Today, in which screens are the norm and the appeal of physical printed materials hasn't faded away. No matter whether it's for educational uses or creative projects, or just adding an element of personalization to your area, Fuel Tax Credit Assessable Income Ato are now a vital resource. For this piece, we'll take a dive into the world of "Fuel Tax Credit Assessable Income Ato," exploring their purpose, where to locate them, and how they can add value to various aspects of your lives.

Get Latest Fuel Tax Credit Assessable Income Ato Below

Fuel Tax Credit Assessable Income Ato

Fuel Tax Credit Assessable Income Ato -

Fuels eligible for fuel tax credits To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You

Fuel tax credits you claimed for fuel you used to generate domestic electricity are not assessable income and you do not need to include them in your tax

Fuel Tax Credit Assessable Income Ato encompass a wide assortment of printable, downloadable materials available online at no cost. These materials come in a variety of designs, including worksheets templates, coloring pages and much more. The appeal of printables for free is their flexibility and accessibility.

More of Fuel Tax Credit Assessable Income Ato

Federal Budget Highlights Oct 2022 Www hksrussell

Federal Budget Highlights Oct 2022 Www hksrussell

Most grants and payments are assessable income and need to be included in the tax return These payments include fuel tax credits or product stewardship oil

If you are using the accruals accounting method you include all assessable income earned for the year even if you haven t physically received the

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: This allows you to modify the design to meet your needs when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Benefits: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, making them a vital source for educators and parents.

-

Affordability: Access to a myriad of designs as well as templates will save you time and effort.

Where to Find more Fuel Tax Credit Assessable Income Ato

Federal Budget Highlights Oct 2022 Www hksrussell

Federal Budget Highlights Oct 2022 Www hksrussell

Calculate your fuel tax credits You claim fuel tax credits on your BAS Before you can claim on your BAS you need to calculate your fuel tax credits To get

Fuel tax credits are part of your business income so you need to include them in your tax return at Assessable government industry payments Pay as you go PAYG instalment

Since we've got your interest in Fuel Tax Credit Assessable Income Ato Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in Fuel Tax Credit Assessable Income Ato for different purposes.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free, flashcards, and learning materials.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- These blogs cover a wide array of topics, ranging starting from DIY projects to party planning.

Maximizing Fuel Tax Credit Assessable Income Ato

Here are some new ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets for teaching at-home and in class.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Fuel Tax Credit Assessable Income Ato are a treasure trove of practical and imaginative resources which cater to a wide range of needs and pursuits. Their access and versatility makes them an essential part of every aspect of your life, both professional and personal. Explore the many options of Fuel Tax Credit Assessable Income Ato today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes they are! You can print and download these tools for free.

-

Can I use the free printables for commercial use?

- It's determined by the specific conditions of use. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright issues in Fuel Tax Credit Assessable Income Ato?

- Some printables may have restrictions in use. Be sure to check the terms and regulations provided by the designer.

-

How do I print printables for free?

- Print them at home using printing equipment or visit the local print shops for top quality prints.

-

What program do I require to open printables at no cost?

- Most printables come in PDF format. These is open with no cost software, such as Adobe Reader.

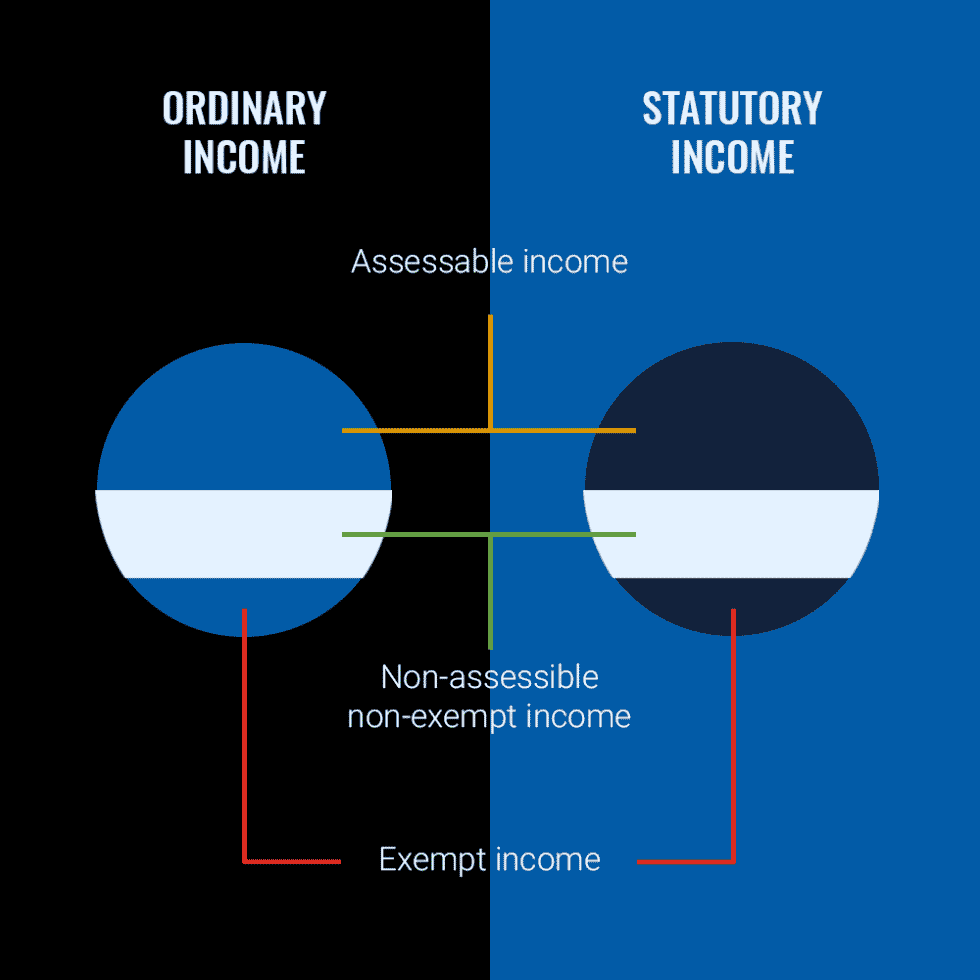

Difference Between Assessable Income Taxable Income Finance Zacks

The Facts About Bad Debt Deductions Cruz And Co

Check more sample of Fuel Tax Credit Assessable Income Ato below

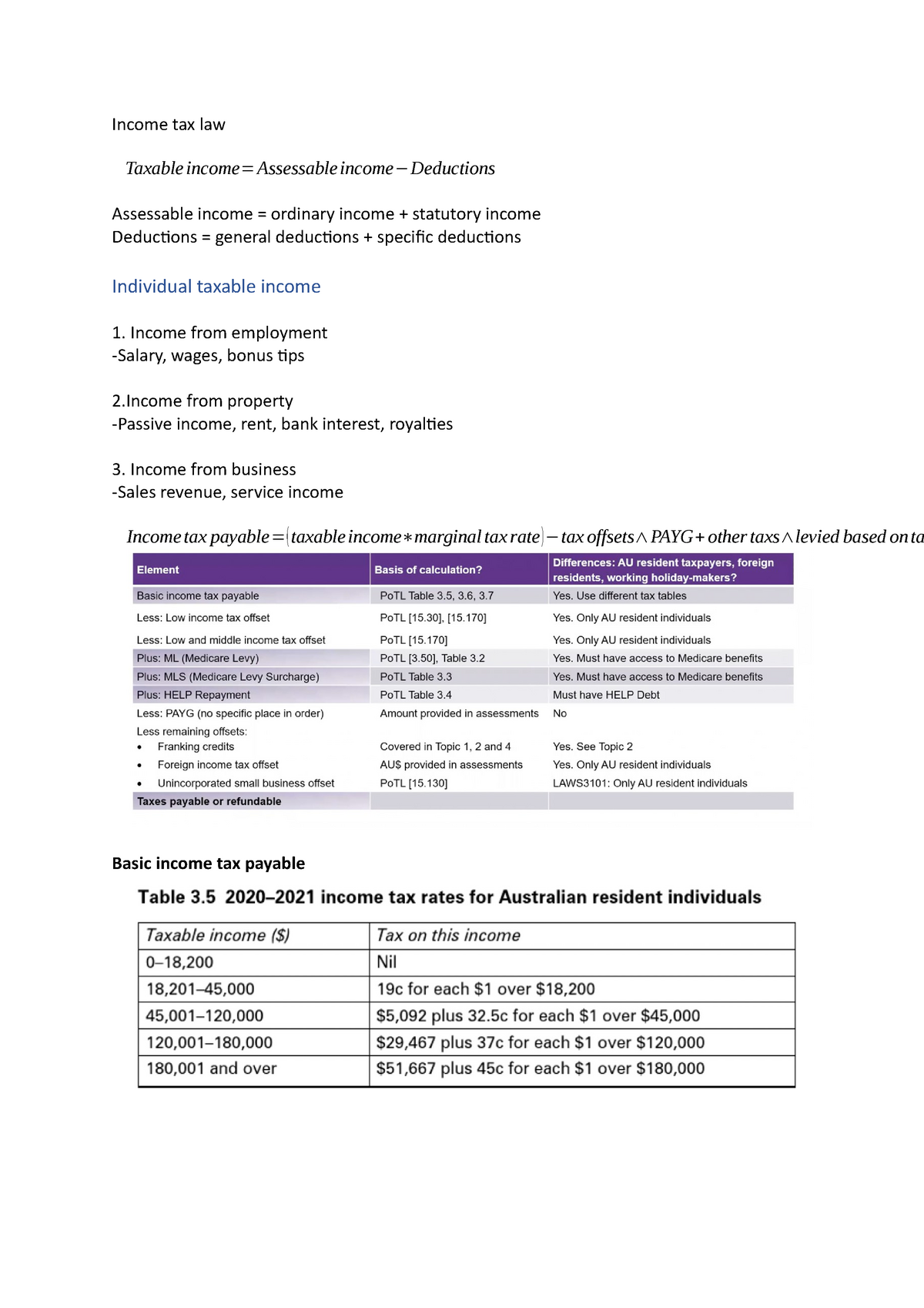

Income Tax Law 1 5 Income Tax Law Taxable Income Assessable Income

Assessable Income Defined YouTube

TU Solution Of Income From Employment Part 3 Assessable Income

Uber Driver Tax Deduction 2021

Assessable Income In Australia Bristax Income Tax Articles

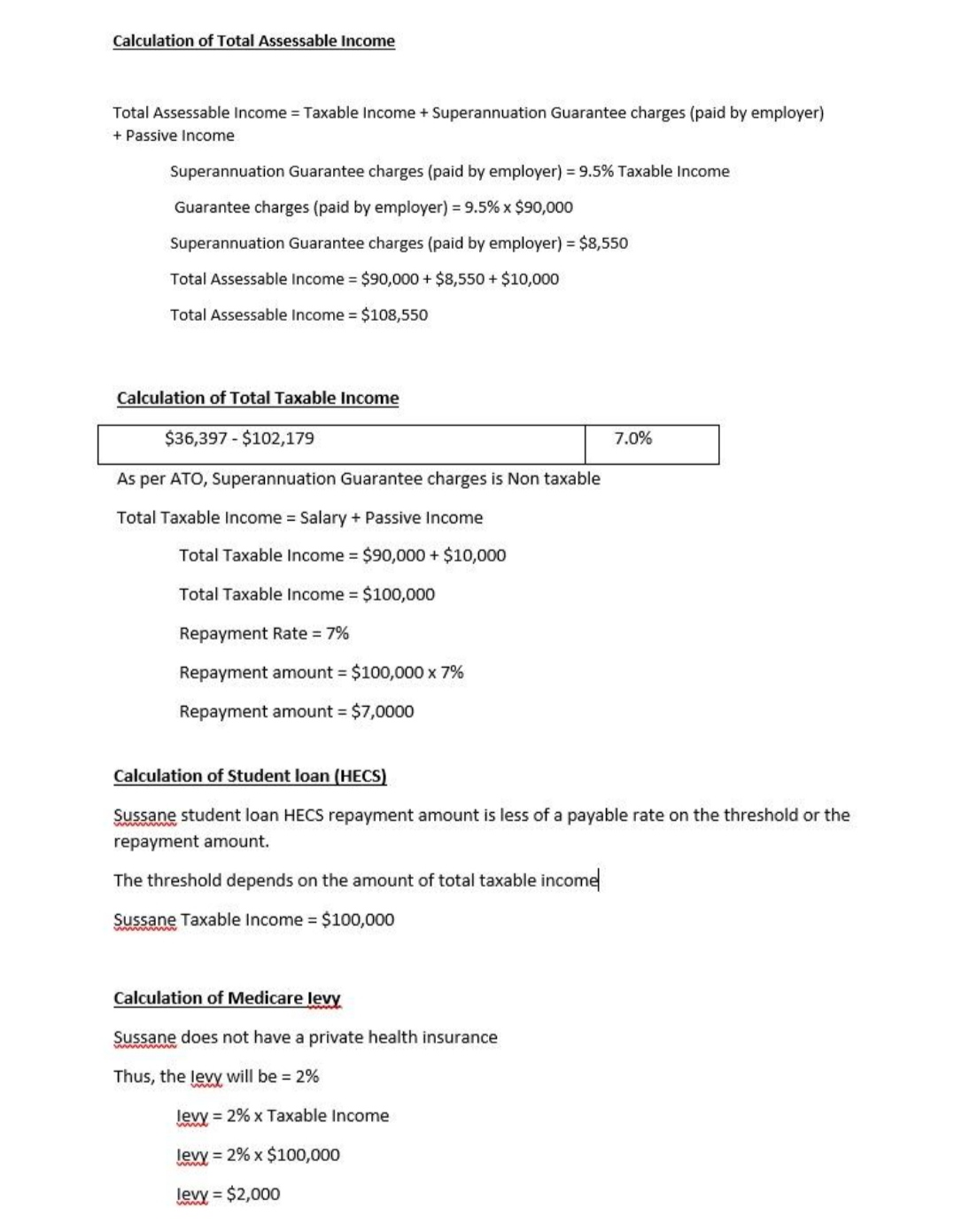

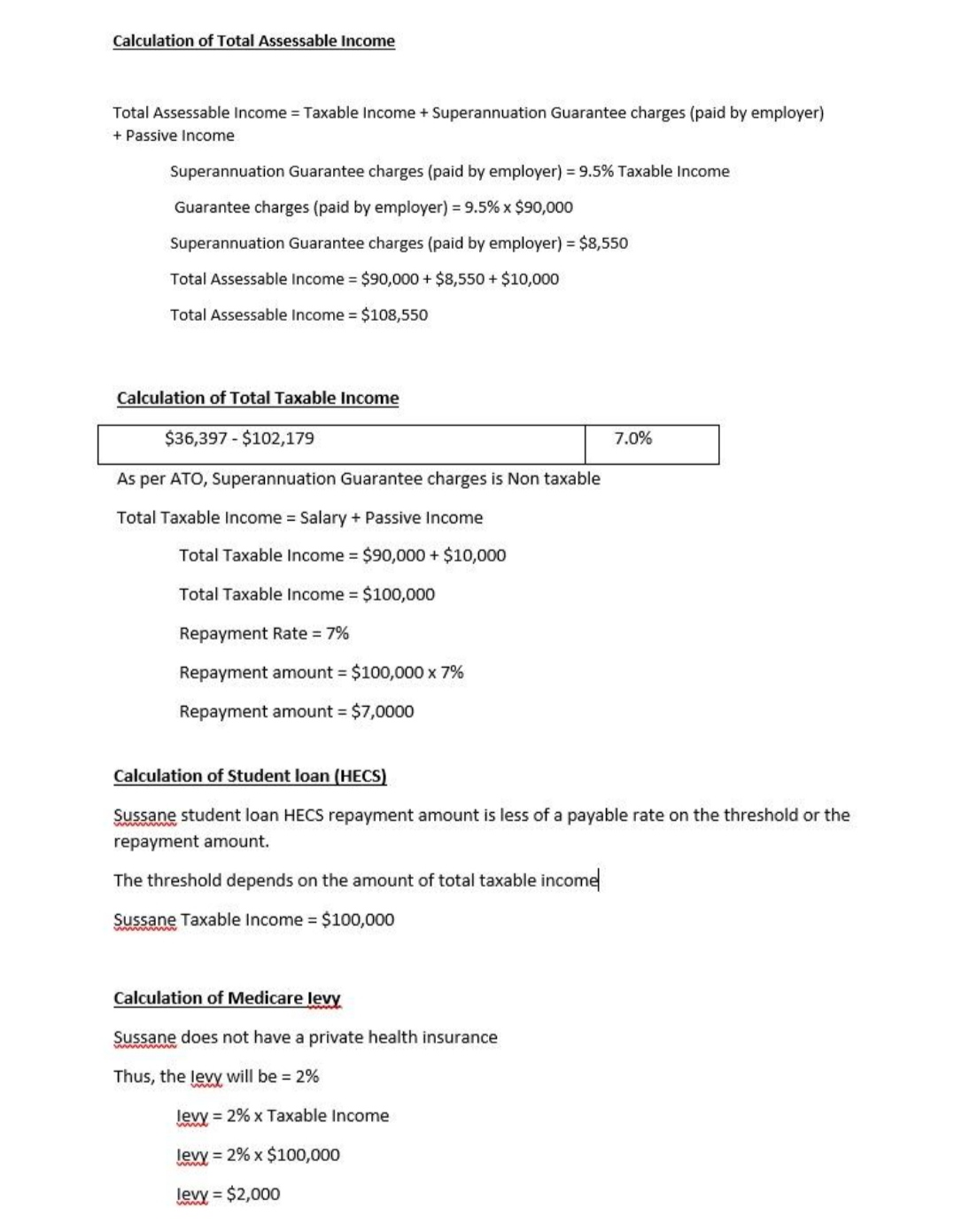

Calculate Total Assessable Income Taxable Income Tax get 1

https://www.ato.gov.au/.../receiving-your-credits

Fuel tax credits you claimed for fuel you used to generate domestic electricity are not assessable income and you do not need to include them in your tax

https://www.ato.gov.au/.../fuel-schemes/fuel-tax-credits-business

Use the rates listed for each financial year to work out your fuel tax credit rates for business Check your eligibility to claim fuel tax credits for fuel acquired and

Fuel tax credits you claimed for fuel you used to generate domestic electricity are not assessable income and you do not need to include them in your tax

Use the rates listed for each financial year to work out your fuel tax credit rates for business Check your eligibility to claim fuel tax credits for fuel acquired and

Uber Driver Tax Deduction 2021

Assessable Income Defined YouTube

Assessable Income In Australia Bristax Income Tax Articles

Calculate Total Assessable Income Taxable Income Tax get 1

Assessable Income In Australia Bristax Income Tax Articles

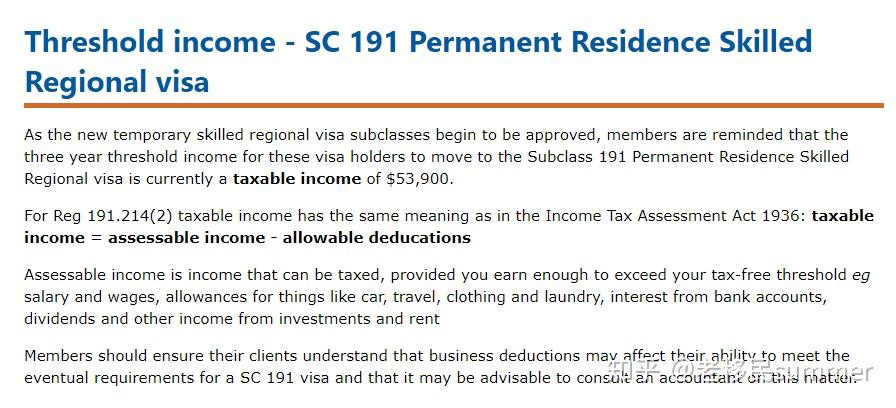

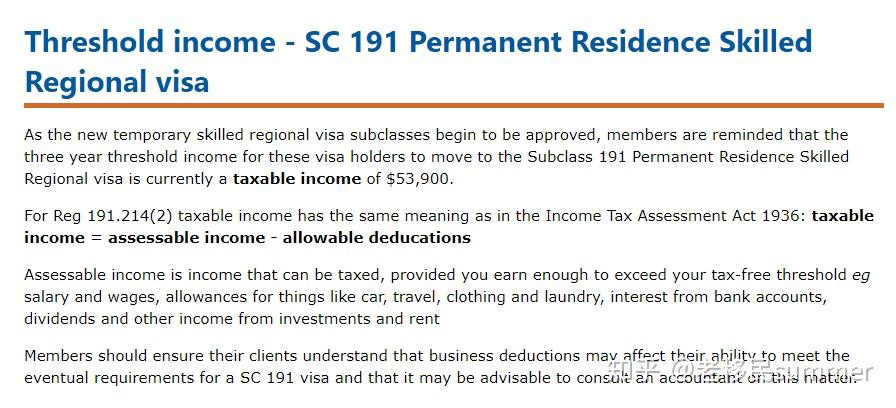

491 494 191 53900

491 494 191 53900

Alumni And Giving S 39 Of The Legal Profession Uniform Law