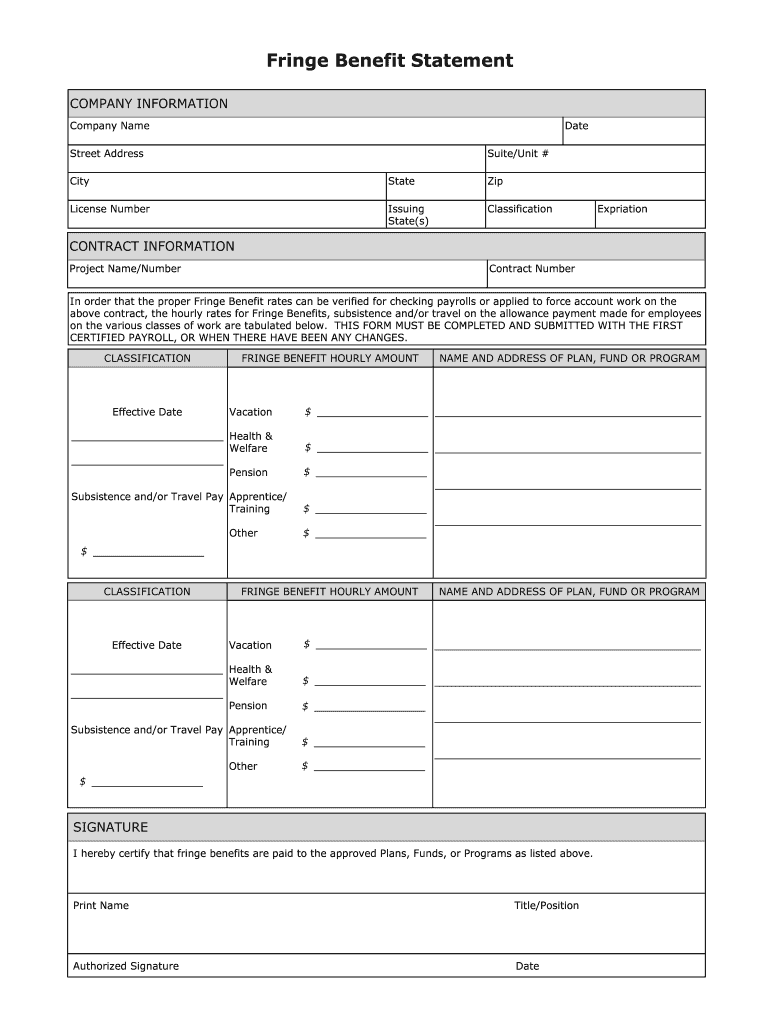

Statement Fringe Benefit Fill Online Printable Fillable Blank